sellers

Buyers

Mineral Rights Taxes

Let’s be honest. No one gets excited about taxes.

But if you own mineral rights or receive royalty income, understanding how mineral rights taxes work could save you thousands of dollars.

Whether you’re thinking about selling your mineral rights or just want to avoid surprises come tax season, we break it all down in plain English.

From capital gains to royalty income, here’s what every mineral owner needs to know to keep more money in their pocket.

We will cover the following topics:

- Tax Advantages of Selling Mineral Rights

- Understanding Ordinary Income Tax vs Capital Gains Tax

- How are Lease Bonus Payments Taxed?

- How is Royalty Income Taxed?

- How is the Sale of Mineral Rights Taxed?

- Calculating Step-Up Basis for Inherited Mineral Rights

- Can you 1031 Mineral Rights?

- Will I get a 1099 after selling mineral rights?

- Are there property taxes due for Mineral Rights?

Do you have an offer to sell mineral rights and you are curious about the tax consequences? Do not sell until you contact us for a free consultation. We can help you get a higher price. Getting competitive bids is the key to getting maximum value when you sell.

Tax Advantages of Selling Mineral Rights

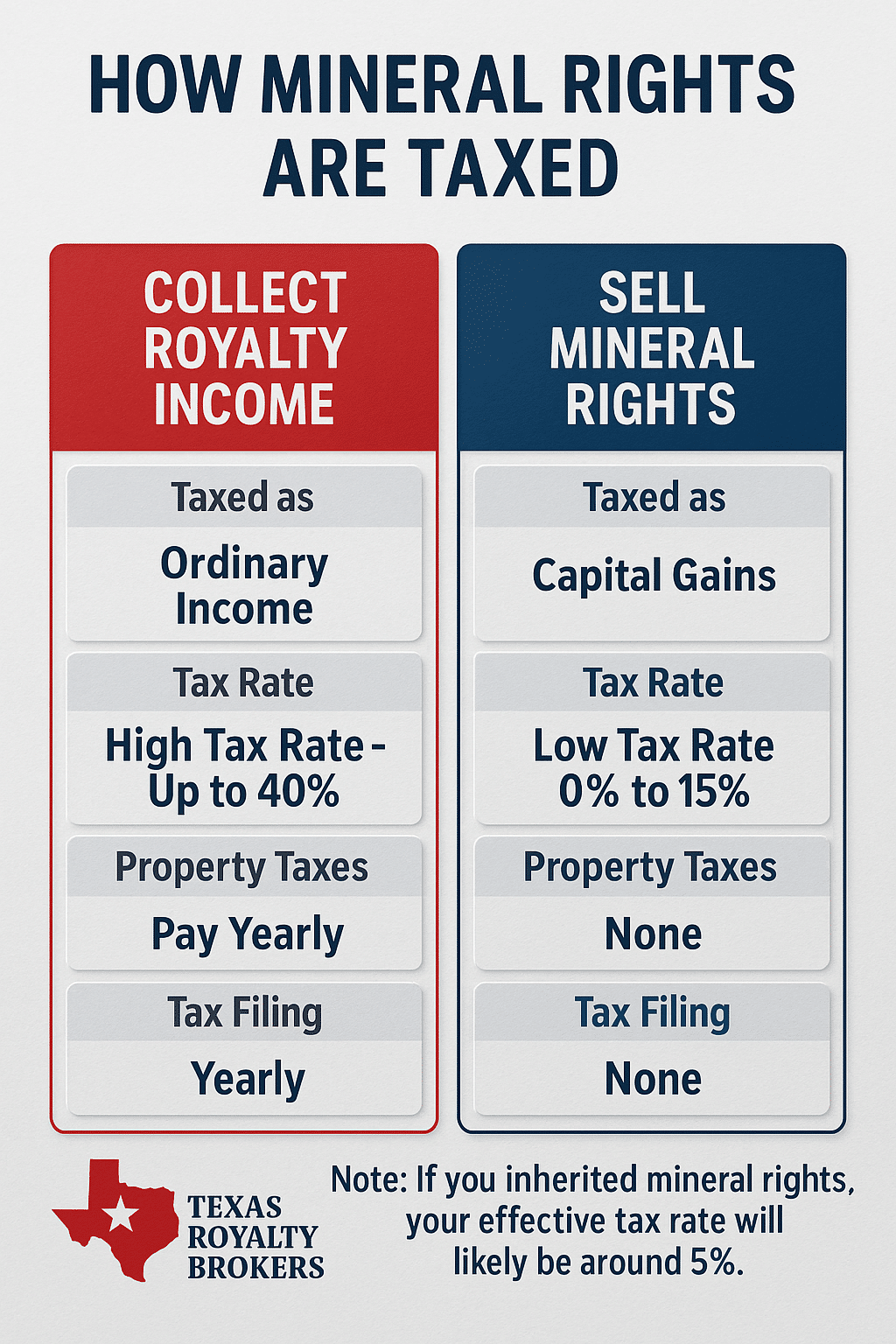

If you’re weighing the pros and cons of selling your mineral rights, taxes might not be the first thing on your mind, but they should be.

Taxes are the #1 reason most mineral owners choose to sell mineral rights.

The truth is, holding onto your mineral rights can cost you more in taxes than you realize.

Keep the following in mind as you collect royalty income:

1. Royalty income is taxed at a higher rate.

Every royalty check you cash is taxed as ordinary income. That means it’s stacked on top of your other income and taxed at rates as high as 37% or more. Ouch!

2. Yearly Tax Filing is a Hassle

Royalty income means messy tax filing every year. You’ll need to track down 1099s, calculate depletion, and report income from multiple sources. Do you live in a different state than the mineral rights? Now you need to file in the state where your mineral rights are located. One missed form or incorrect figure can lead to IRS trouble.

3. Property taxes are a Hassle

Even if your royalties slow to a trickle, you’re still on the hook for county property taxes every year as long as you own the minerals. If you forget to pay, your mineral rights can be taken away by taxing authorities.

There are huge tax advantages to selling mineral rights:

1. Selling brings long-term capital gains treatment.

When you sell mineral rights, that lump sum is usually taxed as a long-term capital gain, typically just 15% to 20%. That’s a huge difference compared to regular income tax rates.

2. Inherited mineral rights

If you inherited the mineral rights, you will get step-up basis tax treatment. This means your effective tax rate will likely fall around 5% to 10%. For some mineral owners, they will owe no tax on the sale of inherited mineral rights. Get a free consultation and we can tell you more.

3. Less Hassle – Less Cost

No more yearly tax filings to mess with.

No more paying property taxes on top of the ordinary income tax each year.

The Bottom Line:

Selling your mineral rights can simplify your taxes and potentially save you thousands.

Instead of getting taxed to death paying ordinary income tax rates and property taxes each year, you could walk away with a big check and a much smaller tax bill.

Understanding Ordinary Income Tax vs Capital Gains Tax

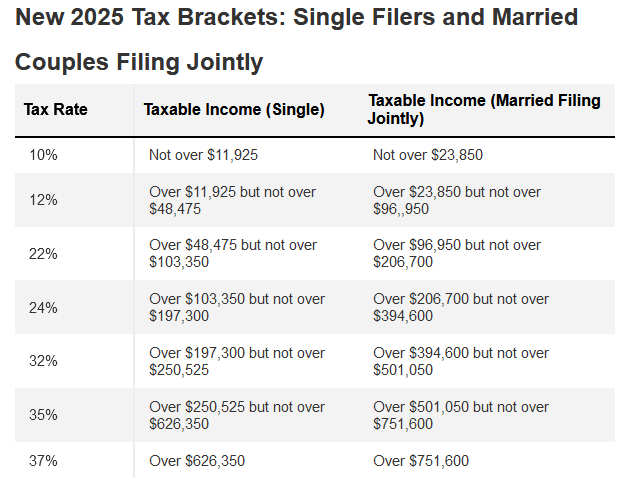

It is important to understand how ordinary income is taxed vs how capital gains are taxed.

Ordinary Income Tax: Ordinary income simply means income that does not receive any type of special tax treatment. Any income you receive throughout the year will be taxed as ordinary income. Regardless of how you earn the income, it will be cumulative. This means your royalty income is added to any other income earned from a job during the year.

While each person has a unique tax situation, most individuals are going to be taxed between 22% and 24% when they are taxed at ordinary income tax rates.

Ordinary income tax rates for 2025 can be seen in the table below:

Source: Kiplinger

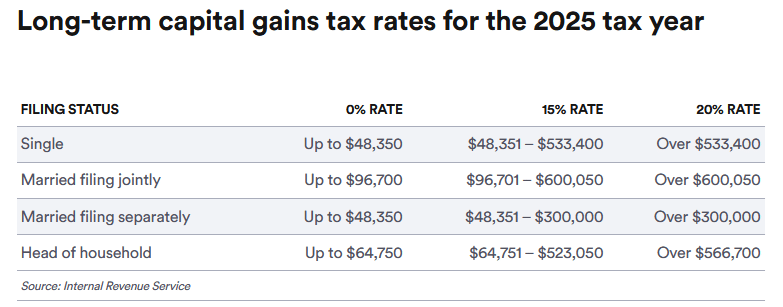

Capital Gains Tax: Capital gains tax rates are applied when you sell an asset that you have owned for greater than 1 year.

Capital gains tax rates for 2025 can be seen in the table below:

Source: BankRate.com

Once again, each person has a unique tax situation, but you will most likely be taxed at a 15% capital gains tax rate. Texas has a 0% capital gains tax rate.

What this means is that when we say ordinary income tax you are probably paying 24% in taxes. When we say capital gains tax you are probably paying 15% in taxes.

How are Lease Bonus Payments Taxed?

If you own mineral rights and you get paid a lease bonus, this bonus paid will be taxed as ordinary income. Lease bonus payments are considered advanced royalties. When the payment is made by the operator, they will generate and send you a 1099 at the end of the year and note the payment as a bonus payment.

How is Royalty Income Taxed?

Oil and gas royalty income is taxed at ordinary income tax rates. Even if you have owned the mineral rights for a long time, this income will be treated like any other income you earn from your job or other sources.

How is the Sale of Mineral Rights Taxed?

This is where things get more complicated.

This is also where you can make a lot more money if you understand how mineral rights taxes work.

If you have owned the mineral rights less than 1 year, you will be taxed at ordinary income tax rates. However, the vast majority of mineral owners have owned the mineral rights for more than 1 year. This means you will be taxed at capital gains tax rates.

Let’s look at an example:

Example 1: John has an offer to sell mineral rights for $300,000. If he sells the mineral rights, he will pay capital gains tax rates of 15% or $45,000 in taxes.

Example 2: John decided to collect royalty income rather than sell his mineral rights. John collected $300,000 over 10 years of royalty income. During that time, John was paying a 24% ordinary income tax rate. This means John paid $72,000 in taxes. More importantly, it took John 10 years to collect the same amount of money and he was paying more in taxes.

In the examples above, the decision to sell mineral rights could be heavily influenced by taxes. The mineral rights taxes John has to pay and the time he has to wait to collect royalty income could easily sway John to sell.

The example above is also the worst case scenario assuming that John received the mineral rights with his home purchase and has a $0 basis in the mineral rights.

Calculating Step-up Basis for Inherited Mineral Rights

In the example above, we ignored step-up basis for inherited mineral rights.

Most mineral owners inherit mineral rights. This means you get to use the step-up basis tax advantage.

Your basis in the mineral rights is how much the mineral rights “cost” you.

When you inherit mineral rights, obviously they don’t cost you anything. However, this special step-up basis tax rule allows you to treat inherited mineral rights as though your “cost”, or basis, is the market value at the time of your inheritance.

What this means is that you only pay on the difference between the sales price and the market value when you inherited the mineral rights. This could mean you owe very little or $0 in taxes when you sell mineral rights.

The best way to figure out step-up basis is to work backwards to determine the market value when you inherited the mineral rights once you sell the mineral rights.

We do this by looking at the inflation adjusted price of oil or looking at the inflation adjusted price of natural gas if your ownership is all or mostly gas. You simply look at the price oil or gas when you sell and compare it to the inflation adjusted price of oil when you inherited.

If your ownership has production from both oil and gas, we recommend using oil prices as they are a better indicator of the overall oil and gas market.

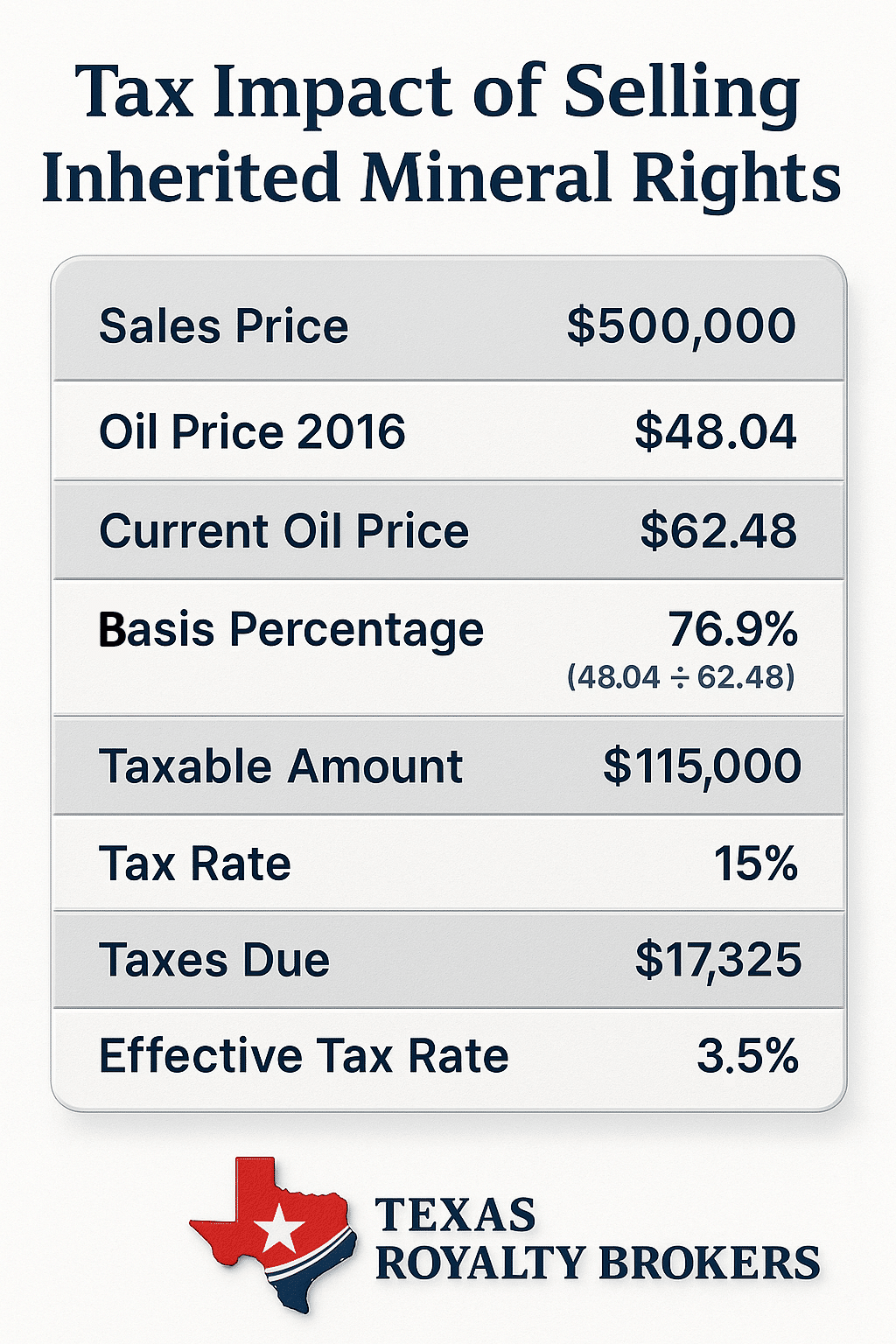

Example 1: Calculating the Tax Impact of Selling Inherited Mineral Rights

In this example, we assume you inherited mineral rights in 2016. You recently sold the mineral rights for $500,000 total. Due to step-up basis, you only pay $17,325 on a $500,000 sale, or an effective 3.5% tax rate.

Example 2: Step-up Basis Calculation for Sale of Inherited Mineral Rights

This is a more detailed break down of the step-up basis calculation.

In this example, let’s assume you sold mineral rights for $300,000 that you inherited in 2009. The current price of oil is $80/barrel. Looking at the table linked above, the inflation adjusted price of oil was $68.26 in 2009.

To determine the amount of taxes due, we first need to determine your basis. Your basis will be $68.26 (market value when inherited) / $80 (current price of oil) = 85.325%. This means that your basis is 85.325% of the total sales price.

$300,000 Sales Price

X 85.325% Basis Percentage

$255,975 Your basis (you do NOT owe tax on this amount)

$300,000 – $255,975 = $44,025 This is your gain and how much you owe taxes on.

Remember that you still get capital gains tax treatment on the sale, so you only owe 15% taxes on a $44,025 sale. This means you owe taxes of $6,603.75 ($44,025 X 15%).

John will pay $6,603.75 in taxes on a $300,000 sale, or just 2.2% in taxes due to step-up basis rules.

As you can see from the example above, understanding mineral rights taxes is important. Due to step-up basis, John is able to pay just a tiny fraction in taxes for the sale of his mineral rights. Compare paying $6,603 in taxes and getting paid $300,000 TODAY vs paying $72,000 in taxes and getting paid over 10 years.

If you inherited mineral rights it nearly always makes sense to sell mineral rights due to stepped up basis.

The step-up basis tax loophole is at risk of being eliminated. This tax loop hole is a mineral owners best friend. If the step-up basis tax treatment goes away, mineral owners are going to lose out on millions of dollars in potential tax savings.

If you inherited mineral rights and you are thinking about selling mineral rights, reach out to us and get a free consultation. Find out how you can save thousands on taxes by selling your mineral rights.

Note: The inflation adjusted price of oil from sales in the past and the current price of oil are constantly changing. To make the calculation, you will need to tailor these numbers to your specific situation.

Can you 1031 Mineral Rights?

Can you 1031 the sale of your mineral rights to avoid taxes entirely? The short answer is YES!

However, there is a question here surrounding what “like-kind exchanges” means related to mineral rights. The rules about what types of property are fairly liberal. You can exchange apartment buildings for raw land.

What can you exchange mineral rights for? This is the tough question. Obviously you can exchange mineral rights for other mineral rights. However, finding a property within the time frame allowed can be challenging. It is likely that you can 1031 mineral rights into another type of real property, but you should consult your qualified tax professional to ensure you can 1031 the mineral rights before you complete the transaction.

You should also be aware of depreciation recapture rules. When you 1031, depreciation recapture comes into play. If you have a good mineral rights tax professional, they have been depreciating your mineral rights as you collect royalty income. This could trigger a tax consequence to completing a 1031 sale on your mineral rights.

The last thing to note is that if you want to do a 1031 on your mineral rights when you sell, you should clearly notify everyone involved up front. Whether this is your mineral rights broker, a mineral buyer, or the owner of the property you intend to purchase, you should keep each party in the loop. A 1031 adds a level of complexity to the sale which means things could take longer. Parties need to know so they can plan accordingly.

Will I get a 1099 after Selling Mineral Rights?

One weird mineral rights tax rule is that mineral buyers are not required to send you a 1099. When you collect income over $600, in most cases a 1099 is required to be issued. The current rules do not require a mineral buyer to send a 1099.

In practice, some mineral buyers do send a 1099.

Whether you get a 1099 for the sale or not, you should simply report the sale of mineral rights on your taxes.

Are there Property Taxes for Mineral Rights?

If you collect royalty income in Texas, there will be property taxes due. These mineral rights taxes are based on how much income is generated.

Each year the oil and gas operators report how much oil and gas they sold, the pricing, royalties payments to mineral owners, etc to the counties and state. Each county will then turn around and bill you for property taxes due on your producing mineral rights. The tax rates are generally low.

Make sure that you are paying these property taxes or you could lose your mineral rights to a sheriff’s auction.

If you do not receive any royalty income from oil and gas operations, generally speaking you will not owe property taxes.

Note: In states outside of Texas, the rules vary. Some states do not have property taxes at all. Some states charge a tax at the time of sale.

Disclaimer

No information provided on this page should be considered legal, tax, or accounting advice. You should reach out to your legal or tax professional to find out how mineral rights taxes work for your specific situation.

Questions about Mineral Rights Taxes?

Taxes might not be the most exciting part of owning mineral rights, but they can make a big difference in how much you actually take home.

If you’re tired of the tax burden that comes with royalty income, selling your mineral rights could be the smarter, cleaner option.

Still have questions about how taxes work when selling mineral rights? We’re here to help.

Contact Texas Royalty Brokers anytime. We’ll walk you through how a sale could impact your tax situation and help you make the best decision.

Want to keep learning? Check out some of our most popular articles:

-

Learn more about Mineral Rights Brokers

At Texas Royalty Brokers, we specialize in helping mineral owners like you get maximum value with minimum hassle. If you have questions, fill out the free consultation form below.