Why Texas Royalty Brokers?

sellers

Buyers

State Specific Guides

Resources

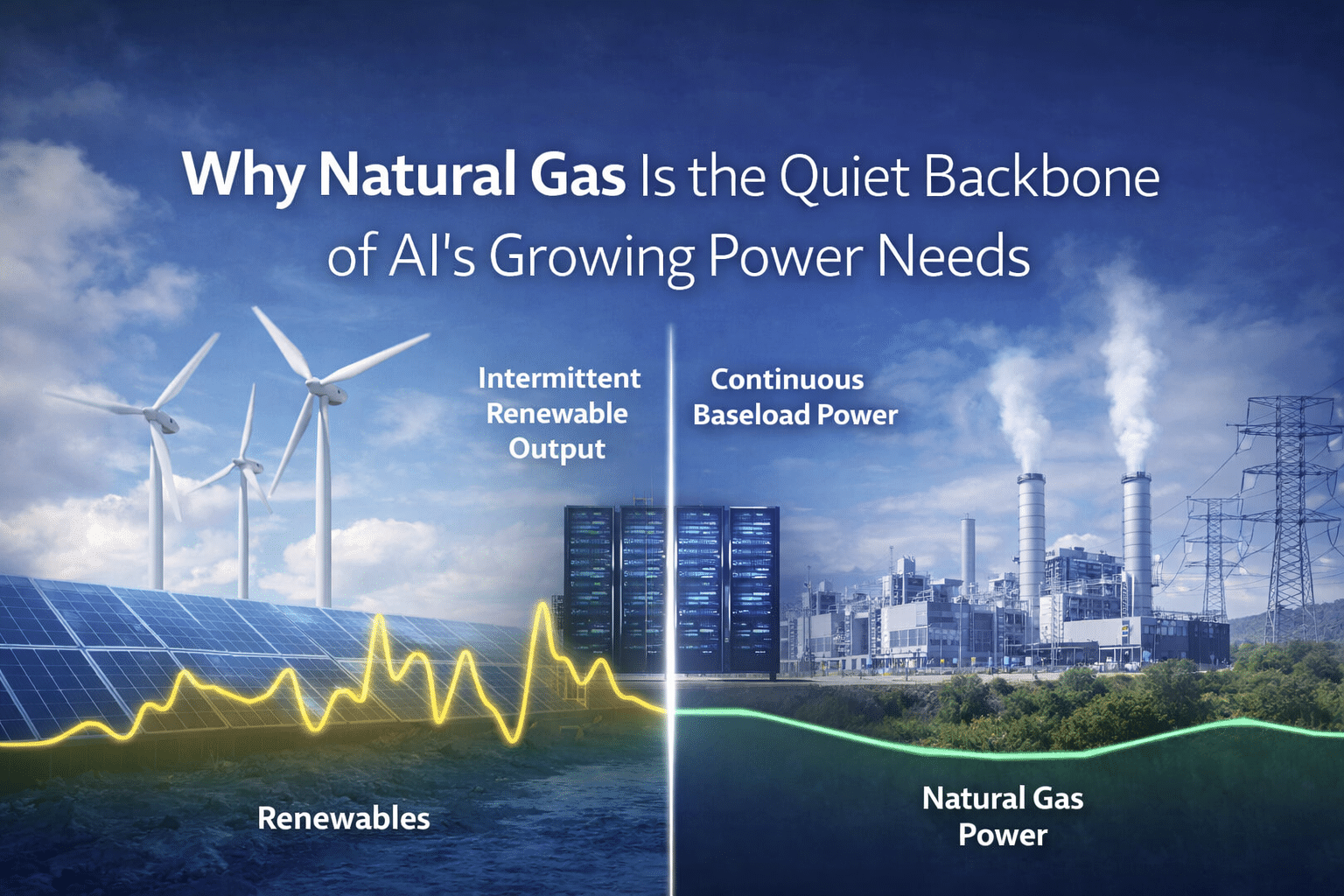

Why Natural Gas Is the Quiet Backbone of AI’s Growing Power Needs

Artificial intelligence is rapidly becoming one of the most power-intensive technologies ever deployed at scale. As large language models, image generators, and real-time inference systems expand across industries, the physical infrastructure required to support them, particularly data centers, is placing unprecedented demands on electricity grids.

Unlike earlier waves of digital growth, AI workloads are continuous and highly sensitive to reliability. Training and inference systems operate around the clock, require stable power delivery, and are often concentrated in specific regions. This concentration creates localized surges in electricity demand that existing grid infrastructure was not designed to absorb. In several parts of the United States, utilities and grid operators have already warned that data center expansion is outpacing available generation and transmission capacity.

Public discussion around AI’s energy footprint often centers on renewables and long-term decarbonization goals. While solar, wind, and nuclear power are frequently cited as future solutions, each faces structural and timing constraints that limit its ability to meet near-term, always-on demand at scale. As a result, a growing gap has emerged between how quickly AI infrastructure is expanding and how fast alternative energy systems can realistically be deployed.

Filling that gap is natural gas. With its ability to provide dispatchable, scalable, and reliable baseload power using existing infrastructure, natural gas is enabling continued AI expansion while longer-term energy solutions remain under development. This role has received comparatively little attention, yet it has become central to how power markets are responding to AI-driven demand growth.

The implications extend beyond utilities and data center operators. Upstream, sustained natural gas demand influences development timelines, capital allocation, and asset valuation. For mineral owners tied to natural gas production, AI-driven electricity demand represents a structural shift that could shape long-term decision making. Understanding this connection is becoming increasingly important as energy markets adapt to the demands of an AI-driven economy.

The Hidden Energy Cost of Artificial Intelligence

Artificial intelligence systems depend on a physical layer that is often overlooked. Behind every large language model, recommendation engine, or real-time inference system sits a growing network of data centers that consume enormous amounts of electricity. As AI adoption accelerates, the scale of this infrastructure is expanding far faster than most public estimates anticipated even a few years ago.

Modern data centers designed for AI workloads are fundamentally different from traditional enterprise or cloud facilities. According to S&P Global research, data centers’ electricity demand is growing rapidly as hyperscale and high-performance computing facilities proliferate, with grid-provided power capacity for data centers projected to increase substantially through the rest of this decade.

Training advanced models requires thousands of high-performance processors operating continuously for extended periods. Inference workloads, which support real-time applications, add another layer of demand by requiring constant availability and low latency. Together, these uses create a sustained and predictable power load rather than the variable demand patterns seen in earlier generations of computing.

Industry estimates now place large AI-focused data centers in the range of tens to hundreds of megawatts of continuous electricity demand. In some regions, clusters of facilities rival the power consumption of mid-sized cities. Unlike industrial plants that may ramp production up or down, AI systems tend to operate continuously, making their energy needs more rigid and less forgiving to grid constraints.

This growth is also highly concentrated. Data centers are often built near existing fiber networks, population centers, and favorable regulatory environments. As a result, electricity demand increases are not evenly distributed across the grid. Instead, they appear as localized surges that strain regional generation capacity and transmission infrastructure. Utilities in several states have begun revising long-term demand forecasts upward as AI-driven expansion accelerates.

What makes this trend particularly challenging is its speed. AI development cycles move far faster than traditional energy infrastructure planning timelines. Power generation assets, transmission upgrades, and permitting processes often require years or decades to complete. In contrast, data centers can be planned and built in a fraction of that time. This mismatch has created a growing gap between electricity demand and the pace at which new supply can realistically be added.

Understanding this hidden energy cost is essential to evaluating how power markets are responding to AI growth. The technologies that ultimately support AI are constrained not by innovation alone, but by the physical realities of electricity generation, grid reliability, and infrastructure deployment. These constraints help explain why certain energy sources are playing a larger role in the near term than many observers initially expected.

Why AI Power Demand Is Different from Past Technology Waves

Every major technology wave increases electricity demand, but artificial intelligence is doing so in a way that differs meaningfully from prior cycles. Cloud computing, enterprise software, and consumer internet services expanded over long time horizons, allowing energy infrastructure to adapt gradually. AI-driven data center growth is compressing that adjustment period into just a few years.

The first difference is intensity. AI workloads require dense clusters of high-performance processors operating continuously. Training large models involves running thousands of specialized chips at near-full utilization for extended periods. Inference workloads add another layer of demand by requiring constant availability to support real-time applications. Together, these uses create a sustained, high-load profile rather than the variable or interruptible demand patterns seen in earlier computing environments.

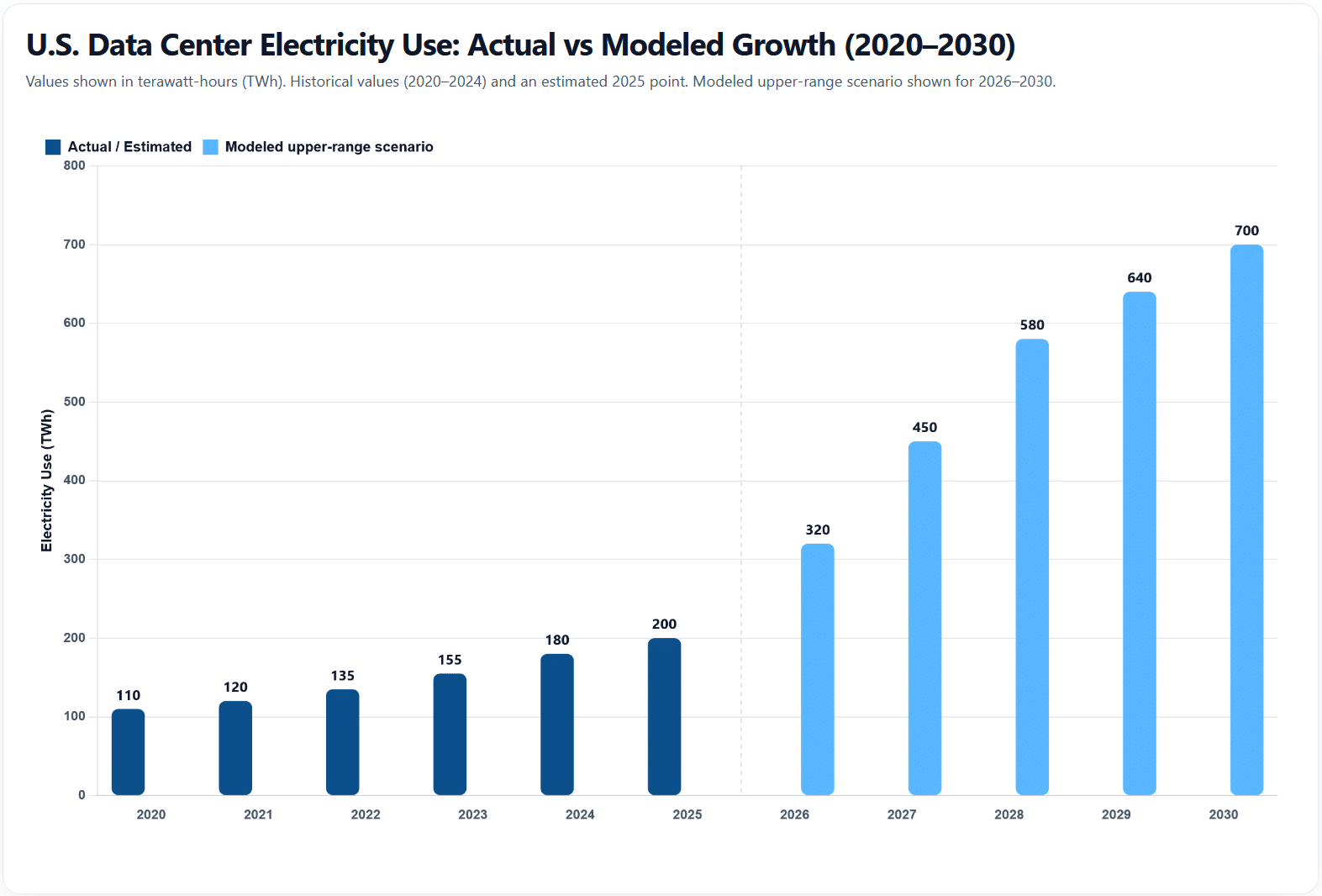

The second difference is scale. Data center electricity consumption has risen steadily over the past decade, but growth has accelerated sharply as AI deployment has expanded. Historical estimates show U.S. data center electricity use increasing from roughly 110 terawatt-hours in 2020 to around 180 terawatt-hours by 2024, with usage estimated near 200 terawatt-hours in 2025. A 2024 analysis from Lawrence Berkeley National Laboratory found that U.S. data centers accounted for approximately 4.4 percent of total U.S. electricity consumption in 2023 and could represent between 6.7 percent and 12 percent by 2028, depending on the pace of AI-driven infrastructure expansion.

Source: Texas Royalty Brokers

This growth trajectory is unusual for a single category of electricity demand. Even conservative modeling points to a steep increase over a relatively short window, reflecting how quickly AI workloads are being deployed compared to past technology cycles. Once data centers are built, their electricity needs persist, making this demand both durable and difficult to defer.

The third difference is concentration. AI data centers are not evenly distributed across the country. They are built where fiber connectivity, land availability, cooling capacity, and regulatory conditions align. This leads to geographic clustering, with large amounts of new demand appearing in specific regions rather than being spread evenly across the grid. Local systems designed for incremental growth are now being asked to accommodate sudden, large increases in load.

Finally, AI demand is additive. It does not replace existing computing or digital infrastructure. Businesses continue to operate legacy systems, cloud platforms, and traditional data centers while layering AI-driven workloads on top of them. As a result, data center growth compounds overall electricity demand rather than redistributing it.

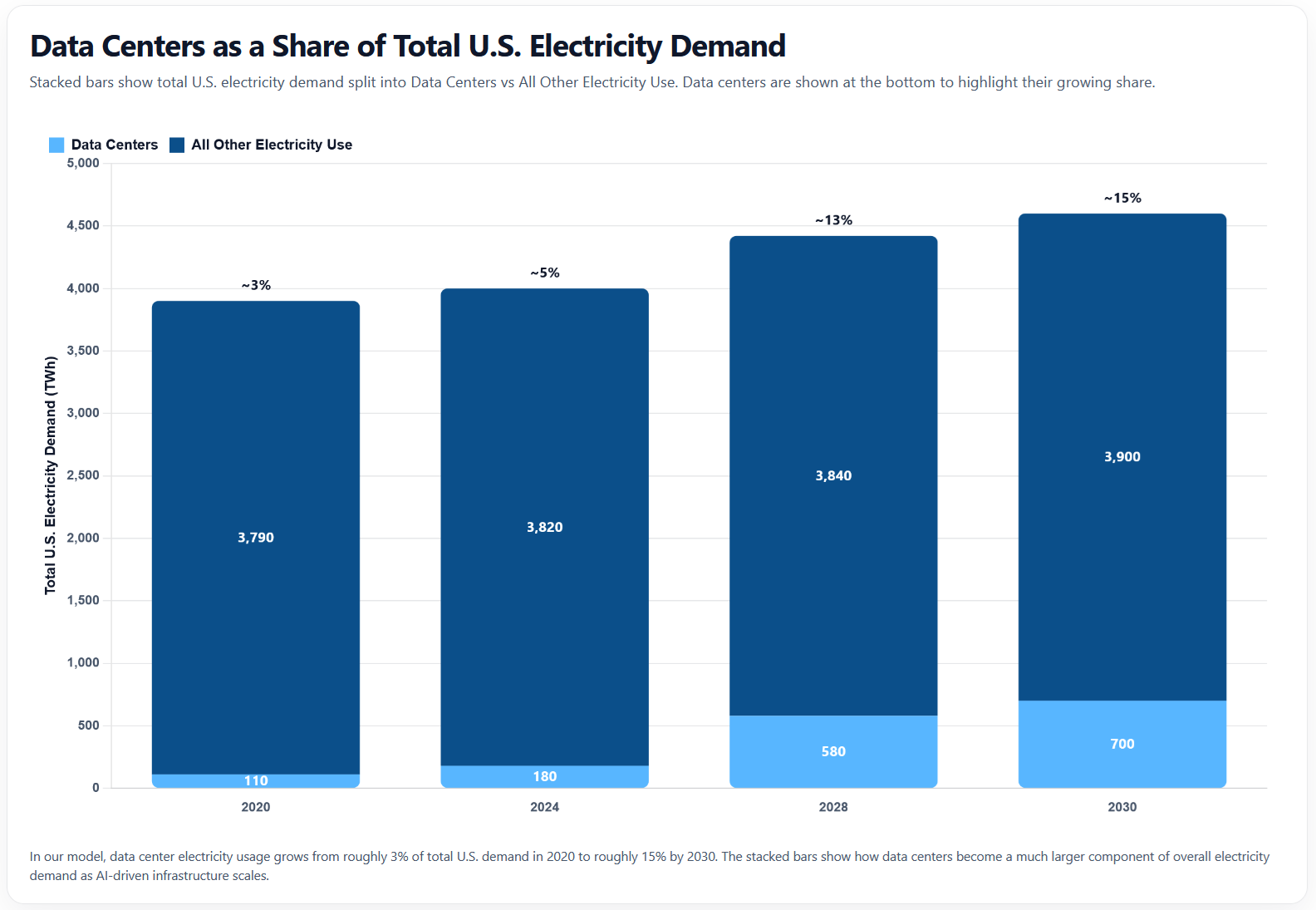

This dynamic becomes clearer when viewed in the context of total U.S. electricity consumption. In 2020, data centers accounted for only a small share of national electricity demand, roughly three percent. As AI infrastructure scales, that share increases rapidly. In modeled scenarios, data center electricity usage grows from a marginal component of total demand into a meaningful and persistent load by the end of the decade.

Source: Texas Royalty Brokers

Viewed together, these trends explain why AI power demand represents a structural shift rather than a continuation of past patterns. Electricity systems are being asked to absorb both steady baseline growth from broader electrification and a rapidly expanding, always-on load from data centers. This combination challenges traditional planning assumptions and helps explain why reliability, dispatchability, and near-term capacity have become central considerations in how the grid responds to AI-driven growth.

The Grid Reality: Renewables Can’t Carry Baseload Alone

Electricity demand driven by artificial intelligence places unique demands on the power grid, particularly in terms of reliability and continuity. While renewable energy sources have expanded rapidly and play an increasingly important role in overall electricity generation, their operational characteristics limit their ability to meet sustained, always-on baseload demand on their own.

Wind and solar generation are inherently variable. Output depends on weather conditions, time of day, and seasonal patterns, which introduces fluctuations that cannot be fully controlled. While these sources contribute meaningfully to total energy supply over time, they do not consistently deliver power at the precise moments when demand peaks. For electricity consumers that can tolerate variability, this may be manageable. For AI data centers that require continuous operation, it is not.

Energy storage can mitigate short-term variability, but current storage technologies remain constrained in both duration and scale. Batteries are well suited for smoothing brief fluctuations or shifting power over short intervals. They are not yet capable of supporting multi-day or continuous high-load demand at the scale required by large AI facilities. As a result, storage alone cannot transform intermittent generation into firm baseload power.

Transmission constraints further complicate the picture. Many renewable resources are located far from population centers and data infrastructure. Expanding transmission capacity to move electricity from generation sites to demand centers requires long permitting processes, significant capital investment, and years of construction. These timelines do not align with the rapid pace at which AI-related data centers are being planned and built.

Grid operators are therefore forced to plan around worst-case scenarios rather than average conditions. According to the U.S. Energy Information Administration’s Short-Term Energy Outlook, U.S. electricity demand is poised for its strongest four-year growth period since 2000, with large computing facilities, including data centers, identified as a key driver of rising demand.

Electricity systems must be able to meet demand during periods of low renewable output, extreme weather, or unexpected outages. When large, concentrated loads come online, reliability becomes the primary consideration. In these circumstances, sources that can provide firm, dispatchable power are necessary to maintain system stability.

This does not diminish the long-term role of renewable energy in the broader energy transition. Instead, it highlights a structural mismatch between the characteristics of intermittent generation and the requirements of rapidly growing, always-on demand. As AI accelerates electricity consumption, the limitations of relying solely on variable generation become more pronounced, shaping how grids respond in the near term.

Why Nuclear Is the Long-Term Answer but Not the Near-Term One

Among low-carbon power sources, nuclear energy is uniquely suited to meet the reliability requirements of AI-driven electricity demand. Nuclear plants provide continuous, high-capacity baseload power with minimal variability. They operate independently of weather conditions and can run at high capacity factors for extended periods. From a purely technical standpoint, nuclear aligns well with the needs of large, always-on data centers.

For this reason, nuclear is often cited as a long-term solution for meeting growing electricity demand while reducing emissions. Advanced reactor designs, including small modular reactors, are frequently discussed as a way to bring new capacity online with greater flexibility and lower upfront capital requirements. In theory, these technologies could support future data center growth while addressing reliability and sustainability concerns.

The challenge lies in timing. Nuclear projects face long development cycles driven by regulatory approval, financing complexity, and construction timelines. Even under favorable conditions, new nuclear facilities typically require many years from planning to operation. These timelines stand in contrast to the pace of AI infrastructure deployment, where data centers can move from concept to operation far more quickly.

Capital intensity is another constraint. Nuclear projects require substantial upfront investment and long payback periods. While large utilities and governments can support these investments over time, they are not easily scaled in response to sudden surges in regional demand. This makes nuclear ill-suited to addressing near-term capacity shortfalls created by rapid data center expansion.

There is also uncertainty around deployment pathways. While small modular reactors hold promise, they remain largely unproven at commercial scale. Regulatory frameworks, supply chains, and operating experience are still developing. Even optimistic projections place meaningful SMR deployment later in the decade or beyond, leaving a gap between current demand growth and future nuclear capacity.

As a result, nuclear energy occupies a clear but limited role in the current landscape. It represents a strong long-term solution for meeting sustained electricity demand, but it cannot respond quickly enough to address near-term growth driven by AI. Understanding this distinction is essential to explaining why other power sources are carrying the load today while nuclear remains part of the longer-term planning horizon.

Natural Gas as the Bridge Fuel for the AI Era

The gap between rapidly rising electricity demand and the slower pace of long-term infrastructure development has created a practical challenge for energy systems. AI-driven data center growth is happening now, while many future-oriented solutions remain years away. In this environment, natural gas has emerged as the primary source capable of meeting near-term needs without compromising reliability.

Natural gas power generation offers a combination of characteristics that align closely with the demands of AI infrastructure. Gas-fired plants can operate continuously, ramp output quickly, and respond to changes in load with precision. This dispatchability allows grid operators to match supply to demand in real time, which is essential when supporting large, always-on data centers with little tolerance for interruption.

Another advantage is speed to deployment. Compared to large-scale nuclear projects or major transmission expansions, natural gas facilities can be planned, permitted, and constructed relatively quickly. In many regions, existing gas infrastructure can also be expanded or repurposed, reducing the need for entirely new buildouts. This flexibility makes natural gas well suited to addressing sudden increases in regional electricity demand.

Natural gas also integrates seamlessly with existing grid architecture. Many power systems were built around thermal generation, and gas plants can often connect to established transmission networks with fewer modifications. This reduces friction at a time when grid operators are already managing tight timelines and capacity constraints driven by data center expansion.

From a planning perspective, natural gas serves as a stabilizing force. It allows grids to absorb rapid load growth while longer-term solutions continue to develop. This does not imply permanence. Rather, it reflects the role of gas as a transitional resource that supports system reliability during periods of structural change.

As AI continues to reshape electricity demand, natural gas is quietly carrying a disproportionate share of the load. Its role is less visible than the technologies it supports, but it is central to keeping power systems functioning as demand accelerates. Understanding this dynamic is key to explaining how the energy system is adapting in the present, even as longer-term transitions remain a priority.

The Overlooked Upstream Impact: Mineral Owners and AI-Driven Demand

Discussions around AI-driven electricity demand often focus on data centers, utilities, and grid operators. Less attention is paid to the upstream implications of this demand, particularly for mineral owners whose assets supply the fuel supporting near-term power generation. As natural gas plays an expanded role in meeting rising electricity needs, the effects extend back through the energy value chain.

Increased and sustained demand for natural gas can influence how and when resources are developed. When power demand is expected to persist over long horizons, operators may adjust drilling schedules, infrastructure investment, and capital allocation accordingly. These decisions affect production profiles, decline curves, and the longevity of producing assets, all of which matter to mineral owners tied to those resources.

AI-driven demand also alters the time dimension of value realization. Short-term price movements receive significant attention, but long-term demand signals often shape development behavior more meaningfully. When demand growth is structural rather than cyclical, it can support extended production timelines and reduce the likelihood of rapid drawdowns. For mineral owners, this distinction matters when evaluating decisions related to holding, leasing, or selling assets.

Geography further shapes these outcomes. Data center development tends to cluster in regions with favorable infrastructure and regulatory environments. Natural gas assets located near or connected to these regions may experience different demand dynamics than those serving more distant markets. As electricity generation becomes more tightly linked to specific demand centers, regional factors can play an increasing role in determining asset performance.

These dynamics underscore why downstream trends cannot be viewed in isolation. Mineral owners sit upstream of electricity markets, even if the connection is not always obvious. As AI continues to influence how power systems evolve, its effects will increasingly be reflected in production planning and asset utilization, shaping the long-term outlook for natural gas resources.

Understanding this upstream impact requires moving beyond headlines and focusing on how demand translates into operational decisions. For mineral owners, the implications of AI-driven electricity growth are not immediate or uniform, but they are meaningful. Recognizing where these demand signals originate and how they propagate through the system is essential to making informed long-term decisions.

Why Long-Term Demand Signals Matter More Than Short-Term Price Cycles

Commodity markets are often discussed in terms of short-term price movements. Daily and monthly fluctuations in natural gas prices attract attention and can influence sentiment quickly. However, for asset owners and long-horizon decision makers, short-term volatility is often less informative than underlying demand trends that shape development and investment over time.

AI-driven electricity demand represents a structural signal rather than a temporary shock. Unlike cyclical factors such as weather patterns or inventory swings, the expansion of data center infrastructure reflects long-term capital commitments. Once facilities are built, their electricity needs persist for years. This persistence influences how producers plan development, allocate capital, and prioritize infrastructure investments.

When demand growth is expected to be sustained, it can support longer development timelines and more consistent production profiles. Operators are more likely to invest in gathering systems, processing capacity, and grid-connected generation when they have confidence in future demand. These investments do not respond to daily price changes. They respond to expectations about where demand will be over multi-year horizons.

Short-term price signals can obscure this dynamic. A period of lower prices may coexist with strong long-term demand expectations, just as a price spike may occur during a temporary supply disruption. For mineral owners, focusing exclusively on near-term pricing risks missing the broader forces that influence how assets are developed and utilized over time.

AI-related electricity growth adds a new dimension to this analysis. Because it is tied to infrastructure buildout rather than discretionary consumption, its demand profile is less elastic. Data centers do not meaningfully reduce power usage in response to modest price changes. This reduces sensitivity to short-term market fluctuations and increases the importance of long-term planning assumptions.

Understanding the difference between cyclical price movement and structural demand growth is critical when evaluating mineral assets. Long-term demand signals shape the environment in which development decisions are made, often with a greater impact on asset outcomes than short-term price volatility. As AI continues to influence electricity markets, this distinction becomes increasingly relevant for those seeking to assess the future trajectory of natural gas demand.

What Mineral Owners Should Understand About AI-Driven Energy Demand

AI-driven growth in electricity consumption introduces a new set of considerations for mineral owners, particularly those tied to natural gas production. While the connection between artificial intelligence and upstream assets may not be immediately obvious, the demand signals created by data center expansion are increasingly shaping how energy systems operate and how resources are developed.

One key consideration is timing. AI-related demand does not translate into immediate price changes in a predictable way. Instead, it influences longer-term planning decisions made by utilities, generators, and producers. These decisions affect when wells are drilled, how long assets remain productive, and where capital is deployed. For mineral owners, understanding this lag between demand growth and observable market effects is essential.

Another consideration is geography. AI infrastructure tends to concentrate in specific regions, which can affect regional demand for power generation and, by extension, fuel supply. Natural gas assets that are connected to or located near these demand centers may experience different development dynamics than those serving broader or more distant markets. Regional infrastructure, pipeline access, and regulatory environments all play a role in how demand is ultimately reflected upstream.

Mineral owners should also recognize the difference between cyclical market noise and structural change. AI-driven electricity demand is tied to long-lived infrastructure investments rather than short-term consumption patterns. As a result, it can support sustained utilization of natural gas resources even during periods of price volatility. Evaluating assets through this lens requires a broader view than monitoring spot prices alone.

Educational resources can help bridge this gap. According to analysis and market education published by Texas Royalty Brokers, mineral owners benefit from understanding how downstream demand trends influence development behavior and long-term asset performance. This perspective does not dictate a single course of action, but it provides context for more informed decision making.

Ultimately, AI-driven energy demand represents an additional layer of complexity rather than a simple signal. For mineral owners, the value lies in recognizing how this demand fits into the broader energy landscape and how it may influence development over time. Staying informed about these dynamics allows asset owners to better evaluate opportunities and risks as the energy system continues to evolve.

Looking Ahead: AI, Energy Infrastructure, and the Next Decade

The growth of artificial intelligence is reshaping electricity demand in ways that extend beyond technology markets. As data centers expand and computing workloads intensify, the energy system is being asked to adapt more quickly than in past periods of digital growth. This shift is unfolding across multiple time horizons, with near-term demands intersecting with longer-term infrastructure planning.

In the coming decade, electricity demand from AI is likely to remain a central factor in energy decision making. While the pace of growth will vary across regions and technologies, the underlying drivers of data center expansion appear durable. Investments in computing infrastructure are long lived, and once operational, these facilities require continuous power support regardless of broader economic cycles.

At the same time, the energy system will continue to evolve. Renewable generation will expand, nuclear development will progress, and new technologies will emerge. The challenge lies in aligning these longer-term transitions with the immediate requirements of reliability and scale. Bridging this gap will remain a defining feature of energy planning as AI-driven demand continues to grow.

For stakeholders across the energy value chain, including mineral owners, the next decade will be shaped by how effectively the system manages this transition period. Long-term demand signals tied to AI are unlikely to fade quickly, and their influence will be reflected in development decisions, infrastructure investment, and asset utilization. Understanding these dynamics requires looking beyond short-term market fluctuations and focusing on structural change.

As artificial intelligence becomes increasingly embedded in the global economy, its energy footprint will remain a topic of active discussion and analysis. The interaction between technology, power infrastructure, and resource development will continue to evolve, creating both challenges and opportunities. For those seeking to navigate this landscape, informed perspective and long-term thinking will be essential.