Why Texas Royalty Brokers?

Selling mineral rights doesn’t have to be complicated. At Texas Royalty Brokers, we handle every step of the process so you can get maximum value with zero stress.

Our team works hard to deliver real offers, real value, and real results.

sellers

Texas Royalty Brokers

Popular Topics

Mineral Rights Report

Buyers

Receive new listing notifications?

Trusted by Mineral Owners

![]()

Glasscock, TX

We had a great experience with Texas Royalty Brokers! Very professional and straight shooters. Hit the market with excellent results. Hightly recommend them!

Lavaca, TX

We worked with Emily to assist us with a sale of some of our mineral interests. Not only was she professional and courteous, but we were paid well above any previous offer and ahead of the expected time frame. What more could you ask for? A well deserved five star rating!

Upton , TX

My wife and I were very pleased with the guidance and knowledgeable advice that Emily and Eric provided to us regarding the sale of her mineral rights in Texas.

Nacogdoches, TX

Eric and his team were very knowledgeable and responsive to our needs and questions. The professionalism and integrity exceeded our expectations throughout the entire process. We highly recommend Texas Royalty Brokers!

Harrison, TX

I decided to work with Texas Royalty Brokers after reading several of their reviews. It was a good decision. They were prompt in their communication and straightforward in their assessments and follow through. I am quite pleased with the outcome and recommend them highly.

Mineral Rights Report

State Specific Guides

Resources

Blog Categories

Free Consultation

Get expert advice on your mineral rights with no pressure and no obligation.

Listing Notifications

To receive notifications regarding new listings that are activated on our website, please enter your email address below.

Listing Title

Mineral rights for sale in Robertson County

Listing ID

401260

Listing Status

pending

- Listing Posted - complete

- Listing Evaluation - complete

- Accepting Offers - complete

- Client Review - complete

- Best and Final - complete

- Under Contract - in progress

Please take a moment to learn more about each listing phase.

Listing Files

Please click the download button below to view the listing files. Listing files include maps, check stubs, and other documentation.

Listing Details

Starting Bid: $825,000

- State : Texas

- County : robertson

- Legal Location : A-25

- Net Acres : 366.51

- Active Lease : Yes

- Royalty Rate : 18.75%

- Producing : yes

- Average Income : $100/Month

Comments:

Update: 1/14/2026

Sale Pending

__________________________________________

Note: This listing was updated on 12/16/2025.

Robertson County, Texas – 366.51 Net Royalty Acres

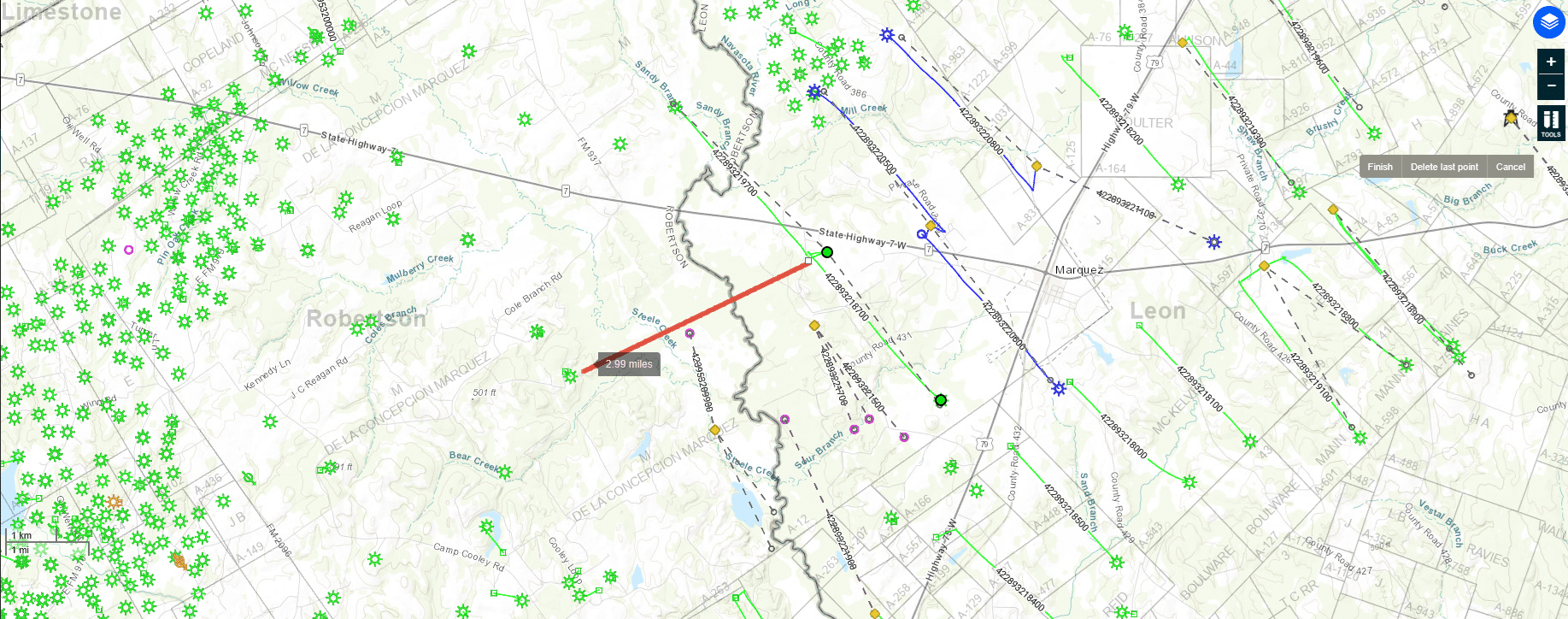

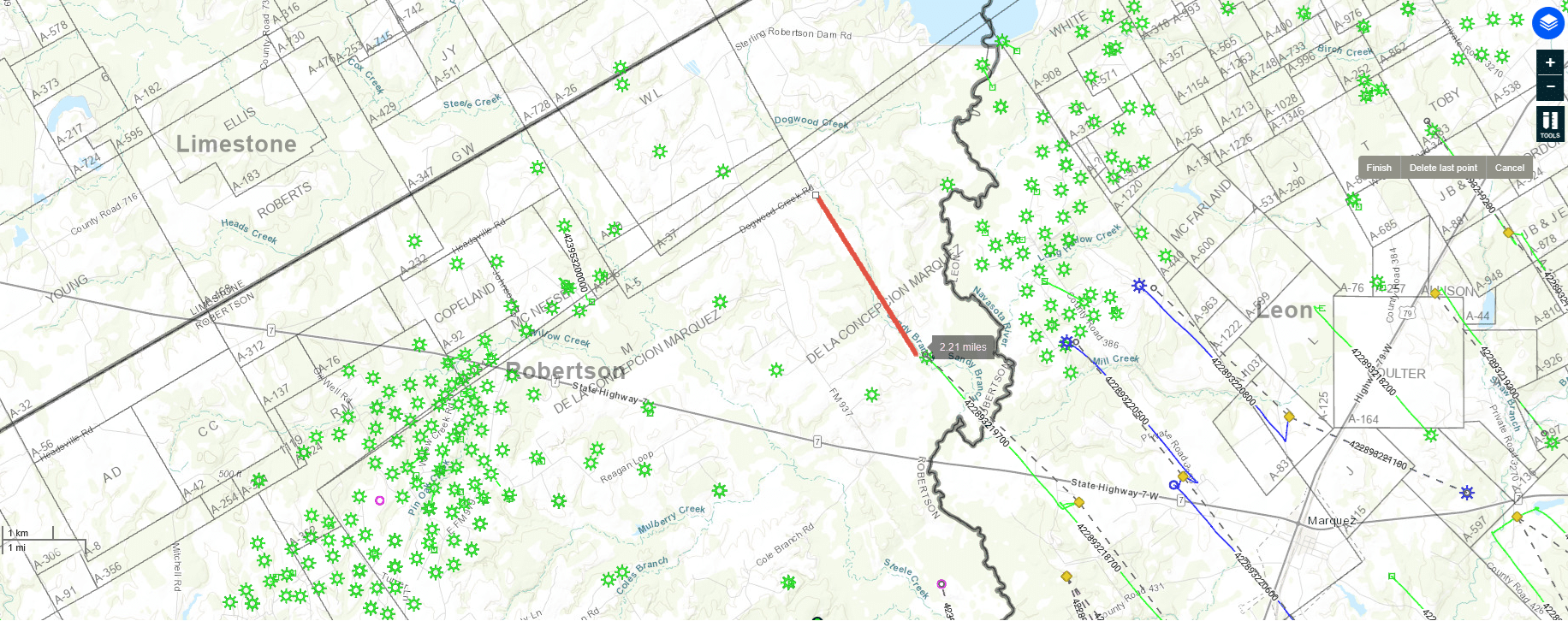

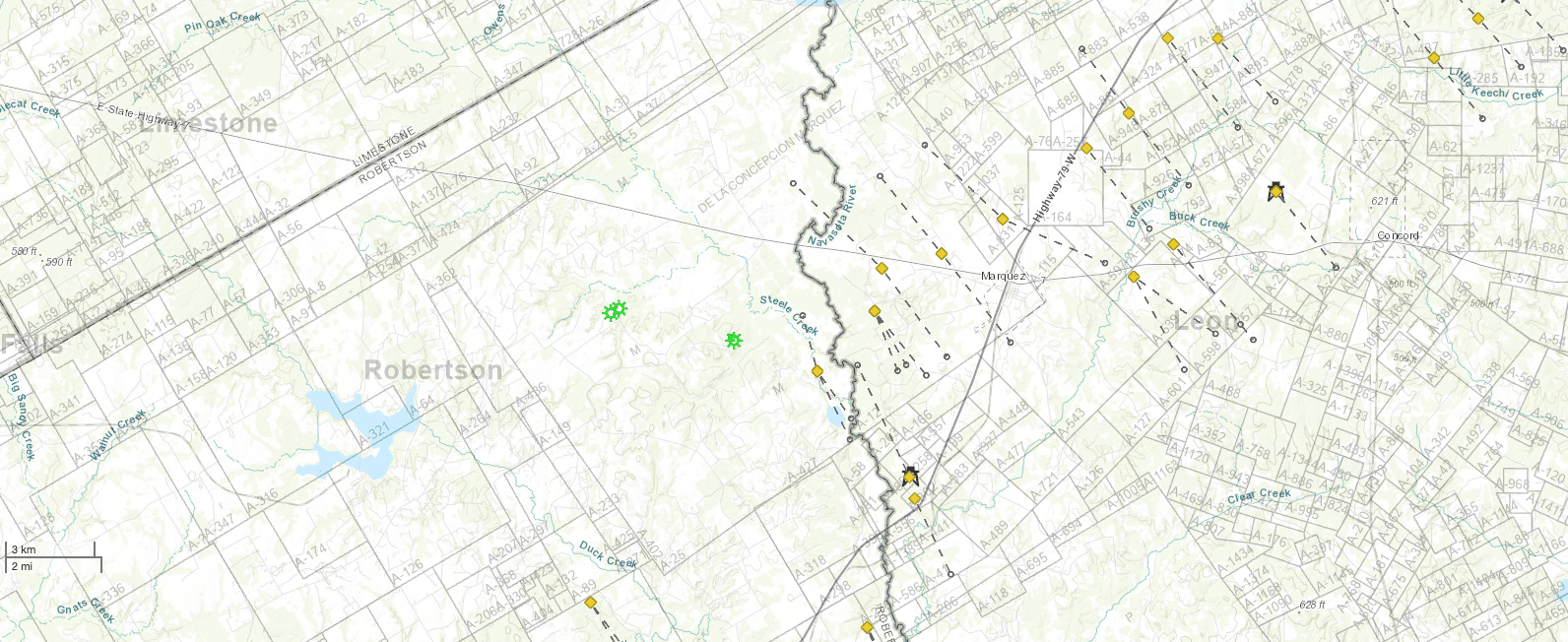

This is an exceptional opportunity pick up a large acreage position in Robertson County. This ownership is right next to the border of Leon County, and within 2 to 3 miles of the Jennings wells drilled by Comstock.

There are 366.51 net royalty acres currently held by production under Diversified. This acreage sits just 3 miles East of the new Comstock Jennings wells.

Producing Acreage – 366.51 net royalty acres

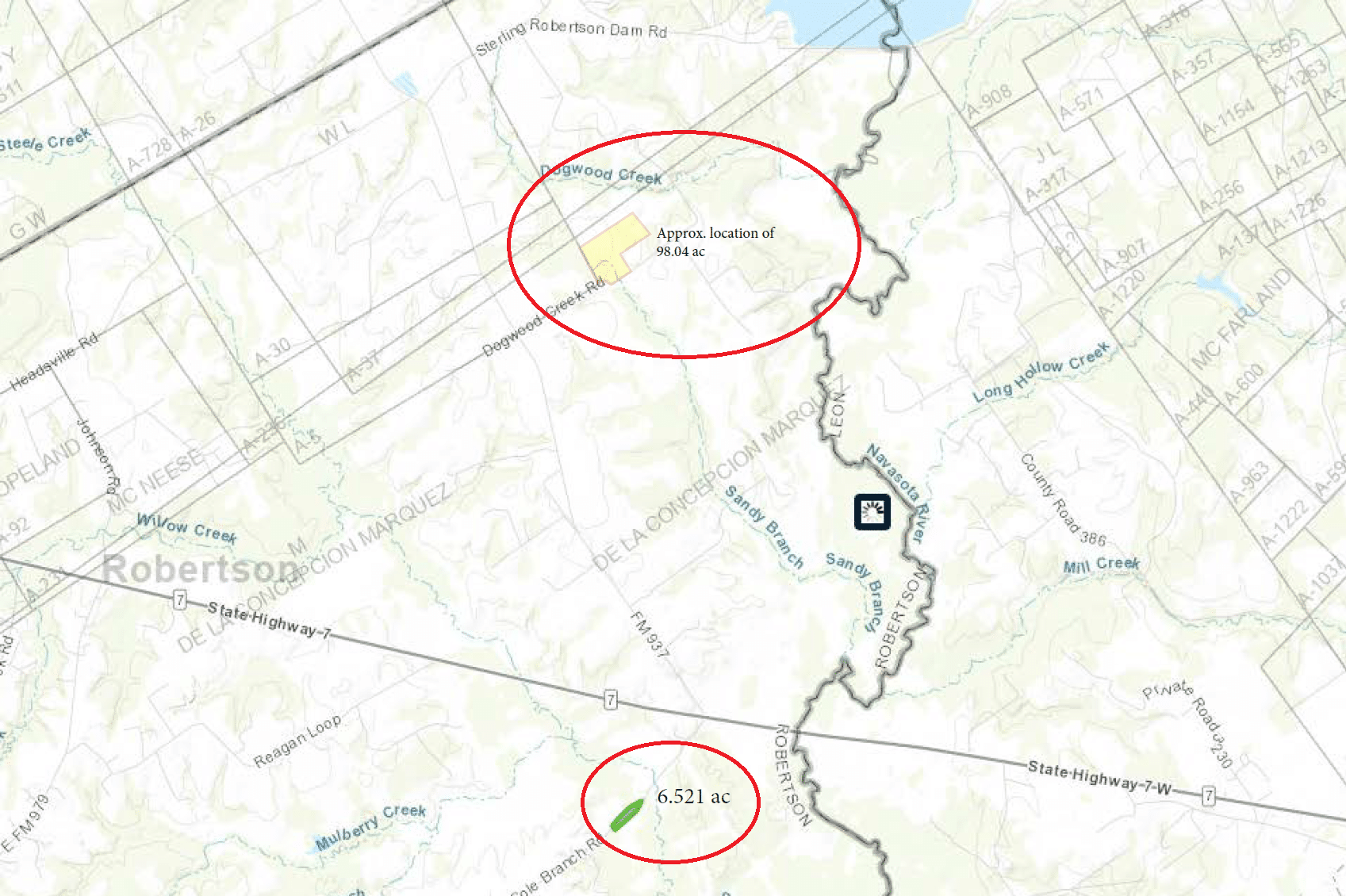

The seller has a total of 366.51 net royalty acres spread across 3 units.

A large chunk of this acreage is in the Manzikert unit under Diversified. The seller has a total of 229.68 net royalty acres in this unit. With just a single vertical well producing and Comstock drilling exceptional wells just East of this location, this acreage will provide huge upside in the future. The royalty income being generated at this time is nominal at only around $2,000 in 2025 and $1,500 in 2024.

To the Northwest, there are two additional units currently producing.

The Mary King and Emma Reagan, both operated by Hilcorp. These units do not generate enough income to produce royalty checks. Combined, these two units provide another 136.83 net royalty acres. Please note that the unit sizes for this appear incorrectly in DI and the units are larger. We show a 703 acre unit under Mary king and 407 acre unit under the Emma Reagan.

Leased Acreage – Comstock

The owner has some acreage currently leased with Comstock. As of 12/16/2025, the seller has elected to hold onto this acreage and not sell it. The files may includes some references to this leased acreage, but it is not currently for sale.

Comstock Wells

If you have been watching the activity in Leon County, TX, you are well aware of the new wells Comstock has been drilling in the area. Comstock has drilled the Lanier CW 1H (API – 4228932181). This well has been producing for 24 months and has generated over 14MMcf. At $3 gas, this well alone has generated over $42MM. Comstock then drilled 3 more wells just next door that have generated 5MM to 7MM MCF.

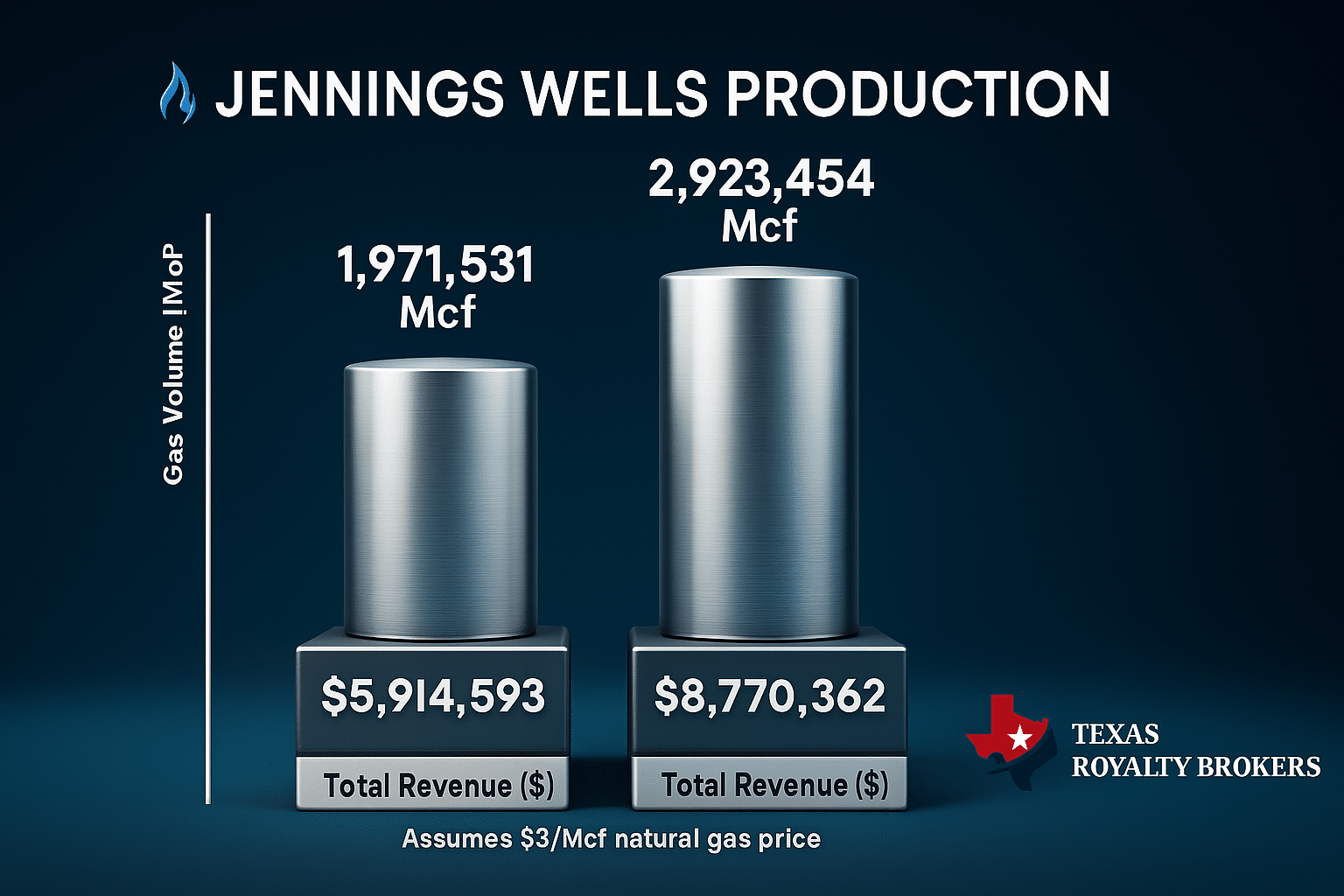

The Jennings wells, which are closest to this acreage, have only been producing for 4 months so we have limited data. However, during that time these wells have produced 1,971,531 and 2,923,454 Mcf and generated between $5.9MM and $8.7MM respectively in just 4 months time. This assumes $3/Mcf gas, with gas currently sitting north of $4/Mcf.

Ownership Information

Our client was gifted these mineral rights from his Grandfather. Our clients Grandfather was Erwin Reagan. We have pulled some prior leases and deeds related to Erwin Reagan and included them within the files. It appears there is a pretty clear chain of title going back, but it spans a number of different legal locations. He inherited from his parents who appeared to have a lot of ownership within this abstract.

Our client’s grandfather intends to convey all oil and gas ownership in Robertson County to our client. An attorney is currently preparing a correcting deed to convey all ownership within the county so any other ownership that falls under Erwin Reagan will be our clients ownership. We have requested that our client not file this deed until the buyer has reviewed it to ensure it doesn’t create any issues.

Note: Our client is not in pay on the producing acreage at this time, but is in the process of getting it switched over with the operator.

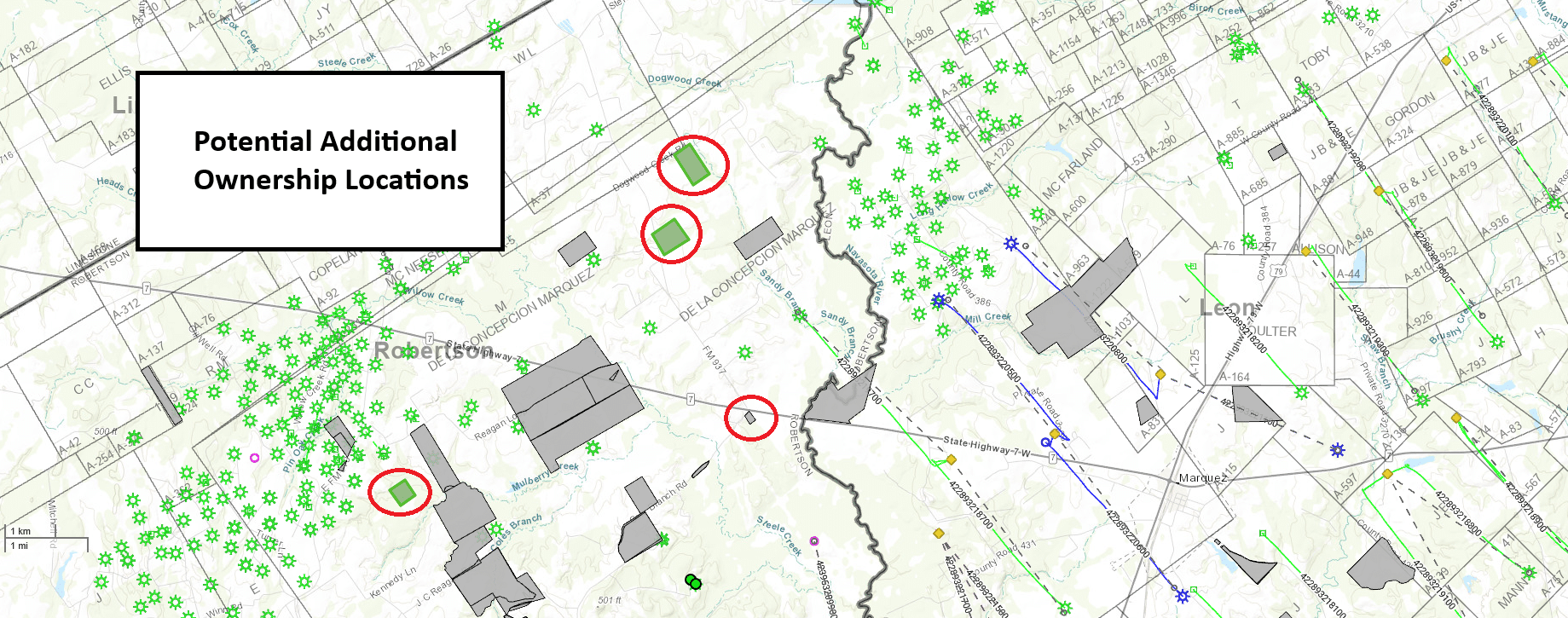

Additional Ownership Possible

In researching our clients ownership, and the ownership held by Erwin Reagan, we believe there is other non-leased / non-producing acreage that falls in this area. We are not making any representations about how much acreage it is or a specific location. This acreage will not be part of the sale. However, for the right price, our client may consider selling some or all of any other ownership the buyer locates while running title.

Closing Timeline & Starting Bid

The starting bid for this ownership is $2,250/net royalty acre, or $825,000.

For this listing, we are requiring the following:

-

- Special Warranty Deed

- 30 Day Close

- Any adjustment greater than 10% to the purchase price must be mutually agreeable.

- Our closing process included in the PSA, which is: At closing, buyer will provide the mineral deed. The seller will execute the mineral deed and return it to Texas Royalty Brokers. Texas Royalty Brokers will provide buyer with a scanned copy of the deed, and buyer will then wire funds to seller and Texas Royalty Brokers respectively. Once funds are confirmed, Texas Royalty Brokers will overnight the deed to the Buyer.

- Buyer must close within 14 days or sign our qualified buyer agreement.

To view/download the listing files, please visit the link below:

We will begin accepting offers on Thursday, November 6th.

All buyers are required to either do a 14 day close or sign our qualified buyer agreement once a deal has been verbally agreed upon. In certain situations, we may require a $25,000 earnest deposit at the sole discretion of Texas Royalty Brokers.

The mineral owner has exclusively listed with Texas Royalty Brokers. Please do not contact the mineral owner directly. To make a bid or ask questions about this listing, please contact Texas Royalty Brokers using the contact form below. Our team will quickly be in touch.

We have other mineral rights for sale.

Exclusitivity Notice

All listings posted at Texas Royalty Brokers are exclusive. The seller has agreed to exclusively sell through our company and will become personally liable if you close a deal directly with the seller. Please direct all offers and communication directly to Texas Royalty Brokers.

Accepting Offers on 11/6/2025