Why Texas Royalty Brokers?

sellers

Buyers

State Specific Guides

Resources

Best Time to Sell Mineral Rights

If you own mineral rights, you’ve probably asked yourself, “When is the best time to sell?” It’s a fair question, and an important one.

While no one can predict the market with perfect accuracy, there are certain moments when your mineral rights are likely worth more than others.

Think of it like selling a home. You can’t control the real estate market, but you can choose to sell after a remodel, when interest rates are low, or when homes in your area are in high demand.

The same idea applies to mineral rights. You don’t need to guess where oil prices are headed or wait for a perfect scenario. Instead, focus on recognizing key points when your minerals are most valuable and be ready to take advantage of those moments.

In this article, we’ll walk through the different timing opportunities that can boost your mineral rights value. We’ll explain how drilling activity, leasing status, inheritance, and oil prices all play a role. We’ll also talk about how your personal situation can help determine when it’s the right time to sell.

And if you want help navigating that process, Texas Royalty Brokers is here to make it easy. We specialize in selling oil and gas mineral rights, and we’ll help you get the best price with less hassle.

Let’s take a closer look.

Best Time of Year to Sell Mineral Rights

When it comes to selling mineral rights, a lot of people wonder if there’s a perfect time of year to make a move. The truth is, you can’t time the market perfectly, but you can avoid certain times when buyer activity tends to slow down.

We generally do not recommend listing your mineral rights for sale between Thanksgiving and New Year’s.

This part of the year is typically quiet in the oil and gas industry. Buyers are out of office, budgets are locked in, and things are slower. If you list during this time, it’s not impossible to get offers, but you’re likely to see fewer buyers and less competition.

To avoid this slowdown, we recommend listing by November 1st if you’re aiming to sell in the current calendar year. This gives you time to go under contract before Thanksgiving when activity starts to dip. If you miss that window, it’s often better to wait until early January, when buyers are back in action and planning for the new year.

Every property is different, and there’s no one-size-fits-all answer, but avoiding that late holiday lull is a smart move. When you’re ready, Texas Royalty Brokers can help you plan your listing around the best timing for both market conditions and buyer interest.

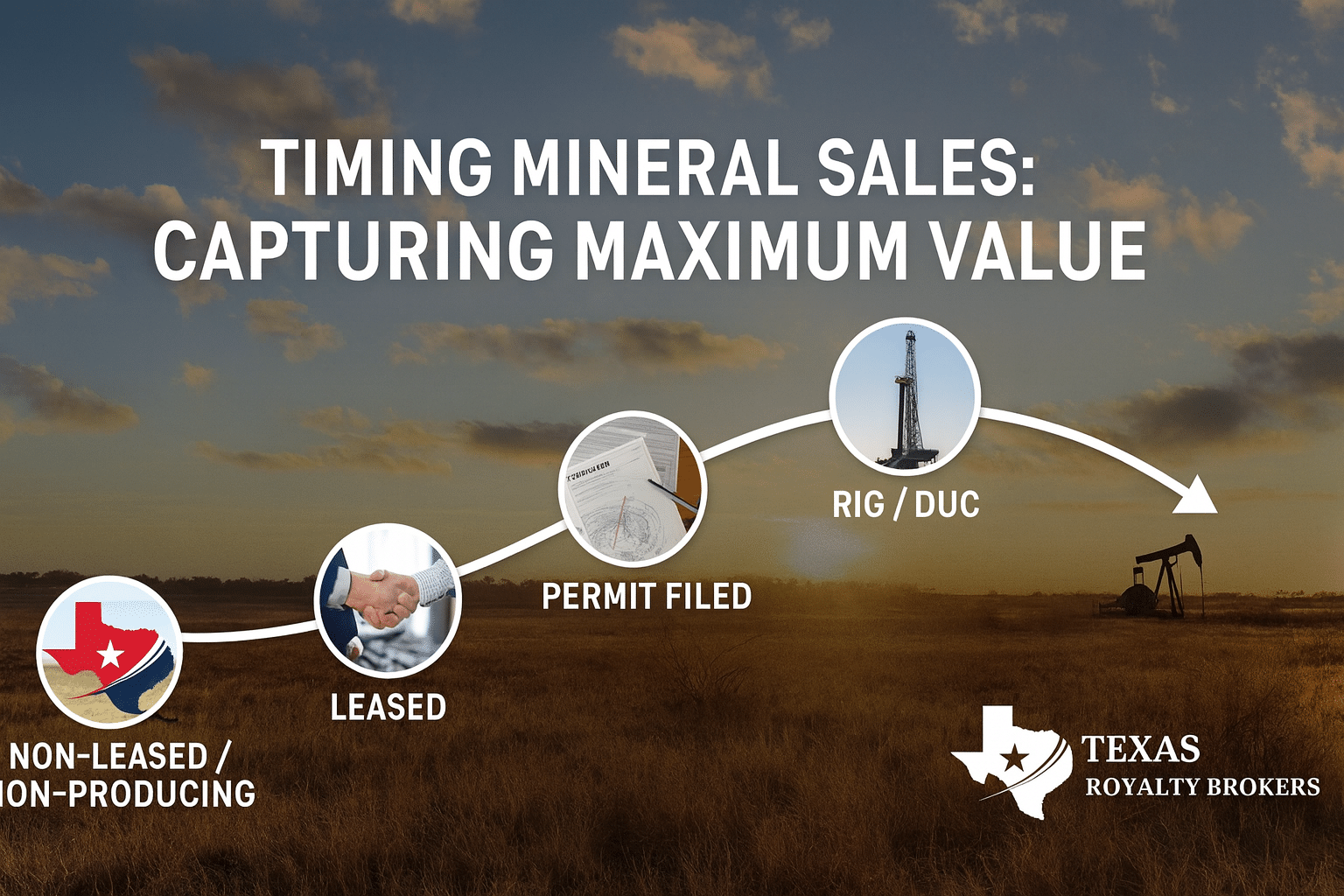

Timing Based on Production Phases

Timing the market is impossible, but we’re going to help break this topic down for you.

If you want to “time the market” and pick the best possible time to sell mineral rights, this is the section you need to understand!

The single biggest factor in when to sell mineral rights is the stage of activity on your property. Oil and gas buyers are always looking for signals that show the potential for drilling or future production. Depending on what phase your minerals are in, your property could be worth significantly more or significantly less.

Here’s how the different stages usually play out:

Non-Leased / Non-Producing

This is generally not a great time to sell. If your minerals are not leased and there is no production, buyers have no guarantee that anything will happen with your property. You might still get offers, but they will be heavily discounted because the risk is high and the future is uncertain. In many cases, you can’t even sell non-leased / non-producing mineral rights because mineral buyers do not want to purchase acreage with no income and no near term upside.

Leased Mineral Rights

Leasing is often the first big turning point for mineral rights owners. Before your minerals are leased, they may not have much value at all because there is no clear sign that drilling will happen. Once an operator decides to lease your minerals, that all changes.

The lease itself is proof that an oil and gas company believes your acreage has potential. This is the moment when your mineral rights start to have real market value. In fact, it’s common for leased minerals to be worth two to three times the lease bonus you received.

Mineral buyers see that a company has invested money into leasing your property, and they know there is at least some chance of development in the future. That confidence translates directly into higher offers.

Selling while your minerals are under lease can be a smart move because it creates competition. Multiple buyers may be interested at the same time, which helps you get a better price.

However, there is also risk in waiting too long. If your lease expires without a well being drilled, the value of your minerals will usually fall right back down to where it started. Unleased and non-producing minerals have far less buyer interest, and your offers could be cut in half or worse.

This is why timing matters so much. Leasing opens the first real window of value, but it does not stay open forever. If you are considering selling, it often makes sense to do so while your minerals are still leased rather than rolling the dice and hoping for a second lease in the future.

At Texas Royalty Brokers, we see this scenario all the time. Owners who sell while leased tend to capture much more value than those who wait until after a lease expires. We help mineral owners take advantage of that window so they can maximize their return before the opportunity fades.

The value will be highest just after you sign a new lease. If you wait until just before the lease expires and there is no new activity, the price will reflect the fact that the lease is going to expire and the buyer will be left holding the bag.

New Permit Filed

The next major jump in mineral rights value often comes when a new drilling permit is filed. A permit is one of the strongest signals that an operator intends to drill a well, and it is a clear sign to buyers that development is very likely in the near future.

When a new permit is filed, your minerals instantly become more attractive. Buyers know the operator has already invested time and money in preparing to drill, and that reduces much of the uncertainty they usually face. This creates competition, and in many cases, selling right after a permit is filed will generate some of the highest offers you’ll receive.

It is important to understand, though, that a permit does not last forever. In Texas, permits are typically valid for about one year. If no drilling takes place during that time, the permit expires. Once it expires, the added value it created goes away almost overnight. Buyers will treat your minerals much like they did before the permit was filed, and your offers will drop significantly.

That is why timing your sale around the permit stage is so important. Selling while the permit is new allows you to capture the maximum value. Waiting until the permit is close to expiration can have the opposite effect. Buyers are less confident the well will ever be drilled, so they lower their offers to reflect that risk.

At Texas Royalty Brokers, we help mineral owners identify when a new permit has been filed on their property and guide them through the process of listing at just the right time. Selling during this window can make a meaningful difference in the offers you receive and the financial outcome of your sale.

If you want to know if there are permits on your location, contact us for a free consultation.

Rig on Location / DUC Wells

If you are looking for the absolute best time to sell mineral rights, it is usually when a rig is on location or when a DUC well has been drilled.

A rig on location means the operator is actively drilling a well on or near your property. At this point, the company has already spent millions of dollars to get to this stage. Buyers know that production is almost certain, and the risk of the well never being drilled is basically gone. This is when buyers are most motivated, and your offers will often be at their highest.

A DUC well stands for “drilled but uncompleted.” In other words, the wellbore has been drilled, but the operator has not yet fracked or connected the well to pipelines. Completing the well is the final step before oil and gas can flow and royalties can begin. Buyers see DUCs as a guaranteed payday that is right around the corner. Since the well is already in the ground, it is only a matter of time before it is producing.

For mineral owners, this stage combines two advantages:

-

Certainty of production – The well is drilled, and the hardest part is already done.

-

No royalty income yet = massive tax savings – Because the well is not producing, you have not yet received royalty checks that would trigger taxable income. You will save an absolute fortune in taxes if you inherited mineral rights. Even if you didn’t inherit, selling now will save you a fortune in taxes. Contact us to find out how.

This makes the rig-on-location or DUC stage the most valuable window to sell mineral rights. Buyers are willing to pay a premium because the risk is low and the upside is high, but you still get to avoid years of tax obligations that come with collecting royalty income.

The flip side is that this window does not last long. Once the well is completed and begins producing, the situation changes completely. At Texas Royalty Brokers, we specialize in helping mineral owners recognize this timing and take full advantage of it. Selling during the rig or DUC stage can mean a significant difference in the value you capture.

Important: If you receive a division order for new wells DO NOT SIGN THE DIVISION ORDER until you consider your options. Once the division order is signed, you’re accepting all the new income and you no longer have options.

New Production

When new wells finally come online, many mineral owners think this is the perfect time to sell. On the surface, it makes sense. Royalty checks are rolling in, the income looks incredible, and the property finally feels like it is worth something. But in reality, this is usually the worst time to sell mineral rights.

Here’s why. Buyers know that the first three to five years of a new well’s life are the most productive. That early production is when the well pays out the majority of its value. If you try to sell during this stage, buyers will discount their offers heavily because they know you are collecting the strongest royalty checks right now. In other words, your income feels high, but your offers will feel low.

This creates a very common trap. Many mineral owners hope to collect several years of large royalty checks and then sell their rights at the same high prices they saw before the wells came online. Unfortunately, it does not work that way. Once those early years of production are gone, they are gone forever. As the wells decline, the value of your minerals declines with them. By the time you are ready to sell, the offers will be much lower than you expected.

Think of it this way: your minerals are like a bank account that is being drained. Every royalty check you cash reduces the long-term value of what is left. Buyers are not going to pay you today for income you have already received.

For these reasons, the new production stage is one of the hardest times to get the offers you want. Most mineral owners who hold through the drilling and early production end up keeping their minerals long-term because selling simply does not make financial sense anymore.

At Texas Royalty Brokers, we help mineral owners avoid falling into this trap by identifying the right windows to sell before production starts. Capturing value while buyers are still competing for future income is almost always a better strategy than waiting until after the oil and gas is already flowing.

Selling When It’s Right for You

So far, we’ve focused on the market factors that drive value, like leasing, drilling permits, and new wells. Those things are critical, but there is another part of the equation that often matters even more: what is right for you personally.

Every mineral owner has a unique situation. For some, mineral rights are a nice bonus on top of other income. For others, selling is a way to cover important life events or to reduce financial stress. The best time to sell is often less about market timing and more about timing your life.

Here are some of the most common reasons mineral owners choose to sell:

-

Retirement planning – Turning future royalty income into a lump sum today can give you peace of mind and financial stability during retirement.

-

Medical expenses or debt – Sometimes selling mineral rights is the best way to take care of pressing needs without taking on loans.

-

Diversification – Minerals are a very concentrated investment. Selling can free up cash to spread into real estate, stocks, or other assets, reducing your risk.

-

Estate planning – Passing mineral rights down to children or grandchildren can create complications. Many owners prefer to sell and leave cash behind instead of dividing up royalty interests.

It is important to remember that mineral rights are an asset, just like land or stocks. Holding them can create value, but that value is only realized when you sell. If the timing of a sale helps you reach your personal or financial goals, that can be just as important as market conditions.

Some people will tell you to “never sell mineral rights,” but that kind of blanket advice can actually hurt mineral owners. The truth is, holding forever is not always the smartest move, and waiting too long can mean missing your best chance to capture maximum value.

At Texas Royalty Brokers, we work with mineral owners who are at all different stages of life. Some are ready to cash out and retire comfortably. Others simply want to turn an uncertain stream of royalty income into a guaranteed payout today. No matter what your reason is, we make sure you get maximum value when the timing is right for you.

Why You Should Use a Mineral Rights Broker

Timing your sale is only half the battle. The other half is making sure your mineral rights are marketed correctly and shown to the right buyers. This is where working with a mineral rights broker makes all the difference.

Selling mineral rights on your own might sound simple, but most owners quickly find out it is overwhelming. The market is full of buyers who specialize in picking up minerals at a discount. If you go straight to one or two buyers, you are almost guaranteed to leave money on the table.

A mineral rights broker changes that dynamic.

At Texas Royalty Brokers, we put your property in front of a wide network of serious, competitive buyers. Instead of you chasing offers, buyers compete against each other for your minerals. That competition drives up the price and ensures you are not underselling.

Another key advantage is transparency. We handle the paperwork, help you navigate title issues, and make sure you fully understand the offers you are getting. Our goal is to take the stress off your shoulders so you can focus on the big picture: deciding whether now is the right time to sell.

The bottom line is simple. Owners who work with a broker almost always make more money and deal with fewer headaches than those who try to sell on their own. If you want to maximize value and feel confident you sold at the right time, using a mineral rights broker is the best way to get there.

Real-World Examples of Good and Bad Timing

Sometimes the best way to see how timing impacts mineral rights value is by looking at real-world scenarios. Here are three simple examples that show how the decision to sell — or not sell — can dramatically change the outcome.

1. The Lease That Expired

One mineral owner had a lease on their property and received strong offers to sell. Instead of selling, they decided to hold on, hoping the operator would drill. A few years later, the lease expired and no new lease was signed. The offers disappeared almost overnight, and the minerals became nearly worthless. By not selling during the lease, they lost the best opportunity to capture real value.

2. The Permits That Turned Into DUC Wells

Another owner received offers when permits were first filed on their property. They considered selling but decided to wait. Within a year, the operator had moved a rig onto the property and drilled four wells that were left as DUCs. At that stage, the same property sold for three times the value of the earlier permit-stage offers. By waiting through the permit stage into the DUC stage, this owner captured the best possible outcome.

The risk? If no drilling would have occurred, the value would have gone down substantially!

3. The Million-Dollar Mistake

One mineral owner inherited their mineral rights and had offers around $1,000,000 right before six new wells were about to start producing. Instead of selling, they chose to hold on and collect royalty checks. Over the next 20 years, they received about $1,200,000 in total royalties. On the surface, it looked like they made the better choice. But let’s break it down.

Path A: Sell for $1,000,000

-

Inherited minerals come with a step-up in basis, so almost the entire amount would be treated as long-term capital gains.

-

Effective tax rate: about 5%.

-

Taxes paid: roughly $50,000.

-

After-tax cash in hand: $950,000.

Path B: Collect $1,200,000 in Royalties

-

Royalty income is taxed as ordinary income, which in this case was about a 32% tax rate.

-

Taxes paid: roughly $384,000.

-

After-tax total: $816,000 AND it took decades to collect.

When you put the two paths side by side, the choice becomes clear. Even though the royalty income added up to a larger gross amount, the tax hit made the final outcome worse. The owner who thought they were coming out ahead actually ended up $134,000 behind compared to selling the oil and gas royalties.

This is why big offers should never be ignored. What looks like the safer bet often leaves money on the table once you account for how taxes work.

These examples highlight one simple truth: it is not about holding forever or selling at the first chance. It is about recognizing the right window of value and acting on it. At Texas Royalty Brokers, we help mineral owners identify those windows so they can avoid costly mistakes and walk away with the best outcome.

Conclusion: The Right Time to Sell is When Value is on Your Side

No one can perfectly time the market, and chasing short-term swings in oil and gas prices is rarely the answer. The real key is recognizing the phases when your mineral rights are worth the most and making your move during those windows.

Whether it is when your minerals are leased, when new permits are filed, or when a rig is on location, the right timing can make a huge difference in the value you capture.

Just as important, the “best time” to sell also depends on what is right for you personally. If selling today helps you achieve financial goals, reduce stress, or simplify estate planning, that may be the smartest move of all.

The biggest mistake mineral owners make is waiting too long and watching their window of opportunity close. The second biggest mistake is trying to sell on their own and walking away with less than their minerals are really worth.

That is where we come in.

At Texas Royalty Brokers, we specialize in helping mineral owners sell at the right time, for the right price, with the right buyers. We bring transparency to the process, create competition among qualified buyers, and work to maximize your return with less hassle.

If you are thinking about selling mineral rights, don’t go it alone and don’t wait until it’s too late. Contact Texas Royalty Brokers today and let us help you capture the value of your minerals while the timing is on your side.