Why Texas Royalty Brokers?

sellers

Buyers

State Specific Guides

Resources

Never Sell Mineral Rights

Never sell mineral rights? This common advice is WRONG!

When you hear someone say “never sell mineral rights”, you should take it with a grain of salt. Every person has a unique situation. Deciding whether to sell mineral rights is a personal decision.

Life happens. Maybe you’ve got big expenses coming up. Maybe you’d rather put that money to work somewhere else. Or maybe you’re just tired of the uncertainty and want something more predictable.

The phrase never sell mineral rights originated when families wanted to pass mineral rights down through the generations. The idea of never selling mineral rights came from the fact that eventually those mineral rights would be worth a lot of money. However, that is not always accurate.

If you are thinking about selling your mineral rights, make sure you consider the information in this article before you make a decision.

At Texas Royalty Brokers, we can’t tell you which direction to go. That’s a personal decision.

We’re here to give you the facts, help you understand your options, and make sure you come out ahead—whatever you decide. Let’s walk through it together so you can make the right call for your situation.

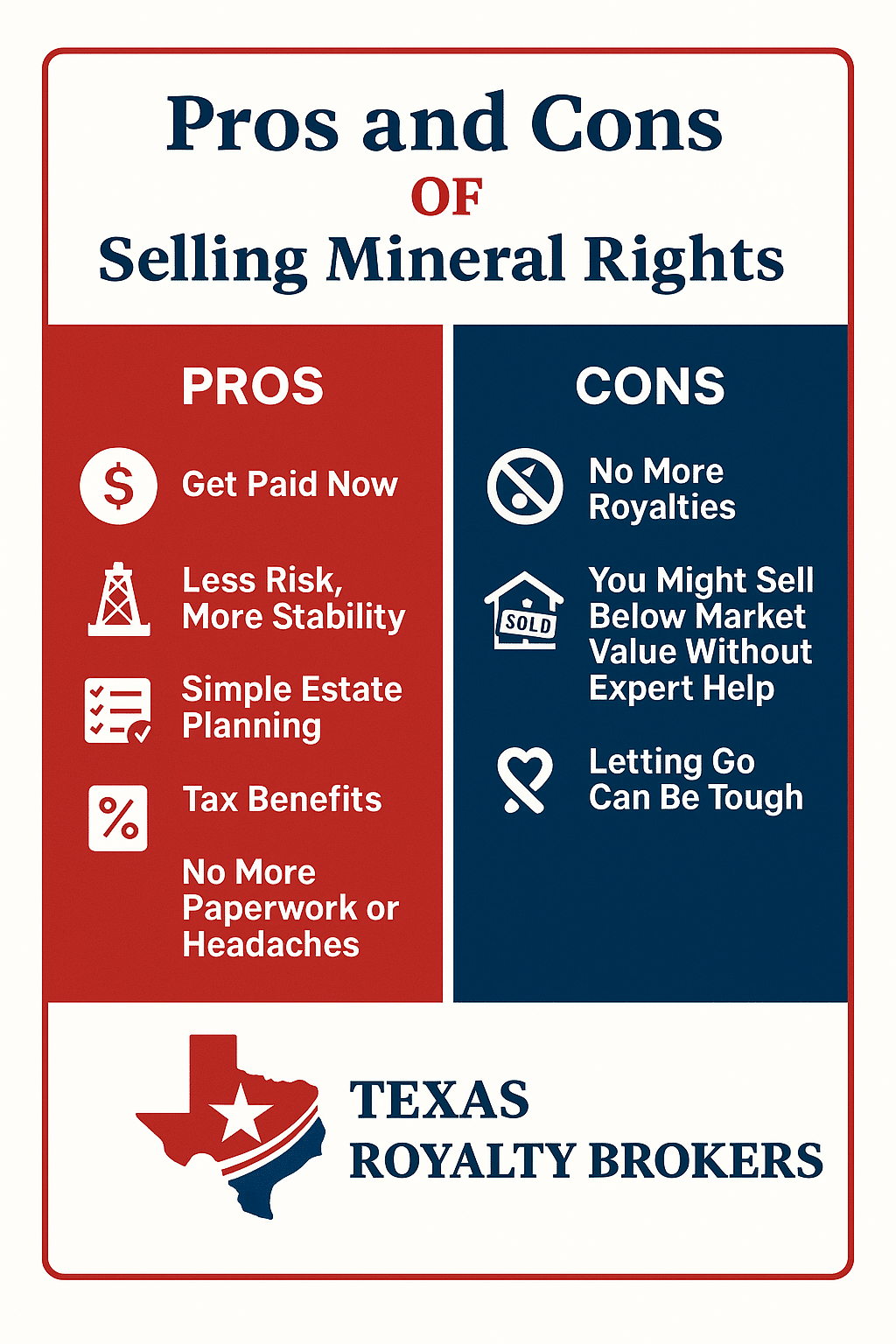

The Pros and Cons of Selling Mineral Rights

Before we dive into reasons people choose to sell (or hold), it’s helpful to take a look at the general pros and cons.

Selling mineral rights isn’t always a bad idea. However, keeping them isn’t always the best choice either.

Pros of Selling Mineral Rights

1. Get Paid Now

Selling mineral rights means you can cash in today. That money could go toward paying off debt, buying a home, investing elsewhere, or even just giving yourself a little breathing room.

2. Less Risk, More Stability

Oil and gas prices go up and down like a roller coaster. When you sell, you’re taking the guesswork out of it and locking in a guaranteed amount no matter what the market does later.

3. Simple Estate Planning

Passing mineral rights down to family can get messy, especially if you’ve got several heirs. A lump-sum payout is a lot easier to divide and manage than royalties stretched out over decades.

4. Tax Benefits

There are significant tax benefits from selling mineral rights. Depending on your situation, the money you make from selling could be taxed at a lower rate than regular royalty income. Always talk to a tax pro, but it’s something worth looking into. You will also save money compared to paying property taxes every year.

5. No More Paperwork or Headaches

Owning mineral rights means keeping up with lease agreements, production updates, and royalty statements. If that sounds like a chore, selling can take it all off your plate.

Cons of Selling Mineral Rights

1. No More Royalties

Once you sell, you’re giving up any future income from your mineral rights. If production increases or oil prices spike, that upside goes to the mineral buyer, not you. However, oil prices can also go down as well.

2. You Might Sell Under Market Value Without Expert Help

Mineral rights aren’t like selling a car, you can’t just Google the value. Without expert guidance, you risk leaving money on the table. Get a free consultation at Texas Royalty Brokers to ensure you maximize the value.

3. Letting Go Can Be Tough

For some families, mineral rights have been passed down for generations. There can be a lot of pride and tradition tied up in them, and selling can feel like closing a chapter.

At the end of the day, there’s no right or wrong answer. All that matters is what’s right for you.

And if you decide that selling makes sense, the most important thing you can do is sell the right way, with a broker who knows how to get you the best deal.

That’s exactly what we do here at Texas Royalty Brokers. We take the stress and guesswork out of the process so you walk away with more money in your pocket and zero regrets.

Want to know what your mineral rights are worth? Let’s talk. Get a free consultation.

#1 Reason to Sell Mineral Rights – Tax Savings

The #1 reason why you should sell mineral rights is due to tax savings. The common advice to never sell mineral rights is wrong when you look at how much you can save in taxes.

When it comes to selling mineral rights and taxes, it is important to understand how mineral rights are taxed.

Royalty Income: When you collect royalty income, this is taxed as ordinary income. This means you are taxed at the same rate as income earned from a job. Everyone has a unique tax situation, but it is likely you would pay at least 24% in taxes on any royalty income.

Sell Mineral Rights: If you sell the mineral rights, you will pay capital gains tax rates. This means you will likely pay a 15% capital gains tax rate.

Even in the worst case scenario, you will save 10%+ by selling mineral rights as compared to collecting royalty income over time.

Did you inherit the mineral rights? If so, you will likely save substantially more by selling. You only pay capital gains tax on a portion of the sale, meaning you will save a fortune in taxes.

Continue reading below for some examples of tax savings, or check out our mineral rights taxes article.

#2 Reason to Sell Mineral Rights – Diversification

Diversification is the #1 reason why the advice to never sell is very bad advice for the vast majority of mineral owners.

When you own mineral rights, your investment is not diversified. You own the oil and gas underground. When the value of that oil and gas goes up or down, so does your investment.

Wouldn’t you rather own an investment that is not tied to oil and gas prices and instead be diversified among many industries? The opportunity cost of holding mineral rights vs investing in the stock market is simply not worth it for 99% of mineral owners.

When you also consider the fact that you will save money in taxes and be diversified, selling mineral rights makes a lot of sense.

To put it simply, the advice to never sell mineral rights is wrong. Dead wrong!

If you can answer YES to the following question, you might consider holding onto your mineral rights:

Do your mineral rights make up less than 5% of your net worth?

If so, you have a large portfolio of assets for retirement. Holding the mineral rights can make sense if they represent less than 5% of your retirement plan because they give you diversification outside of the stock market, real estate, and other retirement funds.

For most mineral owners, it make sense to sell and save substantial money on taxes and get diversification.

There are very few mineral owners who did not inherit the mineral rights (they purchased them with property) AND they also have significant assets / retirement accounts, that means the mineral rights make up a very small 1% to 3% of their net worth.

In this situation, it make sense to keep the mineral rights as they are a good source of diversification for your retirement planning.

Common Reasons to Sell Mineral Rights

Below are some of the most common reasons to sell mineral rights in Texas.

Remember that each situation is unique. Deciding whether you should sell is personal. Never let anyone put pressure on you to sell mineral rights or to hold mineral rights. Take a look at your situation and make the right decision for you.

Common reasons for selling mineral rights in Texas:

Taxes: The number one reason to sell mineral rights in Texas is to save money on taxes. Check our mineral rights taxes article for more information.

Diversification: If you have more than 5% of your net worth / retirement savings in mineral rights, you should diversify. It simply doesn’t make sense to hold mineral rights that wildly fluctuate in value. Sell the mineral rights and put them in a diversified ETF in the stock market.

Simplify your Estate: A very common reason to sell mineral rights in Texas is to simplify your estate. Mineral rights are complicated. They create a tax burden on your heirs and dividing mineral rights decreases the value. Over time, as generations pass, mineral rights get further and further divided. Eventually they become so small the value goes down. We frequently help multiple family members who sell as a package to get a better price.

Qualify for Medicaid: You can only have $2,000 in assets to qualify for medicaid. It’s very common for mineral rights to be worth more than that and disqualify someone from Medicaid. Selling mineral rights to qualify for medicaid is very common.

Medical Expenses: If you are in a situation where you need funds to pay for medical expenses, it makes sense to sell mineral rights and use those funds today.

Pay off Debt: If you are paying 20%+ interest rates on credit card debt, there is no reason you should continue holding your mineral rights. When you consider the tax savings of selling along with paying down high interest debt, there is no question you should sell the mineral rights and pay down the debt.

Pay for School: School is an investment, and unfortunately it’s expensive. Take a moment to look at how much money you will make after going to school vs how much money you royalties will generate. Paying for school, or paying down school debt, is an excellent reason to sell mineral rights.

Starting a Business: When you start a business, it takes capital. Selling mineral rights to fund a business start up can make a lot more sense than taking on high interest debt.

Helping a Family Member: There are always situations that come up where a family member needs help. If selling mineral rights will give you the ability to help a family member in need, it can make sense to sell.

Divest from Oil and Gas: Maybe you were trying to figure out how to buy mineral rights and you made some bad investments. There is nothing wrong with selling to simplify your portfolio.

There are many other reasons to sell mineral rights in Texas. We recommend taking some time to figure out what your mineral rights are worth and then deciding whether selling makes sense for your situation.

Questions about mineral rights?

Still not sure if selling is the right move? No worries—this isn’t a decision you have to rush.

If you’re weighing your options, here are a few other articles you might want to check out:

-

How Much Are My Mineral Rights Worth? – Learn what really drives value and how to make sure you’re getting a fair deal.

-

How to Sell Oil and Gas Royalties – If you do want to sell, it’s important to understand how to sell oil and gas royalties.

-

Common Mistakes People Make When Selling Mineral Rights – Avoid the pitfalls and protect your payout.

Whether you’re thinking about selling now or just want to be informed for the future, we’ve got you covered. Dive in and get the info you need to make a smart move.

Our team is standing by to help answer your questions. When you get a free consultation with our company there is no obligation and no pressure. We’ll simply help answer your questions and guide you in the right direction.

To get a free consultation, simply fill out the form below and we’ll be in touch shortly.