sellers

Buyers

Net Mineral Acre vs Net Royalty Acre

Curious about the difference between a net mineral acre and a net royalty acre? A lot of mineral owners find this topic very confusing. We are going to quickly break down the difference between a net mineral acres and net royalty acre. In addition, we’ll explain why it matters and how it affects the value of mineral rights.

Why do Net Royalty Acres exist?

Before we explain the difference, it’s important to understand why a net royalty acre exists.

A net royalty acre is an industry created definition that allows mineral buyers to compare two deals apples to apples.

When you own oil and gas mineral rights, the first step in getting paid royalty income is to lease the mineral rights. When you lease the mineral rights, the lease includes a royalty rate between 12.5% and 25%. This percentage is very important. Why? It defines your share of production from the oil and gas produced from the land.

While the math is more complicated, a simplified example is this:

If you lease your mineral rights at 12.5%, you get 12.5% of each barrel of oil produced.

If you lease your mineral rights at 25%, you get 25% of each barrel of oil produced.

In this simplified example, it is easy to understand that mineral rights with a 25% lease are going to be approximately twice as valuable as those with a 12.5% lease. Why? Because you get double the amount of oil produced from each barrel of oil.

A net royalty acres exists to help mineral buyers understand how much of the production they will receive by purchasing your mineral rights.

What is a Net Mineral Acre?

A net mineral acre refers to the actual amount of physical surface area attributed to your mineral rights.

In many cases, the mineral owner does not own the surface. However, the surface is how your mineral rights are located and measured.

Let’s pretend there is a farm that is 20 net mineral acres. The farmer owns the surface, but you own the oil and gas mineral rights related to those 20 net mineral acres. You have net mineral acres of ownership, which are associated with the surface ownership even though they are two different owners.

An important thing to understand about “net mineral acres” is that they do not change. The net mineral acres are tied to surface ownership. You may not own the surface, but the amount of oil and gas you own is related to past surface ownership.

What is a Net Royalty Acre?

You now know that the amount of net mineral acres you own does not change. You also know that net royalty acres are related to your lease royalty rate. So what exactly is a net royalty acre?

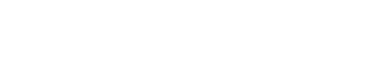

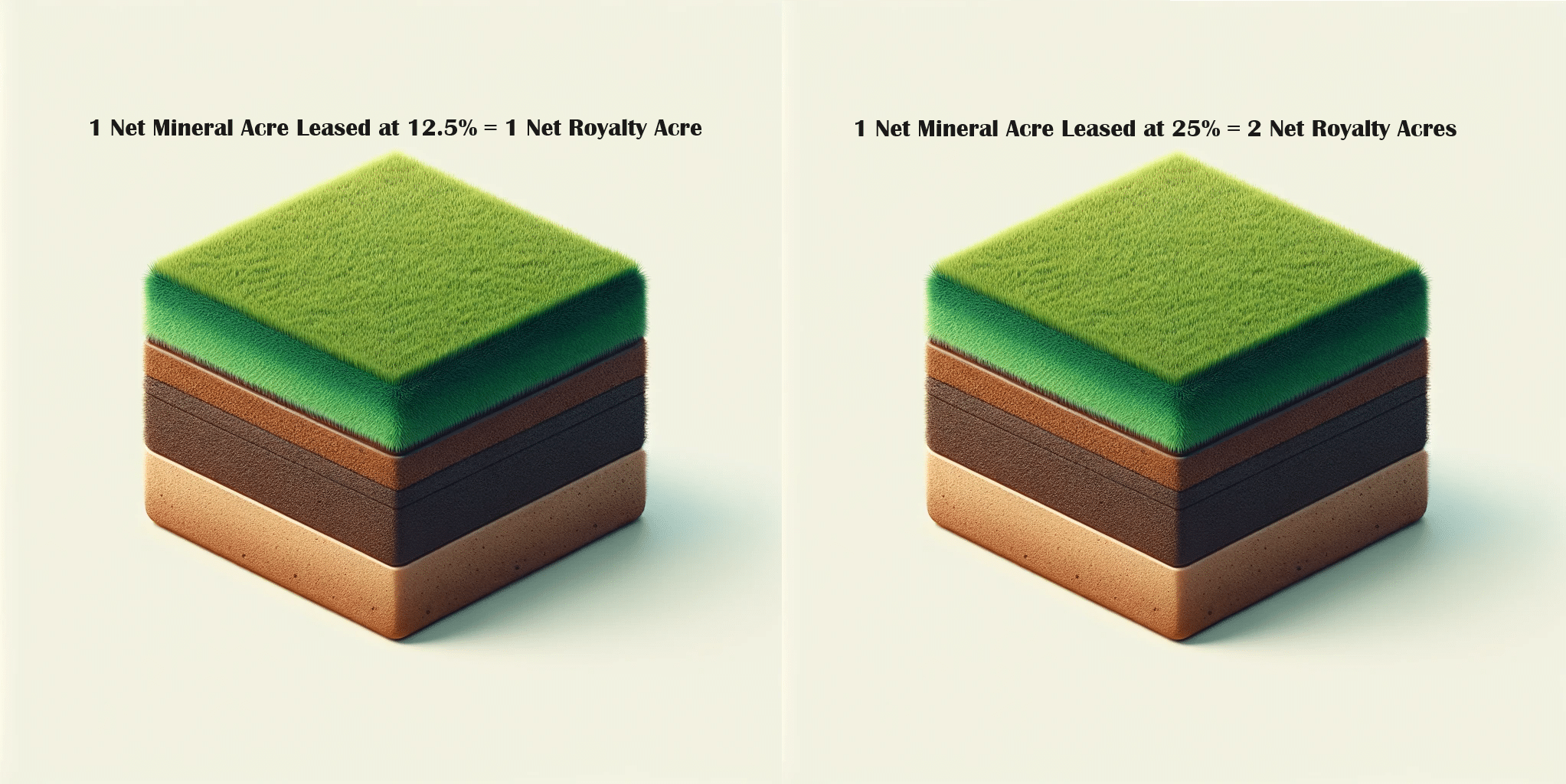

Definition: A net royalty acre is equal to 1 net mineral acre leased at 12.5%.

Using our farm example, you have 20 net mineral acres of oil and gas mineral rights below the farm. When you leased the mineral rights, you accepted a 12.5% lease. Since 1 net mineral acre leased at 12.5% = 1 net royalty acre, you have 20 net mineral acres and 20 net royalty acres.

Let’s assume that instead of leasing at 12.5%, you leased at 25%. Since net mineral acres don’t ever change, you still have 20 net mineral acres of oil and gas mineral rights. However, because you leased at 25%, you now how 40 net royalty acres. You have double the number of net royalty acres because the lease rate is double 12.5%.

Remember that if you have a higher royalty rate, you get a higher share of the production making your mineral rights more valuable. A net royalty acre is simply a numeric representation of the value you get from having a higher royalty rate.

Let’s look at an example where a buyer is comparing three different deals:

Deal #1: 20 Net Mineral Acres leased at 12.5%

This owner has 20 net mineral acres and 20 net royalty acres. The buyer offers $5,000 per net royalty acre or $100,000 for this ownership.

Deal #2: 20 Net Mineral Acres leased at 25%.

The owner has 20 net mineral acres and 40 net royalty acres. The buyer offers the same $5,000 per net royalty acre, but in this case is going to pay $200,000 (double!) the price for the same 20 net mineral acres. Why? Since this savvy mineral owner leased at 25%, they get double the royalty income for their share of production. This doubles the value of the ownership as they get a larger share of production.

Deal #3: 15 Net Mineral Acres leased at 20%

This owner has 15 net mineral acres. Based upon their lease rate, they have 24 net royalty acres (20% is 1.6x higher than 12.5%). The buyer pays the same $5,000/net royalty acre, and will pay $120,000 for this ownership. Even though the mineral owner in deal #3 had less net mineral acres of ownership, they negotiated a better lease rate so their mineral rights were more valuable than owner #1 who leased at 12.5%.

Free Consultation

Texas Royalty Brokers offers free consultations for anyone interested in selling their oil and gas mineral rights. These consultations provide an opportunity for sellers to learn more about the process of selling mineral rights, as well as get a sense of the value of their rights. During the consultation, a representative from Texas Royalty Brokers will discuss the specifics of your property and the minerals in question, and help you understand the current market conditions and what to expect in terms of offers for your rights.

When requesting a free consultation, you can expect a prompt response from Texas Royalty Brokers.

Providing your 3 most recent royalty statements up front can also be helpful in providing you with better information and analysis. These statements will allow Texas Royalty Brokers to analyze your production history, revenue, and other important information that will help them give you a more accurate assessment of the value of your mineral rights. They will be able to use this information to provide you with a better understanding of the offers you can expect to receive.

It is important to keep in mind that the consultation and analysis provided by Texas Royalty Brokers is free of charge and there is no obligation and no pressure to sell your mineral rights after the consultation. This gives you an opportunity to get a professional opinion and make a more informed decision about your next steps.