Why Texas Royalty Brokers?

sellers

Buyers

State Specific Guides

Resources

Net Mineral Acre vs Net Royalty Acre

If you’ve ever seen terms like “net mineral acre” or “net royalty acre” on an offer to buy your mineral rights, you’re not alone in feeling confused.

These phrases get used all the time in the oil and gas world, but most mineral owners aren’t sure what they really mean or how they affect the value of what they own.

In this article, we’ll walk you through the difference between a net mineral acre and a net royalty acre. We’ll explain each one in simple terms and show you why understanding both is important if you want to get the best possible value when selling your mineral rights.

Why do Net Royalty Acres exist?

Before diving into the difference between a net mineral acre and a net royalty acre, it helps to understand why net royalty acres exist in the first place.

A net royalty acre is a term created by the oil and gas industry to make it easier for mineral buyers to compare mineral rights across different deals. Since royalty rates can vary from one lease to another, net royalty acres give buyers a standardized way to measure value.

Here’s why that matters.

When you lease your mineral rights, the lease includes a royalty rate, usually somewhere between 12.5% and 25%. This royalty rate determines how much of the oil and gas production you actually get paid for.

For example:

-

If your lease is at 12.5%, you earn 12.5% of the revenue from every barrel of oil produced.

-

If your lease is at 25%, you earn 25% of the revenue from each barrel.

So even if two mineral owners have the same number of net mineral acres, the one with a 25% royalty rate is earning about twice as much as the one with a 12.5% rate. That makes their ownership much more valuable.

Net royalty acres help simplify this difference.

They allow buyers to account for the royalty rate so they can more accurately compare the income potential of different mineral rights. In short, it tells the buyer how much of the production they’re actually buying.

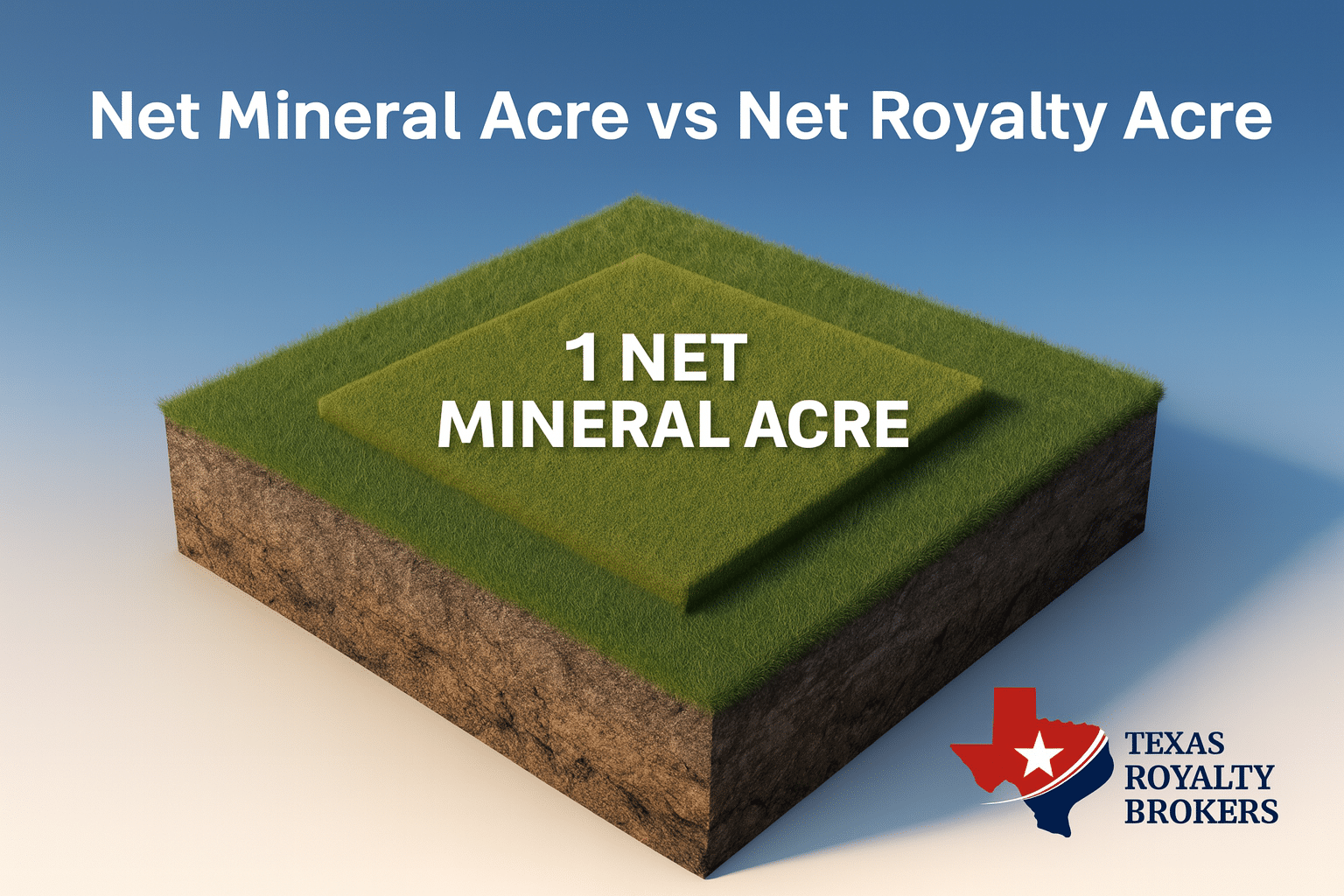

What is a Net Mineral Acre?

A net mineral acre refers to the actual amount of underground mineral ownership you have, based on the surface acres it’s tied to. Even if you don’t own the surface of the land, your mineral rights are still measured and located using surface boundaries.

For example, let’s say there is a 100 acre farm. If you own a 20 percent mineral interest under that land, you own 20 net mineral acres. It doesn’t matter who owns the surface. Your mineral rights are connected to the land itself, and that’s how the acreage is calculated.

It’s important to understand that net mineral acres do not change over time unless you sell or inherit more. They are fixed based on your ownership percentage under a specific tract of land. The surface owner might change, but your mineral ownership stays the same unless you take action to transfer or divide it.

Net mineral acres are the starting point for everything else. They are used to calculate your share of lease bonus payments, royalty income, and even your value when selling mineral rights.

What is a Net Royalty Acre?

Now that you understand what a net mineral acre is, and how it doesn’t change, let’s look at how net royalty acres work. These are directly tied to the lease royalty rate you agree to when leasing your mineral rights.

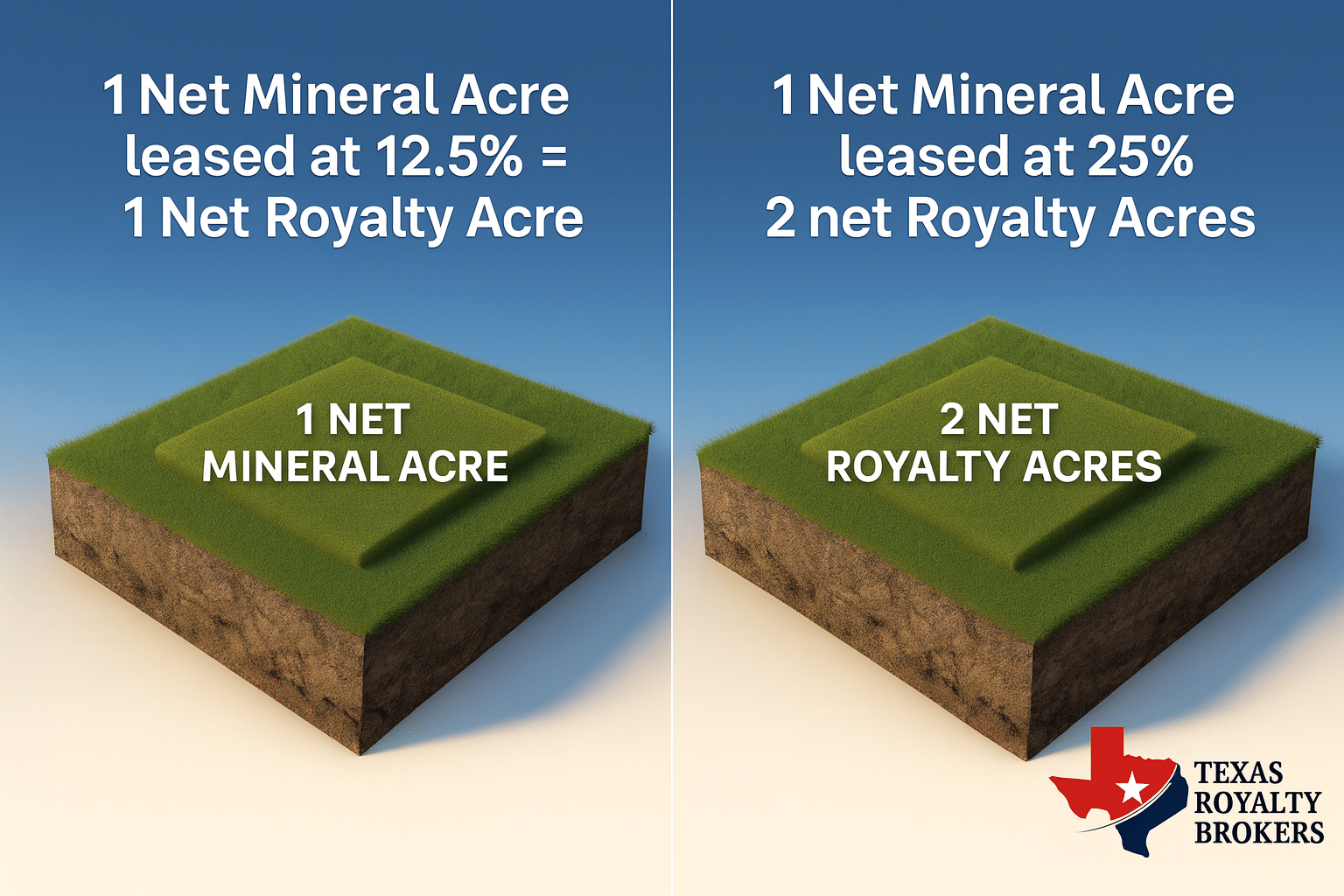

Definition:

A net royalty acre is equal to 1 net mineral acre leased at a 12.5% royalty rate. This is the industry standard used to compare deals.

Let’s go back to the example of the farm. You own 20 net mineral acres under the surface. If you lease those minerals at a 12.5% royalty rate, you have 20 net royalty acres, because the lease rate matches the definition of 1 net mineral acre leased at 12.5%.

Now let’s say you lease at 25% instead of 12.5%. Your net mineral acres stay the same at 20. But because your lease rate is twice the standard (25% is 2 times 12.5%), your net royalty acres double to 40. This happens because you’re entitled to a larger share of production, and the net royalty acre calculation adjusts to reflect that added value.

In simple terms, the higher your lease royalty rate, the more net royalty acres you have and the more valuable your mineral rights become.

Net Mineral Acre vs. Net Royalty Acre: Real-Life Examples

Let’s look at three different scenarios to show how net royalty acres impact the value of your mineral rights:

Deal #1: 20 Net Mineral Acres leased at 12.5%

-

Net Royalty Acres: 20

-

Buyer offers $5,000 per NRA

-

Total offer: $100,000

Deal #2: 20 Net Mineral Acres leased at 25%

-

Net Royalty Acres: 40

-

Buyer offers $5,000 per NRA

-

Total offer: $200,000

-

This mineral owner negotiated a 25% royalty rate, which is double 12.5%, so they receive twice the share of production. That makes their minerals twice as valuable in the buyer’s eyes.

Deal #3: 15 Net Mineral Acres leased at 20%

-

Net Royalty Acres: 24 (20% is 1.6 times higher than 12.5%)

-

Buyer offers $5,000 per NRA

-

Total offer: $120,000

-

Even though this owner has fewer net mineral acres than the first two, they secured a stronger lease rate. As a result, their minerals are more valuable than those in Deal #1.

These examples highlight how mineral buyers use net royalty acres to determine their share of the production. The lease royalty rate you negotiated determine how many net royalty acres you have.

What this means is that your lease royalty rate has a very direct impact on the value of your mineral rights.

Mineral rights ownership can be complicated and it’s important to understand how negotiating a strong lease agreement can have a large impact on value.

How to Calculate Net Royalty Acres Step-by-Step

If you’re receiving royalty checks, you already have the most important piece of information needed to calculate your net royalty acres. That number is called your net decimal interest, or NDI.

You can find it on your royalty statement, usually listed next to the name of the well. It’s a small decimal like 0.008750 or 0.012500, and it tells you how much of the production from that well belongs to you.

To calculate your net royalty acres (NRA), you need three things:

-

Your NDI from the royalty statement

-

The unit size, which is the number of acres the well is spaced across

-

Your lease royalty rate, which may or may not be known

How to find each of these things:

NDI – You can find this from your royalty statement. If you don’t have a royalty statement, contact your operator or sign up for Energylink to download your statements.

Unit Size – This number is typically found on the division orders you signed. It can also be located on the permit found on the RRC website. Contact Texas Royalty Brokers and we can assist.

Lease Royalty Rate – If you don’t know your lease royalty rate, no problem. You can estimate your net royalty acres using an assumed 12.5 percent royalty rate, which is the industry standard base rate.

For this example, we’ll use a standard 640-acre unit.

Example: Estimating Net Royalty Acres

Let’s say your royalty statement shows:

-

NDI = 0.008750

-

Unit size = 640 acres

-

Assumed lease royalty rate = 12.5% (or 0.125)

Here’s the calculation:

-

Multiply your NDI by the unit size:

0.008750 × 640 = 5.6 -

Divide by the lease royalty rate (in decimal form):

5.6 ÷ 0.125 = 44.8 net royalty acres

Based on this example, you would own approximately 44.8 net royalty acres.

Why Net Royalty Acres Matter

Even a small NDI can translate into a large number of net royalty acres. And buyers base their offers on your NRA, not just your mineral acreage. If this number is missing or calculated incorrectly, your offer will likely be lower than it should be.

At Texas Royalty Brokers, we take the guesswork out of this process. Whether you only have a royalty statement or partial information, we’ll help you calculate your net royalty acres and present your minerals in a way that gets you the best possible price.

Important: Only title can fully determine the amount of net mineral acres or net royalty acres you own!

Why Net Royalty Acres Are the Key to Value When Selling

When it comes time to sell your mineral rights, buyers are focused on one thing above all else:

How much royalty income will these minerals produce? That is exactly why net royalty acres (NRA) matter so much.

Net mineral acres (NMA) tell us how much land your mineral rights cover, but they do not tell the full story. Two owners might each have 20 net mineral acres, but if one has a lease at 12.5 percent and the other at 25 percent, the second owner is earning twice as much royalty income. That difference shows up in the number of net royalty acres.

Buyers use NRA to compare different mineral deals in a consistent way. It gives them a true picture of what they are actually buying.

Here is why understanding your NRA is critical when selling:

-

Buyers make offers based on net royalty acres

Most offers are priced per NRA. If you do not know how many NRAs you have, it is impossible to know if an offer is fair. -

A higher royalty rate means more net royalty acres

If your lease royalty rate is higher than 12.5 percent, your NRA count increases. This raises the total value of your mineral rights. -

Net royalty acres reflect true income potential

NMA is about land ownership. NRA is about income. If you want to get top dollar, the buyer needs to know how much of the production you are entitled to. -

You can lose money by ignoring NRA

If you focus only on NMA and ignore how your lease terms affect value, you could easily accept a lower offer than you should.

At Texas Royalty Brokers, we make sure your net royalty acres are calculated correctly and presented clearly to buyers. That is how we help mineral owners get better offers, with less work.

If you want the best possible value, understanding your NRA is the first step. Curious about your net royalty acres? Contact Texas Royalty Brokers for a free consultation.

Free Consultation

Texas Royalty Brokers offers free consultations for anyone interested in selling their oil and gas mineral rights. These consultations provide an opportunity for sellers to learn more about the process of selling mineral rights, as well as get a sense of the value of their rights. During the consultation, a representative from Texas Royalty Brokers will discuss the specifics of your property and the minerals in question, and help you understand the current market conditions and what to expect in terms of offers for your rights.

When requesting a free consultation, you can expect a prompt response from Texas Royalty Brokers.

Providing your 3 most recent royalty statements up front can also be helpful in providing you with better information and analysis. These statements will allow Texas Royalty Brokers to analyze your production history, revenue, and other important information that will help them give you a more accurate assessment of the value of your mineral rights. They will be able to use this information to provide you with a better understanding of the offers you can expect to receive.

It is important to keep in mind that the consultation and analysis provided by Texas Royalty Brokers is free of charge and there is no obligation and no pressure to sell your mineral rights after the consultation. This gives you an opportunity to get a professional opinion and make a more informed decision about your next steps.