How to Buy Mineral Rights

How to Buy Mineral Rights Do you want to know how to buy mineral rights? If so, you're in the right place. This article was written specifically for someone who is interested in buying oil and gas mineral rights, but has never purchased mineral rights and doesn't know where to begin. In this article, we break down everything you need to know to buy mineral rights with confidence. Before we jump in, there are some important things you need to know before you buy mineral rights. A Warning About Buying Mineral Rights Buying mineral rights is risky. When[...]

Understanding Mineral Rights Ownership in Texas

Understanding Mineral Rights Ownership in Texas If you recently found out you own mineral rights, or you’ve been receiving royalty checks and aren't quite sure why, you’re not alone. Mineral rights ownership can feel overwhelming at first. Between legal documents, royalty payments, and industry terms, it’s easy to get lost in the details. Whether you inherited mineral rights, bought land that came with them, or are simply trying to understand your options, this guide is for you. We’re going to break down what mineral rights ownership means, how it works in Texas, and what you need to know[...]

Inherited Mineral Rights

Inherited Mineral Rights If you’ve recently inherited mineral rights, you might be wondering what to do next. You’re not alone. Mineral rights can be one of the most confusing assets to inherit. At the same time, they can also be one of the most valuable. Whether these rights have been in your family for years or you just found out you own them, you may be sitting on an asset with significant potential. The challenge is knowing what you have and what to do with it. Inherited mineral rights can come with royalty income, leasing opportunities, or legal[...]

Closing Process

Closing Process When figuring out how to buy mineral rights or sell oil and gas royalties, one of the most important steps is the closing process. Our closing process is designed to protect both the mineral buyer and mineral owner. To learn more about how we close transactions please see the closing steps below. If you have any questions or concerns about this closing process please let us know before you submit a bid. Closing Steps Once the due diligence process is completed and you are ready to move forward with closing, here are the[...]

Offer Process

Offer Process Before you submit an offer on a listing, please carefully read the information below. We only accept bids from qualified buyers. Please note that all bids submitted at non-binding until you put a property under contract with the mineral owner. Please do not submit bids directly to the mineral owner. All listings are exclusive and all bids should be submitted to Texas Royalty Brokers. How to Buy Mineral Rights Thinking about investing in mineral rights? Buying mineral rights can be a smart move, but it’s not as simple as making an offer and[...]

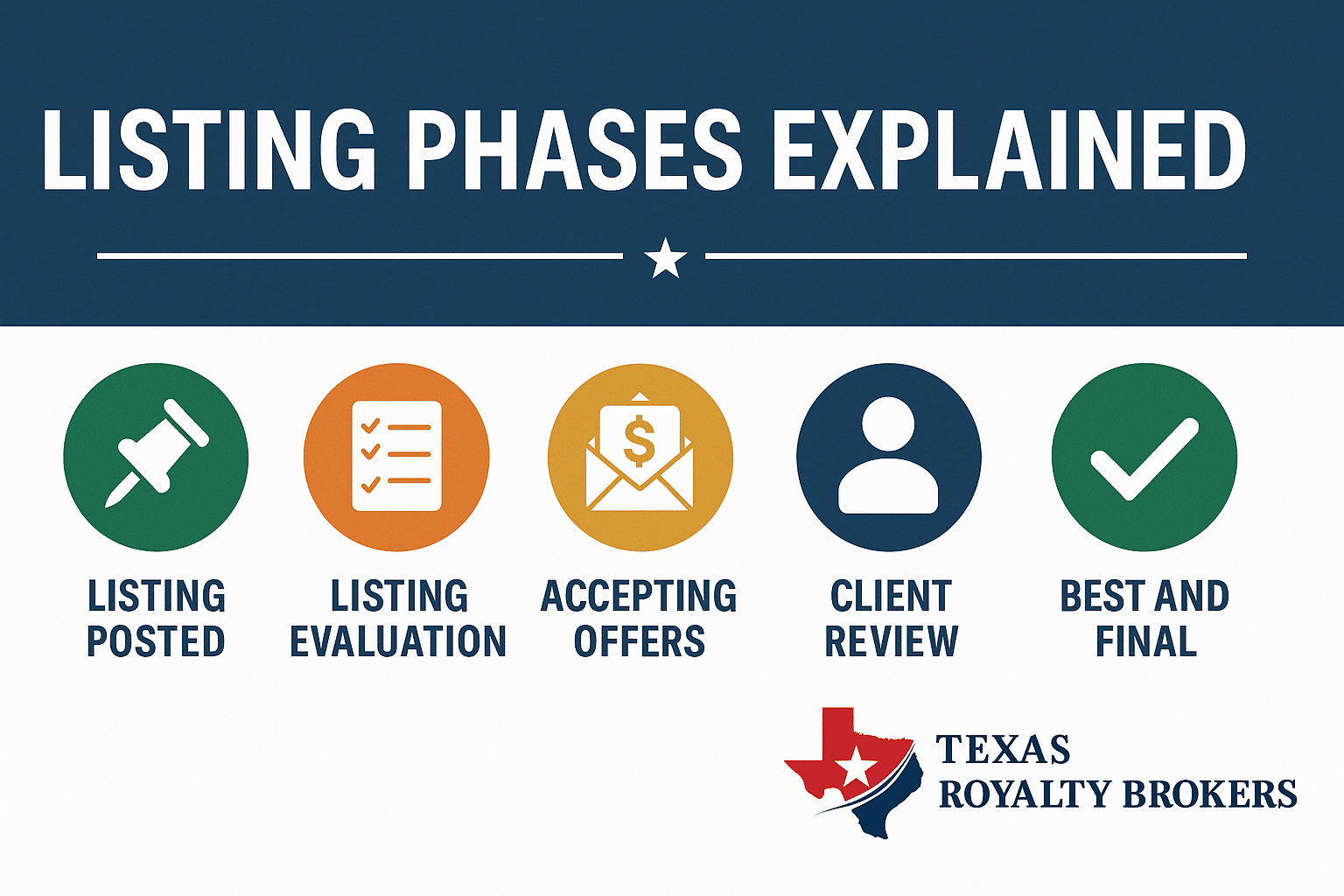

Listing Phases

Listing Phases If you want to learn how to buy mineral rights at Texas Royalty Brokers, it's important to understand the listing phases. Our listing phases are designed to make the process of buying mineral rights transparent and fair for mineral buyers. We designed the process to give each buyer and equal opportunity to analyze a deal and submit a bid. The listing phases below apply to all of our mineral rights listings. Listing Phases Explained Below is an explanation of each listing phase: Listing Posted: Once a listing has been activated on our website,[...]

Types of Mineral Rights

Types of Mineral Rights Ownership There are many different types of mineral rights ownership. You might own oil and gas mineral rights, timber rights, lithium, and many other types. While all of these are considered "mineral rights" they are all very different. The value of oil and gas mineral rights will be very different from timber rights. Use the links below to skip to specific topics related to mineral rights ownership. What are Subsurface Mineral Rights? What are Mining Rights? What are Surface Rights? What are Helium Rights? What are Co2 Rights? What are Lithium Rights? Real Estate[...]

Average Price Per Acre for Mineral Rights

Average Price Per Acre for Mineral Rights If you’re wondering about the average price per acre for mineral rights or the average price per acre for oil and gas rights, you’re definitely not alone. It’s one of the first things mineral owners want to know when they’re thinking about selling oil and gas royalties. The tricky part is, there’s no simple answer. There isn’t a set average price per net mineral acre. In fact, values can vary wildly even within the same county. In one part of the county, mineral rights might be worth $50 per acre. Just[...]

Best Mineral Rights Brokers in 2025

Best Mineral Rights Brokers in 2025 If you are thinking about selling mineral rights, picking a mineral rights broker is an important step. We're going to show you how to pick the best mineral rights broker in 2025. Before you make any decisions, carefully read the information below which will guide you through the process of picking the right oil and gas royalty broker. When selling mineral rights in Texas, you want to pick a mineral rights broker who is going to help you sell for the best price. Equally important, you want a mineral rights broker who[...]

How to Sell Oil and Gas Royalties in 2025

How to Sell Oil and Gas Royalties If you've received an offer to sell your oil and gas royalties, you might be wondering: Is this offer fair? Should I sell now? What are my royalties actually worth? You're not alone and you're asking the right questions. Selling oil and gas royalties isn’t like selling a house or a car. It’s a high-stakes financial decision that can impact your wealth for decades. Unfortunately, many mineral owners sell too quickly, take the first lowball offer they receive, or try to navigate the sale without professional help. Trying to sell oil[...]