sellers

Buyers

Selling Mineral Rights in 2025? Use a Broker to Maximize Value

Before you do anything, carefully consider the information below.

A lot of mineral owners leave money on the table simply because they don’t know how to sell mineral rights for maximum value.

This guide will show you the best way to sell your mineral rights.

We’ll show you how to get the highest price without wasting time, with less stress, and while making more money.

We will cover the following topics about selling mineral rights:

- Is now a good time to Sell Mineral Rights?

- Top 2 Reasons to Sell Mineral Rights

- Common Mistakes when Selling Mineral Rights

- How to Sell Mineral Rights for Maximum Value? Competition

- Understanding Mineral Buyers

- Selling Mineral Rights at Texas Royalty Brokers

At Texas Royalty Brokers, we guide mineral owners through the process and ensure you sell mineral rights for the highest price possible.

Is Now a Good Time to Sell Mineral Rights?

This is one of the most common questions we receive from mineral owners. Is now a good time to sell mineral rights?

When you own mineral rights, you own the physical oil and gas sitting beneath the ground. As the price of what you own underground fluctuates, so does the value. The primary thing to watch is the price of oil and gas.

However, mineral owners believe the value of mineral rights changes daily when oil and gas prices change. This is not correct.

If the price of oil is $50 and overnight it skyrockets to $100 due to war, are mineral buyers now paying twice the price for mineral rights? NO!

If the price of oil is $100 and drops to $50, are mineral buyers now paying half the price? NO!

Important: Mineral buyers are looking at the long term average price for oil, not the current price today. When you buy mineral rights, you are making a long term investment.

While the current price of oil and gas may move a lot, the long term average price does not move nearly as much.

The Best Time to Sell Mineral Rights

As a mineral owner, you should sell mineral rights when it makes sense for you and your family.

It’s impossible to time the stock market, housing market, or mineral rights market.

Top 2 Reasons to Sell Mineral Rights

Deciding whether to sell mineral rights is a personal decision. There is no right or wrong reason for selling mineral rights.

These are the two most important reasons to consider selling mineral rights:

1. Selling Mineral Rights for Diversification

If your mineral rights represent a significant portion (more than 10%) of your net worth, it may be beneficial to consider selling them to diversify your investments. Why?

You have no control over what happens with this ownership. You do not get to decide when a new well is drilled or have any control over oil and gas prices.

The old adage to “never sell mineral rights” is terrible advice.

For many, it makes sense to sell and put that money to work in the stock market. You’ll be better diversified and you can start earning dividend income that compounds the value of your investments.

Unless you have a substantial investment portfolio, and your mineral rights represent less than 10% of your overall investments, selling mineral rights is recommended.

2. Selling Mineral Rights for Tax Savings

Let’s say you are well diversified and your mineral rights are just a small portion of your overall retirement plan or net worth. Deciding to keep your mineral rights might make sense.

The deciding factor is whether you inherited the mineral rights.

If you inherited mineral rights, you should likely sell mineral rights even if you are diversified. There is almost no scenario where you should keep mineral rights if you inherited them due to tax savings.

Why? The reason is that you will pay more in taxes collecting royalty income. Royalty income is taxed as ordinary income, which means you will pay a 28% to 40% tax rate on royalty income.

When selling inherited mineral rights, your effective tax rate will likely be closer to 5%. Some mineral owners will owe $0 tax selling mineral rights. Get a free consultation to find out what your effective tax rate might be.

If you inherited mineral rights, you get a step-up basis, which is extremely important to understand. What this means is that you only pay capital gains tax rates on a portion of the sale price.

Our tax article breaks down the tax implications of selling mineral rights in Texas. If you inherited mineral rights, it nearly always makes sense to sell and take advantage of your step-up basis and capital gains.

Other Reasons to Sell

For the vast majority of mineral owners, selling to diversify and avoid a higher tax rate are the most important reasons to sell. Here are some other reasons to sell mineral rights:

- Simplify your Estate

- Qualify for Medicaid

- Financial Need

- Pay off Debt

- Pay for School

- Starting a Business

- Helping a Family Member

Keep in mind that selling mineral rights is a personal decision. Whatever your reasons, the common advice to never sell mineral rights is wrong. Sell when it makes sense for you.

Common Mistakes when Selling Mineral Rights

The vast majority of mineral owners know very little about their mineral rights.

Rather than seek professional help, they decide to navigate a very complex transaction on their own.

These mineral owners are making a huge mistake. This mistake results in wasting a lot of time, substantial stress, and making less money.

Not working with an expert causes mineral owners to make the following mistakes:

#1 Mistake: Not using a Mineral Rights Broker

As a mineral rights broker, we are biased. We believe every mineral owner should rely on a professional when selling mineral rights. Why?

If you sell mineral rights on your own, you will have more work, a lot more stress, and you will make less money. It’s that simple.

If you could let someone else do the work and walk away with more money, would you let them handle it? That’s exactly how it works at Texas Royalty Brokers.

We specialize in helping mineral owners sell for the best price.

The best part? We guide you through the entire process from start to finish. Our experts will walk you through the process taking away the stress and handling everything.

Mistake: Not Understanding What you Own

A lot of mineral owners sell without understanding what they own. Do you know how many net mineral acres you have? Are you familiar with the difference between a net mineral acre and net royalty acre? As a mineral owner, it’s important to understand the size of your ownership. How many acres you own will have a large impact on the value.

At Texas Royalty Brokers, we help our clients understand what they own before they sell.

Mistake: Not Understanding Cash Flow Value vs Upside Potential

When looking at mineral rights value, it comes down to the cash flow value and upside potential. Understanding how to estimate the cash flow value and whether your mineral rights have upside potential is important to determine before selling mineral rights.

At Texas Royalty Brokers, we help our clients understand the cash flow value and upside potential before they sell.

Mistake: Not Understanding Local Activity

Mineral buyers are able to make substantial money buying mineral rights. The reason?

They have a lot more information than you do.

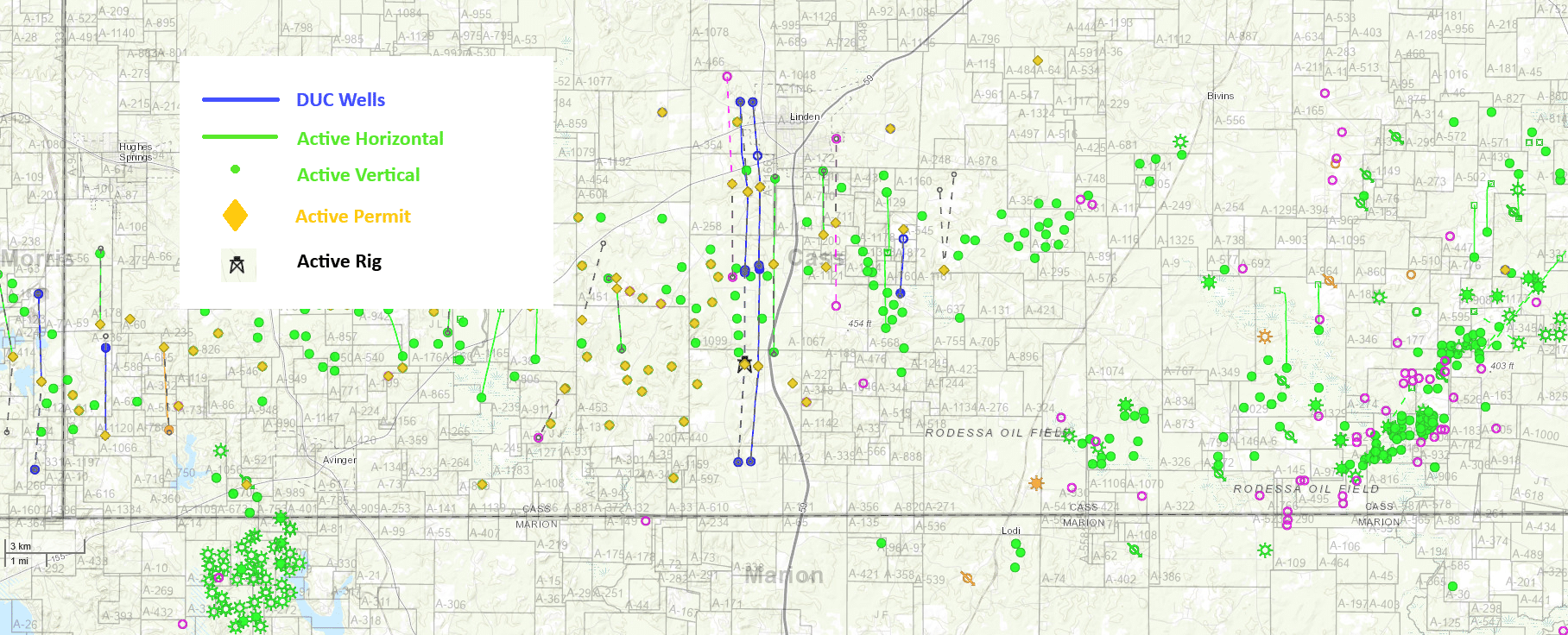

A mineral buyer has a clear view of what is happening with your acreage. Knowing whether your acreage has active permits, rigs, or DUCs on locations is critical. You have to know this information before you sell or you can’t make an informed decision.

Would you like to see a map like this for your acreage? (It’s FREE) Contact us for a free consultation.

At Texas Royalty Brokers, we help our clients understand exactly what’s happening on their acreage before they sell.

Mistake: Avoiding the Check Stubs Hassle

All we require to list mineral rights for sale are your 3 most recent check stubs. We even put together a guide on how to use Energylink to download your checks online.

With just a few minutes of effort, you could walk away with substantially more money. We have watched mineral owners walk away from hundreds of thousands of dollars on a single transaction simply because they didn’t want the hassle of getting their check stubs put together.

If someone offered to pay you $10,000, $100,000, or even $500,000 for an hour of your time, would you do it? For most, the answer is YES!

Mineral owners routinely lose out on a massive amount of money by not taking a single extra step to ensure they get the best price.

How to Sell Mineral Rights for Maximum Value: The Power of Competition

Do you want to sell mineral rights for maximum value? Of course!

To sell mineral rights for the highest price you need a mineral rights broker. Why do you need a broker? Competition.

When you sell mineral rights on your own, you are only reaching a handful of buyers. You’re allowing just a few mineral buyers to compete for you minerals when there are thousands of mineral buyers.

Selling mineral rights on your own will result in getting far below market value. Why? There is no competition.

Competition is the Key to Maximum Value

Finding an offer to sell mineral rights is easy. Finding the absolute highest possible price from a reputable mineral buyer is the hard part.

A lot of mineral buyers have made a fortune reaching out directly with offers.

Most mineral owners will talk to a handful of mineral buyers. They negotiate the best price they can, and then sell.

These mineral owners don’t realize that they could have walked away with substantially more had they simply gotten competitive bids.

Let’s say you received an initial offer for $500,000 and were able to negotiate it up to $650,000. It may seem like you got a good deal right? WRONG

This is a common trap that mineral owners fall into when selling mineral rights.

If you found an offer for $650,000 on your own with a just a handful of buyers, imagine what the price would be if thousands of mineral buyers had an opportunity to bid?

How to get Competitive Bids when Selling Mineral Rights

Most mineral owners who list mineral rights for sale at Texas Royalty Brokers already have an offer in hand.

We allow mineral owners to bring us their best offer in writing. We then list the mineral rights for sale and work to get higher bids. If we don’t get you a higher bid net of commission, we don’t get paid. This makes listing a risk free way to ensure you get maximum value when selling mineral rights.

Over 95% of clients who list with us walk away with a higher offer.

Typically, we see a 10% to 30% price improvement over an existing offer.

If you get a 20% price improvement on a $650,000 offer, you just made an extra $130,000! If you have a $1MM offer, you’re looking at an extra $200,000 simply by working with Texas Royalty Brokers.

Competition is crucial when selling mineral rights. You absolutely must get competitive bids or you are nearly always selling below market value.

Ready to sell mineral rights? Learn more about how to list mineral rights or contact us for a free consultation.

Understanding Mineral Buyers

If you own valuable mineral rights in Texas, you may receive offers to sell them in the mail or by phone.

If you are in a really good location and you have a lot of royalty income, you may be getting offers to sell minerals on a weekly basis. Some mineral buyers will even take the time to locate your phone number and call you directly.

There are four types of mineral buyers who will contact you with letters in the mail:

- Low Ballers: If you have ever received an offer in the mail that was substantially lower than the other offers, this was a low ball offer. These mineral buyers are hoping that you’ll sell below market value. They may attempt to make the process appear easy in order to convince you to sell below market value.

- Teasers: Some mineral buyers will throw out teaser offers. These offers use language like “Up to $30,000 acre in your area.” Any time you see the words up to this is not a real offer. This is a buyer who simply wants you to see a large number and pick up the phone.

- Flippers: These “mineral buyers” are not actually buyers. In fact, most do not have any cash at all. Their goal is to put you under contract at any price, then find someone to pay a higher price. It’s important to understand that these flippers will misrepresent themselves. They will tell you point blank they are buyers. At the very end they will bring in a “partner” who is the actual end buyer. If they do find you a buyer, you sold way below market value. If they don’t find you a buyer, you may have spent time and resources on the process without achieving anything.

- Quality Buyers: A very small percentage of offers you get in the mail are from reputable buyers. Some very high quality buyers do send offers in the mail. The majority of the offers you get in the mail will not be high quality buyers. More importantly, only a very small percentage of quality mineral buyers send letters in the mail. Sending letters is time consuming and not cost effective. Most high quality mineral buyers rely on Texas Royalty Brokers to locate deals and bring them to market where they can bid on them.

If you are getting offers to sell mineral rights in Texas, do not accept any offer until you get competitive bids. A lot of mineral buyers will compare a few offers they got in the mail, and take the highest offer. This is a huge mistake.

Just because you have one offer that is higher than the other offers does not mean it’s a good deal. There are thousands of high quality mineral buyers who want to make a bid. You will get a much higher price when you create a bidding war for your mineral rights.

Selling Mineral Rights at Texas Royalty Brokers

If you are considering selling your mineral rights, let us help you get the best price while saving time and reducing stress.

The team at Texas Royalty Brokers has been helping mineral owners get maximum value when selling mineral rights since 2012.

At Texas Royalty Brokers, we can provide you with the information you need to make an informed decision. Whether your mineral rights are worth $10,000 or $10MM, contact us for a free consultation.

Working with Texas Royalty Brokers will provide you with the following benefits:

- Competitive Bidding: Did you know that using Texas Royalty Brokers to sell will nearly always result in 10% to 30% higher prices? After taking commission into account, our clients saw an average 10% to 30% increase over offers they received on their own. How is this possible? When you receive a few offers in the mail or solicit a few bids on your own, you are typically contacting less than 1% of the mineral buyers in the market. To maximize value, your mineral rights need to be listed in a competitive environment where thousands of buyers are competing to pay you the highest price.

- Commission Rates: In the mineral rights industry, it’s common for mineral brokers to charge 6% to 10%+. At Texas Royalty Brokers, we offer the most competitive commission at just 6%. For clients who own mineral rights valued at $2.5MM or higher, our scale-based commission means the effective commission rate will be less than 6%. Our focus on Texas mineral rights allows us to be more efficient than other brokers. We pass those savings along to our clients. Not only will you get a higher price working with our company, but we also earn a lower commission than other brokers.

- Simplify the Process: Selling mineral rights can feel complicated, but we make it simple. At Texas Royalty Brokers, we handle everything — from finding qualified buyers, to negotiating offers, and closing paperwork. Our process is designed to save you time, reduce stress, and help you get the best price possible without the hassle. If you sell mineral rights on your own, you will do more work and make less money.

Our team is eager to answer your questions and help you better understand your mineral rights.

If you have any questions or are ready to discuss selling your mineral rights in Texas, please use our contact form and one of our team members will respond promptly.