Why Texas Royalty Brokers?

sellers

Buyers

State Specific Guides

Resources

How to Buy Mineral Rights

Do you want to know how to buy mineral rights? If so, you’re in the right place.

This article was written specifically for someone who is interested in buying oil and gas mineral rights, but has never purchased mineral rights and doesn’t know where to begin.

In this article, we break down everything you need to know to buy mineral rights with confidence.

Before we jump in, there are some important things you need to know before you buy mineral rights.

A Warning About Buying Mineral Rights

Buying mineral rights is risky.

When buying mineral rights, the biggest downside is that you have no control over the asset. The oil and gas operator will operate the wells and you don’t get to control the investment.

In addition, the price of oil and/or gas is volatile. If you invest when oil is $75/barrel and then oil drops to $50/barrel, your income will go down by 33% simply due to commodity prices.

Before investing in oil and gas, make sure you are comfortable taking a large amount of risk. It’s possible to lose all of your money.

We are not providing investment advice. This guide simply explains how to buy mineral rights if you choose to do so.

Understanding Mineral Rights Ownership

Before you buy mineral rights, it’s important to understand what you are buying.

When we refer to “mineral rights,” we are specifically referring to oil and gas mineral rights. There are many types of mineral rights including coal, lignite, timber, etc..

When you buy mineral rights, you are buying the physical oil and gas beneath the ground. You are not buying any rights to the surface.

While you may own the oil and gas underground, extracting that oil and gas is challenging and expensive. This is where an oil and gas operator comes in.

An oil and gas operator will extract the oil and gas and keep the majority of the income generated. The operator takes a significant portion of the income generated because they took the risk. Drilling an oil and gas well typically costs millions of dollars, so the operator needs to be compensated for that risk.

If you buy mineral rights, you receive the right to a certain percentage of the income being generated from oil and gas as it is extracted by the operator.

Analyzing Mineral Rights Ownership

Consider the information in this section carefully.

There are many factors that come into play when analyzing an investment in oil and gas mineral rights.

Below we are going to highlight the most important things to look at when buying mineral rights. At a bare minimum, you should understand the factors we have identified below before you buy mineral rights.

Phases of Oil and Gas production

There are three basic stages of life for mineral rights. Understanding which stage the mineral rights fall into is key to understanding how much risk you are taking.

- Non-Leased / Non-Producing: Extremely High Risk!

If you buy mineral rights that are not currently leased and not currently producing royalty income, you are purchasing non-leased / non-producing mineral rights.

These mineral rights are considered “speculative” in nature. We often refer to this type of ownership as “lottery ticket acreage.” It may be worth nothing in the long term but you could get lucky.

We do not recommend buying non-leased / non-producing mineral rights unless you deeply understand the location where you are buying and are comfortable losing 100% of your investment. The value here could be $0 to $1,000/NMA, with the value typically falling in the $50 to $250/acre range.

Keep in mind that if you buy mineral rights that are not leased or producing, it may be difficult to impossible to sell the mineral rights.

- Leased Mineral Rights: High Risk!

The first step towards a producing oil and gas well is an oil and gas lease.

When an operator wants to drill in an area they will lease the mineral rights from the mineral owner. This gives the operator the legal right to extract the oil and gas. Once a lease has been signed, these mineral rights are now considered leased mineral rights.

While buying leased mineral rights is less risky than buying non-leased mineral rights, we still consider this investment high risk.

Why? If the lease expires, you now own non-leased / non-producing mineral rights. The fact there is no current production tells you that the area has not been historically productive.

When the mineral rights are leased, it is a positive sign that activity might be starting in the area. However, you should still be cautious buying leased mineral rights because the risk is still high.

The value for leased mineral rights typically falls in the 2x to 3x lease bonus range. For example, if a mineral owner received a $50,000 lease bonus, you would expect to buy those mineral rights for around $100,000 to $150,000.

- Producing Mineral Rights: Medium Risk!

Once an operator starts drilling and producing oil and gas, the mineral rights are now producing. This means that royalty income is being generated for the mineral owner.

The monthly payment could be a few cents per month to thousands per month.

If the mineral rights generate current royalty income, this means the investment is less risky than leased or non-leased mineral rights. The reason is that you know you will get at least some return on investment.

You can use the current royalty income vs the purchase price to determine the yield or ROI you will get on the investment.

For example, if you buy mineral rights for $10,000 that are generating $100/month, we know that your return on investment is about 12% per year. ($100/month X 12 months = $1,200 / purchase price of $10,000).

While that might appear to be a great investment, you need to understand oil and gas decline curves. Read more about decline curves below!

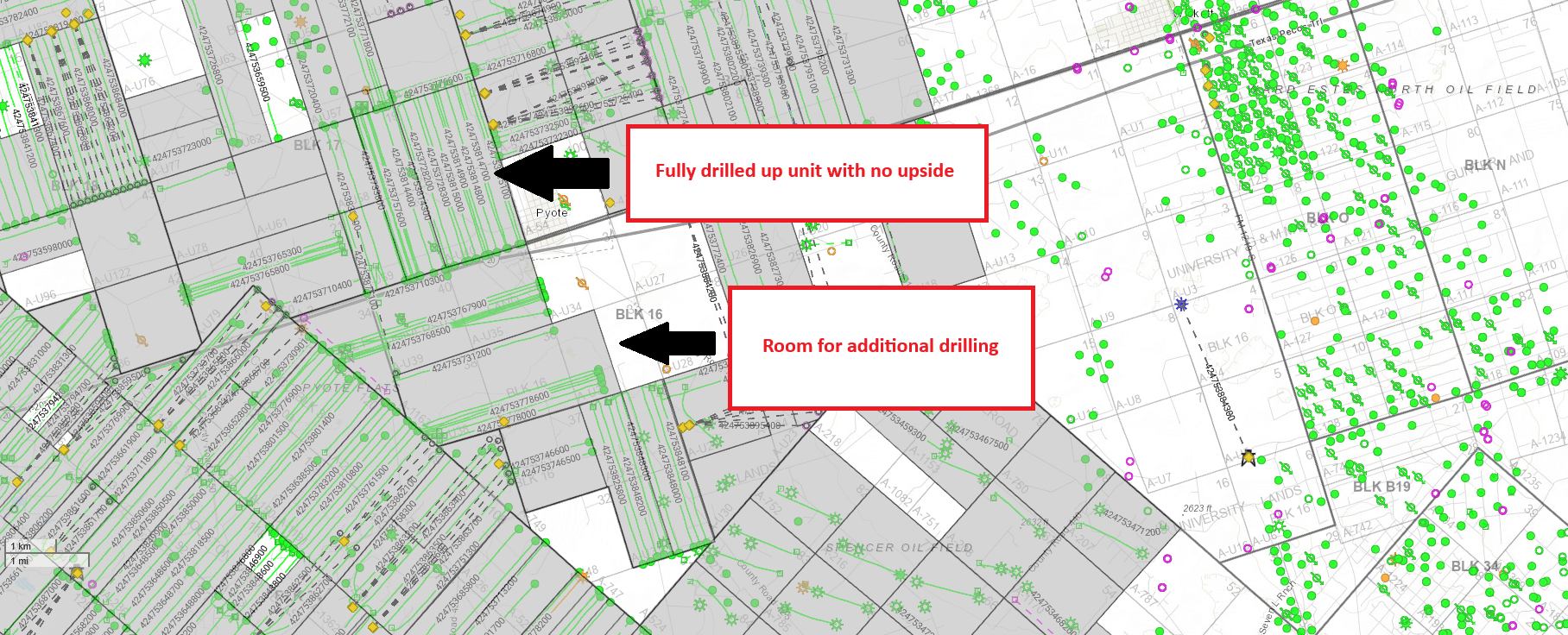

With producing mineral rights, there are two components to value. The current royalty income being generated and the upside potential.

Royalty Income Value + Upside Potential = Total Value

You might be making $100/month in royalty income, but your mineral rights could be worth $1,000,000. How is that possible?

If you have a single well producing, but there is room for an operator to add 5 more horizontal wells, you have a lot of upside potential. The royalty income may be minimal while the upside potential is massive.

In some cases, there is no upside potential and all the value is in the current cash flow. If they have already full drilled up the unit there is no upside. You can expect to buy fully developed acreage for around 4 years to 6 years X the currently royalty income.

These examples are at extremes. In reality, each deal you analyze to buy will have some mix of production + upside.

When you buy mineral rights, your goal is to analyze what value you place on the current income and any upside potential.

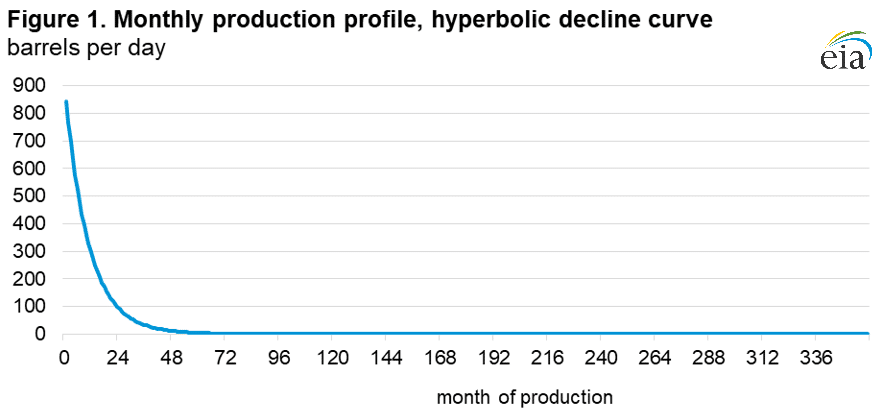

Decline Curves / Age of the Production

While we put the phases of production as the first thing to analyze, understanding decline curves and the age of production is the most important factor to consider when analyzing the ownership.

First time mineral buyers fall into the “flush production” trap over and over again.

Do not buy mineral rights until you understand flush production!

When you are looking at existing production from wells (royalty income) you need to take into consideration how long the wells have been producing. When a new well is drilled, they will frack the well which unlocks substantial amounts of oil and gas. Fracking is great for the operator because it allows them to quickly recover a lot of oil and gas.

When these new wells come online at a high rate of production, this is called flush production.

From an investment perspective, you need to understand that there is a large amount of production for the first 4 to 5 years of a wells life. What this means is that the income will dramatically decline for the first 4 to 5 years.

If you buy mineral rights and the wells producing are only 12 to 36 months old, they will be producing approximately half as much income 12 months later. Invest accordingly.

A lot of first time mineral buyers get taken advantage of by companies who off load flush production to inexperienced buyers. On paper, it looks like an amazing deal because the mineral rights are generating substantial income. In reality, that income is going to drop like a rock.

Let’s take a look at what an oil and gas decline curve looks like below:

Source: EIA

Keep in mind that every well has a different oil and gas decline curve. The above example just highlights the kind of drop in production you will see from a new well.

As you can see, the production and the income you can expect will drop dramatically in the first few years before leveling offer. If you buy mineral rights that have only been producing for 12 to 36 months, you can see how quickly that income is going to drop in the chart above.

Once the wells have been producing for 5+ years, you are generally beyond the initial “flush production” decline. The wells will still decrease each year over time, but that decrease will be less dramatic.

Mineral Buyer Tip: As you look at royalty income on check stubs, you need to understand how old every well is. You may look at a listing that has 7 old wells and only 1 new well, so it would appear that the flush production from 1 well is not a problem. However, if you look closely, you may find that the 1 well is making up 80% of the income being generated. If 80% of your income is about to decline rapidly, that needs to be taken into account when you make an offer to buy mineral rights.

Number of Acres

When you analyze each deal, it’s important to know how many acres are owned by the seller. The number of acres owned will determine your share of production.

The only time the number of acres owned is less important is when the mineral rights are fully drilled up and there is no upside potential.

If you are buying mineral rights that have upside, the more acres you purchase the higher your share of any upside potential.

Net Mineral Acres vs Net Royalty Acres

A net mineral acre is directly tied to a net acre of surface ownership.

If you have a farm that is 10 net acres, there are 10 net mineral acres of oil and gas directly associated with those 10 net acres of surface ownership.

However, just because you have 10 net mineral acres it does not mean you will get the same share of production as the person next door. The lease royalty rate is another factor that plays a role.

Example:

Farmer John has 10 net mineral acres and signs a lease at 12.5%.

Farmer Sue has 10 net mineral acres and signs a lease at 25%.

Since farmer Sue signed a 25% lease, she will get double the amount of royalty income.

To account for this, mineral buyers created a term called “net royalty acres” which helps us compare two deals apples to apples.

A net royalty acre assumes a 12.5% royalty rate. When a net mineral acre is leased, the lease rate will determine how many net royalty acres you have.

1 net mineral acre leased at 12.5% = 1 net royalty acre

1 net mineral acre leased at 20% = 1.6 net royalty acres

1 net mineral acre leased at 25% = 2 net royalty acres

Lease rate / 12.5 = net royalty acres

Confused? Let’s look at a real world example:

Farmer John wants to sell us 10 net mineral acres of mineral rights that he leased at 12.5%.

Farmer Sue comes along and wants to sell us 10 net mineral acres of mineral rights that she leased at 25%.

If we buy Farmer John’s acreage, we are going to get half the royalty income that we would get if we bought Farmer Sue’s acreage.

Farmer Sue leased 10 acres at 25% so she has 20 net royalty acres. Farmer John only has 10 net royalty acres. We would pay double the price for Farmer Sue’s acreage because she is leased at a higher royalty rate giving her a larger share of the production.

Mineral Buyer Tip: When we list mineral rights for sale we often do not know the lease rate. However, we can determine the number of net royalty acres by assuming a 12.5% lease rate, looking at the decimal interest on the check stubs, and knowing the unit size. This is why many of our listings show a 12.5% lease royalty rate. The royalty rate may be higher than that, but we are using a net royalty acre calculation that assumes 12.5% so we represent the ownership at a 12.5% lease royalty rate.

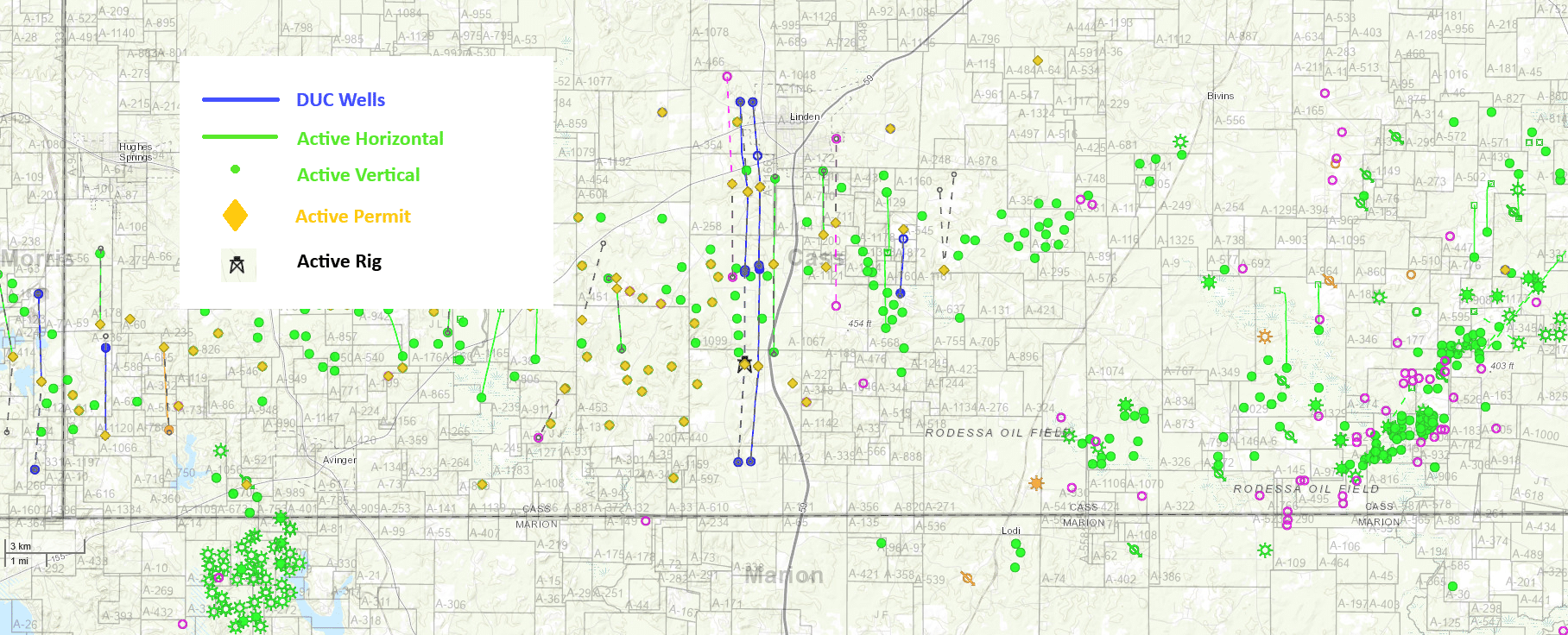

Permits & Rigs & DUCs

Are there active permits on the location? This increases the value of the ownership because it shows intent by the operator to drill. The operator may choose not to drill, but it still increases the value.

Is there a rig on location? Is there a rig nearby? Keep an eye on rig activity. This will give you a good idea of the near term potential upside.

Are there DUC’s (drilled uncompleted) wells on the acreage? If so, this means it is 100% certain that new flush production will come online. You can bid aggressively on this ownership knowing that more royalty income is guaranteed.

In the map below, you can visually see the permit, rig, and DUC activity. There is a big difference between buying mineral rights sitting under a DUC well next to an active rig and buying mineral rights that are on the fringe with no active production.

Unit Sizes

Is the unit size 40 acres or 640 acres? Unit sizes will vary by location from 40 acres up to 1,280 acres. In some cases, there will be “super units” with even more than 1,280 acre units.

The unit size matters. If you have 3 wells drilled on a 320 acre unit, there likely isn’t much upside left there due to the unit size. However, if there are 3 wells drilled on a 640 acre unit, there is plenty of room for additional wells.

Mineral Rights Interest Types

Do you fully understand the difference between a royalty interest, non-participating royalty interest, and a working interest?

Not all mineral ownership is equal. There are certain advantages or disadvantages to each type of ownership. Make sure you fully understand what type of mineral interest you are buying.

Commodity Prices

Even if you keep all factors consistent, the price of oil and gas will dramatically change your ROI.

If you buy mineral rights when oil is $75/barrel, and it drops to $50/barrel next month, your investment return just dropped by 33% in one month.

Pay attention to the type of production from the oil and gas wells you are buying. If you are buying in East Texas with heavy gas production, oil prices may not be as relevant and you should be looking at natural gas prices.

When you buy mineral rights, keep in mind you are making a bet about the long term price of oil and/or gas. If you believe prices are going down you should adjust your offer accordingly. If you believe prices are moving higher you can make more aggressive offers.

Operator

Pay attention to who operates the wells. There is a big difference between Exxon operating the property and “Mom & Pop Drilling Inc” operating the property.

Exxon has virtually unlimited funds to drill and this plays a role in valuing upside. If you buy mineral rights under Mom & Pop Drilling and place a lot of value on the upside, but Mom & Pop are not operating any rigs and can’t afford to drill, that upside may take years.

Depleting Asset

It’s important to remember that oil and gas mineral rights ownership is a depleting asset.

When you invest in real estate the value increases over time. The yield on real estate might be 5% to 10%, while oil and gas may show a yield like 15% to 20%.

The reason is that oil and gas depletes. That oil and gas is not magically back underground 30 years from now. That oil and gas is never coming back and the resource is being depleted.

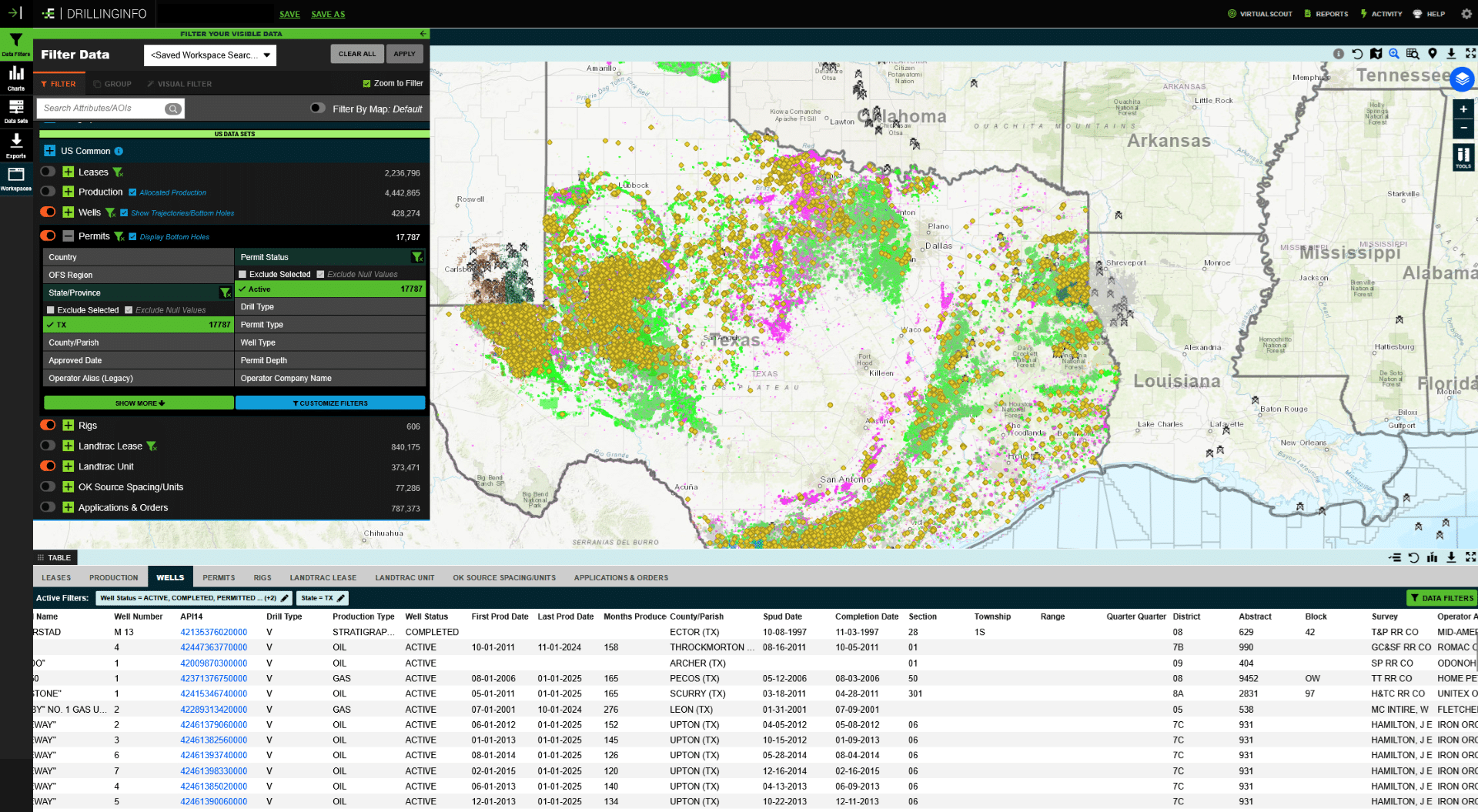

Best Software for Buying Mineral Rights

While the listings on our website provide enough information to get started, you need software to help you buy mineral rights.

It’s important to analyze the actual production detail, decline curves, and other information related to production. In addition, you may want to take a closer look at the surrounding area and see what kind of production is happening, what operators are active, and who is running rigs in the area.

Your ability to buy mineral rights comes down to having the right information in front of you.

Above, we described how to analyze the ownership but that is just the tip of the iceberg and you are missing key data. To really dive into buying mineral rights, you need software that assists you and provides the relevant data.

In our view, the best software for buying mineral rights is:

Texas Railroad Commission: This is the best option to consider if you are on a budget because it is free! However, it is not very user friendly. Figuring out exactly what is going on will require a lot of time and effort. You will need to get familiar with the GIS viewer and learn how to use the search queries. Firing out how to buy mineral rights using the RRC can be a challenge, but it’s a good place to start if you are just learning how to buy mineral rights.

Enverus / Drilling Info: The gold standard in the oil and gas world, Drilling Info (owned by Enverus) is the leading software tool used by mineral buyers. Pricing varies, but expect to pay thousands per year to access this tool. While expensive, Drilling Info creates a clear view of exactly what’s going on in the oilfield. The real time data is easy to sort through, analyze, and export as needed. This makes the process of figuring out how to buy mineral rights much easier.

Before you start buying mineral rights, we recommend getting familiar with one of the two tools above so that you can better analyze each deal that comes up.

Where to Buy Mineral Rights

If you want to buy mineral rights, there are few different options to consider. Even if you know how to buy mineral rights, you have to know where to find the deals to buy.

Direct Sales – You can contact mineral owners directly by looking at the tax roll data. You can then send letters in the mail to mineral owners and see if they are interested in selling.

This is a challenging way to buy mineral rights. The reason is that you’ll spend thousands of dollars just locating a single mineral owner who wants to sell. Once you locate a mineral owner who wants to sell, do you even want to buy the mineral rights?

You might be able to get a better price doing an off market deal to buy mineral rights, but it also comes with a lot more risk and effort.

Texas Royalty Brokers – We might be slightly biased, but we think Texas Royalty Brokers is a great place to buy mineral rights. We offer mineral rights for sale where the sellers are serious about getting offers for their mineral rights. You can quickly review the ownership and download documentation to start analyzing the ownership. There are a couple other legitimate mineral rights brokers out there that also offer mineral rights for sale.

Mineral Rights Fund – While not direct ownership of mineral rights, you can also choose to invest in a mineral rights fund. Companies like Rising Phoenix offer investment opportunities to buy mineral rights without being involved in the direct purchases or hassle of management. You will typically need to be an accredited investor to purchase through a fund.

How to Make an Offer to Buy Mineral Rights

Ready to start making offers to buy mineral rights? Here are the next steps.

Step 1: Determine an offer price

As a mineral buyer, it is entirely up to you to determine what price you want to offer.

Unlike the housing market or stock market where pricing is clear and transparent, there is no guide to tell you what price to offer. It comes down to the price you’re willing to pay for the income and upside potential.

On each listing, we provide a starting bid price. This starting bid price is a good general guide on what type of offer to make. However, it is entirely up to you to determine your risk tolerance and what you believe is a fair price. This number may be higher or lower than the starting bid price.

Step 2: Due Diligence Period

As a part of your initial offer, you’ll need to indicate how long you need for due diligence. We discuss running title more in depth below.

The industry standard is 30 calendar days.

Step 3: How to Submit an Offer to Buy Mineral Rights

At the bottom of each mineral rights listing, you will find a contact form. Fill out the contact form with your information and provide your required due diligence period. In the notes section, provide a specific offer price.

Do not leave the notes section blank! If you are not making a specific offer, ask specific questions that help us determine how we can help.

Step 4: Offer Acceptance

Once your initial bid to buy mineral rights is submitted, this bid is non-binding. There may be multiple buyers bidding.

Once a verbal agreement has been reached, you will move forward with putting together a purchase and sale agreement. No deal is under contract until you have a fully binding purchase and sale agreement signed.

Tips for Mineral Buyers

- Do NOT submit a bid unless you are prepared to follow through on the bid.

- Do NOT submit multiple low ball bids. Doing so will result in your bids being ignored.

- You must have funds in place prior to submitting a bid. No bank will finance the purchase of mineral rights.

- The starting bid price is the starting point of a negotiation. There is no “Buy it Now” price.

Mineral Rights Purchase and Sale Agreement

Once your offer has been verbally accepted, it’s time to put together a purchase and sale agreement.

This purchase sale agreement serves as the legal document that guides the transaction to closing.

In the mineral rights industry, a purchase and sale agreement can be a simple 1 page document or a complex 10+ page document full of complicated legal language. A purchase and sale agreement is also called a “letter of intent” to buy mineral rights.

A purchase and sale agreement should have the following elements:

-Buyer’s and seller’s names and addresses

-Purchase price clearly defined

-The purchase price breakdown, including the % to the broker and % to the seller at closing

-The due diligence period (typically 30 days)

-The effective date of the sale

-Language around title/due diligence/adjustments

-Closing process

-Legal description of what is being purchased

Keep in mind that a mineral rights purchase and sale agreement is going to vary for every deal. There are certain elements of each transaction that change, and your PSA should change accordingly to ensure all angles are covered.

For informational purposes only, we are providing a sample PSA for mineral buyers

It is the buyers responsibility to put together the PSA and provide a legal description. This is a legally binding document. Your PSA should include a legal description that accurately conveys the ownership that is intended to be conveyed.

Title & Due Diligence

Before you buy mineral rights, you need to complete due diligence to ensure you are making a good investment.

Running title is one of the most important steps in your due diligence process.

Running Title

What is title? A title report will show you the ownership history of the mineral rights.

The ownership history is important because it will confirm that you are getting exactly what you expect.

An operator might be paying a mineral owner for 30 net royalty acres. However, after running title you determine a prior owner reserved an ORRI which means the seller actually only has 20 net royalty acres.

If you don’t run title and just assume the operator is paying the mineral owner correctly, you might purchase something they don’t even own!

How do you run title? You can contact a land company who specializes in running title. You can also contact an independent landman who can run title for you.

Mineral Buyer Tip: Don’t hire Billy Bob

This process typically involves someone physically going to the county courthouse in the county where you are buying the mineral rights. They trace the ownership back to patent title and confirm the ownership.

This could run $500 on the low end or $2,500+ depending on how many tracts are being reviewed and how complex the research is.

Should you always run title? In some cases, it makes sense to skip running title and assume the operator is correct.

For example, if you were buying mineral rights that were $25,000 but the title report is going to cost $1,500, do you want to incur that expense? You might elect to skip running title on lower value deals because the cost is not worth it. This is a personal decision that increases the risk but can save you money when buying mineral rights.

There is no such thing as title insurance with mineral rights.

Property Taxes

Prior to closing, you should confirm that the property taxes are current. You can do this by visiting the county appraisal district website or the county property tax website to search for the current owner. You will be able to see if the owner is currently past due on any taxes. If they are, this amount would be deducted from the seller’s amount due at closing.

As an example, you can look at the Reeves County Appraisal District website.

It is the buyer’s responsibility to confirm that taxes are current prior to purchasing the mineral rights. If a seller discloses they are past due on taxes up front we note this on the listing but not all seller’s disclose they are behind on taxes.

A title report should also confirm whether there are past due taxes, but you should always double check just to make sure.

Liens / Mortgages

Are there any liens or mortgages that would prevent this ownership from transferring? While rare, you should check the county recorder to verify there are no liens or mortgages associated with the mineral rights. You can check Texas File in the state of Texas.

In most cases, mineral rights do not have any liens or mortgages attached.

Mineral Deed

Once your due diligence process is complete, it’s time to prepare the deed for closing.

The deed is the document that actually legally conveys the mineral rights from the seller to the buyer. A mineral deed is generally a simple 1 to 2 page document.

Each time the mineral rights are sold a new deed is created. You do not need any old deeds or documents to convey the ownership.

Make sure that the deed includes an accurate legal description and the legal names are spelled accurately. This document needs to be signed and notarized by the seller. Once it has been signed and notarized, it will be returned to Texas Royalty Brokers until payments have been issued via wire transfer.

Our closing process is simple to follow and ensures that all parties are protected.

Below we provide a sample mineral deed for review. This mineral deed is for example purposes only and you should consult with an attorney to create your own mineral deed.

Post Closing

Record the Deed

Once you receive the deed back from the seller you can now record the deed to make the transaction official.

To record a mineral rights deed, you need to send the original deed to the county clerk for recording. You will send the original deed, a check that covers the recording fee, and self addressed return envelope with prepaid postage to the county recorder. In approximately two weeks, you will get the recorded deed back in the mail.

Notify the Operator

Once you have the recorded deed back from the county, you can now notify the operator about the ownership change. Typically, the operator will require a copy of the recorded deed and your W-9. The operator will then take 30 to 90 days to put the ownership into pay status.

Most operators will send you division orders to sign prior to placing you in pay status. This varies by operator.

Once you get your first royalty check you will know you have been placed into pay status.

Notify Appraisal District

Once the ownership has been fully transferred at the operator level, you should notify the appraisal district for the county of the change in ownership. In theory, the operator is supposed to complete this step but taxes are often not updated correctly.

When the appraisal district is not notified about the ownership change, the property tax bill will continue to be sent to the prior owner. The prior owner will likely ignore that property tax bill which means the property taxes on your mineral rights are not being paid.

When buying mineral rights, you should carefully keep track of the taxes and ensure that they are up to date and paid each year.

What happens if the taxes are in the old owners name? Simply pay them off. The county does not care who pays the taxes they just want them paid. Pay off any taxes for ownership you have and then notify the appraisal district to fix it for the next year.

Final Thoughts

As you can see, figuring out how to buy mineral rights is a complicated process with a lot of variables.

Wouldn’t it be easier to just invest in an index fund? YES! Actually it would be way easier to simply invest in an index fund.

If you are going to buy mineral rights, make sure that you have a clear understanding of your investment goals and objectives. If you want to invest in mineral rights, it should be considered an alternative investment that compliments your other investments in the stock market, real estate, etc..

Keep in mind that as you acquire mineral rights, you are now going to be responsible for filing taxes in each state where you acquired mineral rights. This is because you will now be getting royalty income in another state. If you live in Florida and buy mineral rights in Texas, you will now need to file in Texas as well as Florida.

A lot of mineral owners sell mineral rights to simplify their estate. They get tired of dealing with the extra tax headache and keeping track of their ownership. Before you invest in oil and gas mineral rights, carefully consider your investment objectives and ensure this is a path you want to go down.

If you are still interested in buying mineral rights, head over to our mineral rights listing page and start reviewing the listings.

Final Disclaimer:

- The information found on this page represents the extent of the information we provide to potential mineral buyers. We do not have the resources to answer phone calls to educate potential buyers about how to buy mineral rights.

- If you use our website to buy mineral rights, it is assumed you are a sophisticated investor who fully understands how to invest in mineral rights. We have no liability whatsoever if you rely on the information found on this page or any other page on our website when buying mineral rights.