sellers

Texas Royalty Brokers

Popular Topics

Mineral Rights Report

Buyers

New Listing Notifications

To receive notifications regarding new listings that are activated on our website, please enter your email address below.

Client Reviews

Denton, TX

A superb service that obtained the target price I had set for the sale of my minerals. Emily, who is great to work with, patiently navigated me through the process from beginning to end. Highly recommended!

Glasscock, TX

Emily was efficient and informative in effecting the sale of an oil property I owned. A pleasure to work with.

Lavaca, TX

Such a smooth transaction! Highly recommend!

Reeves, TX

I had the pleasure of doing business with Texas Royalty Brokers and I was very satisfied with the results! Emily was straightforward, quick to respond, and honest the whole way through. I highly recommend Emily, Eric and the team at Texas Royalty Brokers.

Karnes, TX

Emily and Eric were great! Very fast process! I had lots of questions and they were very responsive and gave lots of updates.

Blog Categories

Listing Notifications

To receive notifications regarding new listings that are activated on our website, please enter your email address below.

Listing Title

Buy mineral rights in Pecos County, TX

Listing ID

401234

Listing Status

active

- Listing Posted - complete

- Listing Evaluation - complete

- Accepting Offers - in progress

- Client Review - tbd

- Best and Final - tbd

- Under Contract - tbd

Please take a moment to learn more about each listing phase.

Listing Files

Please click the download button below to view the listing files. Listing files include maps, check stubs, and other documentation.

Listing Details

Starting Bid: $1,200,000

- State : Texas

- County : pecos

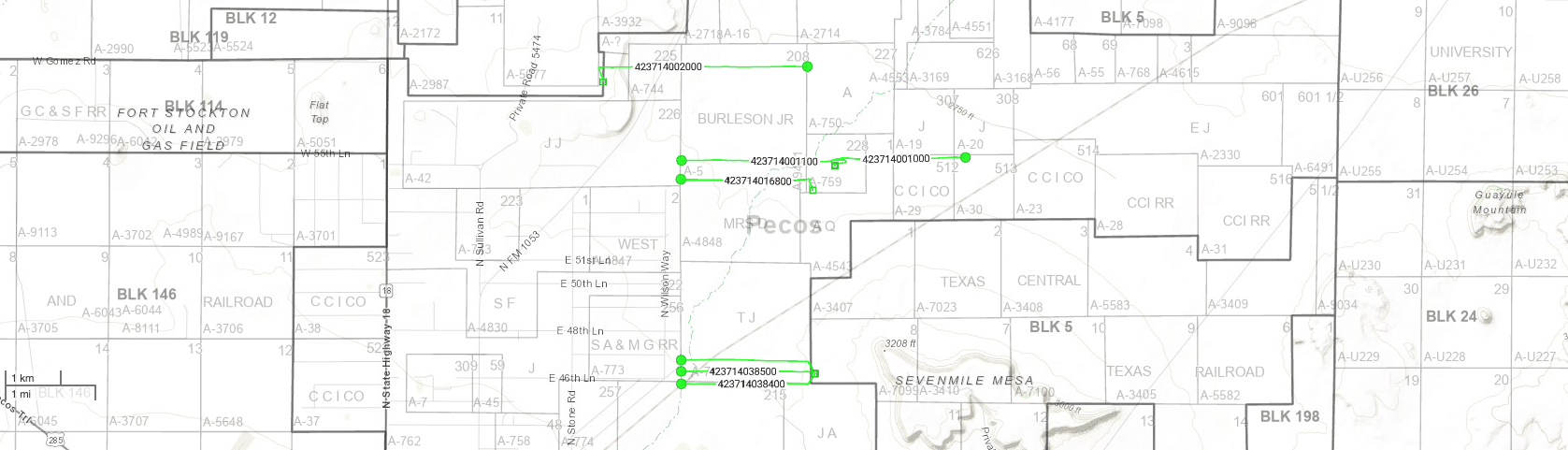

- Legal Location : Multiple - See attached maps

- Net Acres : 524.21

- Active Lease : Yes

- Royalty Rate : 24%

- Producing : yes

- Average Income : $5,265/Month

Comments:

Executive Summary

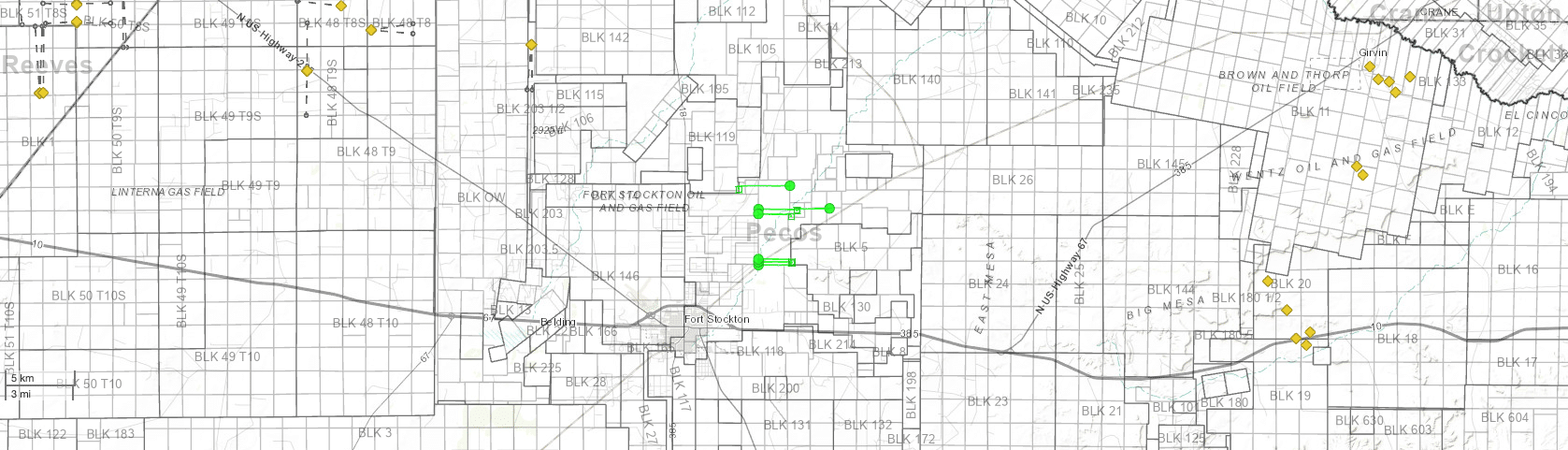

This is a very rare opportunity to buy 524.21 NMA with potential for over 1,000 net royalty acres in Pecos County Texas.

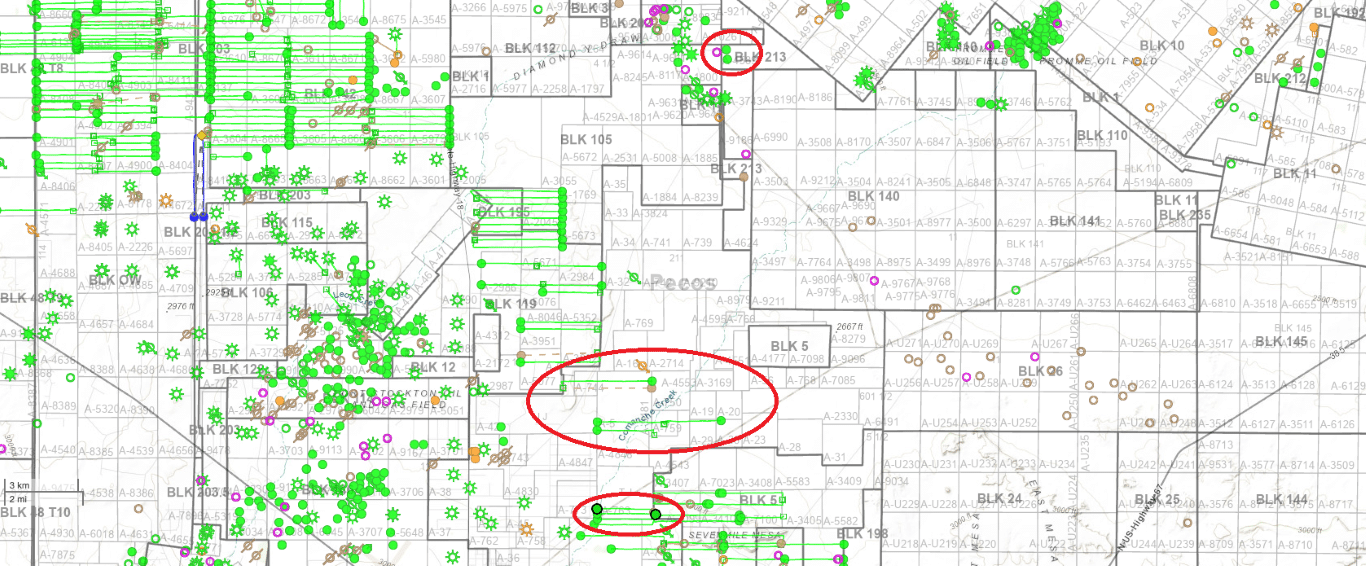

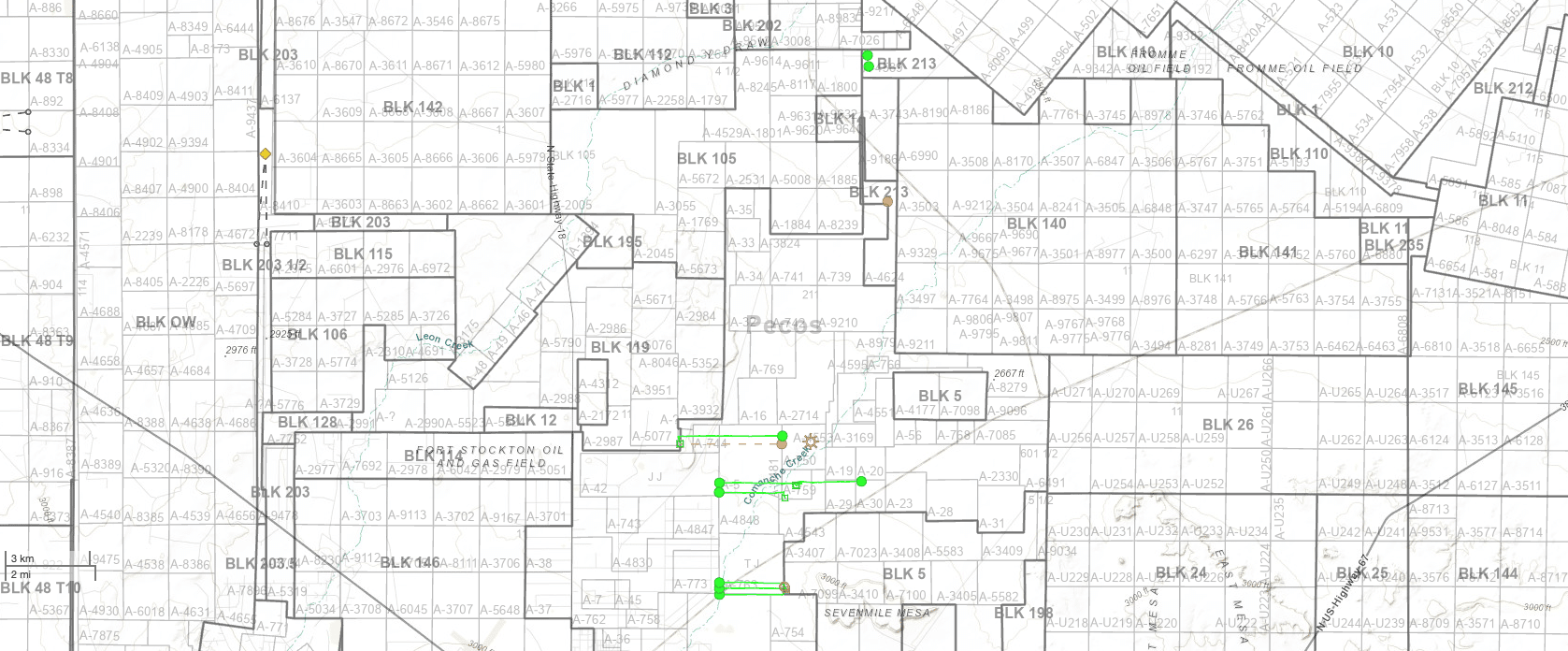

This ownership is currently generating over $5,250/month in royalty income under Diamondback and Gordy Oil. There are currently 285 NRA producing on 148 NMA. We estimate the owner has an additional 376 NMA unleased, providing potential for an additional 720 NRA.

About the Ownership

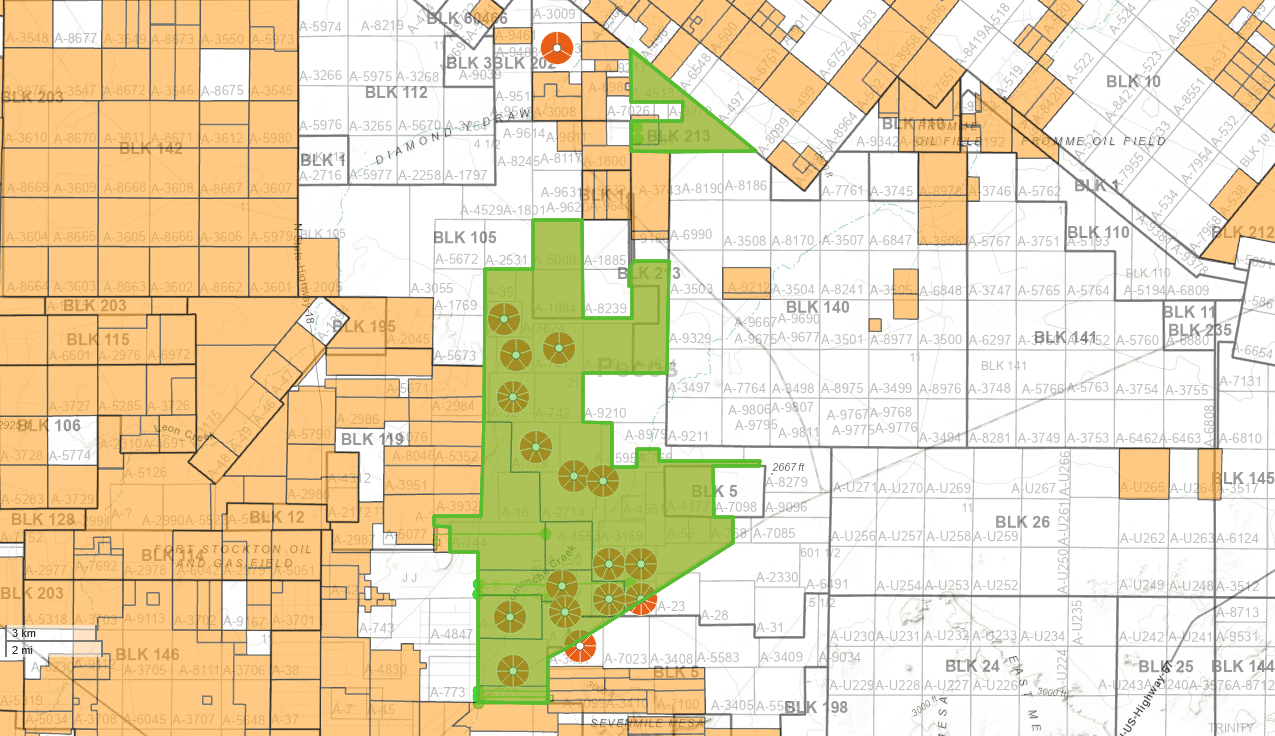

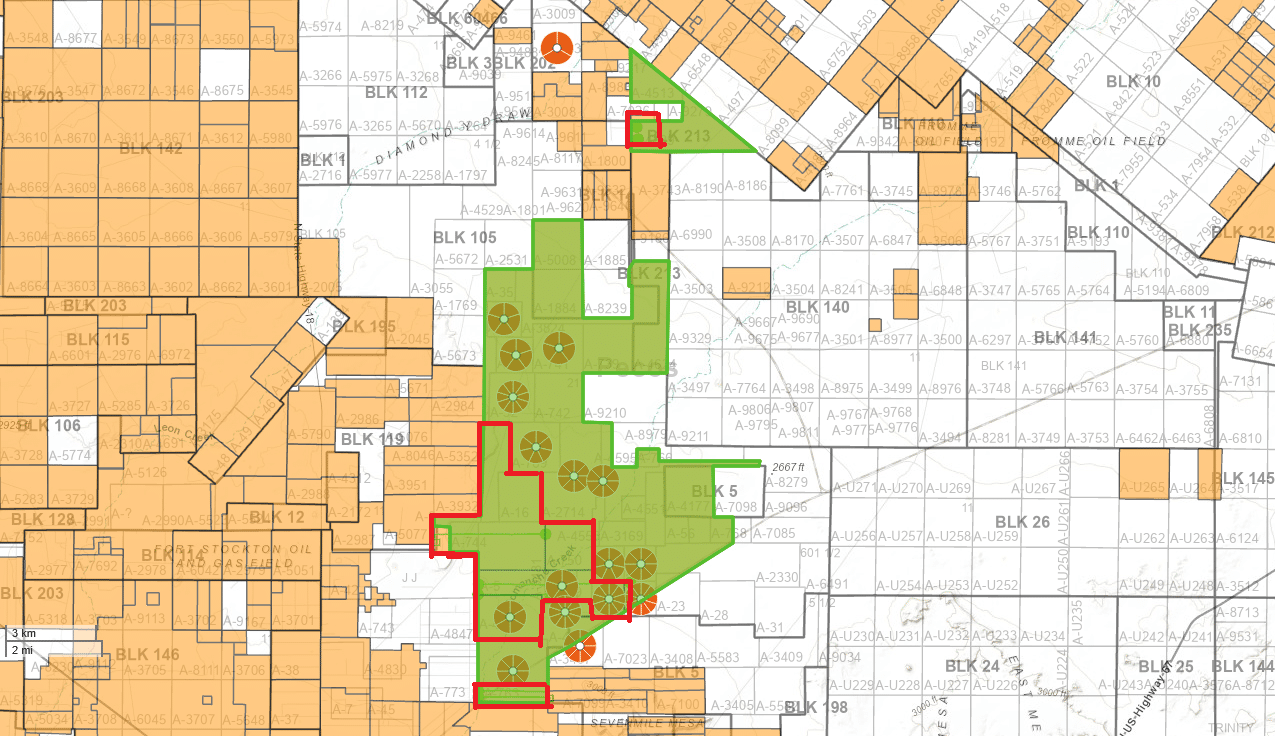

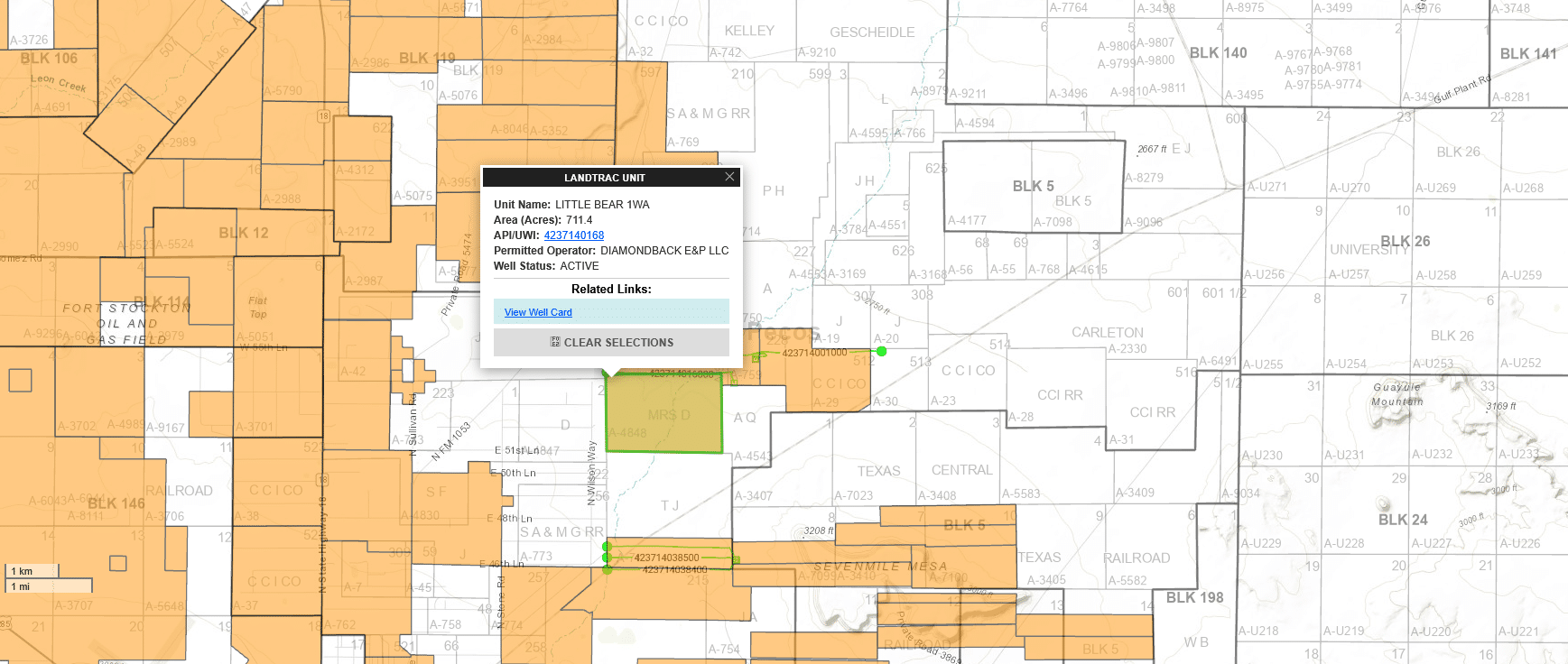

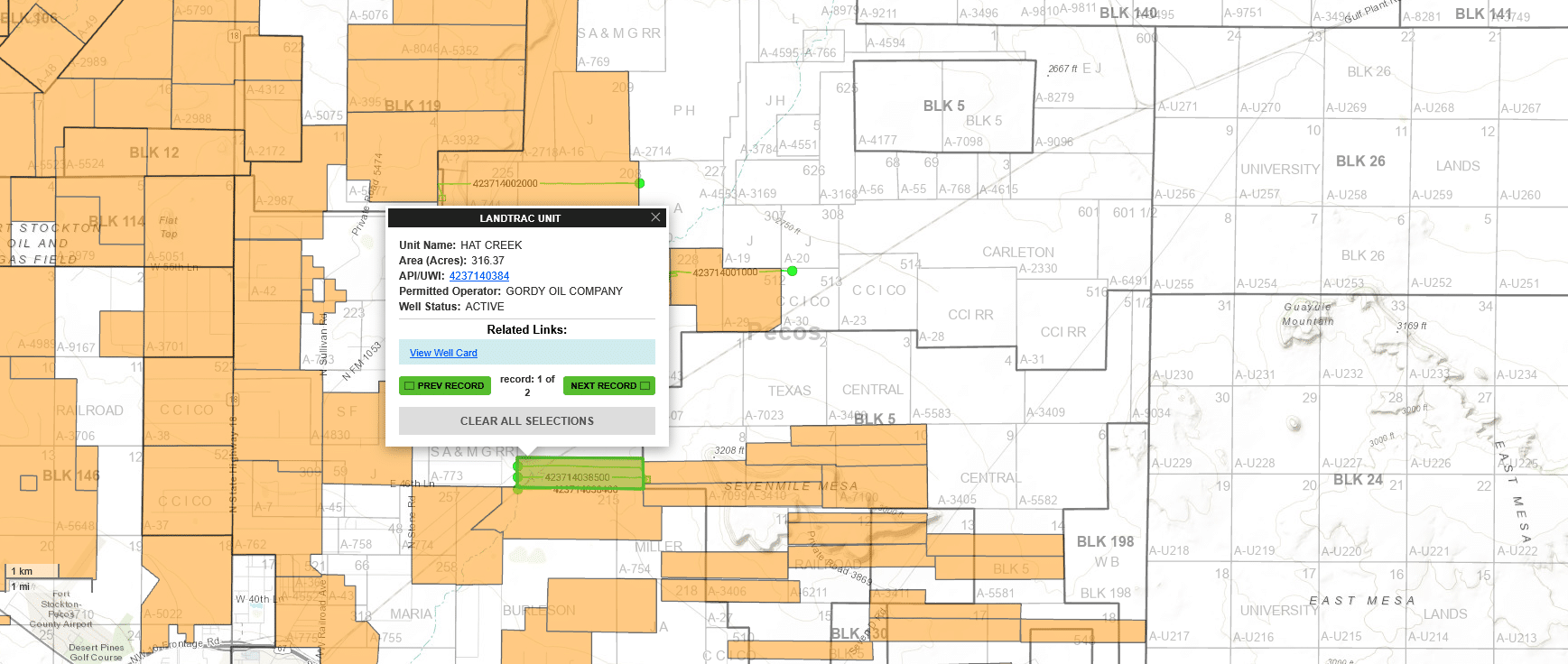

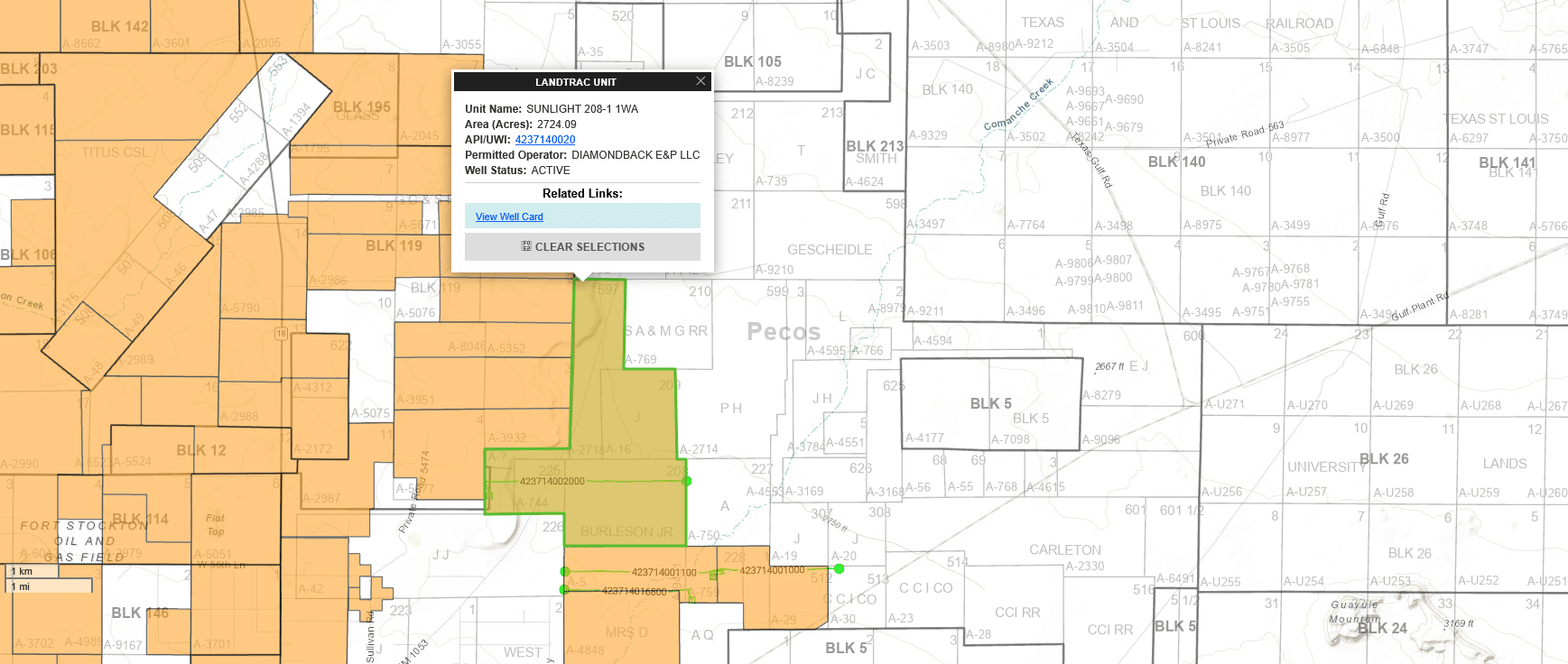

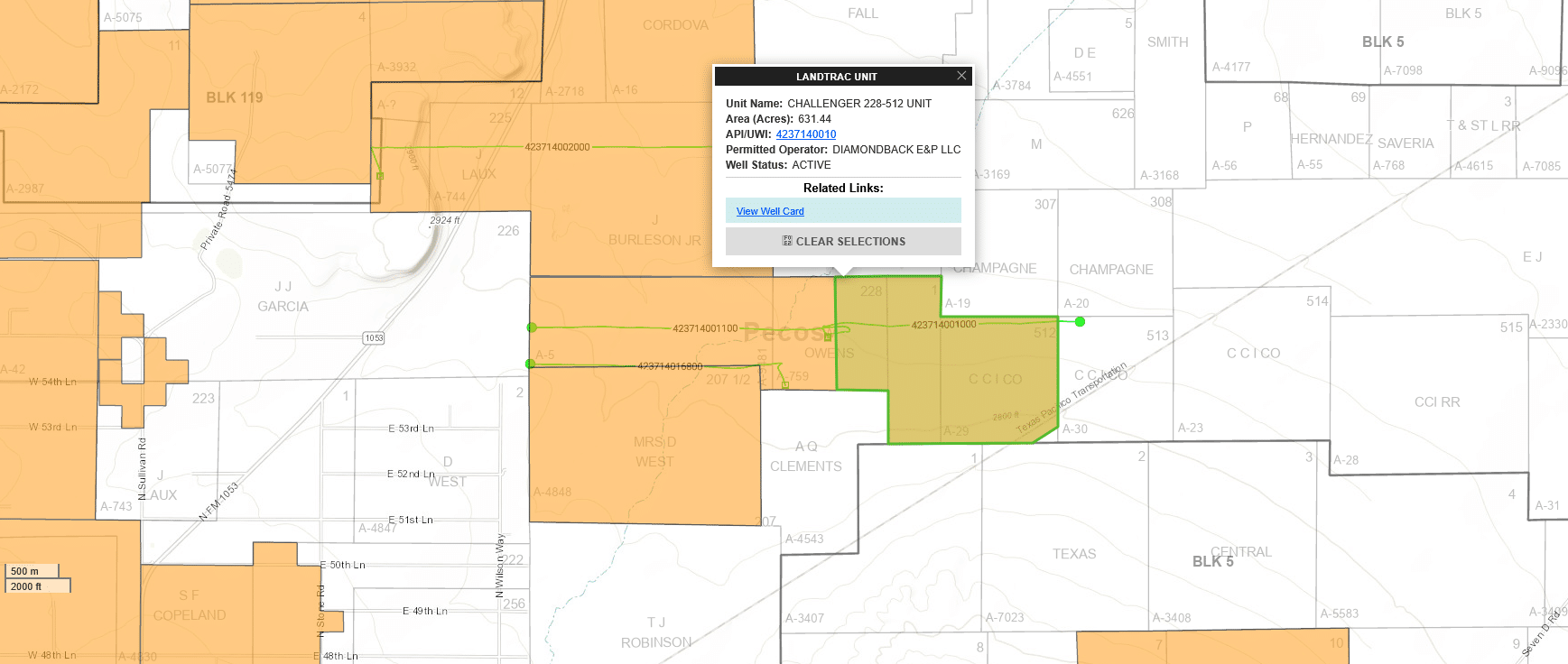

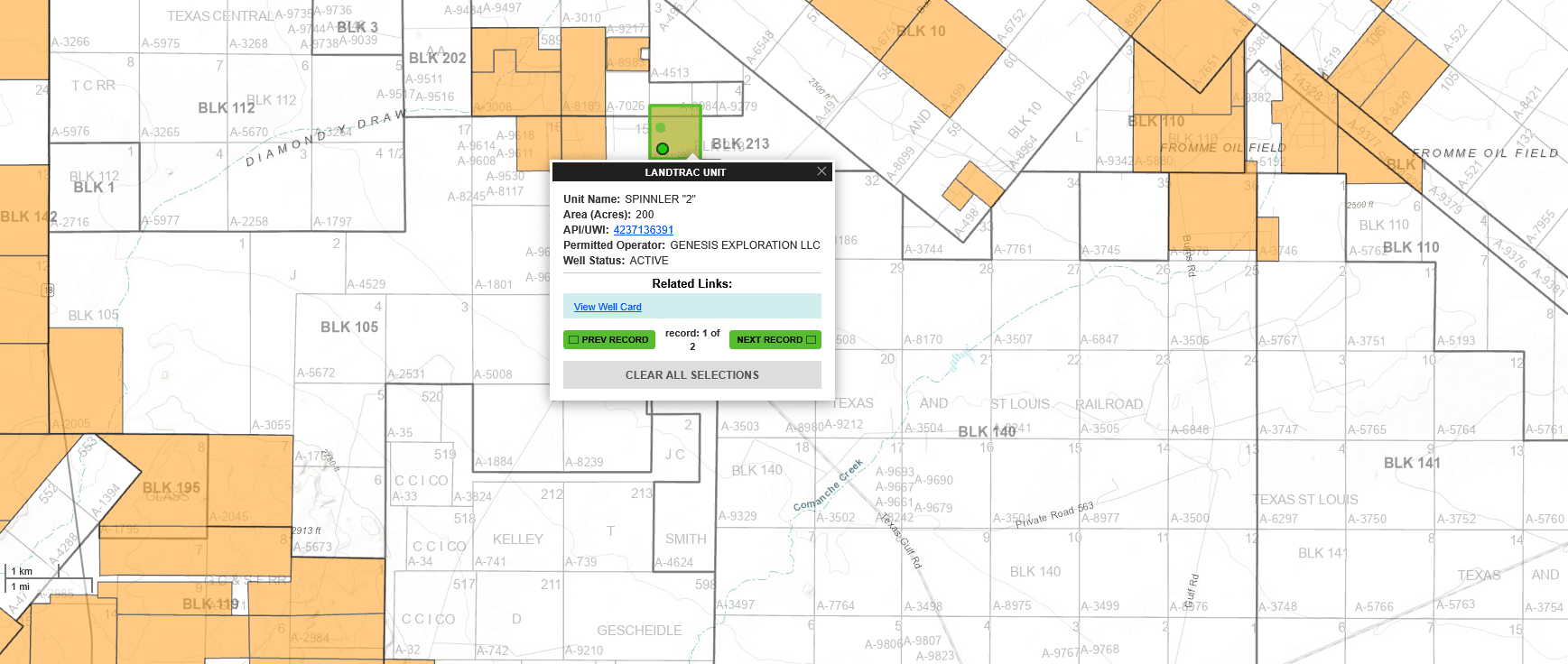

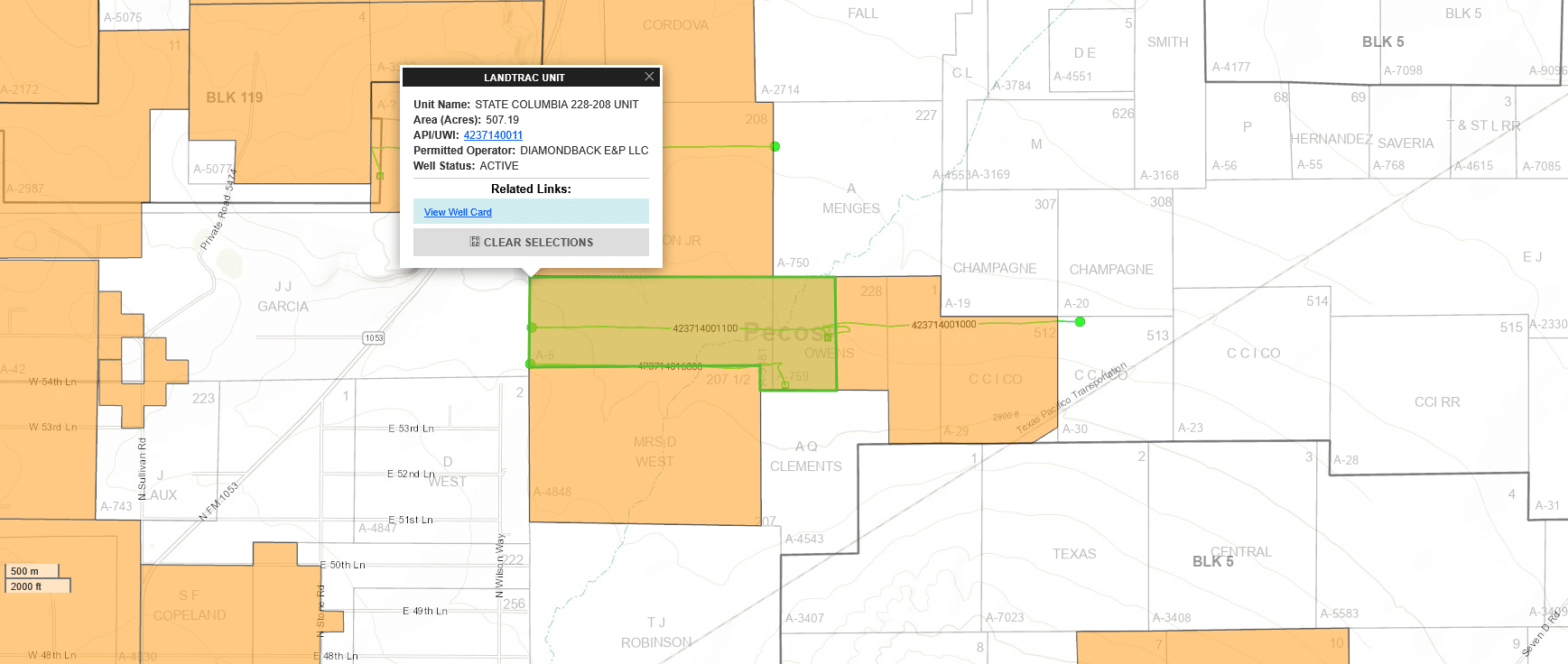

This ownership has a very interesting history. In 1971, the mineral rights from the San Pedro Ranch, consisting of 20,941 gross acres, were sold to multiple families. In the maps attached, you can see the San Pedro Ranch as a Landtrac unit (green section). We have then highlighted the producing units within the San Pedro Ranch with a red outline.

The San Pedro Ranch did not own 100% of the mineral rights, but it appears they owned a very large amount of the mineral rights. Our client, Riley A. Armstrong, was included in this original 1971 deed. In addition to the original source deed, our client received more of this ownership in 1988 (source deed 2) and 2003 (Source deed 3).

Note: On the original source deed, you can see some of the legal locations where the Ranch did not own 100% referenced.

When looking at the tax roll, you can see that a lot of these same families still own within all these same tracts that our client does. Some of the leases that were taken in the past include acreage in other parts of the Ranch. Taken together, this confirms that our client has ownership spread across the entire ranch.

Type of Ownership

Our client has ownership as both a royalty interest and a non-participating royalty interest according to the check stubs. In some units they have a royalty interest only. In other units, they have a mix of NPRI and RI. You can see this on the Diamondback check stubs. Based on past leasing, we believe the owner of the executive rights also has an interest in this ranch as they have leased at similar high royalty rates.

Ownership Estimate

In the attached ownership estimate, we show the currently producing ownership with a calculation of the net royalty acres and net mineral acres owned. These are all actively producing wells with the exception of the Anton Menges which is inactive. We have a unit size, so we included this acreage in our ownership estimate under the producing acreage even though it does not actively produce income.

In many cases, estimating ownership on non-producing acreage is virtually impossible. In this particular case, we believe our client effectively has the same amount of ownership across the entire ranch. This allows us to estimate their ownership by using the gross acreage and an assume NDI.

The seller is currently in pay under 5,731 gross acres. This leaves them with 14,560 acres of unleased gross acreage. Looking at their recent production from Gordy and Diamondback, we are using .0062 as our clients estimated NDI in the gross acreage. A lease from 2016 shows a lease rate of 24% in some of the producing locations, so we are assuming a 24% lease rate.

We believe our client has 376 unleased NMA, giving you the potential to have 720 additional NRA if this was leased at 24%. Obviously, at a 25% lease rate, it could be a bit higher than that.

We are making some assumptions on this ownership estimate, but we believe our estimate will be in the ballpark based on the available information. The buyer will need to run title to confirm the ownership.

Upside Potential

Producing Units – Within the producing units, there is plenty of room for more drilling. The only unit without upside is the Hat Creek unit under Gordy with 3 wells on 316 acre spacing. Every other unit has substantial space for more drilling under an already producing unit.

Southern Non-leased Acreage –In the “San Pedro Ranch – Producing Acreage” map, you can see the currently producing acreage that we based our calculation on. The Hat Creek unit is the southern most square on this map. Between this unit and the Diamondback unit there is a lot of open space for additional drilling. This acreage is currently non-leased / non-producing but sits in an area with a lot more active wells and production.

Non-leased acreage – There is a substantial amount of non-leased acreage in the rest of the ranch to the north. While there is no active production in this area, there is a lot of production to the South and just West of this location. This acreage was leased at $550/acre in 2016 according to the attached lease. Some of that acreage remains HBP.

Pricing and Offers

The seller would like to sell 100% of their ownership as a package.

When making an offer, we need an offer split into two parts:

- Offer 1: Producing Acreage – Based upon 148 NMA leased at 24%.

- Offer 2: Based upon 376 NMA unleased. Please provide your per NMA offer.

Example:

$5,000 X 148 NMA @ 24% = $740,000

$1,250 X 376 NMA = $470,000

Total offer: $1,210,000

Important: In our ownership estimate, we have the producing acreage calculated. This includes the Anton Menges (inactive well) and Sunlight (unit size estimated at the largest of 3 numbers we saw). We consider all of this acreage the “Core” acreage of the package. This is all the acreage in the red boxes on the “San Pedro Ranch” images. If it turns out that acreage is unleased, or part of the acreage isn’t included in the unit, it would still be valued at the price per acre for the core acreage.

While we know the price on this package will adjust, any price adjustment over 10% must be mutually agreeable.

For this listing, we are requiring the following:

-

- Special Warranty Deed

- 30 Day Close

- Any adjustment greater than 10% to the purchase price must be mutually agreeable.

- Our closing process included in the PSA, which is: At closing, buyer will provide the mineral deed. The seller will execute the mineral deed and return it to Texas Royalty Brokers. Texas Royalty Brokers will provide buyer with a scanned copy of the deed, and buyer will then wire funds to seller and Texas Royalty Brokers respectively. Once funds are confirmed, Texas Royalty Brokers will overnight the deed to the Buyer.

- Buyer must close within 14 days or sign our qualified buyer agreement.

To view/download the listing files, please visit the link below:

We will begin accepting offers on Thursday, May 8th

All buyers are required to either do a 14 day close or sign our qualified buyer agreement once a deal has been verbally agreed upon. In certain situations, we may require a $25,000 earnest deposit at the sole discretion of Texas Royalty Brokers.

The mineral owner has exclusively listed with Texas Royalty Brokers. Please do not contact the mineral owner directly. To make a bid or ask questions about this listing, please contact Texas Royalty Brokers using the contact form below. Our team will quickly be in touch.

We have other mineral rights for sale.

Exclusitivity Notice

All listings posted at Texas Royalty Brokers are exclusive. The seller has agreed to exclusively sell through our company and will become personally liable if you close a deal directly with the seller. Please direct all offers and communication directly to Texas Royalty Brokers.

Accepting Offers on 5/8/2025