Why Texas Royalty Brokers?

Selling mineral rights doesn’t have to be complicated. At Texas Royalty Brokers, we handle every step of the process so you can get maximum value with zero stress.

Our team works hard to deliver real offers, real value, and real results.

sellers

Texas Royalty Brokers

Popular Topics

Mineral Rights Report

Buyers

Receive new listing notifications?

Trusted by Mineral Owners

![]()

Pecos, TX

I had a very good experience working with Eric and his team. Eric was very professional and due to his knowledge added a lot of insight into helping me sell my mineral interests. I was kept well informed on a weekly basis and once there was a buyer, Eric continued to help me understand the process. From the start to the finish, during the entire process I wasn’t ever disappointed. Eric has a great deal of experience and knowledge of mineral values and he also has many connections in the industry. If you are interested in selling minerals you own, I highly recommend you contact Eric and the good folks at Texas Royalty Brokers.

Glasscock, TX

We had a great experience with Texas Royalty Brokers! Very professional and straight shooters. Hit the market with excellent results. Hightly recommend them!

Lavaca, TX

We worked with Emily to assist us with a sale of some of our mineral interests. Not only was she professional and courteous, but we were paid well above any previous offer and ahead of the expected time frame. What more could you ask for? A well deserved five star rating!

Upton , TX

My wife and I were very pleased with the guidance and knowledgeable advice that Emily and Eric provided to us regarding the sale of her mineral rights in Texas.

Nacogdoches, TX

Eric and his team were very knowledgeable and responsive to our needs and questions. The professionalism and integrity exceeded our expectations throughout the entire process. We highly recommend Texas Royalty Brokers!

Mineral Rights Report

State Specific Guides

Resources

Blog Categories

Free Consultation

Get expert advice on your mineral rights with no pressure and no obligation.

Listing Notifications

To receive notifications regarding new listings that are activated on our website, please enter your email address below.

Listing Title

Reagan County Texas Mineral Rights for Sale

Listing ID

401150

Listing Status

sold

- Listing Posted - complete

- Listing Evaluation - complete

- Accepting Offers - complete

- Client Review - complete

- Best and Final - complete

- Under Contract - complete

Please take a moment to learn more about each listing phase.

We are currently in the listing evaluation phase for these mineral rights. We will begin accepting offers on Thursday, April 20th.

Listing Files

Please click the download button below to view the listing files. Listing files include maps, check stubs, and other documentation.

Listing Details

Starting Bid: $345,000

- State : Texas

- County : reagan

- Legal Location : Various, please see the attached files.

- Net Acres : 40.64

- Active Lease : Yes

- Royalty Rate : 25%

- Producing : yes

- Average Income : $395/Month

Comments:

Update: 5/11/2023

SOLD

_________________________

Update: 4/26/2023

Under Contract

_________________________

Update: 4/21/2023

Best & Finals due end of day, Tuesday, April 25th.

_________________________

Update: 4/20/2023

We will be accepting offers on this listing until close of business on Friday, April 21st. Feedback will be provided to all buyers who submit a bid on Monday afternoon.

_________________________

Update: 4/11/2023

The seller heard back from their family attorney that the new lease is currently on hold. The company who was potentially going to lease the acreage determined that Conoco owns a significant mineral interest in the area, so they decided to back off the lease for now. A lease could be worked out with Conoco in the future.

We are leaving the offer sheet the same. The assumption should be 3.35 NMA on those items highlighted in Yellow and the bids for that acreage should assume unleased acreage of 3.35 NMA. The seller agrees that no payment shall be due from buyer to seller as previously mentioned since the lease fell through. You are effectively buying 3.35 NMA of unleased acreage and you can lease this acreage for an immediate ROI.

_________________________

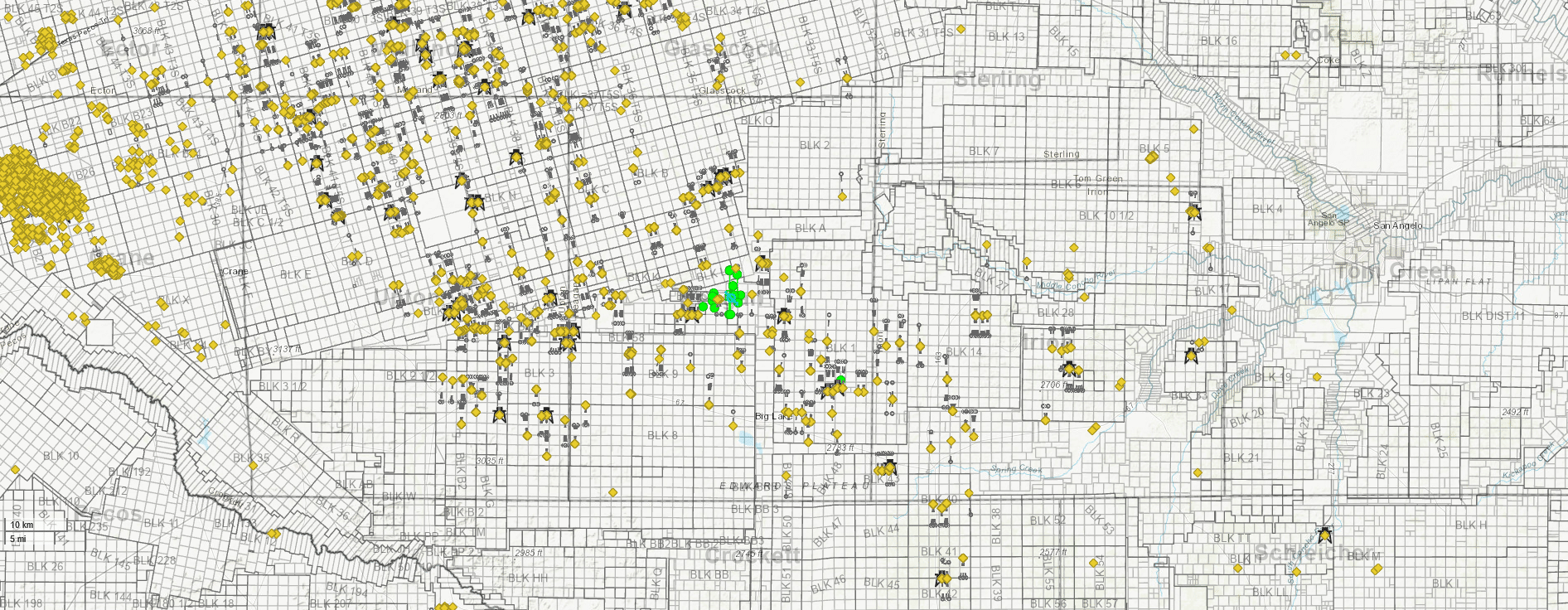

This is an opportunity to buy a nice amount acreage in an excellent location. From the attached map, you can see this ownership is absolutely surrounded by rigs and permit activity. This is not fringe acreage, it’s right in the core of all the activity.

There are a lot of moving parts on this particular listing, but in total it represents a great opportunity for buyers. There is current cash flow, leasing activity, active permits, and a rig next door that is almost certain to move onto this acreage. With current cash flow, near term upside, long term upside, and diversification, this is a great opportunity for buyers to expand their footprint in Reagan County.

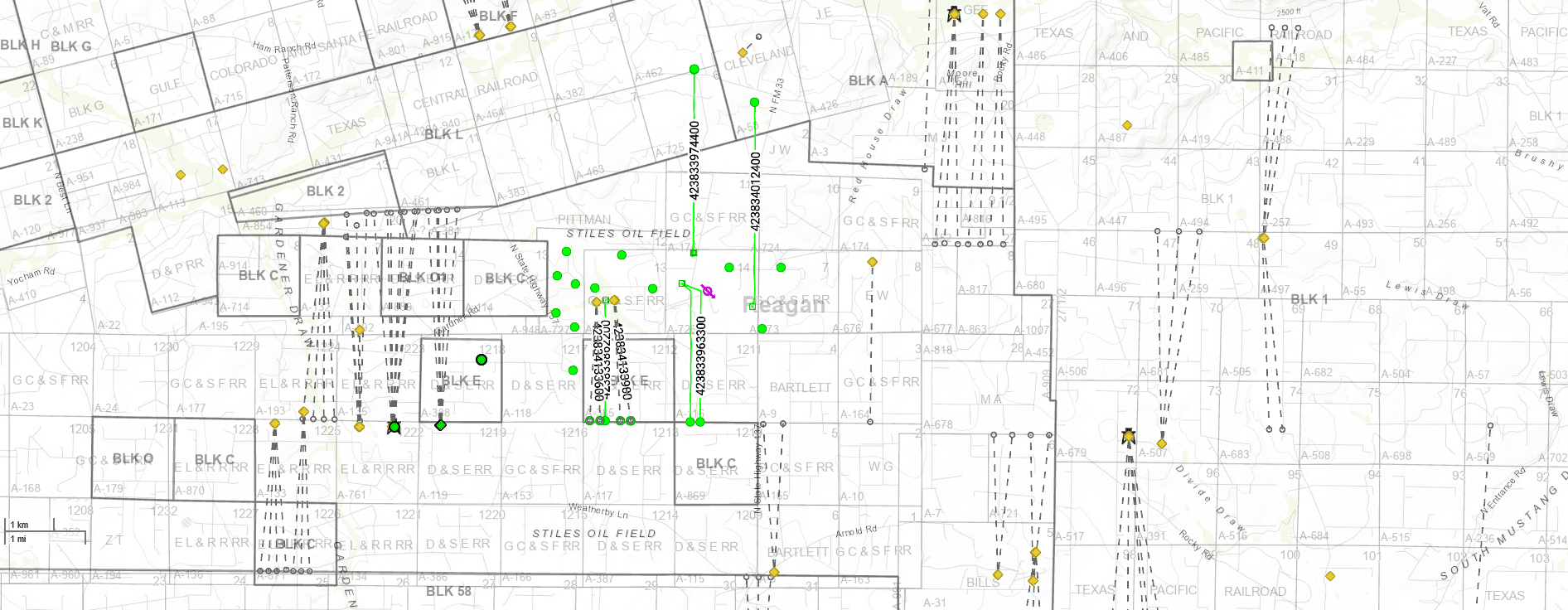

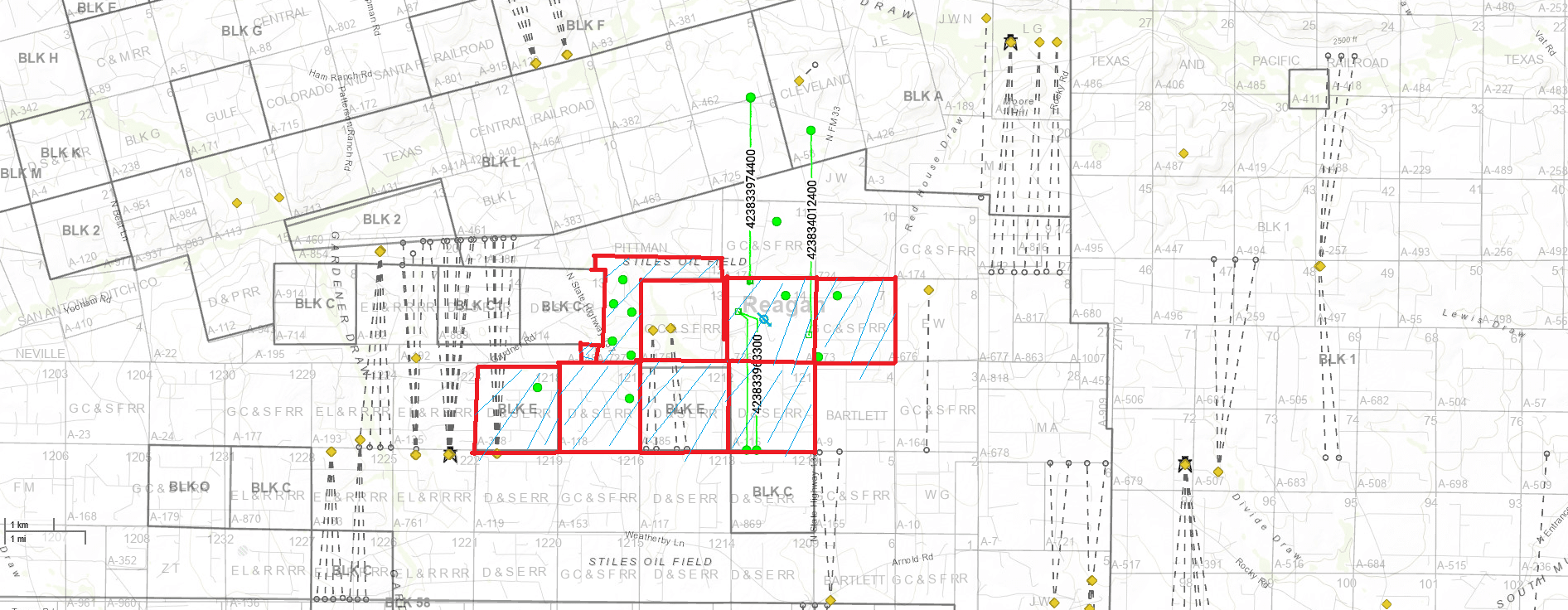

The acreage breaks down as follows:

32.01 NRA HBP

2.29 NMA Leased

3.35 NMA Proposed Lease

.7 Unknown

There are 3 currently active units:

The Gould A 1 well (2.8 NRA) is an old vertical well that is barely hanging onto a 646 acre unit. There were 5 permits filed for the “Pink Floyd” wells in late February 2023. The operator has a rig running one section over right next to where these permits were filed. It’s virtually certain this rig will slide over and drill those permits due to the age of the Gould A 1 and how much acreage it’s currently holding in such a core position. This represents a very high probability of near time upside for the buyer.

There are another 11.1 NRA in the Gould Lou well. This is a 640 acre unit with this single vertical well from 1997 holding it. The operator on this is DE IV so it’s also possible some new permits are filed on this acreage and that rig continues it’s path towards this acreage. While this acreage may not be drilled immediately, this acreage is in a prime spot with only a single vertical well providing a much greater probability of upside compared to other investments.

The Loftin Hughes 13-1212 well is comprised of both ORRI and RI for a combined 12.2 NRA. There are currently 5 active permits for more Loftin Hughes wells. These permits were filed in early March 2023. The operator, Earthstone, has a rig running just to the North and East of this position. This is provides another good possibility for near term upside on this acreage.

Note: We are representing a 25% royalty rate on this listing based on the recent lease agreements and proposed leases. We are not representing 25% for the HBP acreage, only the number of NRA.

Leased Acreage

K-9 Leased approximately 2.3 acres in March 2023. We believe the lease rate on this one was just over $4,000/NMA. This is a 25% lease so we are estimating 4.58 NRA owned by the seller.

Proposed Lease

There is currently a proposed lease that the seller’s family believe represents 3.35 NMA. This lease supposedly covers the same acreage as the Driftwood lease from 2018, which we have attached for reference. If that is correct, this lease would cover A-726, A-173, & A-116 (E/2 as W/2 is in production and HBP). The family is currently negotiating a 25% lease, $5,000/NMA lease bonus, and only an 18 month primary with optional 18 month extension. This is a great sign that this acreage will be drilled soon with such a short primary term + extension.

Please note that on this acreage, we are looking for net mineral acre offers, but the rest of the acreage should be on a per net royalty acre basis. As there is unleased acreage here, the NRA would be double the 3.35, but since the lease has not been signed we will just make the offers based upon NMA.

Important: The seller is entitled to sign this lease agreement up until closing with a buyer and collect the lease bonus payable even after closing occurs. If the seller has not signed a lease agreement prior to closing, the buyer must pay an additional $16,763, which represents their portion of the lease bonus which is currently under negotiation. Please factor this into your offer.

Note: Private email communications can be provided to the buyer after offer verbal acceptance, pending sellers approval, to show the status of this ongoing negotiation.

Unknown Acreage

We estimate there are a couple locations the seller has ownership but we do not know the status. These could be leased, HBP within some of the units they are already in pay on, or open. We don’t feel this acreage is material in size, but please make your offers accordingly as we don’t know the status.

A diagram of interests has been provided which gives a rough idea of the family overview. We have also included a “Mineral Deed – Family Member” which just shows the legal locations listed out. This deed is not for our client.

We have attached an “offer worksheet” for this listing since there are a lot of moving parts here. We are requesting that all buyers submit their offers using this offer worksheet. You can enter your price per NRA / NMA in the worksheet and submit this as your offer. This will allow the seller to compare offers on an apples to apples basis since the status of each tract varies so greatly.

We have listed cash flow at the total of the two check stubs provided. The cash flow is not relevant to this deal given the size.

The starting bid price on this package is $345,000. If the NRA/NMA estimate is in the ballpark, this acreage is being offered for sale at a blended rate of right around $8,500/NRA. When you consider the location, near term upside, active permits, recent leasing activity, and diversification, this a very attractive starting bid price.

To view/download the listing files, please visit the link below:

We will begin accepting offers on Thursday, April 20th.

All buyers are required to either do a 14 day close, make a $5,000 deposit, or sign our qualified buyer agreement once a deal has been verbally agreed upon.

The mineral owner has exclusively listed with Texas Royalty Brokers. Please do not contact the mineral owner directly. To make a bid or ask questions about this listing, please contact Texas Royalty Brokers using the contact form below. Our team will quickly be in touch.

We have other mineral rights for sale.

Exclusitivity Notice

All listings posted at Texas Royalty Brokers are exclusive. The seller has agreed to exclusively sell through our company and will become personally liable if you close a deal directly with the seller. Please direct all offers and communication directly to Texas Royalty Brokers.

Accepting Offers on 4/20/2023