Why Texas Royalty Brokers?

Selling mineral rights doesn’t have to be complicated. At Texas Royalty Brokers, we handle every step of the process so you can get maximum value with zero stress.

Our team works hard to deliver real offers, real value, and real results.

sellers

Texas Royalty Brokers

Popular Topics

Mineral Rights Report

Buyers

Receive new listing notifications?

Trusted by Mineral Owners

![]()

Pecos, TX

I had a very good experience working with Eric and his team. Eric was very professional and due to his knowledge added a lot of insight into helping me sell my mineral interests. I was kept well informed on a weekly basis and once there was a buyer, Eric continued to help me understand the process. From the start to the finish, during the entire process I wasn’t ever disappointed. Eric has a great deal of experience and knowledge of mineral values and he also has many connections in the industry. If you are interested in selling minerals you own, I highly recommend you contact Eric and the good folks at Texas Royalty Brokers.

Glasscock, TX

We had a great experience with Texas Royalty Brokers! Very professional and straight shooters. Hit the market with excellent results. Hightly recommend them!

Lavaca, TX

We worked with Emily to assist us with a sale of some of our mineral interests. Not only was she professional and courteous, but we were paid well above any previous offer and ahead of the expected time frame. What more could you ask for? A well deserved five star rating!

Upton , TX

My wife and I were very pleased with the guidance and knowledgeable advice that Emily and Eric provided to us regarding the sale of her mineral rights in Texas.

Nacogdoches, TX

Eric and his team were very knowledgeable and responsive to our needs and questions. The professionalism and integrity exceeded our expectations throughout the entire process. We highly recommend Texas Royalty Brokers!

Mineral Rights Report

State Specific Guides

Resources

Blog Categories

Free Consultation

Get expert advice on your mineral rights with no pressure and no obligation.

Listing Notifications

To receive notifications regarding new listings that are activated on our website, please enter your email address below.

Listing Title

Purchase Mineral Rights in Karnes Texas

Listing ID

401139

Listing Status

sold

- Listing Posted - complete

- Listing Evaluation - complete

- Accepting Offers - complete

- Client Review - complete

- Best and Final - complete

- Under Contract - in progress

Please take a moment to learn more about each listing phase.

We are currently in the listing evaluation phase for these mineral rights. We will begin accepting offers on Monday, February 6th.

Listing Files

To view the available files for this listing, please visit the link in the description further below. The button below will not work as there are too many files.

Listing Details

Starting Bid: $795,000

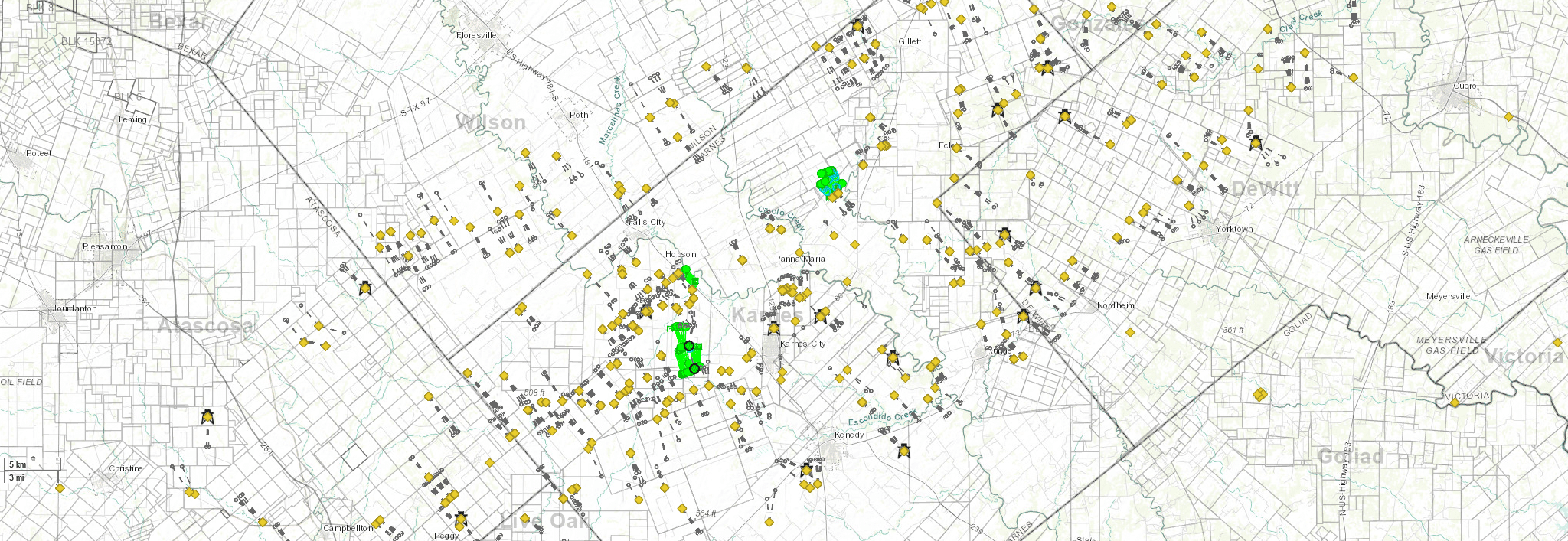

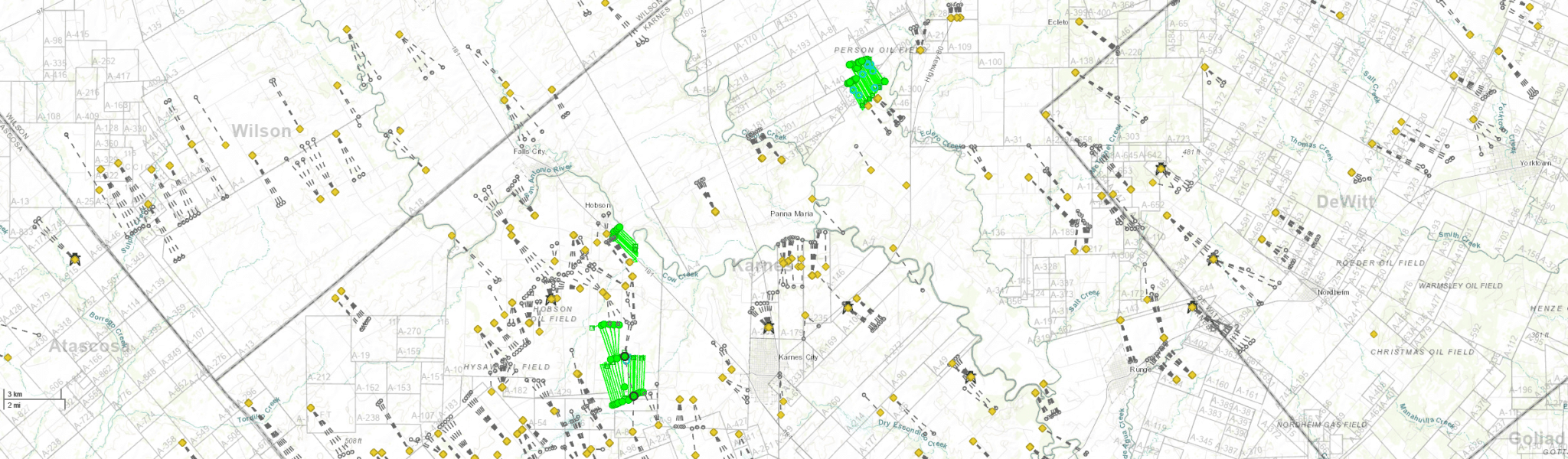

- State : Texas

- County : karnes

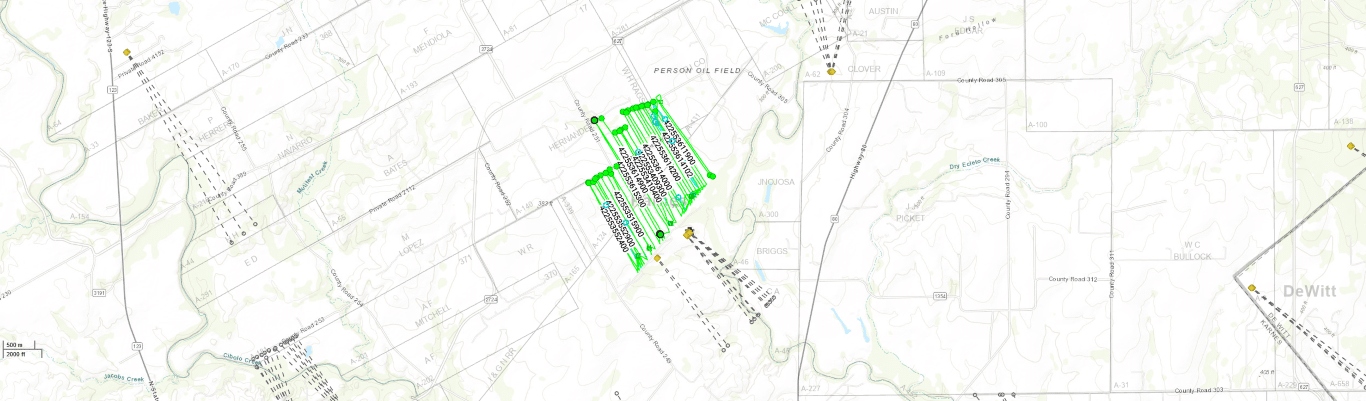

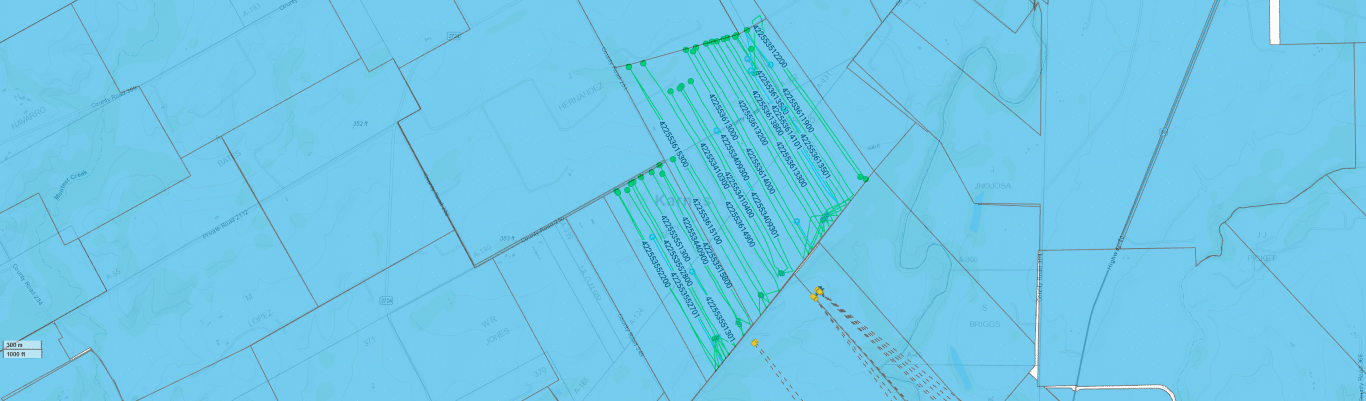

- Legal Location : Multiple - Please see attached plat maps.

- Net Acres : 58.29

- Active Lease : Yes

- Royalty Rate : 12.5%

- Producing : yes

- Average Income : $18,000/Month

Comments:

Update: 4/7/2023

SOLD

____________________________________

Update: 3/6/2023

Under Contract

____________________________________

Update: 2/22/2023

The seller is firm with the starting bid price.

We have updated the wells listed and manually verified every well that appears on the well list shows up on the check stubs. You can find the updated wells list at the download link further below.

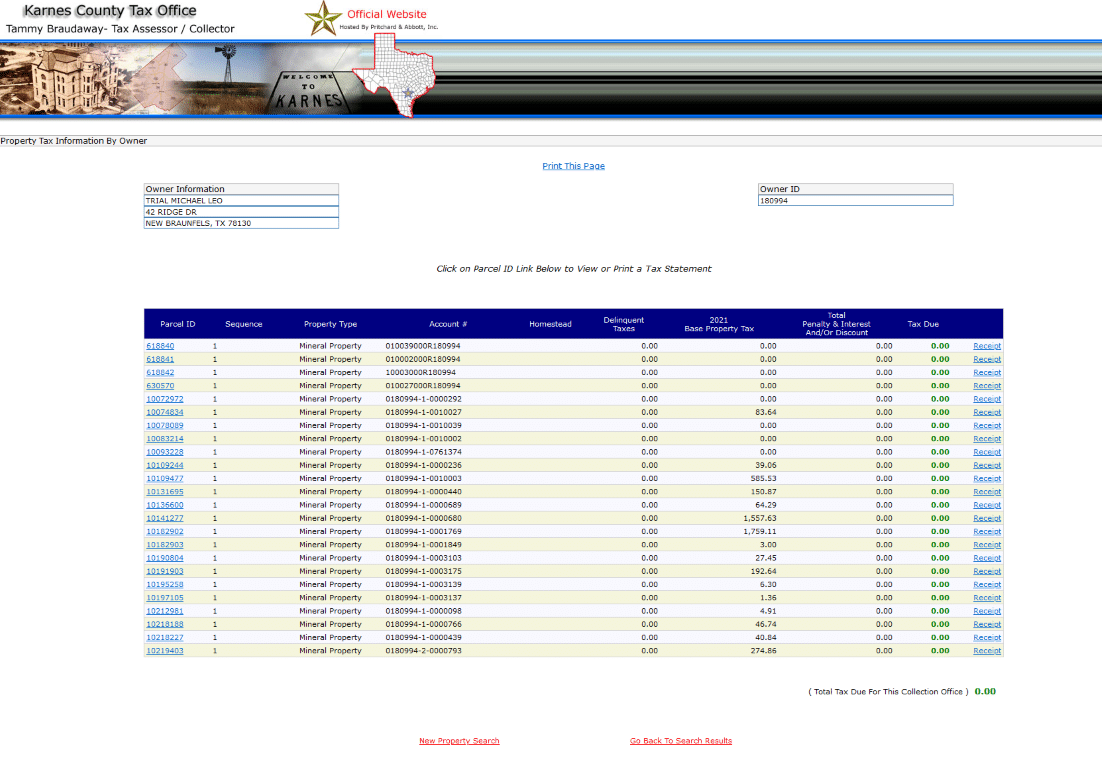

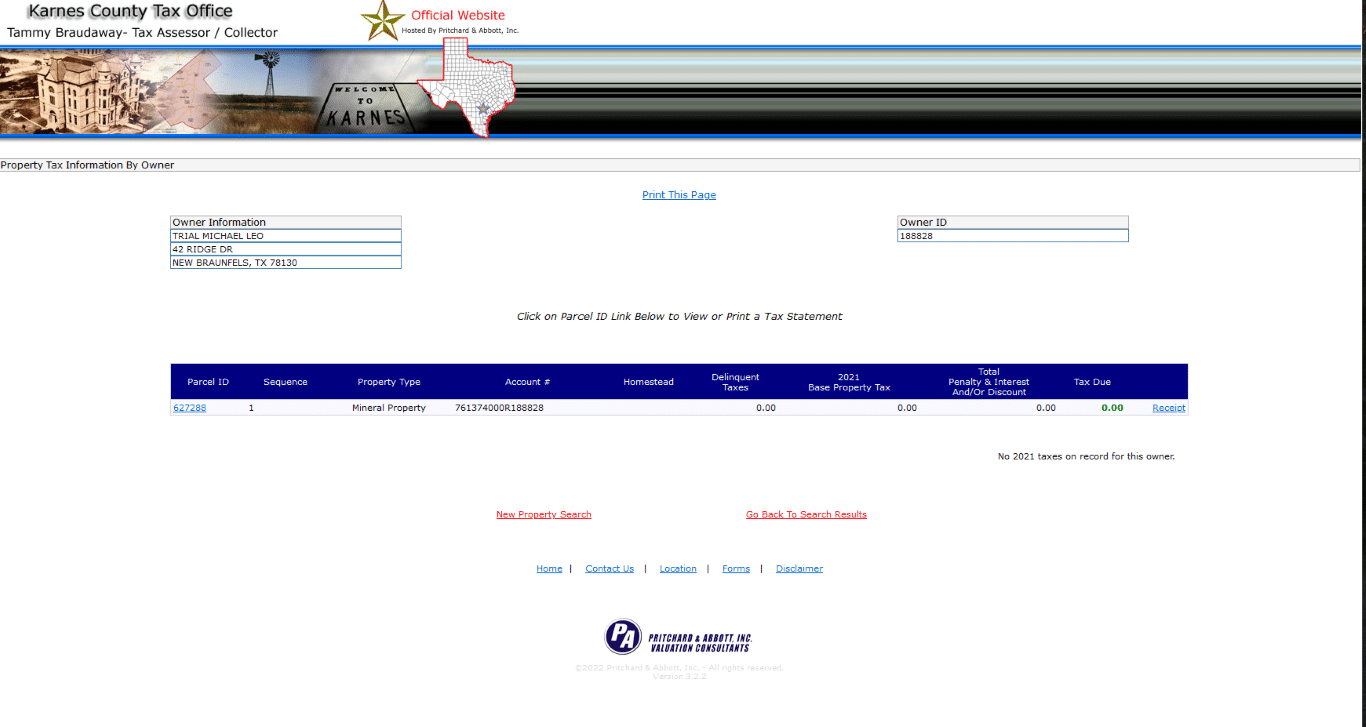

Included in this sale is every well listed on the check stubs provided from Marathon, Magnolia, Validus, and Devon. Note that the tax rolls show different ownership because other ownership not listed on these check stubs was sold in the past. Ownership can be found under Theresa Trial and Michael Leo Trial in the tax rolls. It has since been moved to Theresa’s name.

____________________________________

Back on Market: Update 1/25/2023

The seller has decided to put these mineral rights back on the market. In the link below, we have attached updated royalty statements from 11/2022 to 1/2023. The royalty income from production has remained strong. Using a 6 month average, these mineral rights are generating around $18,000/month. Using a 12 month average, these mineral rights are generating nearly $20,000/month. These wells are past the initial decline so this is a solid income producing property.

Assuming the royalty income maintains $18,000/month going forward, the pay back on this investment is just shy of 4 years.

A few things to note regarding this ownership:

1. The Marathon checks were very low in November and December. In January, the royalty check was much higher. It looks like this happened because A) they were including the owner on some additional wells they were not currently in pay on B) there were multiple months of production paid out in the January check stub for certain wells. Those wells may have been in suspense temporarily as they were doing adjustments but appear to be back to normal now.

2. In the attached files at the link below, we DO NOT include every well they are in pay on. However, every well that is in pay on the check stubs provided is included in the sale. It appears they credited the owner with a very small interest in some wells that they weren’t previously being paid on. It looks like a fraction of an acre, so not very material.

3. In the tax rolls, this ownership shows up under Theresa Trial and also Michael Leo Trial.

4. Previously, the owner wanted to hold onto some smaller acreage they had. They decided to include all of it in this sale now tell sell everything they have in Karnes. We have included check stubs from Devon and Validus which are not included in the royalty income or wells table, but are included in the sale.

Here is a link to the most updated listing files:

We will begin accepting offers on Monday, February 6th.

Note: All bids MUST BE based on the cash flow value. We are not representing any NMA or NRA on this sale. The mineral buyer will receive ownership in the wells listed on the most recent check stubs at the NDI’s listed on the check stubs. No adjustments will be allowed for any reason.

_________________________________

Update 11/21/2022 – Buyer withdrew offer and seller is considering holding onto the mineral rights.

_________________________________

Update 10/28/2022

Sale Pending

_________________________________

Update 10/25/2022

The 10/2022 check stubs have been added to the download files link further below. An updated revenue summary is also provided showing $21,275/month average income. Seller to keep the October checks. If this goes under contract quickly, the seller may be willing to include the November check in the sale for the buyer.

_________________________________

Update 10/11/2022

The seller is willing to sell immediately at $870,000.

_________________________________

Update: 9/26/2022

******Price Update******

The seller has updated the asking price to $1,055,000! This is a $215,000 price reduction.

*Note: Please check the download link below for the most updated files. We have uploaded the 9/2022 check stub for Marathon, the 9/2022 check stub (includes 8/2022 production) for Magnolia, and updated the revenue summary. Average income was nearly the same with updated numbers.

The owner was in suspense with Magnolia and did not get an 8/2022 check stub. You’ll note in 9/2022 that the check stub is in her name now and it’s for approximately double, so this is payment for 2 months. We split the 9/2022 check stub between 8/2022 and 9/2022 evenly just as an approximately idea of monthly income.

Seller will retain the 9/2022 payments received. If an offer is agreed upon before October 15th, buyer may keep all check dates October 2022 forward.

_________________________________

This is an opportunity to buy some exceptional production in Karnes County Texas. The ownership is an excellent opportunity to buy existing royalty income with potential upside as well. The buyer will get some nice diversification as there are multiple units and 51 actively producing wells. These wells are past flush production but not very old so the buyer will receive a very nice royalty income for years to come.

The seller is interested in selling 100% of their mineral rights ownership.

This interest has been producing an average of $21,420/month in 2022. The Yanta et al Unit and Annie Trial unit appear to be fully drilled up. In the EF Medina Unit, it appears that the wells are pretty spaced. It’s possible they could drill more wells there in the future.

It appears that in the EF Medina, the ownership is .0164 NDI in 341.89 acres. On the check stubs, the EF Hoffman trial shows the same NDI. However, the tax rolls show a .008247 NDI. If you use the larger unit size of the combined Hoffman / Medina unit, the acreage works out similar around 45 to 48 NRA. Please note that there are currently Medina-Hoffman wells actively producing. The seller is only being paid on the M Hoffman M Trial SA 1H well which appears to be right in between the Medina unit and the Medina-Hoffman unit. In addition, the seller is not in the tax rolls on the Medina-Hoffman wells, so we don’t believe they have an ownership there.

The owner listed on the check stubs is the estate of Michael Leo Trial. These mineral rights have been deeded to Theresa Garcia Trial (the seller). The seller is currently in the process of transferring the ownership to her name. Any royalty income related to production months from August 2022 and all prior months would be due to the seller.

Please check TexasFile.com on this listing. This seller and the deceased have transacted many times and there is a lot of documentation to review. We pulled a few of the relevant documents, but it is up to each buyer to perform their own due diligence. We are basing this listing on what they are currently in pay on. All taxes are showing current.

We have attached a file showing a pending lawsuit from 2014. That issue was resolved a long time ago according to the seller.

All offers should be made on a cash flow basis. No adjustments will be allowed at closing unless mutually agreeable by buyer and seller. The seller would like to start the bidding at $1,270,000 for 100% of the ownership.

Important: The documents attached in the zip file do not contain all documents. Please visit the link below to download all documents.

We will begin accepting offers on Monday, September 19th.

The mineral owner has exclusively listed with Texas Royalty Brokers. Please do not contact the mineral owner directly. To make a bid or ask questions about this listing, please contact Texas Royalty Brokers using the contact form below. Our team will quickly be in touch.

We have other mineral rights for sale.

Exclusitivity Notice

All listings posted at Texas Royalty Brokers are exclusive. The seller has agreed to exclusively sell through our company and will become personally liable if you close a deal directly with the seller. Please direct all offers and communication directly to Texas Royalty Brokers.

Accepting Offers on 2/6/2023