Why Texas Royalty Brokers?

Selling mineral rights doesn’t have to be complicated. At Texas Royalty Brokers, we handle every step of the process so you can get maximum value with zero stress.

Our team works hard to deliver real offers, real value, and real results.

sellers

Texas Royalty Brokers

Popular Topics

Mineral Rights Report

Buyers

Receive new listing notifications?

Trusted by Mineral Owners

![]()

Glasscock, TX

We had a great experience with Texas Royalty Brokers! Very professional and straight shooters. Hit the market with excellent results. Hightly recommend them!

Lavaca, TX

We worked with Emily to assist us with a sale of some of our mineral interests. Not only was she professional and courteous, but we were paid well above any previous offer and ahead of the expected time frame. What more could you ask for? A well deserved five star rating!

Upton , TX

My wife and I were very pleased with the guidance and knowledgeable advice that Emily and Eric provided to us regarding the sale of her mineral rights in Texas.

Nacogdoches, TX

Eric and his team were very knowledgeable and responsive to our needs and questions. The professionalism and integrity exceeded our expectations throughout the entire process. We highly recommend Texas Royalty Brokers!

Harrison, TX

I decided to work with Texas Royalty Brokers after reading several of their reviews. It was a good decision. They were prompt in their communication and straightforward in their assessments and follow through. I am quite pleased with the outcome and recommend them highly.

Mineral Rights Report

State Specific Guides

Resources

Blog Categories

Free Consultation

Get expert advice on your mineral rights with no pressure and no obligation.

Listing Notifications

To receive notifications regarding new listings that are activated on our website, please enter your email address below.

Listing Title

Leon County Texas Mineral Rights for Sale

Listing ID

401163

Listing Status

sold

- Listing Posted - complete

- Listing Evaluation - complete

- Accepting Offers - complete

- Client Review - complete

- Best and Final - complete

- Under Contract - complete

Please take a moment to learn more about each listing phase.

Listing Files

Please click the download button below to view the listing files. Listing files include maps, check stubs, and other documentation.

Listing Details

Starting Bid: $525,000

- State : Texas

- County : leon

- Legal Location : A-17, P Grande Survey

- Net Acres : 474.45

- Active Lease : Yes

- Royalty Rate : 22.5%

- Producing : yes

- Average Income : N/A

Comments:

10/2/2023

Sold

__________________________

8/26/2023

Under Contract

__________________________

8/24/2023

Best and Finals due end of day, Friday, August 25th.

__________________________

Update: 8/11/2023

This listing will stay open for offers until at least end of day on Wednesday, August 16th.

__________________________

Update: 8/10/2023

Now accepting offers.

__________________________

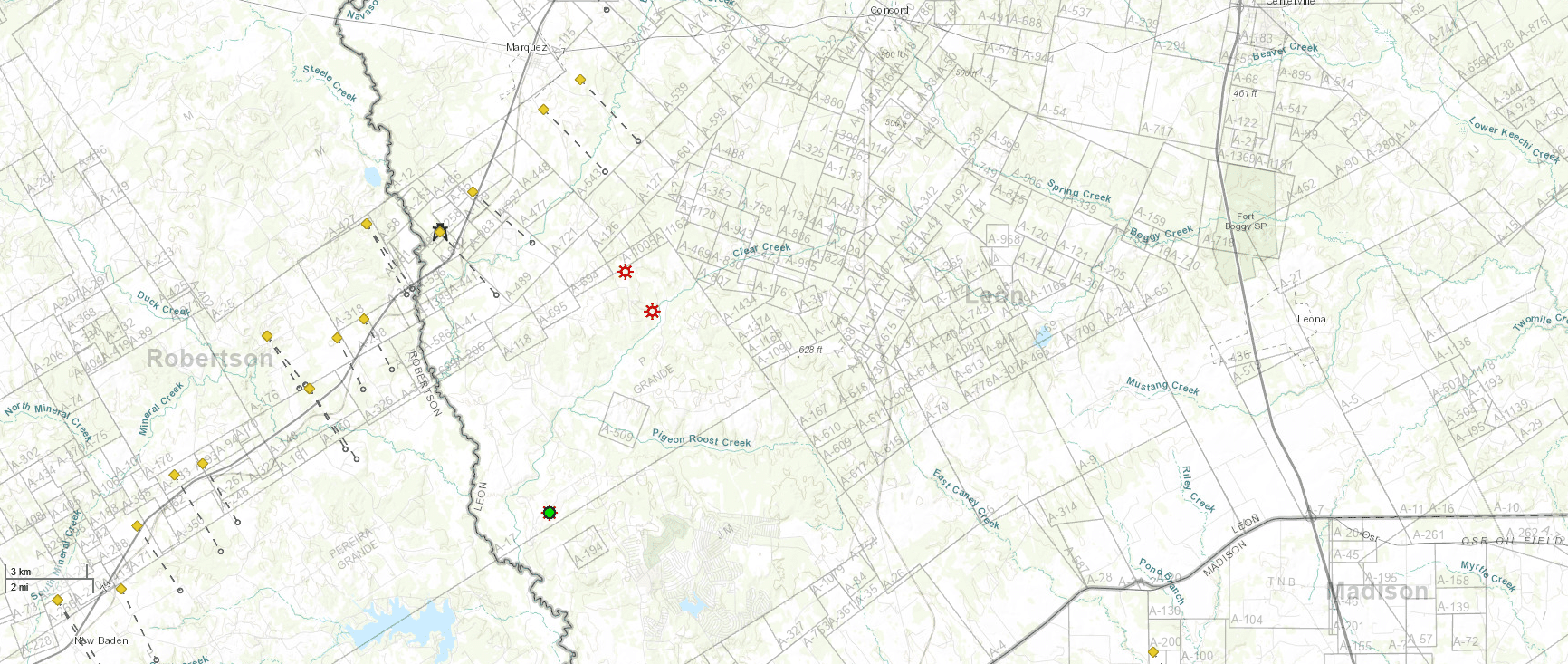

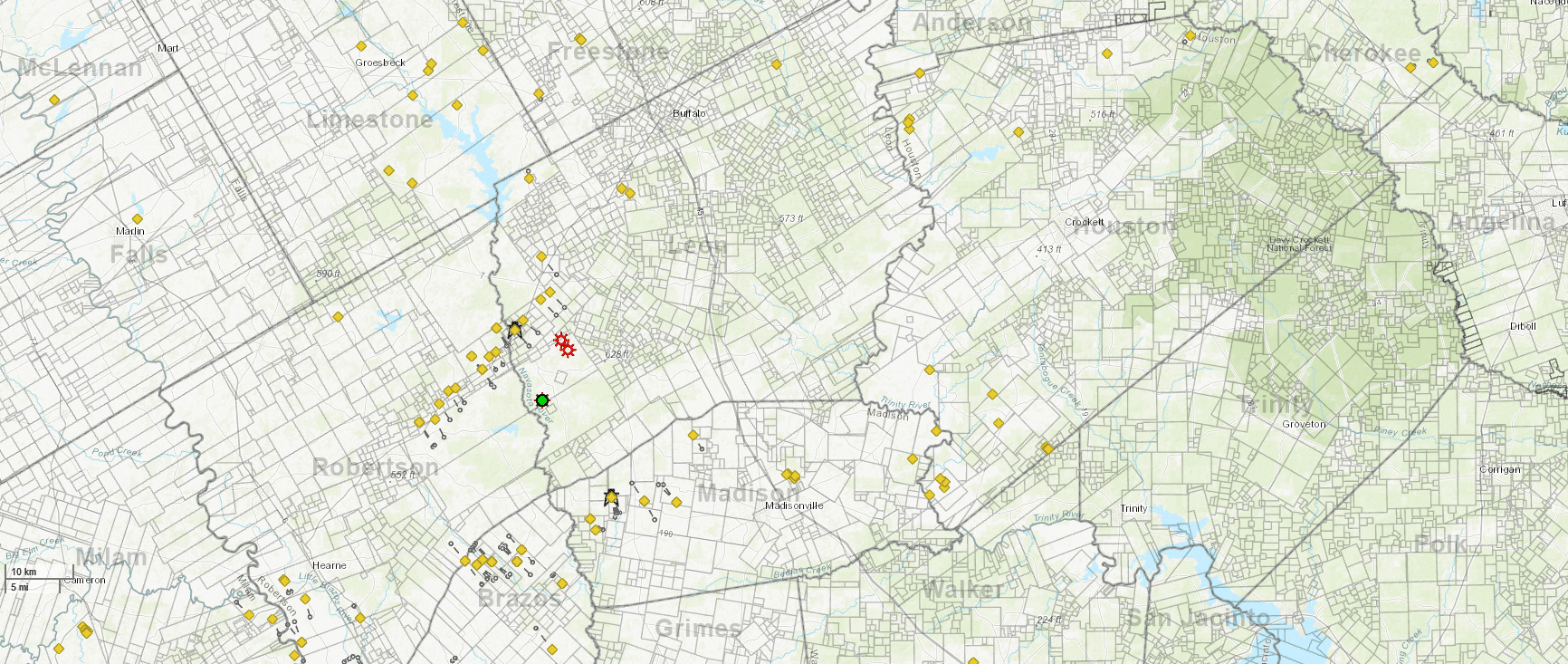

This listing is for 474.45 net royalty acres in Leon County Texas. All of these mineral rights are located in A-17. Some of the acreage is currently producing, and some is currently open for lease.

We do not have check stubs to provide for this listing. The owner has a lot of different interests and these royalties do not pay monthly as the income is so low. We are pulling the tax records here to represent this ownership. Since the income is nominal, we have marked it as N/A since that will not be relevant to the deals.

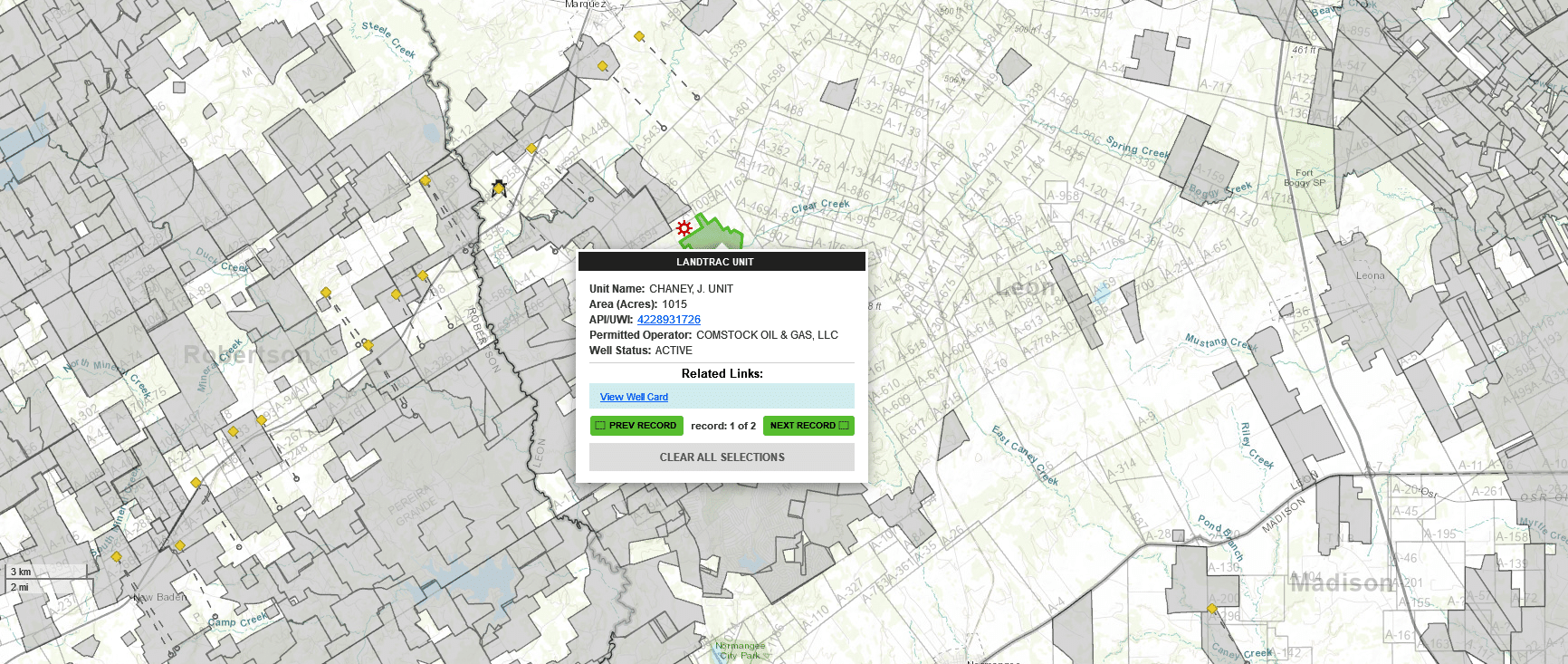

The owner is currently in pay on 3 wells, the Chaney J Unit, Chaney 1, and Fossil Chaney.

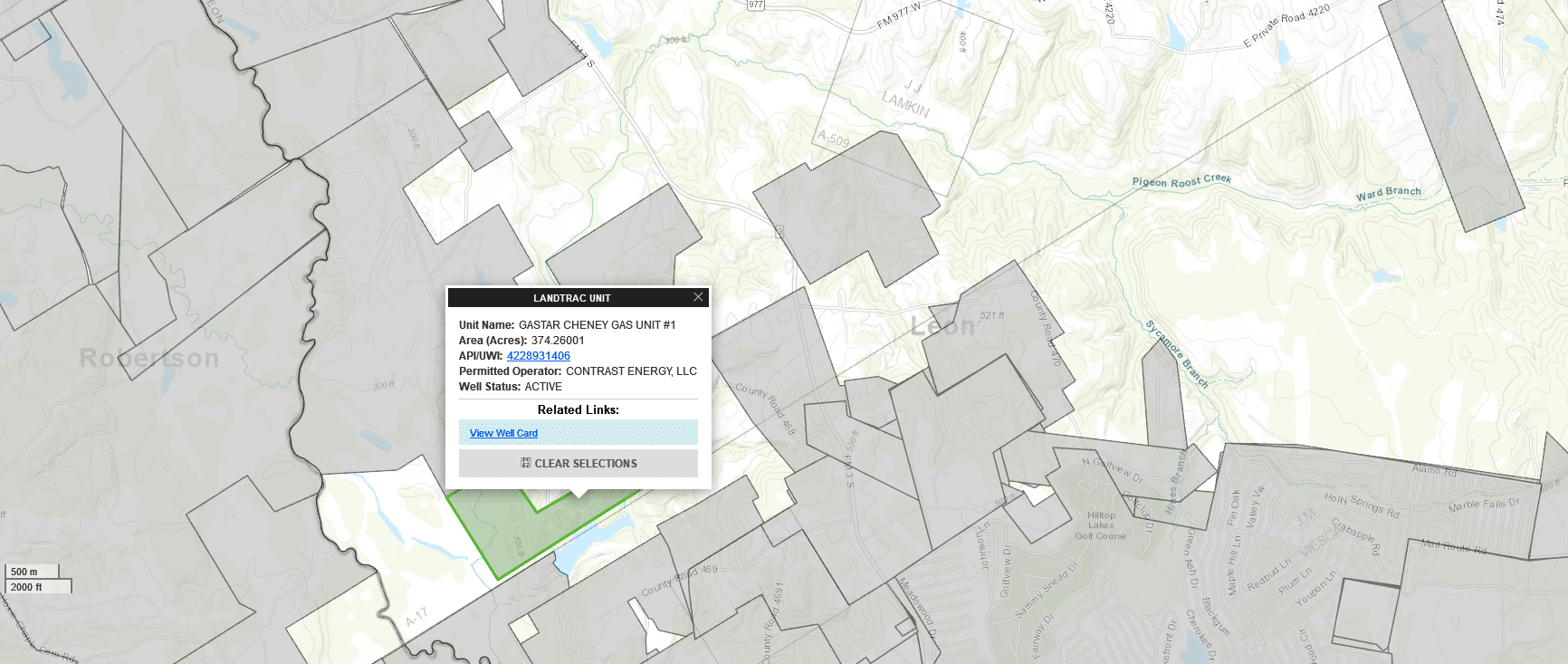

Looking at the attached ownership estimate, we show the seller with 55.76 NRA in the Fossil Chaney. The Cheney 1 (Diversified) and Chaney J (Comstock) appear to both be in the same unit. On the DI map, they show the Comstock well North of the Cheney unit. However, we think this acreage is overlapping as the permits for each show the exact same unit. We think the DI map is wrong in this case. Due to the fact the owner is currently in pay from two operators with different NDI’s in the same unit, we feel these should be added together giving the seller 418.69 NRA in the Cheney unit. This would give the seller a combined total of 474.45 NRA combined when you include the Fossil Cheney Unit.

In addition to this ownership, in 2015/2016, the seller signed 4 different leases in A-17. Since these wells were already productive prior to the leases, we believe these leases represent additional ownership in A-17 that is not included in our calculation and not part of the ownership estimate. What we don’t know is how many acres are owned that are currently unleased.

The seller is selling everything they own in A-17 as a package.

We do not have a confirmed lease royalty rate. However, we found a lease signed back in March 2006 at a 22.5% rate, which timing wise would make sense for the wells they are in pay on. If they are leased at 22.5%, we would show their total net mineral acres at 263.58.

On this listing, we would request offers in the following format:

For the acreage in production, a per net royalty acre offer assuming 474.45 net royalty acres owned.

For the acreage that is non-producing, an offer on a per net mineral acre basis.

The starting bid price is for 474.45 net royalty acres. At $525,000, this would put the starting bid price at $1,106.54 / net royalty acre. All offers should be for the 474.45 NRA, and then the price per NMA for unleased would be paid in addition based on what title shows.

To view/download the listing files, please visit the link below:

We will begin accepting offers on Thursday, August 10th.

All buyers are required to either do a 14 day close, make a $5,000 deposit, or sign our qualified buyer agreement once a deal has been verbally agreed upon.

The mineral owner has exclusively listed with Texas Royalty Brokers. Please do not contact the mineral owner directly. To make a bid or ask questions about this listing, please contact Texas Royalty Brokers using the contact form below. Our team will quickly be in touch.

We have other mineral rights for sale.

Exclusitivity Notice

All listings posted at Texas Royalty Brokers are exclusive. The seller has agreed to exclusively sell through our company and will become personally liable if you close a deal directly with the seller. Please direct all offers and communication directly to Texas Royalty Brokers.

Accepting Offers on 8/10/2023