Why Texas Royalty Brokers?

Selling mineral rights doesn’t have to be complicated. At Texas Royalty Brokers, we handle every step of the process so you can get maximum value with zero stress.

Our team works hard to deliver real offers, real value, and real results.

sellers

Texas Royalty Brokers

Popular Topics

Mineral Rights Report

Buyers

Receive new listing notifications?

Trusted by Mineral Owners

![]()

Pecos, TX

I had a very good experience working with Eric and his team. Eric was very professional and due to his knowledge added a lot of insight into helping me sell my mineral interests. I was kept well informed on a weekly basis and once there was a buyer, Eric continued to help me understand the process. From the start to the finish, during the entire process I wasn’t ever disappointed. Eric has a great deal of experience and knowledge of mineral values and he also has many connections in the industry. If you are interested in selling minerals you own, I highly recommend you contact Eric and the good folks at Texas Royalty Brokers.

Glasscock, TX

We had a great experience with Texas Royalty Brokers! Very professional and straight shooters. Hit the market with excellent results. Hightly recommend them!

Lavaca, TX

We worked with Emily to assist us with a sale of some of our mineral interests. Not only was she professional and courteous, but we were paid well above any previous offer and ahead of the expected time frame. What more could you ask for? A well deserved five star rating!

Upton , TX

My wife and I were very pleased with the guidance and knowledgeable advice that Emily and Eric provided to us regarding the sale of her mineral rights in Texas.

Nacogdoches, TX

Eric and his team were very knowledgeable and responsive to our needs and questions. The professionalism and integrity exceeded our expectations throughout the entire process. We highly recommend Texas Royalty Brokers!

Mineral Rights Report

State Specific Guides

Resources

Blog Categories

Free Consultation

Get expert advice on your mineral rights with no pressure and no obligation.

Listing Notifications

To receive notifications regarding new listings that are activated on our website, please enter your email address below.

Listing Title

DeSoto Parish Louisiana Mineral Rights for Sale

Listing ID

401264

Listing Status

not available

- Listing Posted - complete

- Listing Evaluation - complete

- Accepting Offers - in progress

- Client Review - tbd

- Best and Final - tbd

- Under Contract - tbd

Please take a moment to learn more about each listing phase.

Listing Files

Please click the download button below to view the listing files. Listing files include maps, check stubs, and other documentation.

Listing Details

Starting Bid: $6,500,000

- State : Louisiana

- County : DeSoto

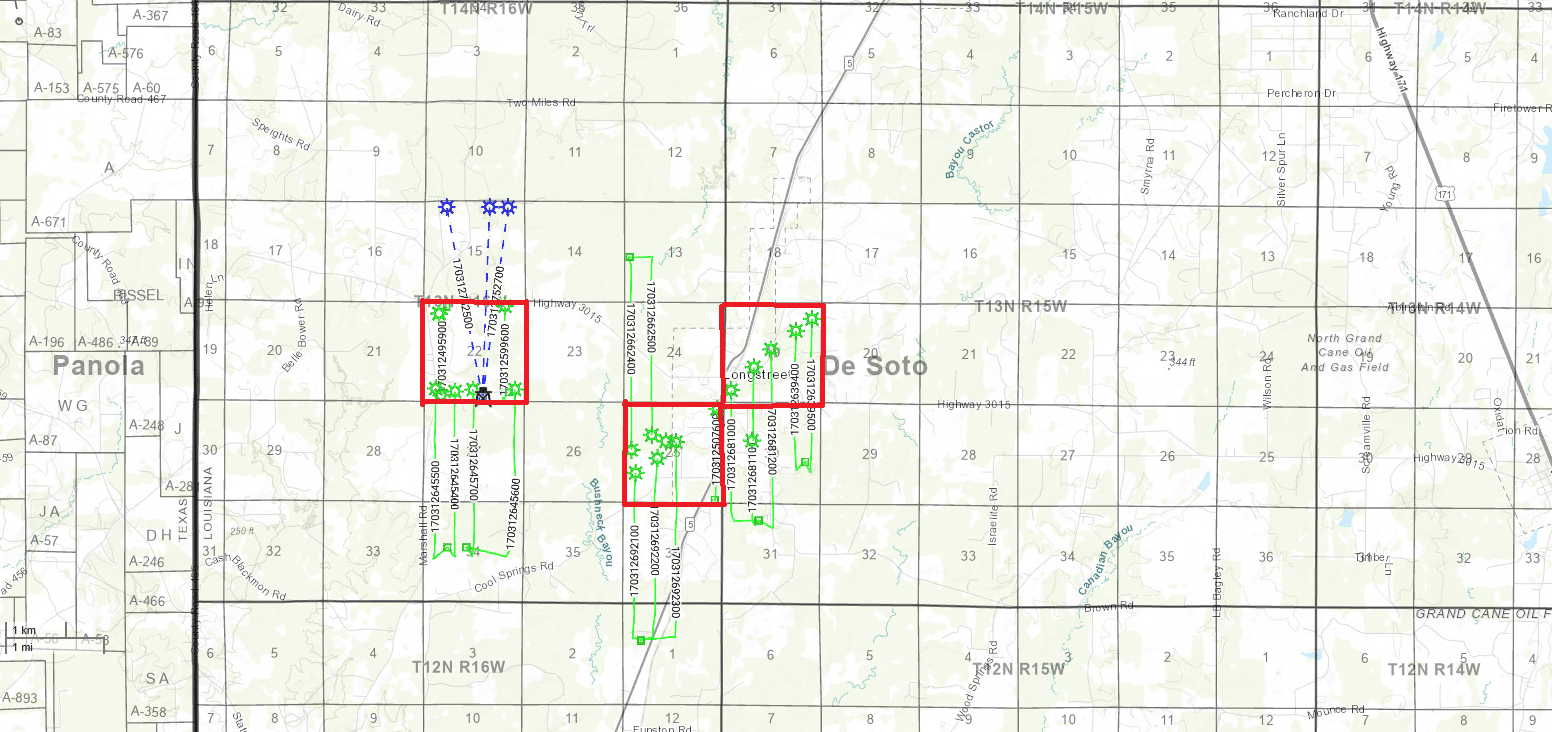

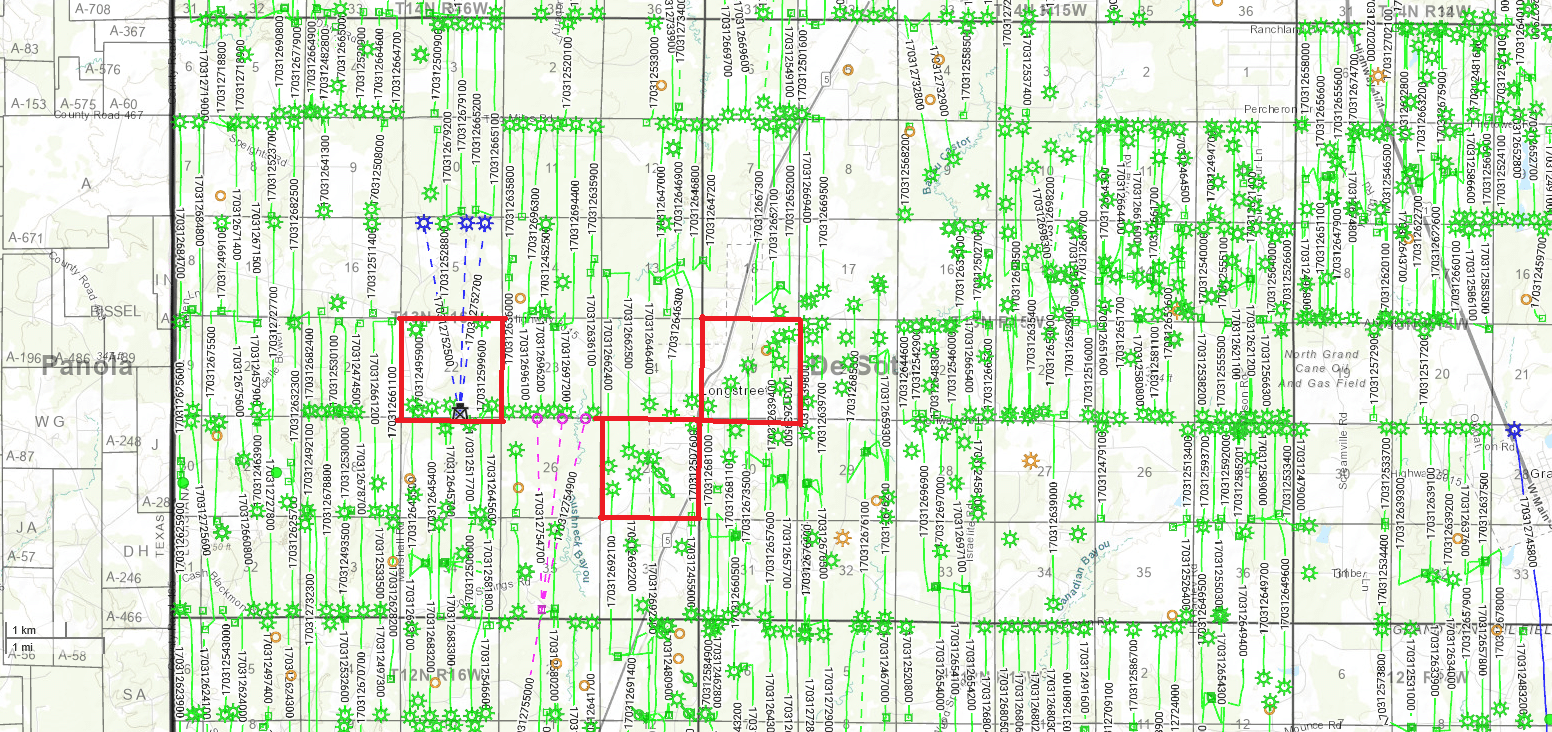

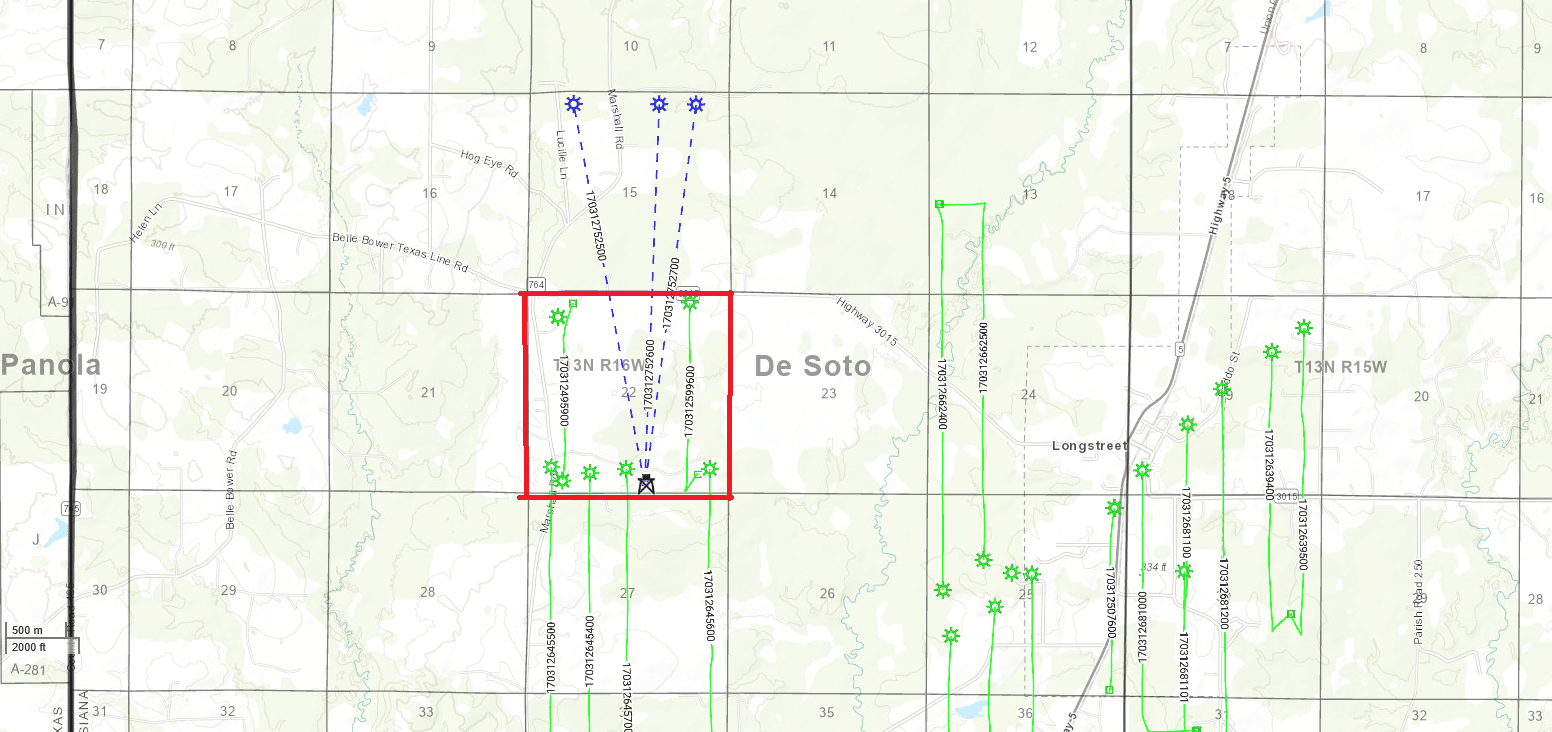

- Legal Location : Section 22, T13N, R16W

- Net Acres : 444.3

- Active Lease : Yes

- Royalty Rate : 16.6%

- Producing : yes

- Average Income : $2,118/Month

Comments:

Update: 1/26/2026 – Listing is no longer available.

_______________________________

DeSoto Parish, Louisiana Mineral Rights –

444.3 Net Mineral Acres

This offering represents a rare opportunity to acquire a large, contiguous acreage position with three (3) DUC Haynesville wells already on location. Assets of this scale, with a defined development path and direct offset production, are increasingly difficult to source in today’s market.

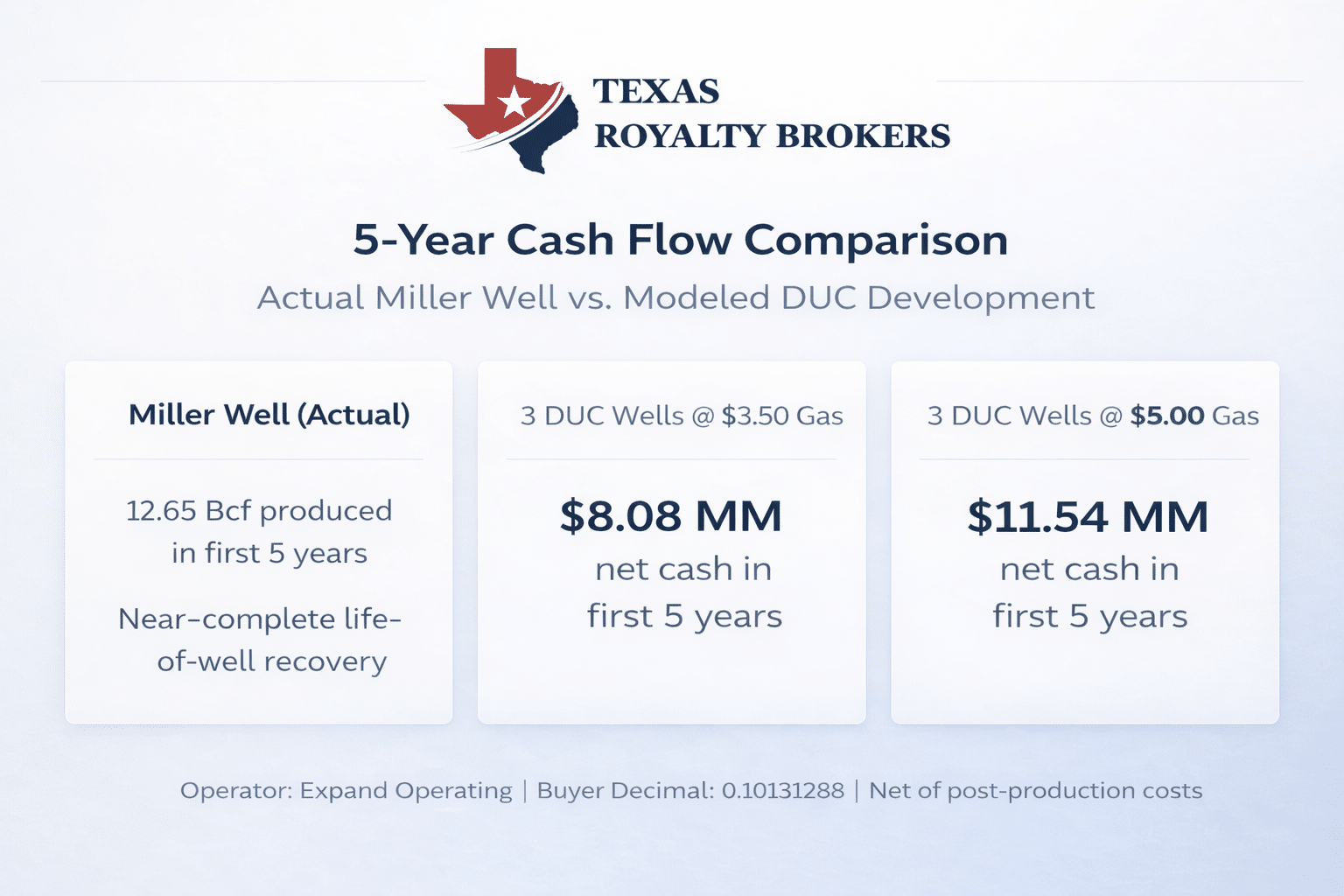

The property sits immediately adjacent to existing production and benefits from clear line of sight to near-term cash flow. Using actual performance from a directly offset well, the three DUC wells have been modeled to generate in excess of $8 million of net cash flow within the first five years at current natural gas prices, with meaningful upside in a stronger pricing environment.

The combination of size, proximity to proven production, and completion-ready inventory creates a compelling acquisition profile for buyers seeking scale and risk-adjusted returns without relying on undeveloped acreage assumptions.

This is a straightforward opportunity to step into a position with quantifiable value today and potential upside going forward, at a time when comparable DUC-backed packages of this size are rarely available.

Miller Well Comparison and DUC Upside

Directly north of the subject acreage is the Miller well (API 1703126792) under Comstock, with unit boundaries that touch the property. Because of this immediate proximity, the Miller well provides a highly relevant production comparison for evaluating the value of the three permitted but undrilled (DUC) wells on the acreage.

The Miller well has produced approximately 13.3 Bcf of natural gas, with roughly 95% of that production occurring within the first five years. Using the actual production history from the Miller well as a benchmark, we modeled the expected performance of the three DUC wells if they achieve similar results.

Based on this comparison:

At $3.50 natural gas, the three DUC wells are estimated to generate approximately $8.1 million of net cash flow within the first five years.

At $5.00 natural gas, the same wells are estimated to generate approximately $11.5 million of net cash flow within the first five years.

These estimates reflect net cash to the owner, after accounting for gathering, treating, fuel, and severance taxes, using realized netbacks observed under Expand Operating. This is intended to represent realistic, check-level economics, not gross revenue.

The planned DUC wells are designed with similar lateral lengths to the Miller well, but are drilled to a greater total depth of approximately 27,000 feet, compared to the Miller well’s ~21,000-foot total depth. While results ultimately depend on execution and reservoir performance, the nearby Miller well provides a strong, data-backed reference point.

When viewed against these projected cash flows, a starting bid of just $6.5 million represents a compelling value, with the potential for full payback within five years at current gas prices and meaningful upside in a higher-price environment.

Disclaimer: It is up to each buyer to perform their own due diligence. The information provided above is an estimate and/or projection and should not be used to determine your offer. We are also not representing that each well will have the same .1013 net decimal interest. This interest is pulled from the existing wells.

Ownership Estimate – Lease Rate and Net Mineral Acres (NMA) Basis

All bids are requested on a standardized basis of 444.31 net mineral acres (NMA) leased at a 1/6th royalty. This framework is being used strictly to ensure that all offers can be evaluated on an apples-to-apples basis.

Based on our ownership analysis, the mineral interest underlying this position appears to include multiple lease rates, and we believe the effective royalty rate is likely closer to approximately 14.75%. That said, to maintain clarity and comparability across bids, we are not requesting buyers to price based on varying royalty assumptions.

Accordingly:

-All offers should be submitted assuming 444.31 NMA at a 1/6th royalty.

-Buyers are responsible for running their own title and ownership analysis to confirm net acres, royalty burdens, and effective lease rates.

-Any adjustments resulting from title confirmation or differing lease terms can be addressed during diligence.

This approach allows the seller to efficiently compare offers while providing buyers the opportunity to underwrite the asset based on their own title work and economic assumptions.

Please also note that the Berry 22-13-16 well under Expand is at a lower .05398 NDI. We believe this is due to the fact that this well does not encompass the entire unit. Both the vertical well directly on top of this well and the horizontal on the other side of the section under Diversified show the higher NDI.

Production Outside the Sale Area

The check stubs provided for reference include production from additional sections that are not part of this offering. These amounts are shown solely to provide context and should not be included in any valuation or offer unless explicitly agreed otherwise.

Specifically:

Section 25:

The seller holds an interest in Section 25 that is not included in the sale. Based on our estimates, this interest may represent up to approximately 174.89 net royalty acres (NRA). This ownership has been excluded from the offering and should not be reflected in submitted bids. That said, for the right price, the seller would consider including this interest as part of a broader transaction.

Section 19:

The seller’s interest in Section 19 is relatively small and not material in the context of this offering. No separate calculation has been included, and this interest is not part of the sale.

Buyers are encouraged to review the check stubs carefully and underwrite the offering based solely on the interests expressly included herein. The attached revenue estimate is only for Section 22. Any discussion regarding additional interests would be handled separately and only by mutual agreement.

For this listing, we are requiring the following:

-

- Special Warranty Deed

- 30 Day Close

- Any adjustment to the purchase price greater than 15% must be mutually agreeable.

- No adjustments will be allowed on the basis of the shallow rights being leased at a lower rate. The only factor at play is the deep rights as this is where the DUC wells are and this is where the value is.

- Our closing process included in the PSA, which is: At closing, buyer will provide the mineral deed. The seller will execute the mineral deed and return it to Texas Royalty Brokers. Texas Royalty Brokers will provide buyer with a scanned copy of the deed, and buyer will then wire funds to seller and Texas Royalty Brokers respectively. Once funds are confirmed, Texas Royalty Brokers will overnight the deed to the Buyer.

- Buyer must close within 14 days or sign our qualified buyer agreement.

To view/download the listing files, please visit the link below:

We will begin accepting offers on Tuesday, January 20th.

All buyers are required to either do a 14 day close or sign our qualified buyer agreement once a deal has been verbally agreed upon. In certain situations, we may require a $25,000 earnest deposit at the sole discretion of Texas Royalty Brokers.

The mineral owner has exclusively listed with Texas Royalty Brokers. Please do not contact the mineral owner directly. To make a bid or ask questions about this listing, please contact Texas Royalty Brokers using the contact form below. Our team will quickly be in touch.

We have other mineral rights for sale.

Exclusitivity Notice

All listings posted at Texas Royalty Brokers are exclusive. The seller has agreed to exclusively sell through our company and will become personally liable if you close a deal directly with the seller. Please direct all offers and communication directly to Texas Royalty Brokers.

Accepting Offers on 1/20/2026