Why Texas Royalty Brokers?

sellers

Buyers

State Specific Guides

Resources

Selling Mineral Rights in Texas: 2026 Guide

If you’re thinking about selling mineral rights in Texas, you’re in the right place. This is one of the most important financial decisions many mineral owners will ever make, and the process can feel overwhelming if you’ve never been through it before.

The good news is that you don’t have to figure it out alone.

At Texas Royalty Brokers, we specialize in helping mineral owners across Texas understand exactly what they own, what it’s worth, and how to create real competition between buyers. That competition is what drives prices higher and ensures you walk away with the best possible offer.

This guide was built with one goal in mind: to give you a clear, step by step path to selling mineral rights in Texas. Here’s what we’ll cover:

- Understanding What You Own

- Understanding Local Activity

- Mineral rights value in Texas

- Choosing a mineral rights broker

- Preparing to sell mineral rights – documentation

- Tax implications when selling mineral rights in Texas

- Step by step summary to sell mineral rights in Texas

By the end, you’ll not only know how the process works, but also how to make sure you don’t leave money on the table. Let’s walk through it together.

Understanding What You Own

Most mineral owners in Texas inherited their mineral rights. That means you may own something valuable but not fully understand what you have. And that is completely normal.

The problem is that value depends on details many owners never think about. How many acres you own. Whether those acres generate royalty income. How much room there is for future upside.

All of these factors play a huge role in what a buyer is willing to pay.

Ask yourself a few questions:

- Do you know how many net mineral acres you own?

- Do you know the difference between a net mineral acre and a net royalty acre?

- Do you know if there is any upside left on your acreage?

- Do you know what type of mineral interest you own? (RI, ORRI, NPRI, WI)

- Do you know how these details change the offers you receive?

If you are unsure about any of these, you are not alone. Most mineral owners cannot answer these questions with confidence. But mineral buyers can. And they use that knowledge to their advantage.

Selling mineral rights without first understanding exactly what you own is one of the biggest mistakes a mineral owner can make.

This is where expert guidance matters. At Texas Royalty Brokers, we help you understand exactly what you own before you ever consider an offer. With that clarity, you can move forward knowing you are in control and positioned to sell for maximum value.

Understanding Local Activity

Once you know what you own, the next step is understanding what is happening on and around your acreage. Local oil and gas activity plays a major role in determining the value of your mineral rights.

Are there drilling rigs operating near your property?

Have permits been filed in your area?

Is there active production nearby?

Is there room left for more drilling on your acreage?

These are critical questions that serious buyers already know the answers to. They have access to data that shows exactly where rigs are running, which operators are active, how many permits have been filed, and where the next well is likely to go.

This information directly affects how much they are willing to offer and the value of your mineral rights.

Most mineral owners don’t have this insight. You might have heard there’s some drilling nearby, but unless you can actually see the full picture, you’re at a disadvantage. Without this information, it’s easy to accept a low offer simply because it sounds fair on the surface.

Most mineral owners accept an offer to sell mineral rights without knowing anything about what is happening on their acreage. Do not fall into this trap.

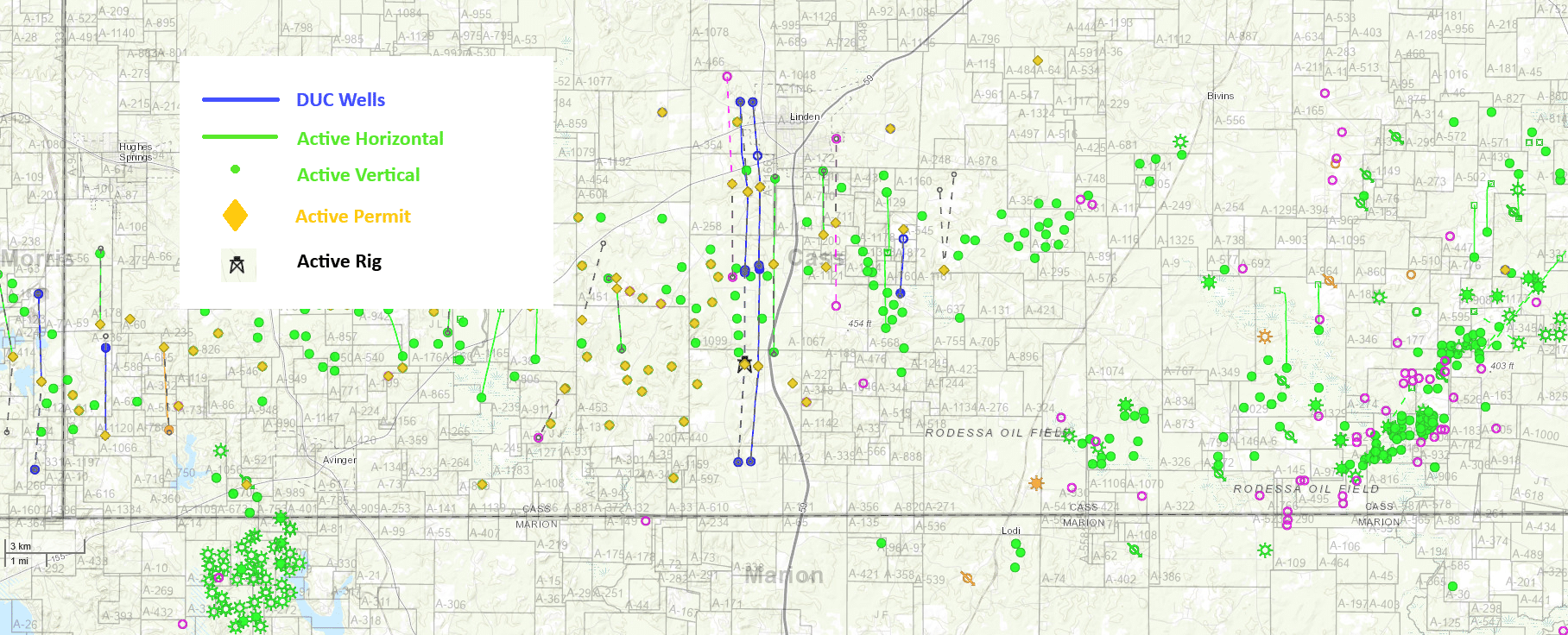

At Texas Royalty Brokers, we provide you with a custom map that shows what is happening around your property. You’ll see active rigs, permits, horizontal and vertical wells, and more. The map is free and easy to understand. It shows you exactly what buyers are seeing so you can make an informed decision.

We will provide you with a map and analysis of your ownership free of charge even if you don’t list with our company. We are dedicated to helping mineral owners make better decisions.

This isn’t optional information. If you’re serious about getting the best price for your mineral rights, you need to understand local activity. Whether the area is heating up or slowing down, it impacts value in a major way.

Contact us for a free consultation. We’ll send you a custom map and walk you through what it means for your mineral rights. There is no pressure and no obligation, just expert help.

We can provide you with a map like this for your acreage. Contact us for a Free Consultation.

Mineral Rights Value in Texas

If there’s one thing that determines the value of mineral rights, it’s competition.

The more buyers that are interested in your property, the higher the price will go. It’s that simple.

The biggest trick mineral owners play on themselves is thinking they already know what their minerals are worth. A few offers show up in the mail, and it’s easy to start believing that those numbers reflect true market value. They DO NOT represent market value.

Those offers are just a rough ballpark. They come from buyers who send thousands of letters, hoping someone will accept without asking too many questions. The buyers who send these offers represent only a small fraction of the overall market.

The real value of your mineral rights comes out when multiple serious buyers are forced to compete. That is what drives prices up.

There is no such thing as an average price per acre for mineral rights. Every property is different. Some have producing wells. Some have future drilling potential. Some are in hot areas with new permits and active rigs. Unless your minerals are put in front of real buyers who are ready to compete, you are only guessing at the value.

At Texas Royalty Brokers, we create that competition for you. We make sure your property is seen by a wide range of qualified buyers so the market can set the price.

Do you want to see what your mineral rights in Texas are worth with 95% accuracy? If you have an offer in hand, simply enter it below. The calculator will give you an estimated value range that is 95% accurate.

- Multiple buyers compete simultaneously, which tightens pricing.

- Clear timelines create urgency and stronger final bids.

- Qualified buyer outreach reduces lowballing and negotiation drag.

Using the calculator above, you can see the impact that listing at Texas Royalty Brokers has. When selling mineral rights in Texas, listing at Texas Royalty Brokers will ensure you sell for the absolute highest price possible.

If you want to sell mineral rights for the highest value possible, it’s imperative to list your mineral rights for sale and start getting competitive bids.

Choosing a Mineral Rights Broker in Texas

Not all brokers are the same. If you want to sell mineral rights in Texas for the best price, you need a broker who offers more than just basic help. A strong mineral rights broker should provide these key advantages:

✅ Local knowledge

Texas is unique. Every county has different drilling trends, operators, and value drivers. A broker with local knowledge understands the difference between acreage in the Permian, the Eagle Ford, or the Haynesville. That knowledge allows them to market your minerals with accuracy and confidence.

✅ Access to buyers and competition

The best price only comes when buyers compete. A good broker will have a large network of serious, qualified buyers who are active in Texas. The more buyers that see your minerals, the stronger your final offer will be.

✅ A visible listing platform

Many mineral brokers operate behind closed doors. The strongest brokers have a publicly available listing platform where your minerals are presented to the market with transparency. Visible listings build trust and help attract more buyers.

✅ Expertise to guide you

Selling mineral rights can be confusing if you’ve never done it before. A good broker will explain each step, help you organize documentation, answer your questions, and keep the process moving forward. You should never feel like you are on your own.

✅ Closing and escrow process

Peace of mind is critical. A strong broker will have a defined closing process that protects you and ensures that funds are secured before you transfer ownership. This eliminates risk and ensures you get paid in full.

✅ Track record of success

Finally, you want a broker with a proven track record. Look for a history of helping mineral owners sell for higher prices, not just a promise that they can do it.

At Texas Royalty Brokers, we check every one of these boxes. We have deep knowledge of Texas mineral markets, a large network of serious buyers, a transparent listing platform, and years of experience guiding owners through smooth, secure closings. That is why we are the number one place to sell mineral rights in Texas.

Did you know that all we do is mineral rights sales in Texas? That focus is the reason mineral owners choose us. We know the local market, we know the mineral buyers, and we know how to create competition that drives the highest possible price.

Preparing to Sell Mineral Rights – Documentation

Documentation is one of the most overlooked parts of the selling process, but it plays a major role in how much you can sell your mineral rights for.

Most mineral owners get a few offers in the mail and figure that if buyers can make an offer without any documents, then why go to the trouble of pulling anything together?

Here’s the truth: those mail offers are just ballpark guesses. They’re often based on limited data and a hope that you’ll take the deal without asking too many questions.

If you want to get the best possible price, you need to put the right information in front of serious mineral buyers. That’s what allows them to sharpen the pencil, run the numbers, and come in with stronger offers. This means more cash for you.

Documentation is the key to helping you sell mineral rights in Texas for the best price, and we’re here to help you get everything in order.

Here’s what we look for based on your situation:

If your Mineral Rights are Producing Royalty Income:

-

Your 3 most recent royalty statements

These show your current monthly income, which wells are producing, your decimal interest, and the operator responsible for paying you. Most operators use a portal like EnergyLink, where you can download these statements online.

If your Mineral Rights are Leased but NOT Producing:

-

A copy of your lease agreement

This is the signed, notarized document showing the royalty rate, lease term, and any key provisions. -

Order for payment

This shows how much you were paid for the lease bonus and the price per acre. It’s often just a one-page summary you received after signing.

For all mineral owners – Helpful Information – Not Required:

- Division orders

A division order is a short document issued by the operator that confirms your interest before they begin paying you. Not required, but helpful in verifying your decimal ownership. -

Your deed or conveyance document

This confirms how you acquired the mineral rights and includes the legal description of the property. -

Any supporting records or ownership history

These might include older deeds, probate records, or internal family records. If you have them, they’re helpful. If not, we can usually help track things down.

You don’t need a perfectly organized file folder. Just send us what you have.

At Texas Royalty Brokers, we walk you through the process and help clean up anything that’s missing or unclear.

When the right information is in front of the right buyers, the offers get stronger. Our goal at Texas Royalty Brokers is to help you sell for the absolute highest price possible. Good documentation is a crucial step to ensuring you sell for the highest market price available.

Tax Implications When Selling Mineral Rights in Texas

Don’t skip this section!!! Taxes are boring, but we will quickly show you how to save a fortune in taxes.

When you sell mineral rights in Texas, the sales price is only part of the story. What really matters is how much you keep after taxes.

The good news is that Texas has no state income tax, so you only have to consider federal taxes.

For most mineral owners, the sale of mineral rights is taxed as a long-term capital gain. The rate you pay depends on your income, but for many people the rate is 15%. It could be more or less depending on your tax bracket, but 15% is the most common.

Example: $1,000,000 sale vs. $1,000,000 in royalties

If you sell your mineral rights for $1,000,000, a 15% capital gains tax means you pay $150,000 in taxes. You walk away with $850,000 in your pocket.

Now compare that to receiving $1,000,000 in royalty income over time. Royalties are taxed as ordinary income, not capital gains. That means you could pay 24% to 37% in federal taxes, plus self-employment tax in some cases. At 32%, you would owe $320,000 in taxes, leaving only $680,000.

If you sold the mineral rights, you would have saved $170,000 in taxes compared to collecting royalty income. Selling mineral rights can often save you a fortune in taxes compared to holding and collecting royalty income.

Inherited mineral rights and step-up basis

If you inherited mineral rights, the tax advantages can be even greater. When mineral rights are inherited, the cost basis resets to the market value at the time of inheritance. This step-up in basis can dramatically reduce your taxable gain.

For example, imagine you inherited mineral rights valued at $900,000 in 2018 and sold them this year for $1,000,000. Your taxable gain would only be $100,000. At 15%, your tax bill would be just $15,000. That means you keep $985,000 out of the $1,000,000 sale! Seriously, this is possible.

Compared to collecting $1,000,000 in royalty income and paying $320,000 in taxes, selling could leave you with more than $300,000 extra in your pocket.

Curious how this would apply to you? If you haven’t sold yet, contact us and we’ll provide a free consultation and show you the tax savings.

Why this matters

Taxes should never be the only factor in your decision, but they are a major piece of the puzzle. The way the tax code is structured often makes selling far more favorable than holding for long-term royalty income, especially with inherited properties.

At Texas Royalty Brokers, we are not tax advisors, but we help mineral owners every day who are weighing these decisions. We can explain the basics and work alongside your CPA to make sure you understand the potential savings.

Our mineral rights tax article has more in depth information which you may find helpful.

Step-by-Step Summary to Sell Mineral Rights in Texas

We’ve covered a lot of ground in this guide. To wrap it up, here is a simple step-by-step summary of how to sell mineral rights in Texas the right way. Our goal is to help you maximize value while making the process as smooth as possible.

-

Understand what you own

Know how many net mineral acres or net royalty acres you hold, and whether there is upside potential left on your acreage. -

Understand local activity

Look at rigs, permits, and active wells around your property. This shows how much demand and future value your minerals may have. -

Estimate value

Remember that there is no average price per acre. Value comes from cash flow plus upside, and the only way to know the true value is through competition. -

Gather documentation

Royalty statements, division orders, leases, deeds, and ownership history all help buyers sharpen their pencils and make stronger offers. -

Choose the right broker

A strong broker brings local knowledge, buyer competition, a visible listing platform, and expertise to guide you through the process. -

Create competition among buyers

Listing your minerals with Texas Royalty Brokers exposes your property to a wide range of serious buyers, which pushes offers higher. -

Navigate taxes and closing

Understand the tax benefits of selling, especially if you inherited your minerals. Then close securely through escrow with expert guidance every step of the way.

Selling mineral rights in Texas does not have to be confusing or overwhelming. With the right process, you can feel confident that you know exactly what you own, what drives value, and how to get the best price.

At Texas Royalty Brokers, we specialize in making that happen. From free consultations and activity maps, to competitive bidding and secure closings, we are here to help you sell with confidence and walk away with the highest possible value.

Contact Texas Royalty Brokers

If you are considering selling your mineral rights in Texas, let us help you get the best price while saving time and reducing stress.

The team at Texas Royalty Brokers has been helping mineral owners get maximum value when selling mineral rights since 2012.

At Texas Royalty Brokers, we can provide you with the information you need to make an informed decision. Whether your mineral rights are worth $10,000 or $10MM, contact us for a free consultation.

Our team is eager to answer your questions and help you better understand your mineral rights.

If you have any questions or are ready to discuss selling your mineral rights in Texas, please use our contact form and one of our team members will respond promptly.