Why Texas Royalty Brokers?

sellers

Buyers

State Specific Guides

Resources

How to Sell Mineral Rights in 2026

If you have received an offer to sell your mineral rights, the decision you make next could be one of the most important financial choices of your life. The first number you see is almost never the highest you can get.

Mineral buyers are professionals who make their money by purchasing at the lowest possible price. Without the right knowledge, it is easy to sell too quickly and leave a life changing amount of money behind.

This guide is designed to show you how to sell mineral rights the right way.

Before you sign an offer, you need to know what drives value, what to look out for, and the steps that lead to the strongest price with the least amount of stress. The information here will give you the same advantage buyers use, so you can sell with confidence knowing you are making the best decision for yourself and your family.

At Texas Royalty Brokers, we have helped countless mineral owners avoid costly mistakes and walk away with higher offers. Reading this guide before you sell could be the difference between simply accepting a check and truly maximizing the value of what you own.

This guide will walk you step by step through how to sell mineral rights for maximum value. Before you sign anything, take a few minutes to read through the sections below. Each one covers a key part of the selling process and shows you how to avoid common mistakes.

- Should You Sell Your Mineral Rights?

- What Determines the Value of Mineral Rights

- What to Know Before You Sell Mineral Rights

- Do You Need a Mineral Rights Broker to Sell?

- Step by Step Process to Sell Mineral Rights

- Common Mistakes When Selling Mineral Rights

- Why Work With Texas Royalty Brokers

- State Specific Guides

- Free Consultation

You are about to learn the right way to sell mineral rights.

By the end of this guide you will know exactly how to avoid lowball offers, how to attract competitive bids, and how to make sure you walk away with the strongest deal possible. Let’s get started.

Should You Sell Your Mineral Rights?

One of the first questions most owners ask is simple: should I sell my mineral rights?

The truth is, there is no one-size-fits-all answer. What makes sense for one family may not be the best choice for another.

For decades, the common advice was to never sell mineral rights. While that sounds safe, it is not always smart. Holding on forever can create tax issues, limit your ability to diversify, or leave you with unpredictable royalty checks that rise and fall with oil and gas prices. That old advice to never sell mineral rights is simply outdated.

The two biggest reasons mineral owners decide to sell are:

- Diversification: If minerals make up a large share of your net worth (over 5%), selling allows you to spread that money into other investments for balance and security.

- Taxes: Inherited mineral rights often come with favorable tax treatment when sold, but royalty income is taxed at much higher rates if you simply hold on. You can save a fortune selling if you understand mineral rights taxes.

At the end of the day, you should sell mineral rights when it makes sense for you.

There is no perfect time to sell mineral rights, and it is nearly impossible to “time the market.” What matters most is making an informed decision and ensuring that, if you do sell, you are getting the strongest possible price.

What Determines the Value of Mineral Rights

One of the biggest questions mineral owners have is what their rights are actually worth.

A lot of mineral owners contact us asking for the average price per acre before they sell. They assume the answer will help them determine if they have a fair offer.

The answer is not simple because mineral rights value depends on several moving parts. Buyers look at both what your minerals are producing today and what they might produce in the future.

The main factors that determine value include:

- Production status: Minerals that are producing monthly royalty income are usually worth more than minerals that are not currently producing.

- Location and geology: Acreage in active plays or proven formations commands higher prices than acreage in areas with little to no development.

- Lease terms: Royalty rates, lease bonuses, and the details of your lease agreement directly impact income potential and therefore your value.

- Nearby activity: Active rigs, new permits, or wells being completed near your acreage increase your upside potential and make buyers more competitive.

- Oil and gas prices: While many owners assume daily price swings change their value overnight, buyers focus on long-term price averages when making offers.

These factors explain why one mineral owner might receive a very different offer than a neighbor. Each mineral buyer values the same details differently, which is why no single offer truly represents market value.

The only way to know what your minerals are really worth is to create competition among buyers and let them bid against each other. That is exactly what we do at Texas Royalty Brokers. We list your mineral rights for sale in a competitive marketplace where qualified buyers submit offers, giving you confidence that you are walking away with the best price possible.

What to Know Before You Sell Mineral Rights

Before you sell, there are two critical pieces of information you must have. Most owners skip over these details and jump straight to the first or second offer that comes their way. That mistake can cost you thousands, sometimes hundreds of thousands of dollars.

You need to understand exactly what you own and what is happening locally before you even think about signing paperwork. If you do not, the buyer already has the upper hand.

Understanding What You Own

Most mineral owners across the U.S. either inherited their mineral rights or received them through a family transfer. That means you may own something valuable without truly knowing the details. This is completely normal.

The problem is that value depends on specifics most owners have never been taught. How many acres you own. Whether those acres are producing royalty income. How much upside is left in the ground. What type of mineral interest you hold.

These details make a huge difference in the offers you receive. Ask yourself a few questions:

- Do you know exactly how many net mineral acres you own?

- Do you know the difference between a net mineral acre and a net royalty acre?

- Do you know whether your acreage still has upside potential?

- Do you know what type of mineral interest you own (RI, ORRI, NPRI, WI)?

- Do you know how these details change the way buyers value your rights?

If you are unsure about any of these, you are not alone. Most mineral owners cannot answer these questions with confidence. Mineral buyers can. They use that knowledge to their advantage when making offers.

Selling without first understanding what you own is one of the biggest mistakes you can make. This is where expert guidance matters. At Texas Royalty Brokers, we help you understand your ownership before you ever consider an offer. With that clarity, you can move forward in control and ready to capture maximum value.

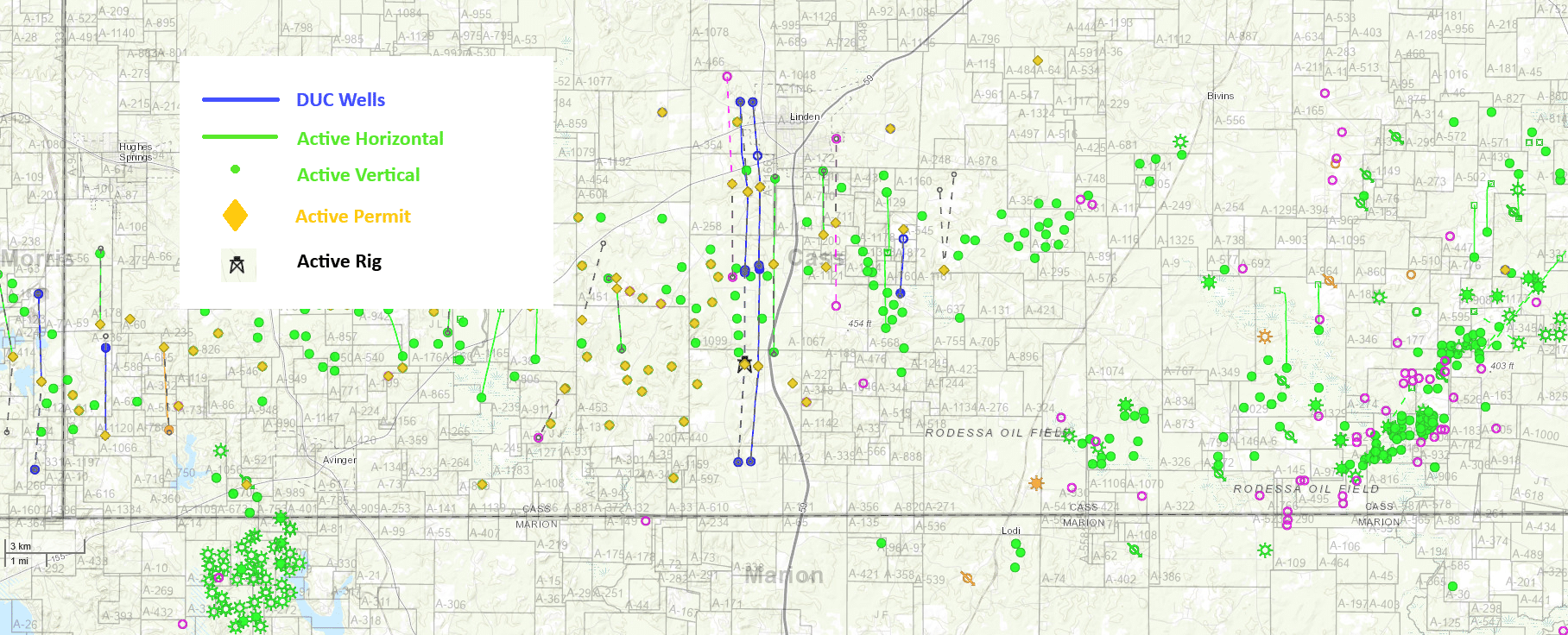

Understanding What Is Happening Locally

Once you understand what you own, the next step is knowing what is happening on and around your acreage. Local oil and gas activity plays a massive role in determining the value of your mineral rights.

Ask yourself these questions:

- Are there drilling rigs currently operating near your property?

- Have any new permits been filed in your area?

- Is there production nearby?

- Is there room left for more drilling on your acreage?

Serious buyers already know these answers. They pay for data that tracks every rig, permit, and well in the area. That information directly impacts how much they are willing to pay.

Most mineral owners, on the other hand, have very little visibility. You may have heard there is some activity nearby, but without the full picture you are negotiating in the dark. That is how owners end up accepting offers that sound good on the surface but are far below true market value.

At Texas Royalty Brokers, we level the playing field. We provide our clients with a free custom map showing exactly what is happening around their property. You will see the rigs, the permits, the wells, and the operators. You will have the same information buyers are looking at. Even if you never list with us, we provide this map and analysis free of charge.

This information is not optional if you want the best outcome. Whether an area is heating up or slowing down, local activity drives value. Before you sell, make sure you know exactly what buyers know.

Below is an example of the kind of data you should be looking at prior to selling mineral rights.

If you want to see a clear picture of your acreage before you sell, reach out for a free consultation. We will provide a custom map of your property with no obligation and no pressure, so you can make your decision with confidence.

Do You Need a Mineral Rights Broker to Sell?

In the last section we talked about two things you must know before you sell: understanding what you own and understanding what is happening locally. On your own, those questions are almost impossible to answer.

With Texas Royalty Brokers, that information comes standard before you ever think about signing an offer.

The value a mineral rights broker creates does not stop there.

Selling mineral rights is not a level playing field. Buyers have more data, more experience, and more leverage. To get the best result, you need an advocate on your side.

At Texas Royalty Brokers, we make sure you are not taken advantage of and that your minerals are sold in a way that benefits you, not the buyer.

Here is how Texas Royalty Brokers helps:

- Know What You Own: We help you estimate your exact ownership prior to listing, so you know what you are selling.

- Understand Local Activity: We provide a clear picture of drilling rigs, permits, and wells around your property.

- Qualified Buyers: We filter out flippers and lowball groups, connecting you only with serious buyers who have the funds and intent to close.

- Create Competition: One offer does not equal market value. The only way to know what your minerals are truly worth is to let multiple qualified buyers compete. Competition is the key to walking away with the highest possible price.

- Safe and Simple Closing: We guide you through contracts, escrow, and paperwork so the process is smooth, transparent, and risk free.

- Expert Guidance: With years of experience, we know how to avoid the traps buyers set and how to put you in the strongest position.

Most mineral owners who sell on their own think they are saving money by avoiding a commission. In reality, they almost always walk away with less because they never create true competition.

To see the impact that listing at Texas Royalty Brokers can make, enter your most recent offer below.

- Multiple buyers compete simultaneously, which tightens pricing.

- Clear timelines create urgency and stronger final bids.

- Qualified buyer outreach reduces lowballing and negotiation drag.

At Texas Royalty Brokers, our clients routinely see offers improve by 10 to 30 percent after listing with us, even after commission.

Selling mineral rights is not just about finding an offer. It is about finding the best offer and closing the deal with confidence.

Step by Step Process to Sell Mineral Rights

When you list with Texas Royalty Brokers, the process is simple, transparent, and designed to get you the best possible price with the least amount of stress.

Here is how it works:

- Gather Documentation

What you need depends on your situation:- Leased but not producing: Provide your lease agreement and order for payment.

- Producing: Provide the last three months of royalty check stubs. These documents allow us to confirm your ownership, evaluate your property, and prepare it for buyers. You can use EnergyLink to download check stub detail.

- Free Consultation

Once we have your documents, we go over what you own, review activity in the area, and provide a custom map showing rigs, permits, and wells nearby. This is truly a free consultation with no pressure and no obligation. - List at Texas Royalty Brokers

After the consultation, we market your mineral rights to our large network of qualified buyers. Listing with us puts your mineral rights in front of a wide audience and creates the competition you need to get maximum value. - Offers and Negotiation

As bids come in, we verify that each buyer is legitimate and able to close. We then negotiate on your behalf to ensure you get the strongest deal. Our interests are aligned with yours, and we always negotiate the best possible outcome for our clients. - Purchase and Sale Agreement

Once you accept an offer, the buyer provides a purchase and sale agreement. We carefully review this contract to protect your interests and make sure the terms are clear and fair. This step is critical, and having an expert on your side makes all the difference. A lot of mineral owners get taken advantage of at this stage. - Escrow and Closing

After the agreement is signed, the transaction moves to escrow. The buyer will typically have 30 days to run title. You then execute a deed and return it to us. We hold it safely until funds are received. Once payment clears, the deed is delivered to the buyer and the sale is complete. This process ensures a smooth, transparent, and safe closing for everyone involved.

Working with Texas Royalty Brokers means you do not have to navigate this process alone. From start to finish, we make selling your mineral rights simple, efficient, and profitable.

Common Mistakes When Selling Mineral Rights

Most mineral owners only sell once in their lifetime. Because of that, they often make mistakes that cost them time, money, and peace of mind. Avoiding these pitfalls is one of the biggest advantages of working with an experienced mineral rights broker.

Here are the most common mistakes we see:

- Taking the first offer: The first number a buyer puts in front of you is rarely their best. Without competition, you have no way of knowing if a better deal is on the table. Did you get a few offers and feel one offer stands out? Do NOT accept this offer. This is how mineral owners trick themselves into a bad deal.

- Not understanding what you own: Many sellers cannot clearly explain their acreage, royalty interest, or type of ownership. Buyers can and will use this knowledge gap to their advantage.

- Selling without knowing local activity: New permits or active rigs near your property can add significant value. If you do not know what is happening, you risk selling below market price.

- Dealing with the wrong buyers: Some “buyers” are really flippers who try to lock you into a contract and then resell your minerals for more. Others send lowball offers hoping you will bite. Without guidance, it is easy to waste time or walk away with less.

- Overlooking contract details: Purchase and sale agreements are written to favor the buyer. If you do not have someone reviewing the terms, you could agree to conditions that hurt you later.

- Trying to go it alone: Selling on your own may feel like the simple route, but it often leads to more stress and less money. The process is complex, and without expert help you are negotiating at a disadvantage.

These mistakes are why so many mineral owners leave money on the table.

At Texas Royalty Brokers, our process is designed to prevent these issues before they happen. By creating competition, verifying buyers, and guiding you through every step, we make sure you get the strongest price possible with less stress.

Our goal in every transaction is simple. We want to see you walk away with the highest possible price for your mineral rights.

We are here to guide you through the process, protect your interests, and give you the confidence that you made the very best decision for you and your family.

Why Work With Texas Royalty Brokers

If you want to get the best possible outcome when selling mineral rights, who you work with matters.

At Texas Royalty Brokers, our focus is simple: we represent mineral owners, not mineral buyers. Our only job is to make sure you walk away with the strongest deal possible.

Here is what sets us apart:

- Specialized Expertise: Since 2012, our team has focused exclusively on oil and gas mineral rights sales. We know the market, the buyers, and the process inside and out.

- Competitive Bidding Environment: Listing with us means your minerals are put in front of thousands of qualified buyers. We create a true bidding environment that drives offers higher. On average, our clients see a 10 to 30 percent improvement over their best existing offer.

- Simplified Process: Selling mineral rights can feel overwhelming. We handle everything for you including marketing, offers, negotiations, contracts, escrow, and closing so you can focus on the outcome, not the paperwork.

- Trusted Representation: Our clients know we are in their corner. We do not take shortcuts and we are not beholden to buyers. Every decision we make is to protect your interests and maximize your value.

Our goal is the same in every transaction: to see you walk away with the highest price and the confidence that you were represented by experts who care.

State Specific Guides

Every state has its own oil and gas laws, tax considerations, and drilling activity. For a deeper look at selling mineral rights in specific states, we have created individual guides.

- Selling Mineral Rights in Texas

- Mineral Rights in Oklahoma

- Mineral Rights in New Mexico

- Mineral Rights in Louisiana

- Mineral Rights in Colorado

- Mineral Rights in Wyoming

If your minerals are located in one of these areas, be sure to review the state-specific guide along with this article to get the most accurate information for your situation.

Free Consultation

Before you sell mineral rights, make sure you know exactly what you own, what is happening locally, and what buyers are truly willing to pay.

At Texas Royalty Brokers, we provide a free consultation with no obligation and no pressure.

We will review your ownership, show you a custom map of activity around your acreage, and explain your options. Our goal is to give you clarity and confidence before you accept any offer.

Contact us today for your free consultation and take the first step toward getting the best price for your mineral rights.