Why Texas Royalty Brokers?

sellers

Buyers

State Specific Guides

Resources

Finding Trustworthy Mineral Rights Buyers

Thinking about selling your mineral rights? Don’t let the wrong mineral rights buyer cost you thousands.

Finding a mineral buyer is easy.

Finding a trustworthy mineral rights buyer is the hard part.

If you’re searching for mineral rights buyers, you’re in the right place.

Before you sell mineral rights, you need to understand the type of mineral buyers you’ll encounter and how to avoid the shady ones.

Every year, mineral owners unknowingly accept lowball offers, leaving serious money on the table. Why? Because many mineral buyers count on you not knowing what your rights are really worth.

There are thousands of mineral rights buyers across the United States, but only a few are actually willing to pay top dollar.

In this post, we’ll show you exactly how to spot the legitimate buyers, avoid the shady ones, and make sure you get every penny your mineral rights are worth.

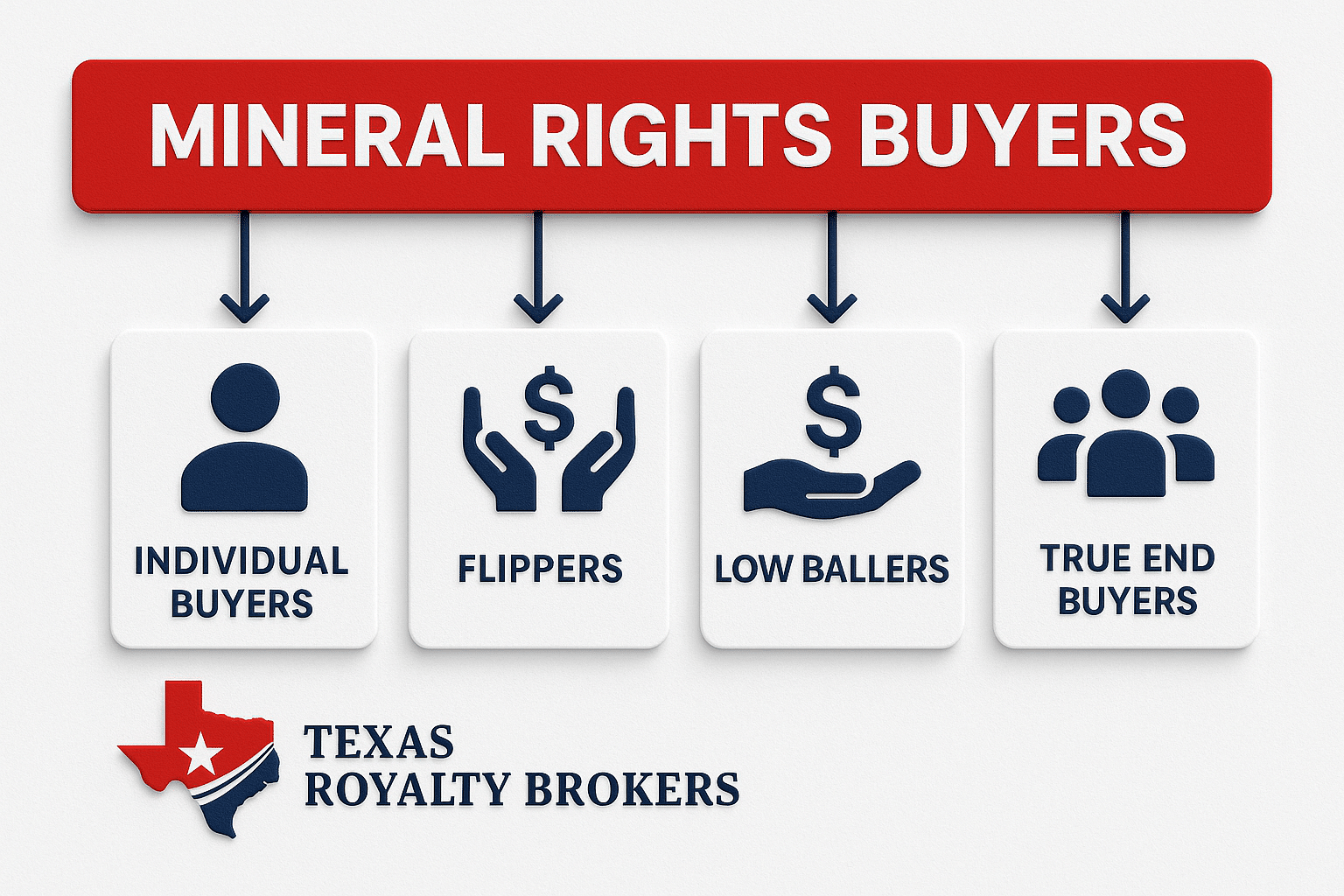

Types of Mineral Rights Buyers

Most mineral owners who are searching for mineral rights buyers are trying to get offers for their minerals.

Before you waste a lot of time searching for buyers, it helps to understand the different types of oil and gas mineral buyers.

Here are the different types of buyers you will encounter:

Individual Buyers: Some mineral rights buyers are high net worth individuals. These mineral buyers are interested in purchasing mineral rights to diversify their investments. Most individual mineral buyers are purchasing deals below $100,000.

Flippers: One huge problem in the mineral rights space is mineral rights flippers. Mineral rights flippers are not buyers and do not have any cash. A mineral flipper will attempt to put you under contract at basically any price. Once they put you under contract, they mark up the price by 25% to 100% and attempt to sell your mineral rights to a real buyer. If they are successful, the flipper just took cash that should have been paid to you. The tricky part with mineral flippers is that they will not tell you they are flipping. They will pretend to be a legitimate buyer.

Low Ballers: While technically a legitimate mineral rights buyer, low ballers are extremely common. These buyers will send you offers in the mail that are far below market value. These types of buyers will typically apply a lot of pressure to accept an offer and they will also try and make it easy to sell by sending you the deed up front. If you are getting a lot of pressure to accept the offer, it’s probably a low baller.

True End Buyers: A true end buyer will be a private company specializing in mineral rights acquisitions or a private equity backed company specializing in mineral rights acquisitions. These mineral rights buyers are purchasing to hold long term.

How do you know which type of mineral buyer you are talking to? Figuring that out is difficult to impossible if you are not extremely familiar with mineral rights transactions.

Why are there so many shady mineral rights buyers?

When selling mineral rights you need to be extremely cautious. In our estimation, about 90% of “mineral buyers” are flippers and low ballers. Just 10% of the market are actually legitimate buyers.

There are two primary reasons:

1. Lack of Price Transparency: One of the biggest problems when trying to figure out mineral rights value is the fact that sales data is not public information. The mineral rights market is unique. There is no public sales data available to tell you what other mineral rights are selling for. In addition, each property is unique so there is no reliable way to know the value of mineral rights. What this means is that flippers and low ballers know mineral owners don’t know the value of what they are selling.

2. Lack of Competition: Most mineral buyers do not actually have to compete. Mineral owners assume they can find a fair price on their own. They receive a few offers in the mail, reach out to a few mineral buyers online, then take the highest offer they found. These mineral owners don’t realize that talking to a handful of mineral rights buyers is not going to yield the best price. You want thousands of mineral buyers competing to pay you the best price.

When oil and gas royalty buyers know that the value is unclear and they don’t have any competition, this creates the perfect situation to take advantage of mineral owners.

Mineral buyers prey on mineral owners who can “do it themselves” and don’t think they need help selling mineral rights. These mineral owners sell far below market value and allow these shady mineral buyers to make a fortune.

Mineral Buyer Red Flags

We do not recommend selling mineral rights on your own. You will end up spending tons of time trying to figure everything out while making less money. If you’re set on selling mineral rights yourself, realize that you will be selling below market value.

When selling mineral rights on your own, here are some red flags you should look out for:

Pressure: A low baller or flipper will put a lot of pressure on you. They will call or email constantly asking you to make a decision.

Short Deadline: Buyers will create an arbitrary deadline to accept their offer. Typically, within just a few days to a week. You have owned these mineral rights for years. Do not make a rushed decision to sell on the basis of a made up deadline. This is just a mineral buyer tactic to force you into a quick decision.

Easy Negotiation: Did you ask for a substantial amount more and the mineral rights buyer simply agreed? This is actually a bad sign. It means their initial offer was so low they can increase it dramatically and still be getting an excellent deal. Flippers will accept any price you’re willing to take just to have a chance. If you easily negotiated a higher price, you are not working with a legitimate end buyer.

Long Due Diligence: Does the buyer need more than 30 days to close? This is likely a flipper. There should not be any reason to have due diligence longer than 30 days.

Mineral Deed: Does the oil and gas royalty buyer want you to sign a mineral deed before due diligence is complete and send it back with the PSA? If you do this, they are now holding your mineral rights hostage because they have a valid deed in hand.

Escrow: Does the mineral rights buyer have an escrow process in place? If not, you will be sending your mineral deed (which transfers the ownership) to the mineral buyer without getting paid. This is a risky position to be in.

This is just a small sample of the red flags you should be looking for. Mineral buyers are experts. They know how to take advantage of mineral owners.

When selling mineral rights it is extremely important to have an advocate on your side. A mineral rights broker who can weed out the shady buyers and get legitimate offers from true end buyers is going to help you sell for maximum value.

The Best Way to Find Legitimate Mineral Rights Buyers

The best way to find legitimate mineral rights buyers is by working with Texas Royalty Brokers. Why?

At Texas Royalty Brokers, we connect you to thousands of qualified mineral rights buyers. Our goal is to create competition for your mineral rights. After listing your mineral rights with us, they will quickly be seen by thousands of legitimate end buyers on our website. These buyers will compete to pay you the highest price.

We’ll help you avoid the shady buyers, help you through the contracts, and provide an escrow service to protect you.

The best part? You can bring us any offer in writing and we’ll help you get a better price or we don’t get paid a dime.

Typically, we get mineral owners 10% to 30% higher offers.

At Texas Royalty Brokers our team will be there to guide you through each step. We’ll ensure you get the best price and make the process simple. Contact us for a free consultation.

How to find Mineral Rights Buyers

The best way to sell mineral rights is by using a mineral rights broker. Doing so will ensure you sell for the best price and avoid shady mineral rights buyers.

However, we want to provide mineral owners with all the information so you can make the right decision for you.

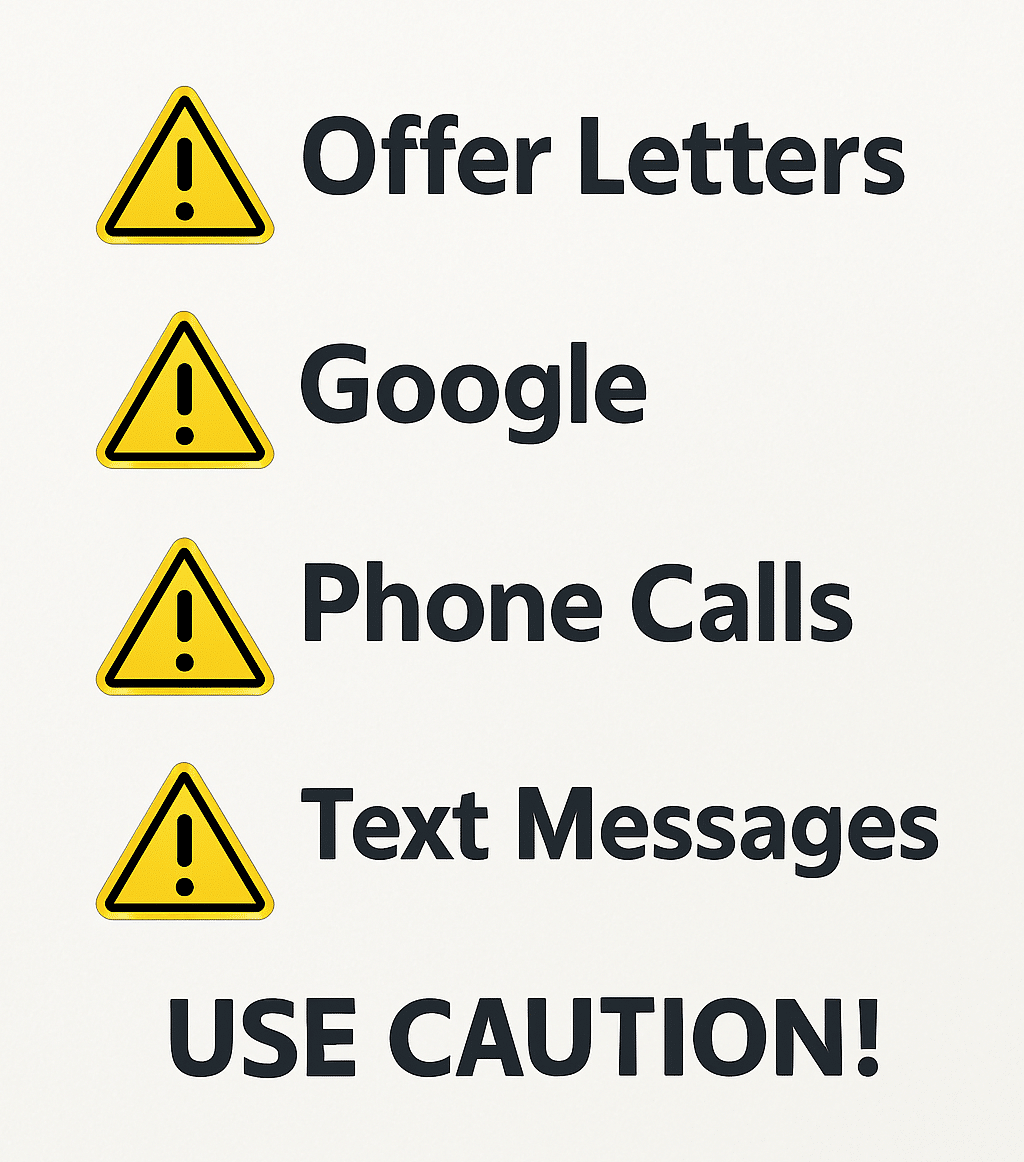

Here are some other ways to find mineral rights buyers:

1. Offer Letters: A lot of low ballers, flippers, and legitimate mineral buyers will send letters in the mail. Most of these letters will come from low ballers and flippers. These offers letters are a good ballpark idea of what your mineral rights might be worth. However, there is nearly always a better price out there. Remember, you don’t want to accept an offer after talking to just a few buyers. This is not how you get the best price.

2. Google: After receiving a few offer letters in the mail, you may be tempted to search Google and find oil and gas royalty buyers. There are literally thousands of them out there. How do you know which buyers to reach out to? How long is that going to take? More importantly, a lot of the best mineral buyers do not have a website at all. They rely on Texas Royalty Brokers to source high quality deals for them to purchase mineral rights.

3. Phone Calls: Mineral rights buyers may call you on the phone directly. They will pull your data and then call you to make a deal. Use caution if a mineral buyer calls you. These calls are often high pressure sales tactics.

4. Text Messages: You may receive a text message offering to buy your mineral rights. These services make it very easy to sell, but are you getting the best price? You need competitive bids to ensure the best pricing.

Deciding how to sell mineral rights is an important decision. Don’t leave it to chance.

For most mineral owners, this is a life changing decision. Do you want to navigate the process blindly hoping you find a quality buyer at the best price?

At Texas Royalty Brokers our team will be there to guide you through each step. We’ll ensure you get the best price and make the process simple.

Questions about Mineral Buyers

At the end of the day, the mineral rights buyer you choose can make or break your mineral rights sale.

Whether it’s a flipper looking to turn a quick profit or a lowball offer hoping you don’t know any better, the wrong buyer can cost you tens of thousands of dollars.

That’s why working with a professional mineral rights broker is so important.

At Texas Royalty Brokers, we specialize in connecting mineral owners with serious, qualified buyers who are willing to pay top dollar.

We handle the negotiations, vet the buyers, and market your property the right way — all to make sure you get the best price with the least amount of hassle.

Want to know what your mineral rights are really worth? Contact us today for a free, no-hassle, no-pressure consultation.

We’re here to help you make the smart move and walk away with the money you deserve.

Ready to learn more? Check out the following articles:

Never Sell Mineral Rights?

How to Value Mineral Rights

Mineral Rights Brokers

Mineral Rights Taxes

Inherited Mineral Rights