Why Texas Royalty Brokers?

sellers

Buyers

State Specific Guides

Resources

Mineral Rights Market

Understanding how the mineral rights market works is important. The mineral rights market is not the same as traditional markets like the stock market or housing market.

Understanding how this market works will help you sell mineral rights for maximum value.

The mineral rights market plays by its own rules—and if you don’t know how it works, you could leave a lot of money on the table.

Whether you inherited mineral rights or you’ve held them for years, understanding this unique market is the key to getting top dollar when you sell. Let’s break it down.

How the Housing Market Works

While there are a number of markets we could compare, we are going to focus on the housing market.

The reason is that selling mineral rights is the most similar to selling a home.

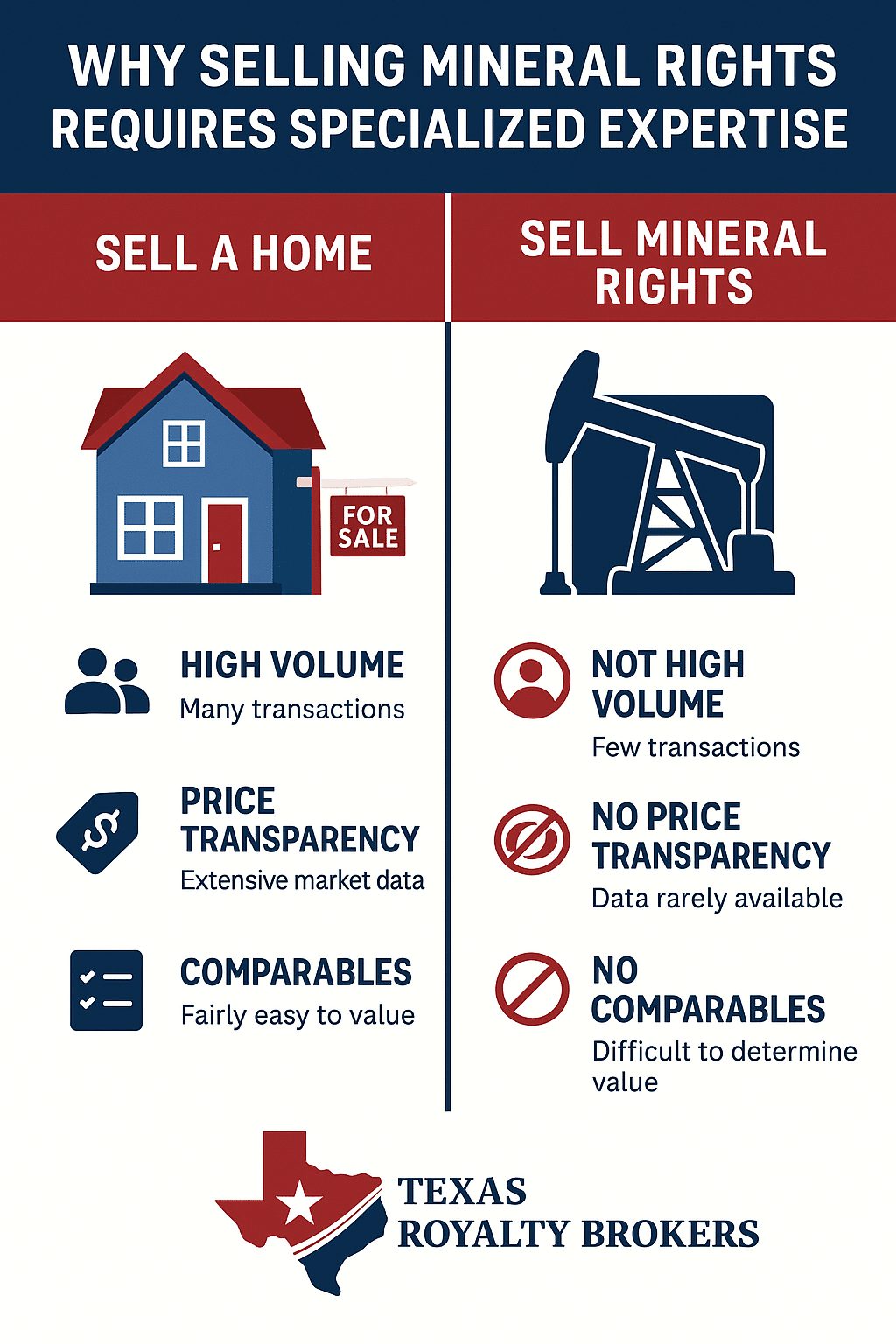

While the housing and mineral rights markets are similar, there are some key differences. These differences are important.

Consider the following:

Sales Price Transparency: When a home is sold, this data is public record. Everyone in the world knows how much your home was sold for. The price is recorded publicly and this data can be gathered and analyzed to provide a clear value to surrounding homes.

Volume: A large volume of homes are sold in a city, town, or even on a neighborhood on a consistent basis.

Comparables: When you sell a home, it can be compared to the homes around it. If you’re looking at two homes, the main differences are going to be the square footage and how updated the home is. In most cases, you can simply look at the price per square foot for recently sold homes and very accurately determine what the market will pay for your home.

In the housing market, you have transparency, volume, and comparables. This is extremely important because it means you can accurately estimate the value of a home.

How the Mineral Rights Market Works

In the mineral rights market, there are some key differences that make it more challenging.

Those same factors we mentioned above for the housing market work differently in the mineral rights market.

Sales Price Transparency: When mineral rights are sold, the sales price is not recorded publicly so no one knows the sales price. Even if you had an identical ownership in your exact wells, you can’t look up what someone else sold for. There is no price transparency.

Volume: While there are a lot of mineral owners in the United States, the number of sales that occur is very low. Even in a “busy” county, you may see between 25 and 100 mineral rights transactions in a single month in the entire county. Compare this to thousands of home sales that would occur in that same county each month.

Comparables: There are no “comparables” in mineral rights because each ownership is unique. As our mineral rights value article points out, there are many factors that swing the value. Each individual factor will cause huge swings in value. This means that even if we knew the price your neighbor sold for, it would tell us nothing about the value of your mineral rights.

What does this mean? It means that it is impossible to get an accurate mineral rights value until you get competitive bids.

Any estimated value is just a rule of thumb we use in the industry to roughly guess at the value. There is simply no way to know the market value of mineral rights until you get competitive bids.

If you are thinking about selling, contact us for a free consultation.

Mineral Rights Market Experts

It’s important to work with an expert when selling mineral rights.

In every transaction, there are a lot of moving parts. You want to ensure that your interests are protected. When you attempt to sell mineral rights on your own, you open yourself up to substantial risk.

Why you need a mineral rights expert

When you buy or sell a home, this entire process is highly regulated. If you were ever taken advantage of when buying or selling a home, there is an entire regulatory body that would look into the situation for you.

In mineral rights, it is 100% up to you to avoid being taken advantage of.

The place where most mineral owners get robbed is when they sign a contract to sell. The contract to sell, known as the purchase and sale agreement, varies from one buyer to the next.

Mineral buyers will insert language that is to their advantage. The price you are paid at closing can and does frequently adjust.

Imagine you were selling a home and you agreed to a price of $750,000. At closing, the buyer says that “title shows something different” and contract you signed allows us to adjust the price to $375,000.

Seems crazy right? This happens all the time.

When selling mineral rights, pricing adjustments at closing are normal.

What is important is that you understand how and why a pricing adjustment will occur.

A buyer may know you are leased at 12.5%, but write the contract to say you have a 25% lease. At closing, their $750,000 offer adjusts to $375,000. They made you an offer they knew would get cut in half based on the contract language.

This market is shady. You need an experienced team that understands the contracts, due diligence, and closing process to ensure your interests are protected.

At Texas Royalty Brokers we have been helping mineral owners sell mineral rights since 2012. We understand these contracts and we can help guide you through the process. When you list mineral rights at Texas Royalty Brokers, we have a clearly defined process so that you know exactly what to expect after listing.

As with any transaction, hiring an attorney to review your contracts is recommended.

Unregulated Market

Did you know that there is zero regulation, oversight, or authority over the mineral rights market? This means that anyone can be a buyer or broker with no license, certification, or oversight.

What this means is that the industry attracts a lot of bad actors. A lot of shady people have entered the industry realizing they can make a fortune taking advantage of mineral owners. They know that most mineral owners don’t have a clue what they are doing, and use this information to take advantage of you.

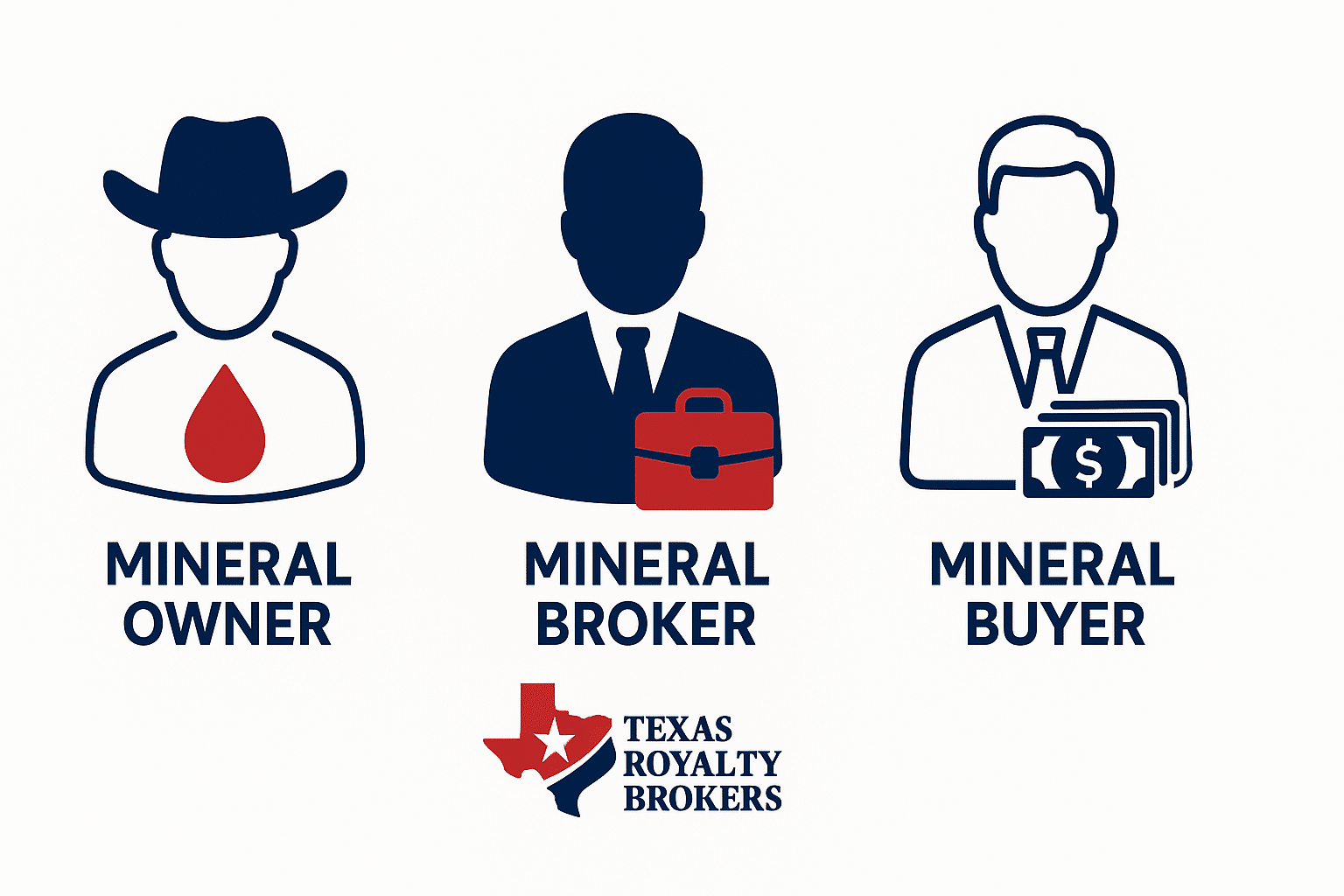

Understanding the Roles: Owners, Buyers & Brokers

There are many different people, companies, and entities operating in the mineral rights space. If you’re curious who you are dealing with, here is a breakdown of the different types of entities you’ll encounter.

Mineral Owners

There are a lot of individual owners around the United States. Most individual mineral owners inherited the mineral rights from family members who owned larger tracks of land in the last generation or two.

Mineral Brokers:

There are a few different types of mineral brokers.

Individual Brokers: There are hundreds, if not thousands, of individual brokers out there. These brokers typically know a handful of buyers. They will work to source deals they sell to the small group of people they know. They will get your mineral rights sold, typically for a below market price.

Attorneys: The worst way to sell mineral rights is through an attorney. For some reason, mineral owners do it all the time. Attorneys have no network of mineral buyers. They are not going to get you the best price. Working with an attorney is like working with the random landman who “knows a few people” and will not get you the best price.

Mineral Rights Marketplace: A true mineral rights marketplace is going to do one thing well. Create competition. To get maximum value when you sell, you need thousands of mineral buyers competing. This drives up the price of your mineral rights and ensures you sell for the best price. In addition, a quality broker will walk you through the transaction to ensure your interests are protected. If your broker doesn’t have listings on their website, they are not a true marketplace broker. At Texas Royalty Brokers, this is exactly what we do!

Mineral Buyers:

There are a few different types of mineral buyers.

Individual Buyers: There are some individual buyers who purchase mineral rights for themselves. These buyers tend to purchase small acreage.

Flippers: These “buyers” are actually not buyers at all. They will claim to be buying your mineral rights, but they are just trying to put you under contract. Once they put you under contract, they will sell the contract to another buyer at a higher price. This means you make less money than your mineral rights were worth. Most of them don’t even know how to buy mineral rights.

Low Ballers: These buyers make low ball offers to mineral owners. Once you agree to sell, they purchase the mineral rights from you and immediately turn around and list the mineral rights with a broker. They end up selling your mineral rights at much higher price. They can do this because the didn’t have any competition.

Buy and Hold Funds: A true end buyer will be a private equity backed investment fund. These are the funds who will pay the highest prices. When selling mineral rights, you want to ensure you are working with a buy and hold investor. At Texas Royalty Brokers, we work exclusively with long term buy and hold investors.

As you can see, there are a number of different types of entities who operate in the mineral rights space.

The challenge is figuring out which one of these entities you’re working with. Are you working with a legitimate buyer or a flipper? Is your mineral rights broker a mineral buyer in disguise or a legitimate marketplace?

Check out our mineral buyer and mineral broker articles that further break down the differences.

Questions about the Mineral Rights Market

Interested in learning more? Check out the following articles:

- Never Sell Mineral Rights?

- Selling Mineral Rights

- Mineral Rights Value

- How to Buy Mineral Rights

- Oil and Gas Royalties

Do you have questions about the mineral rights market? If so, reach out to us for a free consultation using the form below. Our team will quickly be in touch.