Why Texas Royalty Brokers?

sellers

Buyers

State Specific Guides

Resources

Oklahoma Mineral Rights: Value and Pricing Explained

If you own mineral rights in Oklahoma, there’s a good chance those rights are worth more than you think.

With strong oil and gas activity across much of the state and growing interest in critical minerals like lithium, Oklahoma continues to be one of the best places in the country to own mineral rights.

But whether you’re collecting royalty checks or just found out you inherited mineral rights, understanding what you own and what it’s worth can be a challenge. Between market changes, tax considerations, lease terms, and buyer interest, there’s a lot to keep track of. That’s where we come in.

At Texas Royalty Brokers, we specialize in helping mineral owners in Oklahoma get the most money possible when selling their mineral rights. We’ve worked with hundreds of owners just like you and know what it takes to maximize value with minimal effort on your end.

We can help you learn everything you need to know about mineral rights ownership in Oklahoma.

In this guide, we’ll break down everything you need to know about owning, leasing, and selling mineral rights in Oklahoma. We’ll cover the following topics in this article:

- Leasing Mineral Rights in Oklahoma

- Estimating the Value of Mineral Rights in Oklahoma

- How to Sell Mineral Rights in Oklahoma

- How to Buy Mineral Rights in Oklahoma

- Best Counties to Own Mineral Rights in Oklahoma

- Tax Implications of Selling Mineral Rights in Oklahoma

- Why Texas Royalty Brokers

Still have questions about mineral rights ownership in Oklahoma? Contact us for a free consultation.

Leasing Mineral Rights in Oklahoma

Leasing your mineral rights in Oklahoma can be a great way to generate income without giving up ownership.

To make the most of your lease, it’s important to understand how the terms work and how they affect your long-term value.

One of the biggest things to look at is the lease royalty rate. This is the percentage of oil and gas production revenue that gets paid to you, the mineral owner. In Oklahoma, lease rates typically range from 12.5% up to 25%, depending on the area and how competitive the market is. A common lease royalty rate is 18.75%, which means you’d receive 18.75% of the revenue from production on your mineral rights, before any deductions are applied.

Keep in mind that there’s often a tradeoff between your lease bonus and your royalty rate.

A higher royalty rate usually means a lower up-front bonus payment. But if a well is drilled and produces for years, that higher royalty rate can easily lead to more money in your pocket over time.

You might give up cash today with a lower lease bonus payment, but in the long term you will make substantially more money if drilling occurs and you have a higher royalty rate.

When negotiating a lease, there are also a couple of critical clauses you’ll want to push for:

-

Pugh Clause: This helps protect you if only part of your acreage is drilled. Without it, the operator might be able to hold your entire acreage without fully developing it. Make sure you understand the Pugh clause before you sign the lease agreement.

-

No Deductions Clause: This ensures that you receive your full royalty without the operator subtracting expenses like transportation or processing costs. Not all companies are willing to offer this, but it’s worth trying to negotiate.

Another important factor is how many net mineral acres you own. This number determines how much you’re paid for both the lease bonus and the royalties. A higher royalty rate also increases your net royalty acres, which can directly impact the value of your mineral rights if you ever decide to sell.

Leasing mineral rights is often the first step in generating income from mineral rights, but a well-structured lease can also boost the long-term value of your minerals.

If you’re not sure what a fair lease looks like in Oklahoma, or how to position your mineral rights for future sale, we’re here to help. Contact Texas Royalty Brokers for a free consultation.

Estimating the Value of Mineral Rights in Oklahoma

Trying to figure out what your oil and gas royalties are worth in Oklahoma can feel overwhelming at first, but the good news is that there are a few simple ways to get a ballpark estimate.

While there are several factors that impact value, the most common approach starts with your recent royalty income.

If your mineral rights are producing, you can estimate the value by looking at your last three royalty checks. Take the average monthly income, and then multiply it over a period of time, usually between three to six years. This gives you a rough range of what a buyer might be willing to pay based on your current income.

Example:

Let’s say you’re receiving $1,000 per month in royalties.

-

A 3-year payout estimate would be $36,000

-

A 6-year payout estimate would be $72,000

This range provides a helpful starting point, but it’s not the whole story. Market demand, operator activity, commodity prices, and location all play a role in what buyers are really willing to pay. Also, keep in mind that if you’re not currently receiving royalties, the value will be based more on future drilling potential.

To estimate the value of mineral rights in Oklahoma, use our mineral rights value calculator below. Simply find the average of your 3 most recent royalty statements and then enter it in the first field of our mineral rights value calculator below:

Important: If you’ve received an offer to sell your mineral rights, don’t assume it’s fair just because it falls within this general range. Many buyers make low offers hoping you’ll accept without shopping around. Get competitive bids at Texas Royalty Brokers.

Getting the most accurate and favorable estimate depends on obtaining competitive bids.

The more offers you receive, the better you can gauge the true market value of your mineral rights. This is where Texas Royalty Brokers can make a significant difference. Our expertise ensures you get multiple competitive bids, helping you secure the best deal possible. Trust us to guide you through the process and maximize the value of your mineral rights in Oklahoma.

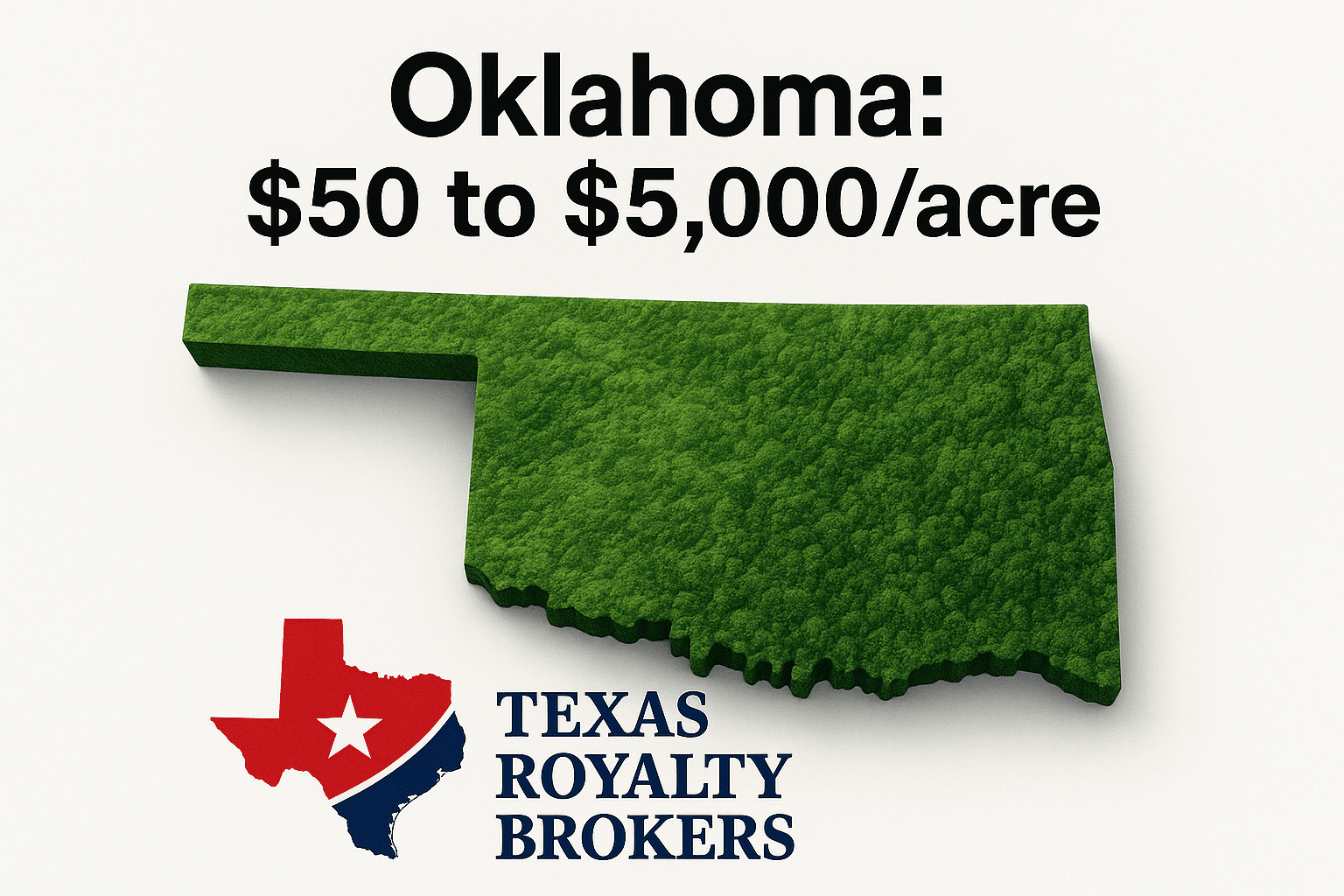

Average Price Per Acre for Mineral Rights in Oklahoma

Mineral rights in Oklahoma typically sell anywhere from $50 per acre to over $5,000 per acre, depending on the county, production history, lease terms, and whether the property is currently generating royalty income.

Here’s a general breakdown of what we’re seeing in today’s market:

-

Non-producing minerals in Oklahoma generally sell for: $50 to $500 per acre

-

Leased but non-producing minerals in active counties: $1,000 to $2,000 per acre (you can also use 2x to 3x your lease bonus as an estimate)

-

Producing minerals in proven areas: $500 to $5,000+ per acre

-

High-demand hotspots with strong production and multiple operators: Over $10,000 per acre is possible, especially with high royalty rates and no deductions clauses

Each mineral rights property is unique, and values can vary widely even within the same county. The key to getting top dollar is putting your rights in front of as many serious buyers as possible.

Why Getting Multiple Offers Matters

The biggest mistake we see mineral owners make is accepting the first offer they receive.

Even if the offer sounds decent, you’ll never know if it’s the best unless you get it in front of multiple qualified buyers. That’s where Texas Royalty Brokers comes in.

We specialize in getting competitive bids from trusted buyers who are actively purchasing in Oklahoma. We know how to highlight the strengths of your mineral rights and create a professional listing that drives interest and increases value. Instead of negotiating with one buyer on your own, you’ll have several buyers competing for your minerals which puts you in control of the outcome.

If you want a realistic, fair market valuation and access to serious mineral buyers, reach out to us for a free consultation. We’ll make sure you get the best deal possible with none of the hassle.

How to Sell Mineral Rights in Oklahoma

If you’re wondering how to sell mineral rights in Oklahoma, it’s important to understand that the process is not straightforward.

Selling mineral rights involves numerous complexities and potential pitfalls that can be overwhelming if you’re not familiar with the industry. This is why having a trusted mineral rights broker by your side is crucial.

Firstly, to sell mineral rights in Oklahoma, you need to prepare your mineral rights.

This involves gathering all relevant documentation, such as deeds, lease agreements, and recent royalty statements. A knowledgeable broker can help you compile and organize these documents, ensuring that nothing is overlooked.

Next, understanding the market value of your mineral rights is essential. Estimating this value involves analyzing your recent royalty checks and considering market trends.

However, the true value can only be determined by obtaining competitive bids. A good mineral rights broker will have the connections and expertise to attract multiple offers, ensuring you get the best price.

The negotiation process is another critical aspect of selling mineral rights. There are many pitfalls to avoid, such as accepting lowball offers or unfavorable terms. A reliable broker will guide you through these negotiations, leveraging their experience to secure the most favorable deal for you.

Finally, the closing process requires meticulous attention to detail. From reviewing contracts to ensuring all legal requirements are met, your broker will handle these intricacies, providing peace of mind and a smooth transaction.

Selling mineral rights in Oklahoma is far from easy, but with the right broker, you can navigate the process confidently and successfully.

Texas Royalty Brokers specialize in maximizing the value of your mineral rights while avoiding common pitfalls. Trust us to guide you through every step, ensuring you achieve the best possible outcome when selling mineral rights in Oklahoma.

How to Buy Mineral Rights in Oklahoma

Buying mineral rights in Oklahoma can be a lucrative investment, but it’s crucial to approach the process with the right knowledge and resources.

Understanding oil and gas decline curves is essential. These curves predict the future production of a well, helping you estimate the long-term value of the mineral rights. A thorough understanding of these curves ensures you make an informed decision, avoiding overvaluation or underestimation of the property’s potential.

Another critical step is having a landman run a title for you. A landman is a professional who specializes in researching property titles and verifying ownership. Their expertise ensures that you’re purchasing mineral rights from the legitimate owner and that there are no hidden legal issues or encumbrances that could affect your investment.

By combining a deep understanding of decline curves with the detailed title work performed by a landman, you can confidently navigate the complexities of buying mineral rights in Oklahoma. Ensure you have the right team in place to maximize the potential of your investment. If you want to look at available mineral rights for sale at Texas Royalty Brokers, our listing page has our available deals.

Here are some additional resources related to buying mineral rights in Oklahoma:

If you have questions, please don’t hesitate to reach out.

Tax Implications of Selling Mineral Rights in Oklahoma

When it comes to selling mineral rights in Oklahoma, understanding the tax implications is crucial for making informed financial decisions. The way you are taxed can significantly affect your overall earnings, whether you choose to collect royalty income or sell your mineral rights outright.

Royalty Income vs. Selling Mineral Rights in Oklahoma

If you choose to collect royalty income from your mineral rights, this income is taxed as ordinary income. This means it is subject to the same tax rates as your regular income, which can be as high as 37% depending on your tax bracket. This can lead to a significant portion of your royalty earnings going towards taxes.

On the other hand, if you decide to sell your mineral rights, the income from the sale is typically treated as a capital gain. Capital gains tax rates are generally lower than ordinary income tax rates. For most individuals, long-term capital gains tax rates are 0%, 15%, or 20%, depending on your overall taxable income. This favorable tax treatment can result in considerable tax savings compared to being taxed at ordinary income rates.

Inherited Mineral Rights and Step-Up Basis

Another important consideration is the tax treatment of inherited mineral rights in Oklahoma. When you inherit mineral rights, you receive a step-up in basis. This means the value of the mineral rights is “stepped up” to their fair market value at the time of the original owner’s death. As a result, if you decide to sell the inherited mineral rights, your taxable gain is calculated based on the stepped-up basis rather than the original purchase price. Our mineral rights tax article provides an example of how to calculate step-up basis for inherited mineral rights.

This step-up basis can substantially reduce your tax liability. In many cases, it can bring your effective tax rate on the sale of inherited mineral rights to less than 10%. This is a significant advantage, as it allows you to retain more of the proceeds from the sale.

Understanding the tax implications of selling mineral rights in Oklahoma can help you make the best financial decision. While collecting royalty income can lead to higher taxes due to ordinary income tax rates, selling your mineral rights can offer the benefit of lower capital gains tax rates. Additionally, inheriting mineral rights provides the advantage of a step-up basis, further reducing your tax burden.

If you’re considering selling your mineral rights, it’s essential to consult with a tax professional to fully understand your specific situation and make the most informed decision. Texas Royalty Brokers can also guide you through the process, ensuring you maximize your value while navigating the complexities of tax implications.

Why Texas Royalty Brokers

In addition to maximizing profits, there are several other benefits to working with a royalty broker like Texas Royalty Brokers when selling your oil and gas royalties.

For one, a royalty broker has the expertise and knowledge to navigate the complex world of oil and gas royalty sales, which can be especially useful for mineral owners who are unfamiliar with the process.

A royalty broker can also help you understand the value of your royalties and provide you with a realistic estimate of what you can expect to receive from the sale. This can be especially important in the oil and gas industry, where prices and demand can fluctuate rapidly.

A royalty broker can provide you with up-to-date market information and help you make informed decisions about when to sell your royalties.

In addition to these benefits, working with a royalty broker can also save you time and hassle. The process of selling oil and gas royalties can be complex and time-consuming, especially if you’re trying to do it on your own. By working with a royalty broker, you can take advantage of their expertise and experience, allowing you to focus on other important matters.

If you’re a mineral owner in looking to sell your oil and gas royalties, working with Texas Royalty Brokers is a smart choice.

By getting competitive bids from thousands of mineral buyers, Texas Royalty Brokers can help you sell your royalties for the absolute highest price possible. In addition to maximizing profits, Texas Royalty Brokers can also provide you with expert guidance and support throughout the selling process, making it a seamless and stress-free experience.