sellers

Buyers

Mineral Rights Value in 2025

If you’re thinking about selling your mineral rights, or just curious what they might be worth, this article is absolutely essential.

Understanding the value of your mineral rights isn’t as simple as checking a price online or asking your neighbor what they got. There are dozens of factors that impact value, and if you don’t know what to look for, you could leave substantial money on the table.

This article breaks down everything you need to know in clear, simple terms — no industry jargon, no fluff.

You’ll learn how mineral rights are valued, what buyers are looking for, and why getting multiple offers is the only way to know what they’re really worth.

Important: If you have an offer to sell mineral rights, do not sell until you get a free consultation with our company. We can quickly help you evaluate the offer and determine if the offer is fair.

We’ll cover the following topics:

Understanding Mineral Rights Value

The most important thing to understand about mineral rights value is that there is no way to know the exact value until you sell. However, we can use some “rules of thumb” to help us estimate the value of mineral rights.

Why is it impossible to know the exact value until you sell? The reason is that each mineral rights ownership is unique.

There are 5 factors that dramatically impact the value of your mineral rights.

1. Net Mineral Acres Owned: The most important factor is how many net mineral acres you own. You are paid royalty income based on how many net mineral acres you own out of the total unit. For example, if there is a 640 acre unit and you have 20 net mineral acres, you have just 3.1% of the total acres in the unit. However, if you have 90 net mineral acres in a 640 acre unit, you have 14% of the unit. The more of the unit you own, the more you get paid.

2. Royalty Rate: The royalty rate determines how much of the oil and gas produced gets paid to you after the oil and gas operators take their share. The higher the royalty rate, the more money you make.

3. Timing: The value of mineral rights is very closely related to the price of oil and/or gas. Ultimately you own the oil and gas underground. If the value of that oil and gas goes up or down, the value of what you own goes up or down. However, the value is not going up or down on a daily basis. Mineral buyers look at the average price of oil and gas over the trailing 6 to 12 months. Once a mineral buyer knows how to buy mineral rights, they know that the long-term average price is the important factor to consider.

4. Royalty Income: Your current royalty income has a very large impact on the value. If you are getting consistent royalty income over $2,500+/month, this is going to appeal to a larger audience of mineral buyers. The reason is that mineral buyers get an immediate return on their investment.

5. Potential Income: The last factor is the future upside potential. This is the hardest factor to estimate! The question is how much income will be generated in the future and when will that income start? Some mineral buyers will put $0 value on the future upside. They only look at current royalty income. Other buyers will pay $5,000,000 for mineral rights that only make $10/month based upon what the mineral rights will generate in the future. This factor alone is what causes you to see offers that vary widely from one buyer to the next.

There are many other factors that affect the value of mineral rights. While those factors are also important, the factors above are what swings the value dramatically.

Estimating Average Price Per Acre for Mineral Rights

Is there a way to estimate the average price per acre for mineral rights? Yes!

While there is no way to determine the exact value of mineral rights, we can estimate the average price per acre for mineral rights.

The estimates of mineral rights value below are just a rule of thumb. The rule of thumb for mineral rights value is based upon the status of your mineral rights.

Mineral rights fall into 3 categories:

Non-Producing: If there is no active lease on your mineral rights, and you don’t get royalty income, you have non-producing mineral rights. The rule of thumb for mineral rights value when they are non-producing is $0/acre to $1,000/acre. In many cases, the value is $0. The only time you can expect to get more than $0 is if you have an offer to sell OR you have a recently expired (within the last 12 months) lease. This acreage is considered pure speculation and has $0 value because it will likely be years (decades) before it produces income.

Leased: If your acreage has an active lease agreement, you can expect to sell for about 2x to 3x your lease bonus. For example, if you had 10 net acres and you leased them for $3,000/acre, you would expect to sell mineral rights for about $6,000/acre to $9,000/acre.

Producing: If you have producing mineral rights, this means you get paid royalties on a monthly basis. Some mineral owners get paid every few months if the value is less than $50/month. The value of mineral rights that are producing is broken down into two components:

1. Cash Flow Value: The cash flow value is based upon your royalty income. To determine the cash flow value of your mineral rights, find the average of your last 3 months of royalty income and then multiply this number by 3 years to 6 years. (Hint: Use the mineral rights value calculator below to estimate the cash flow value of your mineral rights)

2. Upside Potential: If there is space to drill additional wells on your acreage in the future, your mineral rights have additional value in the upside potential. If/when those wells are drilled, the value of the acreage will be higher. This value is very subjective and depends on how a mineral buyer evaluates the upside.

The estimated mineral rights values above are just estimates! If you are curious about estimating mineral rights value for your mineral rights, get a free consultation. There is no obligation and no pressure!

Calculating Mineral Rights Value

If you want to calculate mineral rights value, use our royalty calculator below.

The purpose of this royalty calculator is to show you what producing mineral rights are worth. This is the “cash flow value” component of producing mineral rights mentioned above.

As a general rule of thumb, you can expect your producing royalties to be worth about 3 years to 6 years of your average monthly income.

Using the oil royalty calculator above, you can get a general idea what your producing mineral rights are worth.

Keep in mind that this is only the cash flow component of the value. Your royalty income alone has value, and that is what this mineral rights value calculator is showing you.

In addition to the cash flow value, your producing royalties may also have upside value. There is no way to calculate mineral rights value for the upside potential. Each mineral buyer will run their own analysis.

It’s important to understand that the cash flow value may also be incorrect if you have new wells.

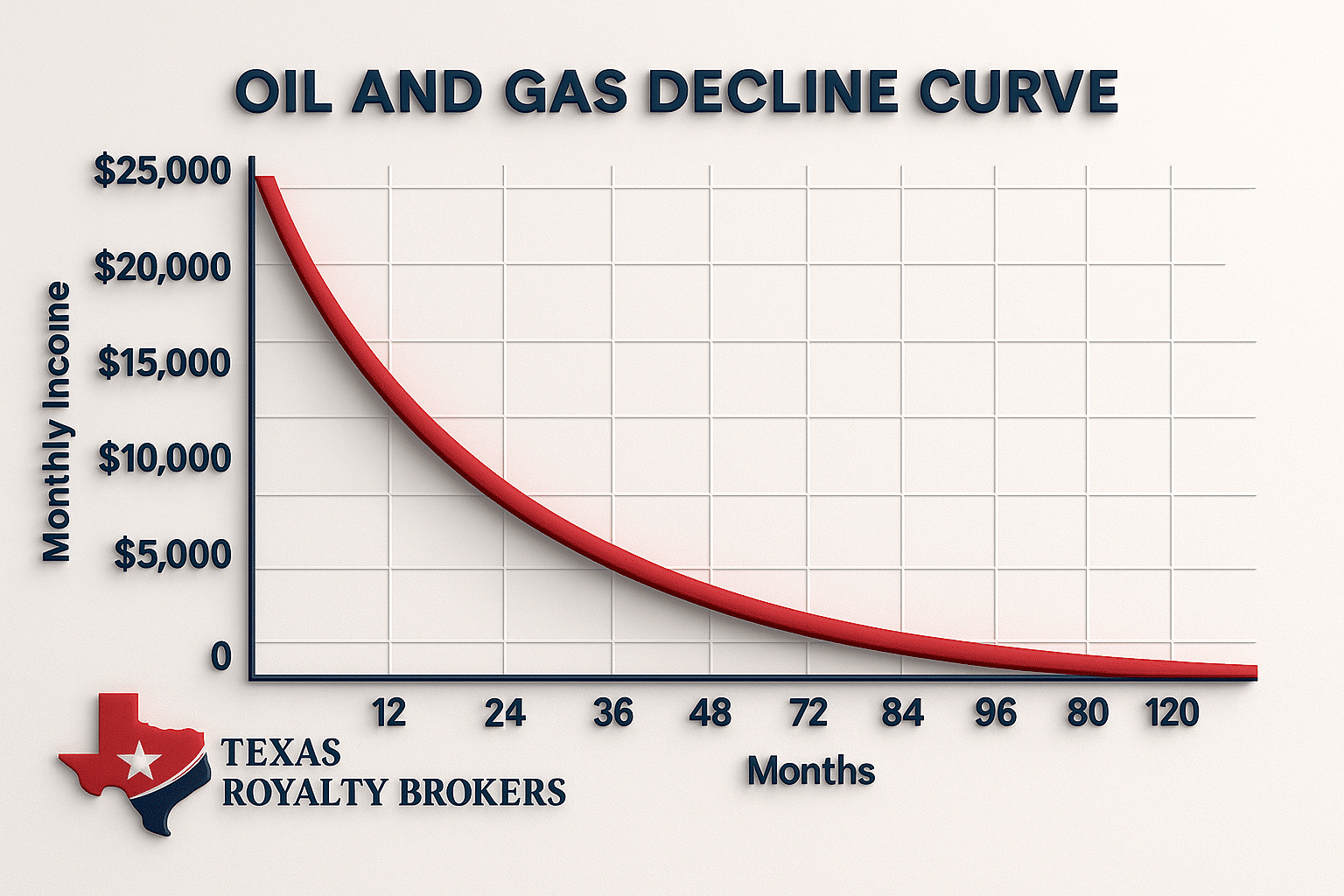

If you have only been receiving royalty income for a few months after new wells were drilled, this means you have flush production. Flush production means your royalty income will be extremely high in the first 3 to 5 years of production. It will rapidly drop off during that time. If you have new wells that just started producing, the mineral rights value calculator above will not be accurate.

Below, you can see an example of what flush production looks like.

As you can see, you may be receiving $10,000/month, but if the oil and gas wells generating the income are only 12 months old, that income is going to drop quickly.

Fair Offer to Sell Mineral Rights

When it comes to mineral rights value, the most important question is whether you are selling for the best price!

If you have an offer to sell mineral rights, you are probably trying to figure out what the value is so you can determine if the offer is fair.

Important: There is NO WAY to determine whether an offer is fair unless you get competitive bids.

Mineral buyers take advantage of mineral owners on a daily basis. Mineral buyers know that there is no way for you to figure out the value of mineral rights.

Mineral buyers will make you offers that are far below market value, then increase the offer to make it seem like you negotiated them higher. They create a false sense of value by starting low and letting you ask for a higher price and then giving it to you. Do not fall into this trap!

If you have a few offers in hand, don’t accept the highest offer you found. It is nearly always far below market value.

When mineral owners sell mineral rights at Texas Royalty Brokers, we consistently help them get 10% to 30% higher prices. This is due to competition.

Mineral Rights Appraisals

Is a mineral rights appraisal worth it?

Mineral rights appraisals can seem like a natural place to start when trying to understand what your mineral rights might be worth.

They’re designed to give you a rough estimate based on things like location, production history, lease terms, and current market conditions. But here’s the truth — an appraisal is just an educated guess.

The only way to know the true market value of your mineral rights is to get competitive bids from actual buyers. Why?

Because every mineral buyer values mineral rights differently.

Some buyers specialize in certain counties or formations, others are more aggressive depending on funding, and some might just be willing to pay more to round out an existing position.

That kind of buyer competition is what drives up your final sale price — not a number someone puts in a report.

And one more thing: you should never pay for a mineral rights appraisal.

There are plenty of companies out there that charge hundreds or thousands of dollars for a mineral rights appraisal that won’t actually help you understand the value of your minerals.

At best, it gives you a general range. Often, the estimate is flat-out wrong.

At Texas Royalty Brokers, we’ll give you a free estimate of value. We specialize in marketing mineral rights in competitive bidding environments, ensuring you walk away with the highest offer possible — no guesswork, no upfront costs, and no pressure.

Want to know what your mineral rights are really worth? Don’t pay for a mineral rights appraisal. Contact Texas Royalty Brokers for a free consultation.

Mineral Rights Value – Contact Texas Royalty Brokers

If you are curious about mineral rights value, we can help.

Our team is happy to answer your questions. We can do a free analysis of your mineral rights and help you get a better understanding of what the value might be. There is no way to know for sure until you get competitive bids, but we can help you better understand the value of your mineral rights.

Fill out the contact form below and our team will be in touch shortly. There is no obligation and no pressure when you get a free consultation with our company.