sellers

Texas Royalty Brokers

Popular Topics

Mineral Rights Report

Buyers

New Listing Notifications

To receive notifications regarding new listings that are activated on our website, please enter your email address below.

Client Reviews

Gregg, TX

Texas Royalty Brokers is wonderful! Everyone is professional, knowledgeable, and so nice. They are responsive and thorough, and I’m so glad they handled my transaction. Everything went very smoothly!

Denton, TX

A superb service that obtained the target price I had set for the sale of my minerals. Emily, who is great to work with, patiently navigated me through the process from beginning to end. Highly recommended!

Glasscock, TX

Emily was efficient and informative in effecting the sale of an oil property I owned. A pleasure to work with.

Lavaca, TX

Such a smooth transaction! Highly recommend!

Reeves, TX

I had the pleasure of doing business with Texas Royalty Brokers and I was very satisfied with the results! Emily was straightforward, quick to respond, and honest the whole way through. I highly recommend Emily, Eric and the team at Texas Royalty Brokers.

Blog Categories

Listing Notifications

To receive notifications regarding new listings that are activated on our website, please enter your email address below.

Listing Title

Buy mineral rights in Fisher County

Listing ID

401176

Listing Status

not available

- Listing Posted - complete

- Listing Evaluation - complete

- Accepting Offers - complete

- Client Review - complete

- Best and Final - complete

- Under Contract - complete

Please take a moment to learn more about each listing phase.

Listing Files

Please click the download button below to view the listing files. Listing files include maps, check stubs, and other documentation.

Listing Details

Starting Bid: $750,000

- State : Texas

- County : fisher

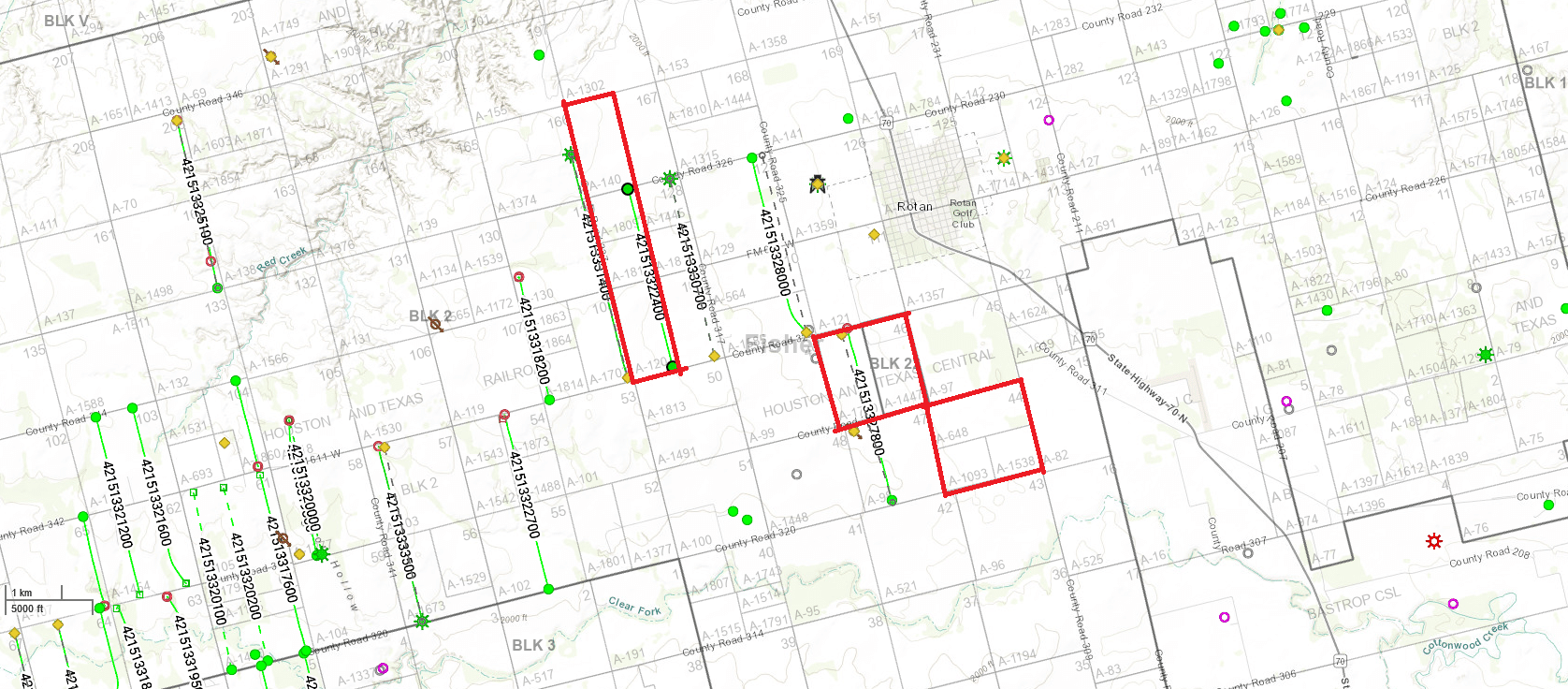

- Legal Location : Block 2: - Section 167 - Section 128 - Section 46 - Section 44

- Net Acres : 264.33

- Active Lease : Yes

- Royalty Rate : 20%

- Producing : yes

- Average Income : $7,740/Month

Comments:

Update 6/5/2024:

This client decided to not sell their mineral rights, therefore this listing is no longer available.

______________________

Update: 5/3/2024

The April royalty check has been added to the listing, which is quite a bit higher than March’s income, at $15,478.26.

With this recent check, we have updated the average monthly income for 50% of the owner’s interest to $7,740/Month. We feel this is a more accurate representation of the monthly income as wells continue to come back online and the monthly income continues to rise.

______________________

Update: 4/22/2024

The price of this listing has been reduced from $850,000 to $750,000.

______________________

Update: 3/27/2024

The price of this listing has been reduced from $1,000,000 to $850,000. The March royalty check was also added to this listing, coming in at $12,632.82, up from February. The purchase price is a 5-6 year payback and the seller is firm at $850,000 as they see a lot of potential in the property, along with the monthly royalty income it provides.

______________________

Update: 3/12/2024

The price of this listing has been reduced from $1,150,000 to $1,000,000. This means you are getting a pay back under 6 years assuming $14,475/month in royalty income and you get massive upside potential. Any new well drilled makes this a fantastic investment.

______________________

Update: 2/26/2024

The seller has provided the latest check stub for February 2024, which was $11,167. The seller has been in communication with the pumper for these wells. The pumped indicated the wells were not producing for the full month so revenue is still down while they complete nearby operations. However, the production is coming back up and we can see an increase in the February 2024 royalty income as the production comes back online.

______________________

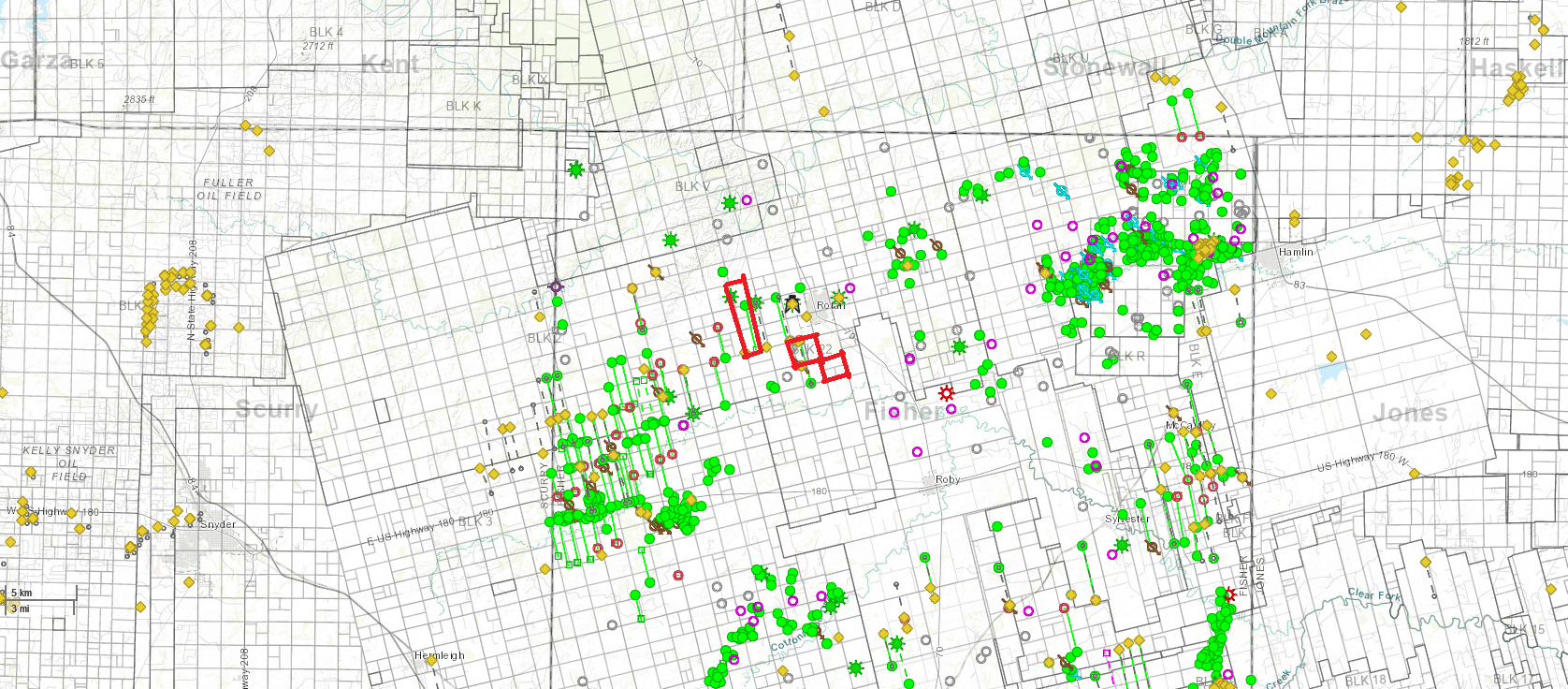

This ownership consists of both producing ownership, and currently leased ownership in Fisher County Texas. This is a nice size acreage position with huge upside potential.

The seller has a total of 528.65 combined NRA (producing) and NMA (non-producing). The owner would like to sell 50% of their ownership, or 264.33 blended acres.

These mineral rights have been generating an average of $28,950/month in total, or $14,475/month for 50%. In December and January, the seller received very small checks as they took the Grand Teton well offline so they could frack the wells next door to this ownership. The seller anticipates the well coming back online soon once the fracking is complete.

The owner has the following wells in production:

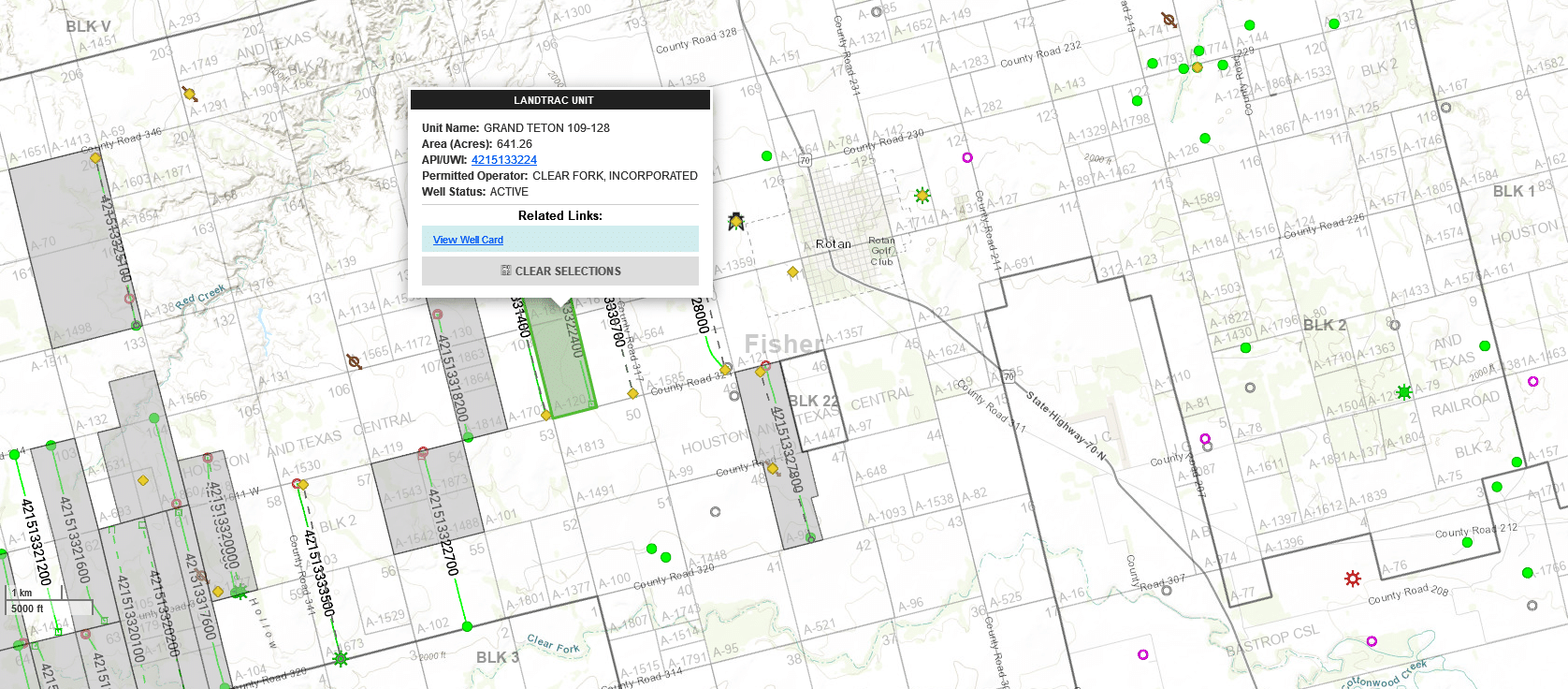

Grand Teton 109-128 (Leased @ 20%) – This ownership is 158.45 NMA, or 253.52 NRA with only a single well drilled on 641.26 spacing. This well has been producing a very solid amount of both oil and gas.

We have attached the 1099 from 2023 for the seller, showing they got a total of nearly $460,000 in 2023. The Grand Teton well started producing in 3/2022, so it’s very likely they received $400K+ in 2022 as well. We estimate the seller has received between $860K and $1MM already from this single well. At 50%, this revenue would be $430K to $500K. If a few more wells are drilled in this location alone, the buyer of these mineral rights will receive a very nice ROI without even taking into account the other ownership.

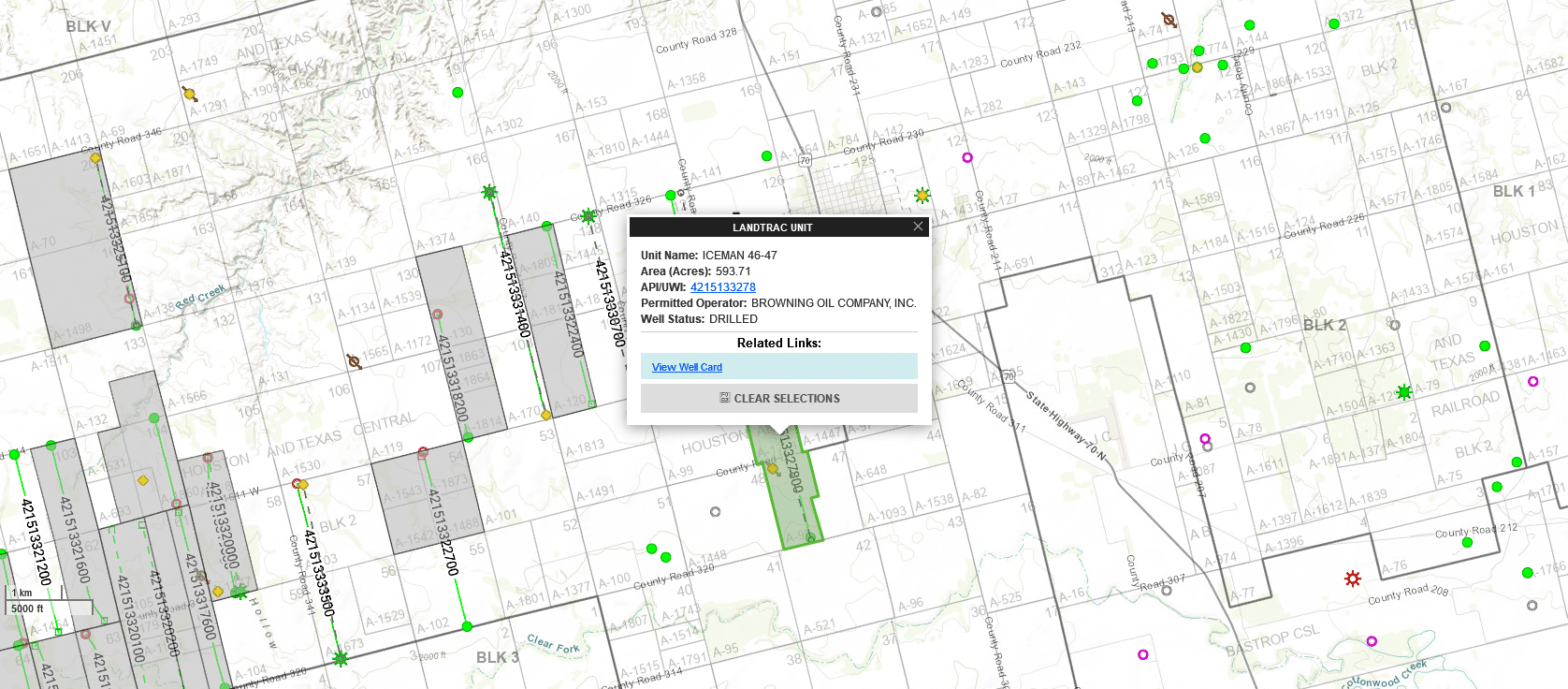

Iceman 46-47 (Leased @ 22%) – This ownership is 20 NMA or 35.2 NRA with a single well drilled on 593.71 spacing. This acreage also has very nice upside potential for the buyer.

In addition to the ownership currently in production above, the seller also have the following leased mineral rights:

Section 44 – This acreage sits just to the East of the Iceman ownership. This acreage was leased for 3 years at 22%, and that lease will expire in March 2025 if it is not renewed. If the optional extension is used, the buyer will receive $73,600 when this acreage renews in 2025. If this acreage is not renewed, you would have the ability to lease at a higher lease bonus rate.

Section 167 sits just above the Grand Teton unit. This acreage is held by the lease agreement for the Grand Teton unit at 20%. The seller was not able to locate the original lease, but he believes the acreage in 167 is HBP due to the Grand Teton unit to the south. In this location, the owner has rights to the W/2 of Section 167. Within that W/2, the owner has 50% executive rights on 159.85 NMA, and a 25% royalty right to the interest. We believe this gives the seller a total of 79.93 NMA, presently leased at 20%, giving him 127.89 NRA in Section 167. We are representing this as 79.93 NMA in our calculations to keep the non-producing acreage consistent based on NMA.

All bids should be based upon the attached estimated NMA/NRA. However, any adjustment over 10% must be mutually agreeable. For the right price, the seller would consider selling more than 50% of his ownership.

To view/download the listing files, please visit the link below:

We will begin accepting offers on Tuesday, February 20th.

All buyers are required to either do a 14 day close, make a $5,000 deposit, or sign our qualified buyer agreement once a deal has been verbally agreed upon.

The mineral owner has exclusively listed with Texas Royalty Brokers. Please do not contact the mineral owner directly. To make a bid or ask questions about this listing, please contact Texas Royalty Brokers using the contact form below. Our team will quickly be in touch.

We have other mineral rights for sale.

Exclusitivity Notice

All listings posted at Texas Royalty Brokers are exclusive. The seller has agreed to exclusively sell through our company and will become personally liable if you close a deal directly with the seller. Please direct all offers and communication directly to Texas Royalty Brokers.

Accepting Offers on 2/20/2024