Why Texas Royalty Brokers?

Selling mineral rights doesn’t have to be complicated. At Texas Royalty Brokers, we handle every step of the process so you can get maximum value with zero stress.

Our team works hard to deliver real offers, real value, and real results.

sellers

Texas Royalty Brokers

Popular Topics

Mineral Rights Report

Buyers

Receive new listing notifications?

Trusted by Mineral Owners

![]()

Pecos, TX

I had a very good experience working with Eric and his team. Eric was very professional and due to his knowledge added a lot of insight into helping me sell my mineral interests. I was kept well informed on a weekly basis and once there was a buyer, Eric continued to help me understand the process. From the start to the finish, during the entire process I wasn’t ever disappointed. Eric has a great deal of experience and knowledge of mineral values and he also has many connections in the industry. If you are interested in selling minerals you own, I highly recommend you contact Eric and the good folks at Texas Royalty Brokers.

Glasscock, TX

We had a great experience with Texas Royalty Brokers! Very professional and straight shooters. Hit the market with excellent results. Hightly recommend them!

Lavaca, TX

We worked with Emily to assist us with a sale of some of our mineral interests. Not only was she professional and courteous, but we were paid well above any previous offer and ahead of the expected time frame. What more could you ask for? A well deserved five star rating!

Upton , TX

My wife and I were very pleased with the guidance and knowledgeable advice that Emily and Eric provided to us regarding the sale of her mineral rights in Texas.

Nacogdoches, TX

Eric and his team were very knowledgeable and responsive to our needs and questions. The professionalism and integrity exceeded our expectations throughout the entire process. We highly recommend Texas Royalty Brokers!

Mineral Rights Report

State Specific Guides

Resources

Blog Categories

Free Consultation

Get expert advice on your mineral rights with no pressure and no obligation.

Listing Notifications

To receive notifications regarding new listings that are activated on our website, please enter your email address below.

Listing Title

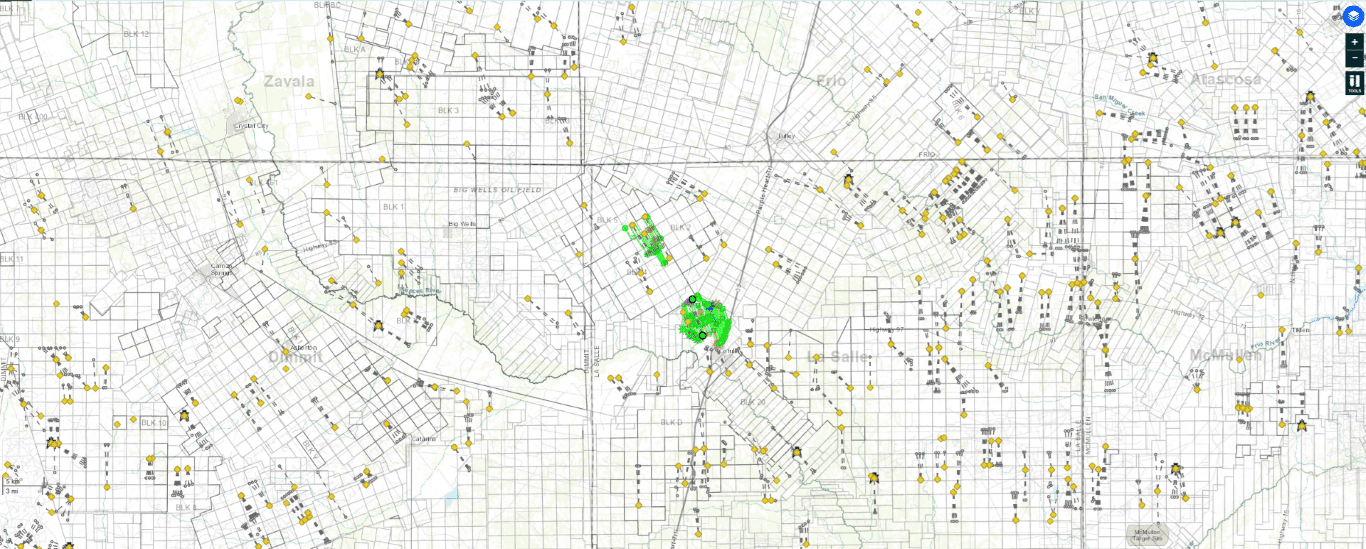

Buy mineral rights in La Salle County Texas

Listing ID

401228

Listing Status

not available

- Listing Posted - complete

- Listing Evaluation - complete

- Accepting Offers - in progress

- Client Review - tbd

- Best and Final - tbd

- Under Contract - tbd

Please take a moment to learn more about each listing phase.

Listing Files

Please click the download button below to view the listing files. Listing files include maps, check stubs, and other documentation.

Listing Details

Starting Bid: $2,500,000

- State : Texas

- County : la-salle

- Legal Location : Multiple - See attached maps

- Net Acres : N/A

- Active Lease : Yes

- Royalty Rate : 12.5%

- Producing : yes

- Average Income : $28,851/Month

Comments:

Update: 4/18/2025

The seller has decided to retain their ownership.

___________________________________

Executive Summary

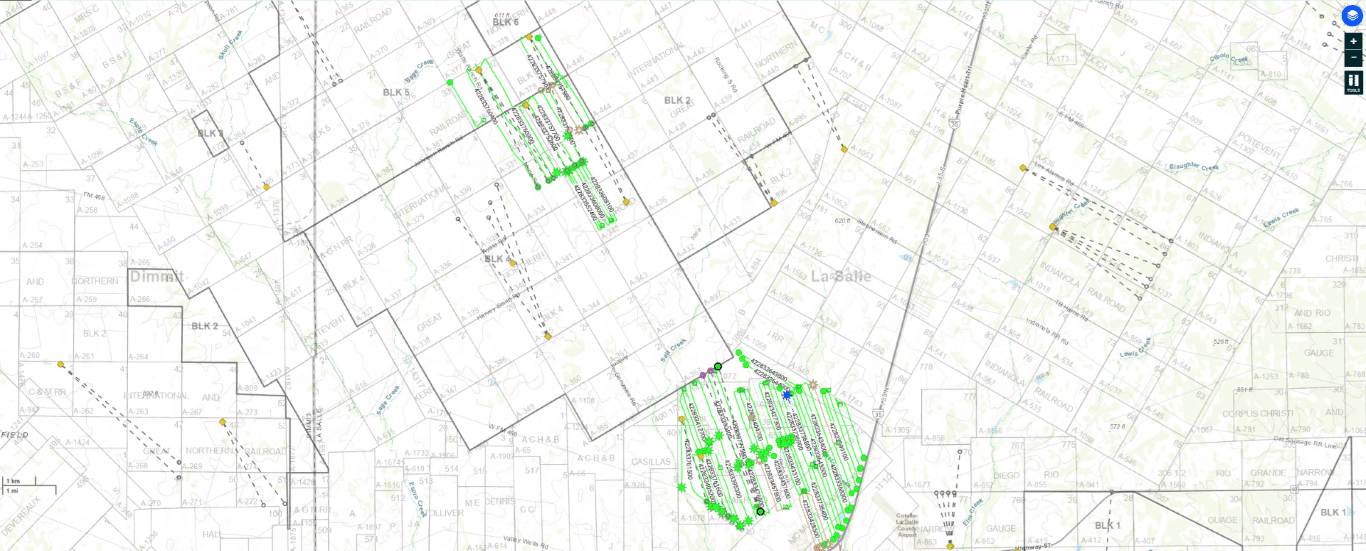

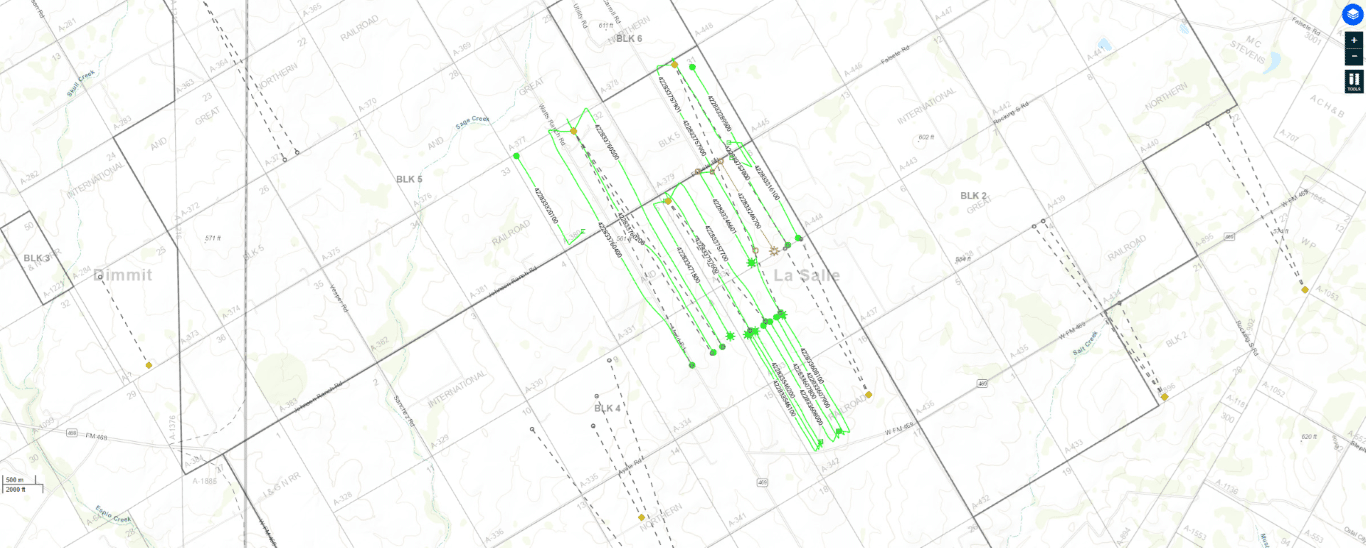

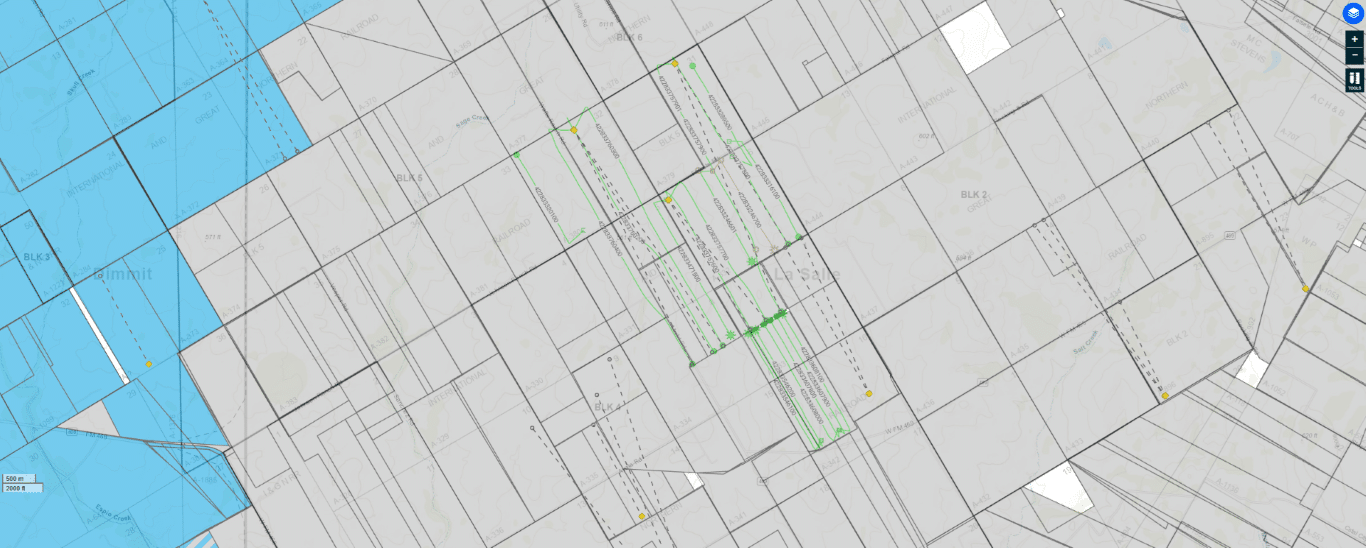

This is an opportunity to buy an ORRI in La Salle County, TX. This ORRI covers multiple leases in multiple units in La Salle county.

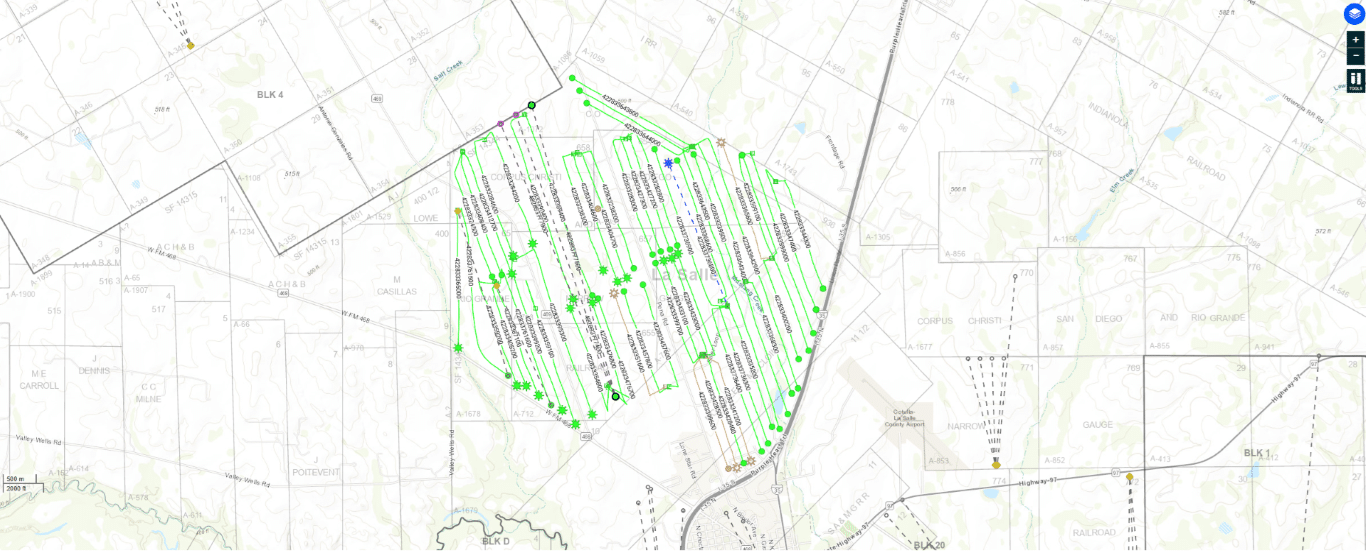

This package includes a little bit of everything. There is existing production from wells that are past flush production, a number of new wells that are currently flush, 1 DUC well, 3 very recent permits, and further upside potential in the future.

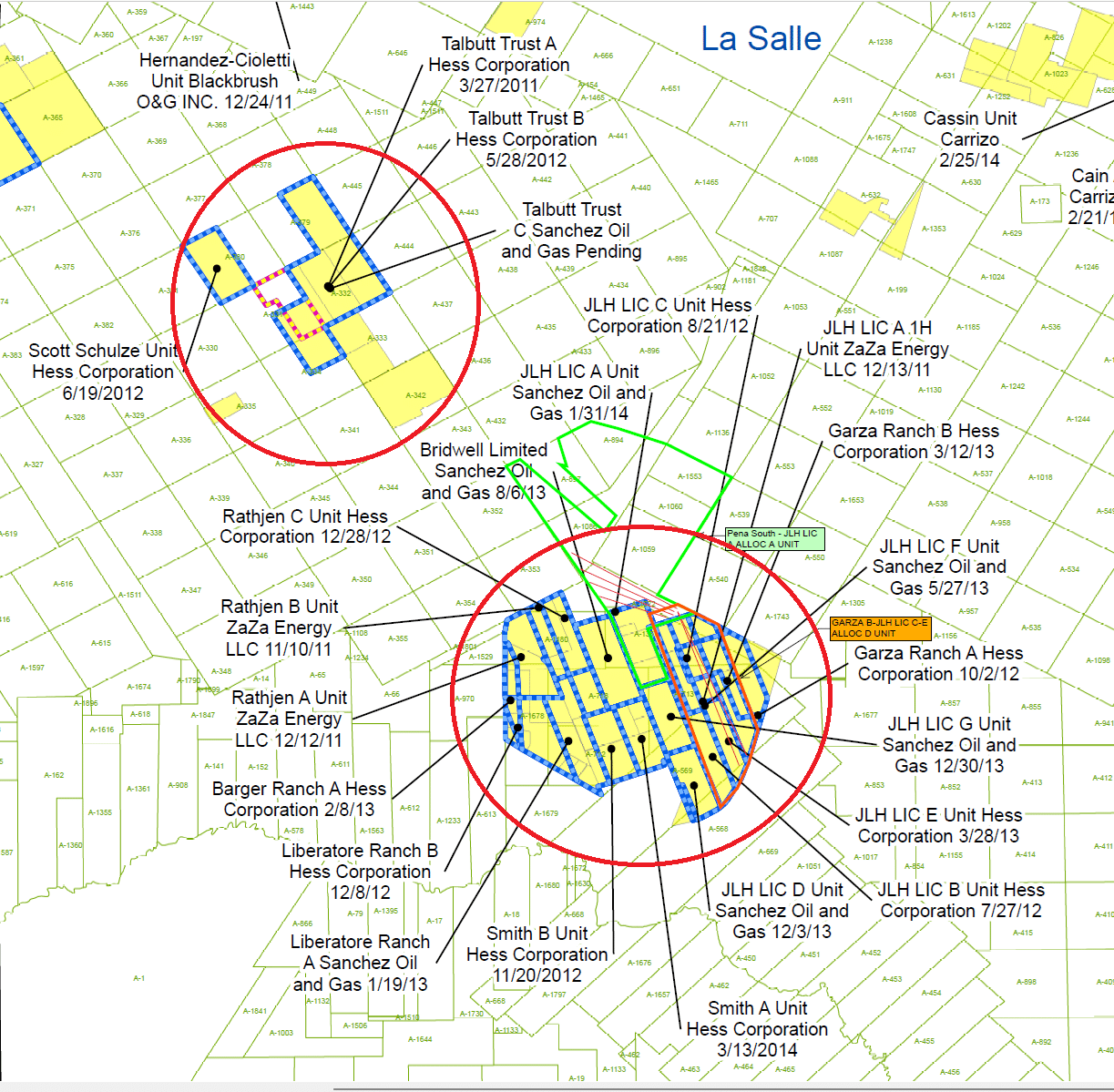

What you are getting with this package is 1% of the leases Zaza assigned to Hess, specifically in the units on the Ridgemar check stubs attached. Certain wellbore only interests within these units were sold previously to Breitling, which are not included in the sale.

Ownership Description

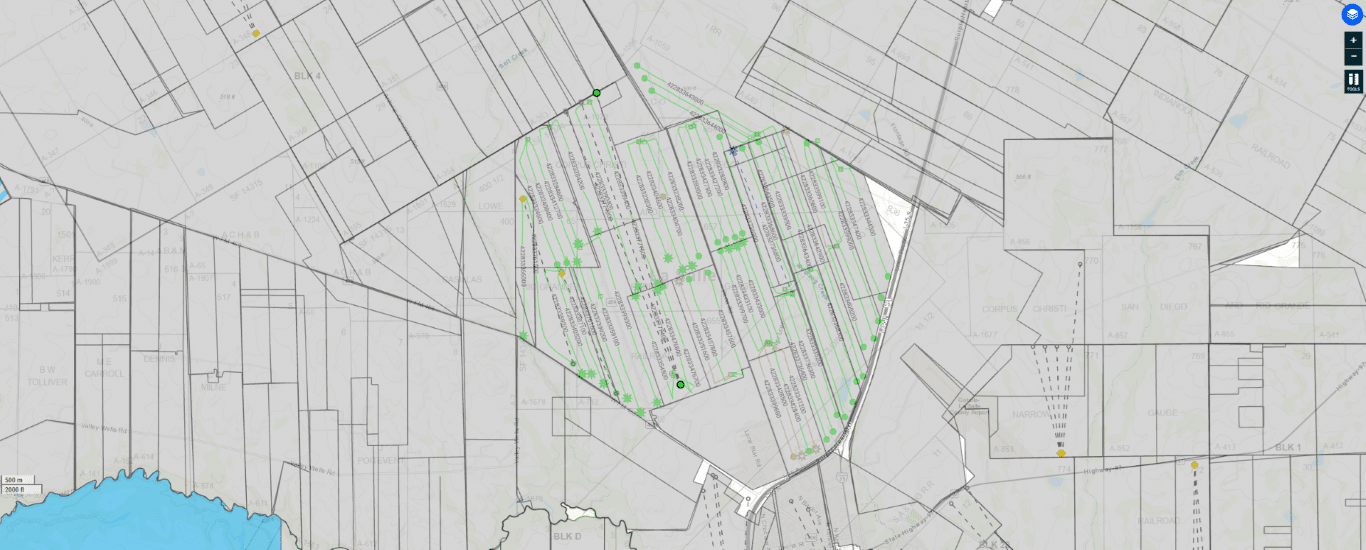

Our client acquired a 1% ORRI in a number of leases totaling more than 6,000 acres in the heart of the volatile oil window in La Salle County, TX. All leases are HBP. We have attached a list of the leases in which our client received a 1% interest. You will note that in certain units, our client has a .01 decimal, while in other units they have less than a .01 ORRI. This is due to some units being fully leased up and our client getting a full 1% ORRI, while other units were not fully leased at the time of the assignment so they have less than a 1% ORRI.

The seller did complete a couple sales of wellbore only interests in 2011 and 2013. We have attached a table that shows the wells that were sold as wellbore only.

What is being sold in this package is 50% of all RTI of their ORRI in the units specifically listed on the check stubs under Ridgemar. Ridgemar was recently acquired by Crescent Energy. Our client has other ownership La Salle and surrounding counties which is not included in the sale. What this means is that you get 50% of the production from all wells currently in production that our client is in pay on and you will get 50% of any future drilling that occurs within these units related to the 1% ORRI our client has.

This is not a wellbore only sale. It is selling 50% of their 1% ORRI in the associated leases, keeping in mind that some wellbore was sold previously which is not included in the sale.

Our recommendation is to start with the “Wells Table” attached to get a better sense of this overall package. In the attached wells table, we are showing those wells as sold in column C. The client retained his ORRI ownership in all future drilling on all minerals that occurs within these units. Since those wellbore only sales, multiple wells have come online generating significant income for our client.

Flush Production

There are currently 9 new wells that are less than 12 months old producing significant income. We took the most recent check from February ($57,702) and divided it in half and represented the cash flow as $28,851/month on this listing. This is flush production so this number will decline. However, a quick sale on this ownership means the buyer can pick up a lot of really nice flush production on new wells that are generating significant current income.

Near Term Upside Potential

In addition to the cash flow currently being generated, this package also includes wonderful near term upside potential from two sources:

DUC Well – The JLH LIC F Unit ( API – 4228337368) is currently in DUC status and sits within the units for sale.

3 Permits – There are 3 very recent permits which were approved on 2/6/2025 for the “Smith XL” wells. These “big boy” wells have massive upside potential with 15,000′ laterals. Crescent recently bought Ridgmar and filed these permits after the December 2024 agreement with October 2024 effective date. Crescent filing new permits is a good indication they are planning to continue development in this area and on these units.

Missing Production Upside

On the wells table, we highlighted two wells in which our client should be in pay, but is not in pay. Our client is working with Crescent Division Order Group to get into pay status. These wells are the JLH LIC B-C-E-F Allocation F and JLH LIC C-E Allocation E wells. These wells started producing well past the wellbore only sale, and are specifically not listed in the wellbore only sale that was completed. We are confident the seller should have an interest in these wells, and our client is currently working to get those well into pay status. While the past income from those wells goes to the seller, there is income from these wells that is not being reflected in the current royalty statements.

Additional Drilling Opportunities

In addition to the near term upside, there is also long term upside potential from additional drilling. We see room to drill more wells in the following locations:

-Scott Shultz Unit (Largest upside potential)

-Talbutt Trust

-Garza A Ranch

-Smith A Unit

-Liberator Ranch (A & B Units)

Ownership Estimate

We have attached an ownership estimate as a reference. This ownership estimate is an estimate. There are multiple units, overlapping units, varying NDI’s, and many factors that may cause this estimate to be higher or lower than estimated. However, the provided ownership estimate should give buyers a look at the approximate NRA benefit you’ll get from this interest. For example, we estimate on the Smith XL permits that the seller has 47.89 NRA with 23.95 (50%) being sold.

Listing Requirements

All bids should be based upon a 1% ORRI in the leases assigned from Zaza to Hess, in the units specifically listed on the check stubs from Ridgemar. The wells table and ownership estimates are a good guide on what is being sold. However, the final assignment will be for 50% of a 1% ORRI in those specific leases conveyed from Zaza to Hess related to the units in pay under Ridgemar.

Note: There may be certain information including leases, legal locations, etc that are included in our listing files which are not a part of the sale. We provided a comprehensive look at all data available that covers the acreage in question. This data may include other units (Briggs, etc) or leases which are not part of the sale.

For this listing, we are requiring the following:

-

- Special Warranty Deed

- 30 Day Close

- No adjustments will be allowed unless mutually agreeable.

- Seller keeps all income for production prior to the effective date, including any funds from wells the seller is not in pay status on but should be as noted on the listing.

- This is a sale of 50% of the seller’s 1% ORRI in certain leases that are specific to units listed on the attached check stubs under Ridgemar.

- Our closing process included in the PSA, which is: At closing, buyer will provide the mineral deed. The seller will execute the mineral deed and return it to Texas Royalty Brokers. Texas Royalty Brokers will provide buyer with a scanned copy of the deed, and buyer will then wire funds to seller and Texas Royalty Brokers respectively. Once funds are confirmed, Texas Royalty Brokers will overnight the deed to the Buyer.

- Buyer must close within 14 days or sign our qualified buyer agreement.

To view/download the listing files, please visit the link below:

We will begin accepting offers on Thursday, March 20th.

All buyers are required to either do a 14 day close or sign our qualified buyer agreement once a deal has been verbally agreed upon. In certain situations, we may require a $25,000 earnest deposit at the sole discretion of Texas Royalty Brokers.

The mineral owner has exclusively listed with Texas Royalty Brokers. Please do not contact the mineral owner directly. To make a bid or ask questions about this listing, please contact Texas Royalty Brokers using the contact form below. Our team will quickly be in touch.

We have other mineral rights for sale.

Exclusitivity Notice

All listings posted at Texas Royalty Brokers are exclusive. The seller has agreed to exclusively sell through our company and will become personally liable if you close a deal directly with the seller. Please direct all offers and communication directly to Texas Royalty Brokers.

Accepting Offers on 3/20/2025