Why Texas Royalty Brokers?

Selling mineral rights doesn’t have to be complicated. At Texas Royalty Brokers, we handle every step of the process so you can get maximum value with zero stress.

Our team works hard to deliver real offers, real value, and real results.

sellers

Texas Royalty Brokers

Popular Topics

Mineral Rights Report

Buyers

Receive new listing notifications?

Trusted by Mineral Owners

![]()

Glasscock, TX

We had a great experience with Texas Royalty Brokers! Very professional and straight shooters. Hit the market with excellent results. Hightly recommend them!

Lavaca, TX

We worked with Emily to assist us with a sale of some of our mineral interests. Not only was she professional and courteous, but we were paid well above any previous offer and ahead of the expected time frame. What more could you ask for? A well deserved five star rating!

Upton , TX

My wife and I were very pleased with the guidance and knowledgeable advice that Emily and Eric provided to us regarding the sale of her mineral rights in Texas.

Nacogdoches, TX

Eric and his team were very knowledgeable and responsive to our needs and questions. The professionalism and integrity exceeded our expectations throughout the entire process. We highly recommend Texas Royalty Brokers!

Harrison, TX

I decided to work with Texas Royalty Brokers after reading several of their reviews. It was a good decision. They were prompt in their communication and straightforward in their assessments and follow through. I am quite pleased with the outcome and recommend them highly.

Mineral Rights Report

State Specific Guides

Resources

Blog Categories

Free Consultation

Get expert advice on your mineral rights with no pressure and no obligation.

Listing Notifications

To receive notifications regarding new listings that are activated on our website, please enter your email address below.

Listing Title

Buy Mineral Rights - Ward County Texas

Listing ID

401178

Listing Status

sold

- Listing Posted - complete

- Listing Evaluation - complete

- Accepting Offers - complete

- Client Review - complete

- Best and Final - complete

- Under Contract - in progress

Please take a moment to learn more about each listing phase.

Listing Files

Please click the download button below to view the listing files. Listing files include maps, check stubs, and other documentation.

Listing Details

Starting Bid: $1,050,000

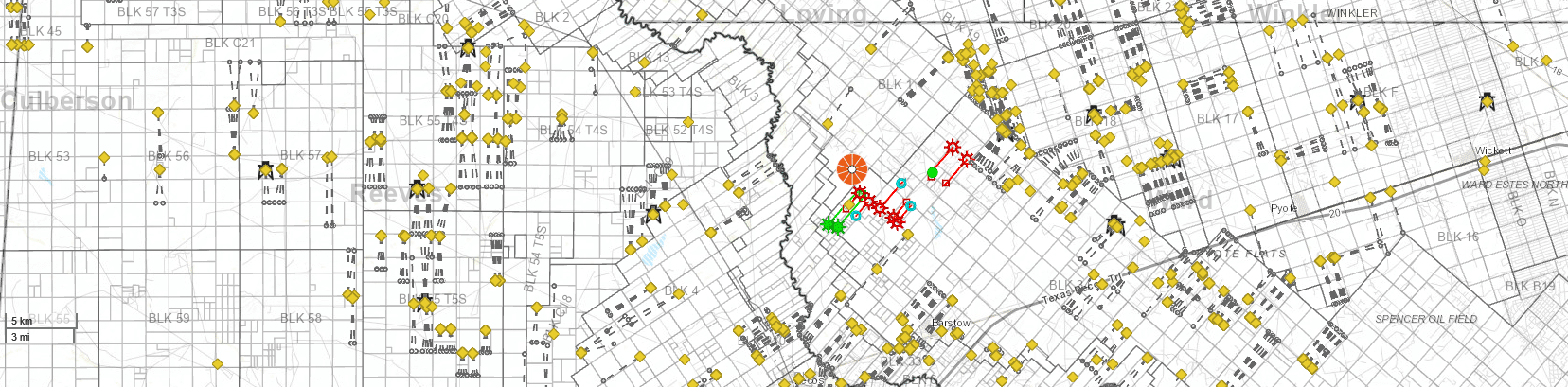

- State : Texas

- County : ward

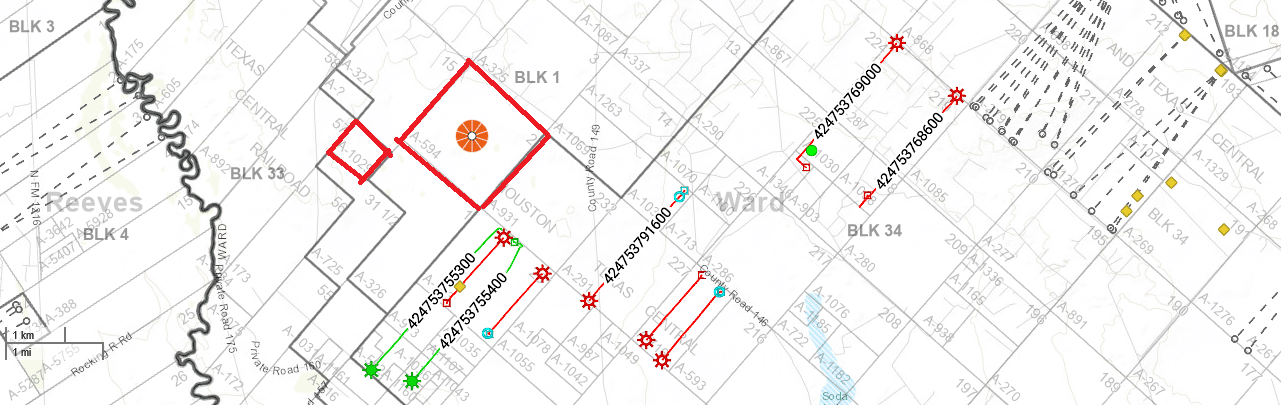

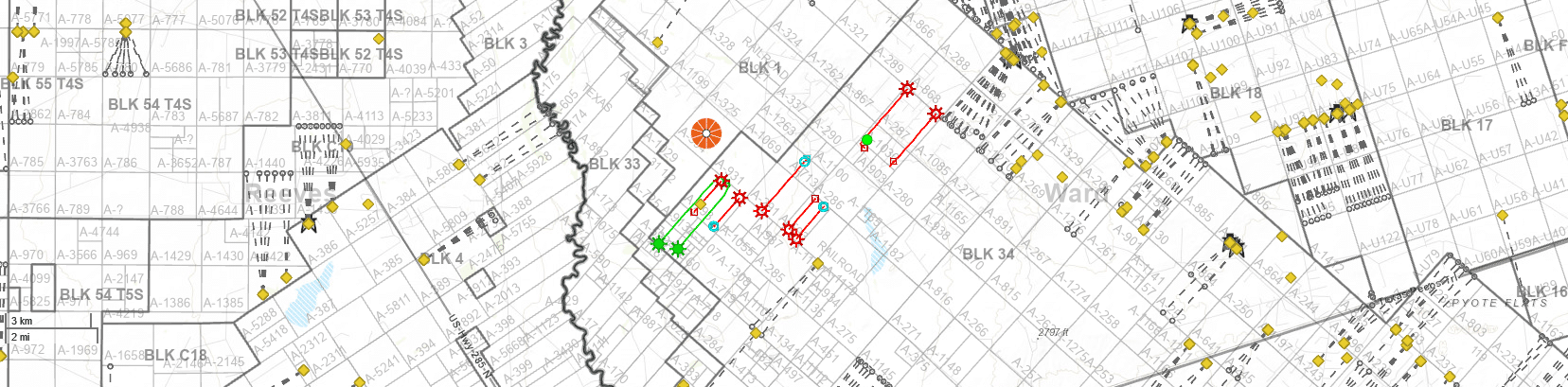

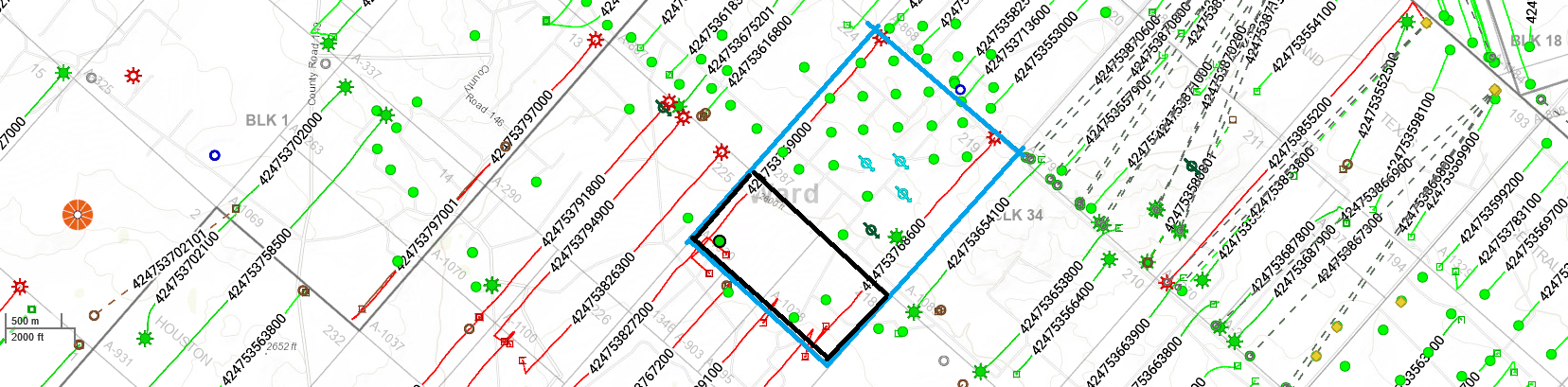

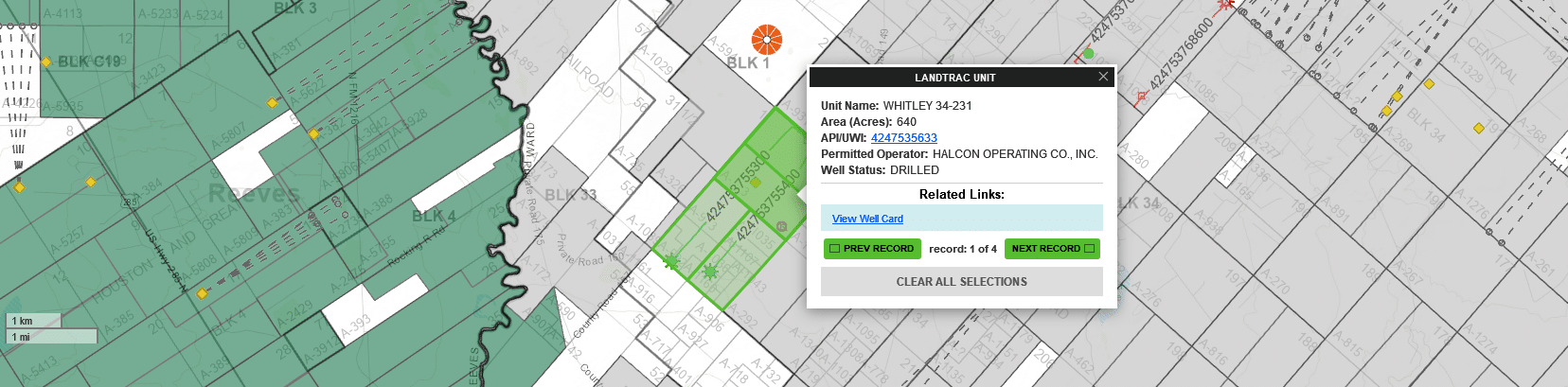

- Legal Location : Block 1 - Section 2 - 40 NMA leased @ 20% Block 34 - Section 226 Block 34 - Section 227 Block 34 - Section 216 Block 34 - Section 218 Block 34 - Section 231

- Net Acres : 208.18

- Active Lease : Yes

- Royalty Rate : 20%

- Producing : yes

- Average Income : $6,500/Month

Comments:

Update: 5/6/2024

Sold

__________________________

Update: 3/19/2024

Under contract.

__________________________

Update: 3/13/2024

Best and final offers due Monday, March 18th by close of business.

__________________________

This is an opportunity to buy mineral rights in Ward County Texas in 2024. This package includes a little bit of everything. There is a large amount of acreage at a very low price point for Ward County. The buyer will enjoy immediate ROI from the income generated along with huge upside potential from new drilling.

These mineral rights are leased between 18.75% and 20% across the board. We have attached the leases that are available to the listing.

The royalty income being generated has averaged right around $6,500/month. We have included some 1099’s from 2023 which would seem to show much higher income, but this is due to money held in suspense being released in 2023. The most recent current average is $6,500/month.

There are multiple tracts within Ward county Texas. Below, we detail each tract.

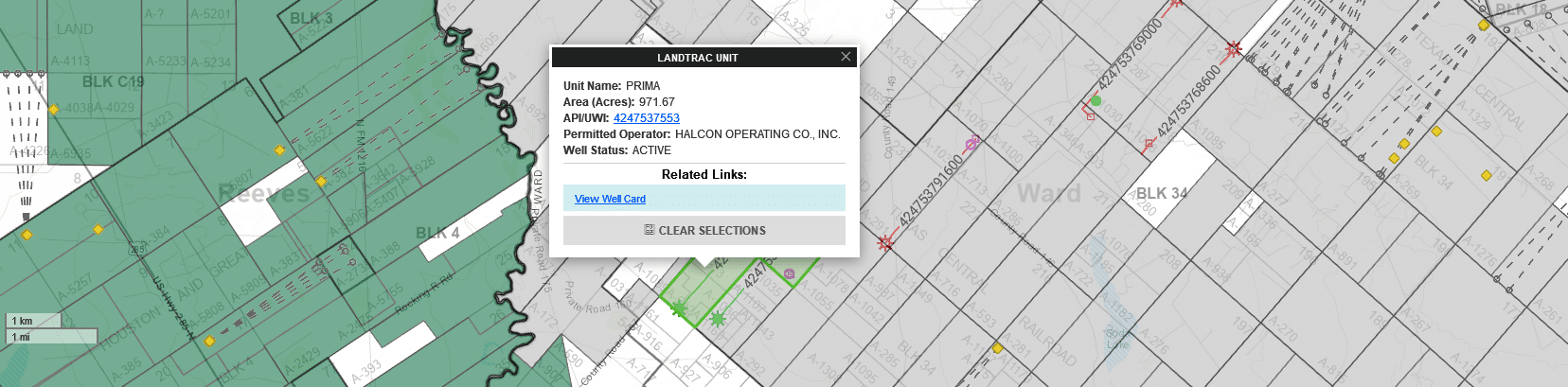

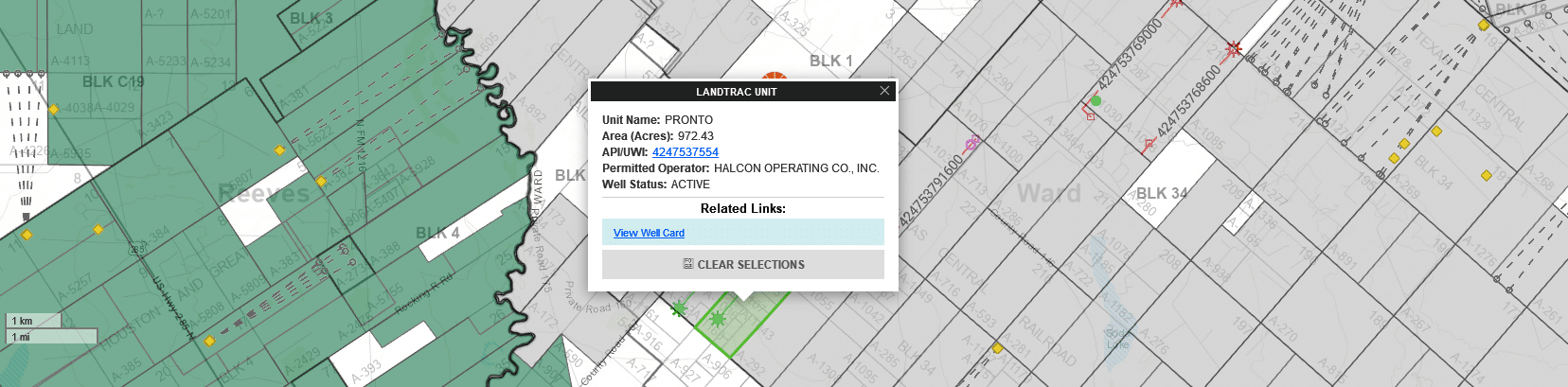

Whitley 1H & 2H wells / Pronto & Prima Wells: Block 34, Section 231 A-293

This is the only acreage within the package we do not feel 100% confident in regarding the number of net royalty acres owned. This acreage was originally a 640 acre unit on the Whitley wells where the seller had an identical NDI in each well. At 640 acre spacing, this would indicate they have a total of 80 net royalty acres here. Subsequently, 2 new allocation wells were drilled (Prima and Pronto) where the owner has differing NDI’s due to them being allocation wells.

The Whitley wells had a 640 acre spacing, but an acreage designation shows these wells with just 160 acres each. However, one of the allocation wells the owner is being paid for splits right between the two 160 acres units. To us, this would indicate they do in fact have a full 80 NRA with Section 231. There is only a 10% adjustment tolerance on this package, and we feel this is the only place there should be a large difference so please review this acreage carefully.

Upside potential! There are currently just two active horizontal wells drilled on this acreage. There is room for between 4 to 6 more wells in our estimation representing a nice upside opportunity on this acreage.

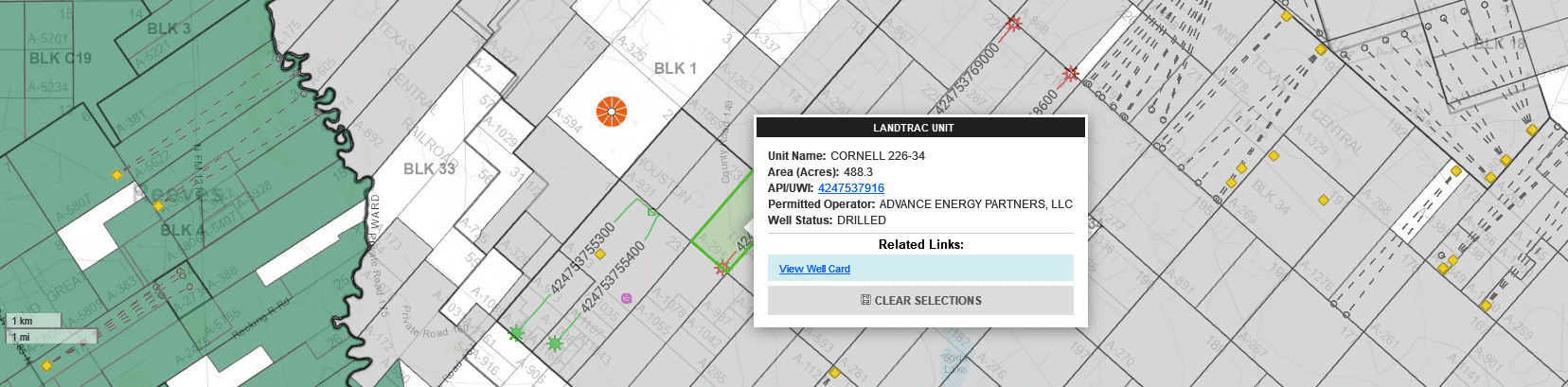

Cornell Unit: Block 34 – Sections 226 & 227, A-291 & A-293

This is a another nice size acreage position with just a single horizontal well on 488 acre spacing. We believe there is room for an additional 3 to 4 wells on this acreage representing another fantastic upside opportunity for the buyer.

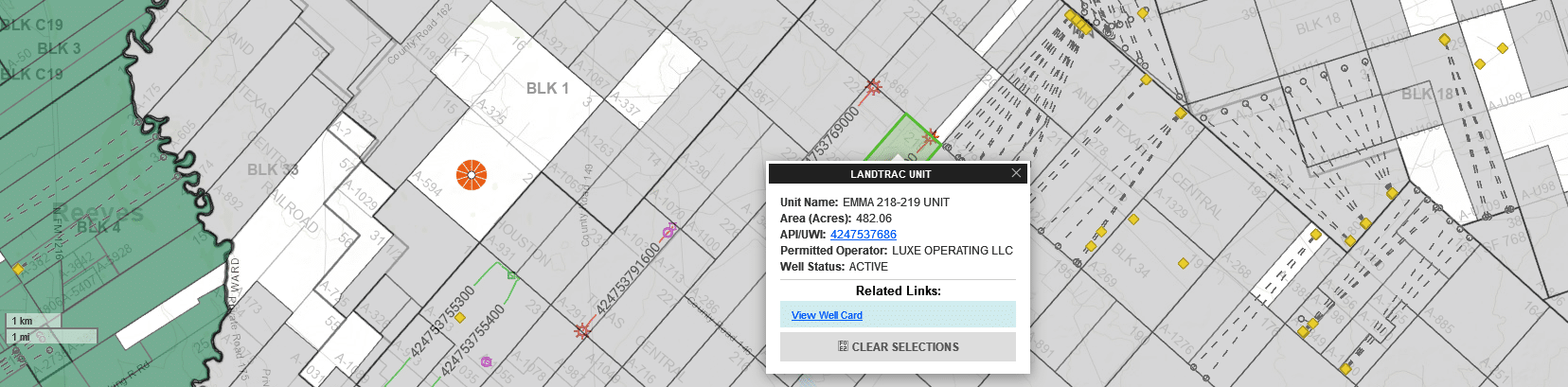

Emma & Abigail / Quito SW & Melissa A: Block 34 – Section 218 – A-1030 & A-1038

There is some old vertical production in the Quito and Melissa wells. These two wells appear to each have 10 NRA, or a combined 20 NRA if those units fall within a 320 acre spacing. The 481 and 482 acre unit sizes of the Abigail and Emma would show as just shy of 10 NRA each, which further confirms we’re looking at 20 NRA ownership. With 10 NRA split equally into each ~480 acre unit, this is yet another great upside opportunity for the buyer. There should be room for another 3 to 4 wells in each unit, with an identical 10 NRA owned in each unit.

Blackstone 34-216 Unit: Block 34 – Section 216

We show the seller has ownership in the Blackstone 34-216 unit 1H and 2H wells with an identical NDI in each. This would indicate just over 10 NRA owned here. The last production on these two wells was in 8-2023. The argument could be made these are no longer HBP and the buyer may be able to lease this acreage at a higher royalty rate and collect a lease bonus payment. Yet again, there is excellent upside potential in this acreage from leasing the acreage at a higher royalty rate and then collecting royalty income.

Leased Acreage: In 2023, the seller leased 40 net mineral acres in Section 2, Block 1. The paperwork shows 60 NMA, but upon title review they determine it was 40 NMA and they were paid a $100,000 lease bonus and the royalty rate is 20%. This is supported by the 1099’s attached. This means they have a total of 64 NRA within that leased acreage. If a well is drilled, the buyer will enjoy an immediate large income from new drilling. If a new well is not drilled, you’ll have the ability to sign another 6 figure lease bonus in the future.

All the acreage above is included in this package sale. All bids should be based upon the units / acreage mentioned above and by looking at the “ownership estimate” calculation worksheet.

Unidentified Acreage: In addition to the acreage above, we believe the seller also has potential ownership in Section 31.5 – A-1029. In a deed filed moving the ownership from an individual to Trust, an Exhibit A references this acreage. In addition, this acreage was leased in the past further supporting some ownership here.

On this Exhibit A, it also lists a couple tracts that we believe the seller DOES NOT have ownership in. There is production in some locations but the seller is not being paid and does not appear to have ownership.

These legal locations that are unidentified / not in pay would not convey with the sale, unless a dollar value was paid for them. The amount paid would be negotiated after title is run and the actual ownership confirmed. It is the intent of the seller to convey all ownership in Ward county, but nothing will convey outside of the acreage listed on the ownership estimate unless payment is made for those other legal locations.

The owner of these mineral rights was Brian Sack. Brian passed in late 2023 and the mineral rights were moved into trust by Larry Sack, Brian’s brother. Some mineral rights may appear in Brian’s name or in the Trust name. Larry has been working on getting everything moved to trust and has POA / Trustee powers. We believe Batallion may have the ownership in suspense currently as they transfer the ownership to trust.

For this ownership, all bids should be based upon the NRA represented in the ownership estimate, which is 208.18 NRA. We will allow adjustments higher and lower here based on the NRA proven in title, with no negative adjustment of 10% of more being allowed unless mutually agreeable. The only area we believe a large adjustment could occur is on the Whitley. If you disagree that this acreage is 80 NRA, please let us know up front and we can structure a deal accordingly so there are no big surprises in title.

To view/download the listing files, please visit the link below:

We will begin accepting offers on Wednesday, March 6th

All buyers are required to either do a 14 day close, make a $5,000 deposit, or sign our qualified buyer agreement once a deal has been verbally agreed upon.

The mineral owner has exclusively listed with Texas Royalty Brokers. Please do not contact the mineral owner directly. To make a bid or ask questions about this listing, please contact Texas Royalty Brokers using the contact form below. Our team will quickly be in touch.

We have other mineral rights for sale.

Exclusitivity Notice

All listings posted at Texas Royalty Brokers are exclusive. The seller has agreed to exclusively sell through our company and will become personally liable if you close a deal directly with the seller. Please direct all offers and communication directly to Texas Royalty Brokers.

Accepting Offers on 3/6/2024